Airlines & Air Freight

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

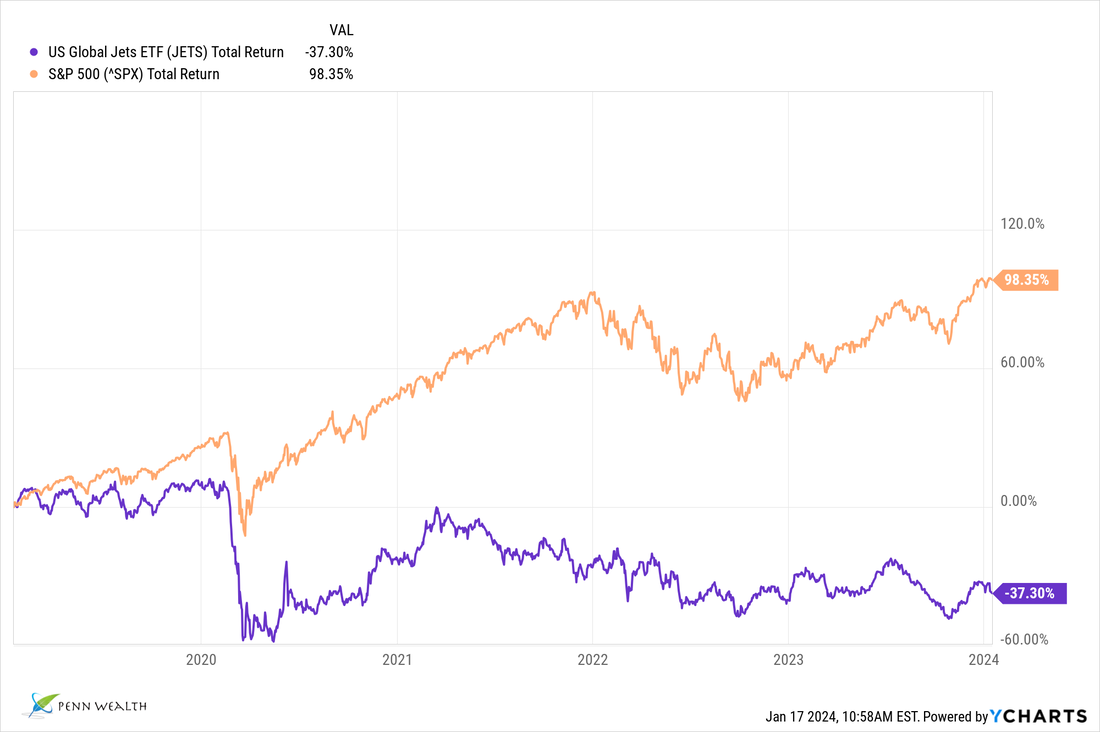

Passenger airline industry and related manufacturers vs the S&P 500 over a five-year timeframe.

|

SAVE $4

JBLU $6 ULCC $6 DAL $48 UAL $53 25 Apr 2024 |

No more fighting for those refunds on canceled flights

It would be difficult for anyone to say, with a straight face, that the state of air travel in the US has improved over the past generation; in fact, one could easily argue that since 9/11 and the pandemic, it has gotten decidedly worse. Try to question that delayed or canceled flight and face the wrath of a ticket agent ready to call for airport security. You may be the paying customer, but they are the airline apparatchik. Complaints surrounding air travel in general and difficulties in dealing with ticket agents specifically have reached an all-time high. Consider this disturbing statistic: one-third of all Spirit Airlines (SAVE $4), JetBlue Airways (JBLU $6), and Frontier Airlines (ULCC $6) flights end up being either delayed or canceled. Delta (DAL $48) has the best on-time record, but flyers still face a one-in-five chance of a delayed or canceled flight with that airline. And arguing for a refund has become a running joke. At least until now. Under new Department of Transportation rules, airlines will now be required to give automatic refunds for canceled or significantly delayed flights, providing much needed consistency throughout the industry. Here's what the DOT considers a "significant change": delays of more than three hours for domestic flights and six hours for international travel; being downgraded to a lower class; a change of departure or arrival airport; and an increase in the number of connections. Any of these circumstances would trigger the auto-refund policy. Missing luggage not delivered back to passengers within a reasonable amount of time (12 hours max for domestic flights) would also trigger the new rule, which is set to be fully in place within the next six months. It is unfortunate that the government had to get involved with this situation, but in this specific case the airlines have no one to blame but themselves. We own United Airlines (UAL $53) in the Penn Global Leaders Club and consider it best-in-class. We believe investors should completely steer clear of the low-cost carriers mentioned above, as their margins will continue to shrink based on this much-needed ruling. Recall that the FTC recently shot down the merger between Spirit and JetBlue, leaving these carriers inordinately vulnerable to the new policy. |

|

SAVE $6

JBLU $5 ULCC $4 17 Jan 2024 |

Spirit Airlines falls 60% after judge ends JetBlue merger

It is funny in a way; unless, that is, you happen to be a Spirit Airlines (SAVE $6) shareholder. Nearly two years ago we wrote about the great merger of the low-cost carriers: Frontier Group Holdings (ULCC $4) agreed to buy Spirit in a deal valued at $6.6 billion—a fat premium for Spirit shareholders. Apparently that wasn't good enough. Greed and arrogance took over when JetBlue (JBLU $5) went hostile for Spirit and shareholders accepted the deal. In May of 2022 we wrote that "JetBlue going hostile for Spirit is a complete waste of time." Two years later, and we have been proven right: a federal judge just shot down the merger. JetBlue shares were unfazed; Spirit shares fell 60% in two days. Granted, we have an incorrigible FTC right now which is intent on suing to stop seemingly every corporate merger, but we believe they would have lost going against the original deal. The judge ruled that a combined JetBlue/Spirit entity would harm the latter's consumer base. We will go further. JetBlue has an atrocious on-time rate and horrendous customer service; an abysmal record that would have been foisted upon Spirit flyers. This would not have been the case were the Frontier deal maintained. We will never know for sure whether the original deal would have stood up in court, but we believe it would have. Instead, Spirit shareholders who had no problem reneging on a deal to gain a few extra dollars find themselves 60% poorer in their investment. Airlines are going through a rough spell right now, and investing in any of the carriers is risky. While we wouldn't own any of the low-cost carriers, we do own United Airlines (UAL $38) in the Penn Global Leaders Club due to its exemplary management team and long-term strategic vision, which includes a return to supersonic travel for the industry. |

|

JBLU $6

08 Jan 2024 |

JetBlue's CEO Robin Hayes, whom we have had few good words for, has decided to step down from his role in February; a decision he came to after "talking to his doctor and his wife." He will be replaced by company President Joanna Geraghty. Hayes is 57. (UPDATE: A week after we wrote this, a judge blocked the JetBlue/Spirit merger. The cynic in us makes us wonder if Hayes knew something the rest of didn't.

|

|

FDX $244

SEA $15 06 Nov 2023 |

Last week it was cargo containers; this week it is FedEx pilots

In last week's Penn After Hours, we reported on the CEO of shipping giant A.P. Moller Maersk's dire warning with respect to the slowdown in container shipping. This week another transportation segment adds fuel to the 2024 recession case: FedEx (FDX $244) has reportedly told its pilots to consider flying for PSA Airlines, a subsidiary of American Airlines, as freight traffic slows. Along with that employee service announcement came news that the air freight and cargo giant is expecting revenue to remain flat in 2024. They must see something on the horizon. There is an argument that with people getting out more following the pandemic shutdown, it only makes sense that e-commerce would contract. But that seems like a stretch. This past February, Air Cargo News reported that cargo capacity had increased 11% from the previous year, while air cargo volume had fallen 4%. It may not rise to the level of demand destruction, but it is certainly demand weakness. And beyond e-commerce, keep in mind that these cargo giants deliver parts to manufacturers and goods for retailers' shelves. We don't believe for a minute that China is fully acknowledging the extent of its own economic problems, which include the slowdown in demand for cheap products produced on the mainland for global consumption. And we know Europe's economy is in a funk. Perhaps competitor UPS (UPS $142) is simply taking market share from FedEx? Considering that company recently reported a 10.9% revenue decrease from the previous year, that doesn't seem to be the case. There is an ETF we can check to validate our concerns. The Global Sea to Sky ETF (SEA $15) holds 30 of the top trucking companies, air cargo carriers, and maritime shippers around the globe. Over a three-year period, the S&P 500 index has lost 2.73% while shares of SEA are down 26.15%. Keep in mind that the Transportation Services Indexes (TSI) are leading economic indicators. While we are more interested in the economic slowdown aspect of this story, it should be noted that we don't currently own any trucking or air cargo firms within the portfolio at this time. We do own one railroad in the Penn Global Leaders Club: Union Pacific (UNP $212), but it is flat year to date. We owned FedEx for years, and certainly prefer it over UPS; we would just wait until the concerns of a slowdown subside before picking it back up again. One more worth keeping on the watch list: Since Canadian Pacific merged with Kansas City Southern and became Canadian Pacific Kansas City Limited (CP $74), we have had our eyes on it. It is the only rail that traverses North America, from Canada into Mexico. As the economy troughs, see if those shares dance around their 52-week low of $68 once again. |

|

SAVE $25

ULCC $11 JBLU $9 |

Shocker: Spirit terminates Frontier bid, agrees to JetBlue merger

(28 Jul 2022) We have written about the ongoing saga between three small-cap airlines, Spirit (SAVE $25), Frontier (ULCC $11), and JetBlue (JBLU $9), each approximately $2.5 billion in size, for the past several months. Despite JetBlue’s hostile takeover push for Spirit, it looked as though a Spirit/Frontier merger was as good as done. In fact, two major shareholder advisory firms were recommending that the deal be approved. The CEO of Spirit, Ted Christie, had argued that the Federal Trade Commission and the Department of Justice would never approve a merger with JetBlue. Suddenly, in a rather shocking reversal, Spirit announced that it was terminating its deal with Frontier—scheduled to be voted on within weeks—and embracing JetBlue’s offer. Something stinks. We will never know what went on behind closed doors, but it would probably be worthy of a book. JetBlue, it should be noted, has the worst on-time record in the industry, with nearly 10,000 canceled or delayed flights (39%!) in the month of June alone. The deal would give Spirit shareholders $33.50 per share in cash, an aggregate equity value of $3.8 billion, and carry with it a breakup fee of $400 million if it is shot down by regulators. There is a lot of baggage to unpack here. First and foremost, we believe the feds will not approve the merger on anticompetitive grounds. Beyond that, what happens to Frontier, our personal favorite of the three, now that they are left to fend for themselves in an industry dominated by the four large players—United, American, Delta, and Southwest? And what magic panacea will allow JetBlue to improve its horrendous on-time record? Our advice? Don’t touch any of the low-cost carriers. And avoid flying JetBlue. |

|

SAVE $25

ULCC $10 JBLU $8 |

JetBlue just can’t win: FAA awards coveted Newark slots to Spirit alone

(06 Jul 2022) Three miles south of downtown Newark and nine short miles from Manhattan lies Newark Liberty International Airport. Serving some 40 million passengers annually prior to the pandemic, the airport remains one of the busiest in the world. Back in 2019, Southwest Airlines (LUV $36) pulled out of the airport due to falling revenue amidst the grounding of Boeing’s (BA $135) 737-MAX fleet. This week, the FAA awarded all sixteen open slots at Newark to low-cost carrier Spirit Airlines (SAVE $25). JetBlue (JBLU $8), which has already been rebuffed twice by Spirit as a takeover target, had also been vying for the slots. A spokesperson for the FAA’s parent organization, the Department of Transportation, said that awarding all slots to Spirit would improve competition and secure more low-cost flights for Newark passengers. A few weeks ago, JetBlue sweetened its takeover offer for Spirit, offering shareholders $30 at close and $1.50 per share in prepayment (from a raised reverse break-up fee). Spirit’s management team, however, remains committed to Frontier’s (ULCC $10) takeover offer, arguing that the deal will not face the same level of government scrutiny. (They are correct: we don’t see the respective government agencies approving a JetBlue/Spirit merger due to routing and competition issues.) Two major shareholder advisory firms, Glass Lewis and Institutional Shareholder Services (ISS), are now urging approval of the Frontier bid during this month’s shareholder vote. It is difficult to find any airline we like right now due to inflation, a slow-moving economic slowdown, and chronic flight cancellations. We have one carrier in the Global Leaders Club, United (UAL $37), but we have a tight stop loss order on the shares. As for the airline in the direst straits (in our opinion): we wouldn’t touch shares of JetBlue. |

|

SAVE $19

ULCC $9 JBLU $10 |

JetBlue is going hostile for Spirit, and it is a complete waste of time

(17 May 2022) We know how much the big four US-based airlines—American, United, Southwest, and Delta—were financially impacted by the pandemic, and quite understandably so. It follows, then, that the smaller players would be in even rougher shape following the two-year nightmare. Consolidation within the industry among these smaller players makes sense, and we reported this past February of Frontier’s (ULCC $9) plans to acquire Spirit Airlines (SAVE $19) in a deal valued at $2.9 billion ($6.6 billion with debt added in). Another small-cap player, JetBlue (JBLU $10), felt threatened by this move (rightfully so), and made its own offer to buy Spirit for $3.6 billion in an all-cash offer. Interesting, as the market cap of JBLU is just $3 billion. Not seeing a path toward regulatory approval, Spirit said thanks, but no thanks. Which leads us to JetBlue’s current tactic: going hostile. Denouncing Spirit’s management team for refusing to perform due diligence with its offer, the company said it will actively pressure SAVE shareholders to reject the Frontier bid at a 10 June meeting. Bizarrely, JetBlue said that it would raise its $30 per share offer to $33 per share if management comes back to the table and provides the financial information being requested. That does nothing to alleviate the real problem: we see no circumstances under which the antitrust forces at the Department of Justice and the Federal Trade Commission will allow the JetBlue/Spirit deal to go through. In fact, Spirit CEO Ted Christie has explicitly stated that this may simply be about foiling the Frontier deal. We believe his argument will carry the day with shareholders. A combination of any two of these players would create the country’s fifth-largest airline, leapfrogging over Alaska Air Group (ALK $47). JetBlue has a host of problems which Spirit wants nothing to do with, to include a worst-in-class, 62% on-time rate. Furthermore, the carrier is already in the Justice Department’s crosshairs, as the agency sued to block the airline’s regional partnership with American Airlines last year. Ultimately, we see the original Frontier acquisition getting approved, which will make JetBlue’s position in the industry even more tenuous. |

|

UAL $45

|

To the delight of the carriers, federal judge in Florida rules CDC overstepped its bounds with airline mask mandate

(19 Apr 2022) On Monday, a federal judge in Florida ruled that the CDC had overstepped its authority when it decreed that masks were required to be worn by all passengers on aircraft and other means of public transportation. Shortly after the judge's ruling, the TSA announced that it would no longer enforce the mandate. By Tuesday, all of the major airlines lifted the requirement. In her ruling, US District Judge Kathryn Kimball Mizelle said that the Centers for Disease Control had failed to adequately give the rationale for its mandate, and did not allow for the normal procedure of public comment before issuing its decree. The United States Department of Justice is reviewing the decision and deciding whether or not it will appeal. In addition to the airlines, Amtrak has officially removed its mask requirement, as has private ride-hailing service Uber (UBER $33). With vaccines and therapies now available, lifting the mask mandate was the common sense next step in our return to some semblance of normalcy. While many health experts are predicting strains of the disease will re-emerge with force when the weather turns colder this coming fall and winter, we don't see a return of either lockdowns or widespread mask requirements. In other words, the disease has become an endemic which must be managed by the health care system for the foreseeable future. As for the airlines specifically, we expect pent up demand for travel to fuel strong earnings over the coming quarters. We own United Airlines Holdings (UAL $45) in the Penn Global Leaders Club. |

|

ULCC $12

SAVE $24 |

Merger of the low-cost carriers: Frontier to buy Spirit Airlines in $6.6 billion deal

(07 Feb 2022) Denver-based Frontier (ULCC $12) is a $2.6 billion ultra-low-cost carrier serving 90 destinations with a fleet of 60 single-aisle Airbus aircraft. Florida-based Spirit Airlines (SAVE $24) is a $2.3 billion ultra-low-cost carrier serving 78 destinations with a fleet of 157 single-aisle Airbus aircraft. Both small cap airlines have lost money since the pandemic. With so much in common, it makes sense that these two airlines, both focused on leisure travel, would join forces. Our only question is the price-tag: Frontier has agreed to buy Spirit in a deal valued at $6.6 billion—or around $1.7 billion more than the combined companies' market cap at the end of last week. If the merger is approved (it should be, but with the current DoJ, who knows), it would create the country's fifth-largest airline, behind American, Delta, Southwest, and United. We know that Frontier would control 51.5% of the merged company, with Spirit shareholders owning the other 48.5%. What has yet to be determined is who will be the CEO, what the entity will be called, and where it will be headquartered. Bill Franke, the current chair of Frontier and managing partner of parent company Indigo Parters, will remain in his role, however. Although its IPO was delayed due to the pandemic, Frontier finally went public on the NASDAQ last April, opening around $19 per share. We like this deal a lot. In fact, it is fair to say that it needed to be done for the long-term viability of both companies. Both carriers have aggressive growth plans, and the combined entity should begin operations before the end of this year, just as leisure travel begins to take off once again. We wouldn't touch shares of either company, however, before the DoT/DoJ appear ready to give the green light to the merger. We own United Airlines Holdings (UAL $44) in the Penn Global Leaders Club. |

|

LUV $53

|

The odd case of the canceled flights: Southwest vs the other carriers

(11 Oct 2021) Southwest Airlines (LUV $53) blamed it on bad weather and air traffic control issues, but could those factors really result in the cancelation of more that 1,800 weekend flights? Putting that number in perspective, nearly one out of every three Southwest flights scheduled for last Sunday did not take off, and 500 others were delayed. The issues seemed to start late last Friday, as severe weather in Florida forced the FAA to impose some air traffic control restrictions. The airline said that the combination of factors led to staffing shortages, as workers could not get to where they needed to be. This led to speculation on social media that the staffing issues were actually related to the order issued last week by management to employees: Assure you are vaccinated for Covid by the 8th of December. While that claim (that workers were calling in sick) was roundly rejected by Southwest, it is interesting to point out that only 5% of American Airlines' scheduled flights for Sunday were canceled, and just 4% of Florida-based Spirit Airlines' scheduled flights didn't take off. That disparity is hard to explain away. Management apologized to its workforce for the problems, and issued plans to cut many of its scheduled flights this fall as it works through "operational problems" related to the resurgence in air travel following the easing restrictions on the heels of effective vaccines. We expect the airline will soon "refine" the talking points being thrown out to investors, the press, and its own workforce. For years, Southwest Airlines was the only carrier in the Global Leaders Club. It once stood, in our opinion, head-and-shoulders above the competition. Unfortunately, we no longer see that as the case. In fact, we no longer have any commercial airliner in the Club, though we do have a 68% gain on Delta Airlines (DAL $43) in the Intrepid Trading Platform—we picked up that airline on 28 May 2020 during the economic trough caused by the pandemic. We also have our eyes on United Airlines (UAL $49), which has a bold strategic plan which includes the largest aircraft purchase in history and the addition of Boom supersonic jets to its fleet. |

|

UAL $57

|

America is entering a new era of supersonic air travel—and Boeing is not building the aircraft

(07 Jun 2021) When I was growing up in the 1970s, with an avid fascination in all things air and space, there were dozens of major, publicly-traded, aerospace and defense contractors. Sadly, due to mergers and acquisitions (the largest being Boeing's 1997 purchase of McDonnell Douglas), the numbers dwindled to a few. As competition helps assure that companies continue to operate at peak performance, we knew that the seemingly-endless acquisitions would lead to complacency. And indeed, based on Boeing's (BA $ 250) string of recent high-profile failures, it did. Fortunately, a new breed of young upstarts has entered the industry, and they are fearless when it comes to putting bold plans into action. While SpaceX is the first name that comes to mind, another, lesser-known company is about to make a major splash. United Airlines Holdings (UAL $57) just announced plans to buy a fleet of 15 supersonic passenger aircraft, capable of traveling at Mach 1.7, from Denver-based Boom Technology. The Boom Overture, which can carry up to 88 passengers and will have a cruising altitude of 60,000 feet, is slated to begin ferrying United passengers by the end of the decade. Using sustainable aviation fuel (SAF), the aircraft is made with advanced composite materials and will be propelled by much quieter—by supersonic standards—Rolls Royce twin engines. It is interesting to note that Boeing CEO, David Calhoun, said that an investment in supersonic travel didn't make sense for his company's business right now. Currently, United is the only US carrier which has signed an agreement with Boom for the Overture, but Japan Airlines (JAPSY $12) has been a major backer of the US firm, investing $10 million in the company and signing a nonbinding option to buy 20 of the aircraft. Putting the speed of the craft in some context, a flight from New York to London will be reduced in travel time by roughly half: from 6:30H to 3:30H. United CEO Scott Kirby stated that "United continues on its trajectory to build a more innovative, sustainable airline and today's advancements in technology are making it more viable for that to include supersonic planes." Well said. In the zeitgeist of too many CEOs focused more on "not offending" than on their own strategic visions, we salute Kirby and his leadership. We also salute yet another startup boldly going where the old, established players fear to tread. Perhaps the latter group needs a little history lesson in what made their respective companies great in the first place. |

|

DAL

AAL |

Delta to furlough 1,900 pilots, American to reduce staff by 19,000

(25 Aug 2020) Delta's (DAL $18-$30-$62) head of flight operations put it succinctly: "We are six months into this pandemic and only 25% of our revenues have been recovered." American Airlines Group (AAL $8-$13-$32) CEO Doug Parker echoed similar sentiments, stating that long-haul trips in Q4 of this year will equal about 25% of last year's Q4 rate. Against that backdrop, both companies have announced a new round of furloughs to take effect when government stimulus aid to the airlines ends on 30 Sep. Delta, which we purchased within the Intrepid Trading Platform at a steep discount back in May, said it will furlough 1,941 pilots—out of the 11,200 or so on the books—unless pilots take a 15% cut in pay. The Air Line Pilots Association, which represents the unionized group, has balked at that request. American Airlines announced even more draconian cuts, saying that 19,000 employees will be involuntarily furloughed after the government relief ends. Incredibly, American Airlines has lost 77.7% of its value since January of 2018, versus a 50% loss for Delta and a 23% gain in the S&P 500. Our Delta position is up 15% since we purchased it, and we see plenty of growth ahead as the pandemic subsides. |

|

BRK.B

|

Buffett's sale of his airline stocks helped the industry find a bottom

(08 Jun 2020) Back in 2016, investor Warren Buffett decided to bet big on the US airline industry, with his Berkshire Hathaway (BRK.B) spending over $7 billion to accumulate shares. Around mid to late April, as the airlines were suffering through a virtually complete shutdown, Buffett threw in the towel, liquidating all of his holdings in the industry at a loss. Berkshire held an enormous position in the four American carriers—to the tune of approximately 10% of the outstanding shares of each. Right when these airlines were most vulnerable, Buffett bailed. It didn't take long, however, for astute investors to gobble up the shares the billionaire sold, betting on a recovery. They bet right. Since 01 May, American (AAL) is up 84%, United (UAL) is up 69%, Delta (DAL) is up 51%, and Southwest (LUV) is up 35%. Buffett's opportunity cost due to his panic selling? Just shy of $3 billion. |

|

DAL

|

With its new stake in Wheels Up, Penn member Delta Airlines moves more heavily into rapidly-growing space. (12 Dec 2019) The private jet charter business has been blossoming over the past few years, and Penn Global Leader Club member Delta Airlines (DAL $45-$57-$63), already an active participant in the space with its Delta Private Jets unit, is doubling down by becoming the single largest shareholder in Wheels Up. The company, in fact, will streamline its business by combining Delta Private Jets with the membership-based, pay-as-you-go charter company. Meanwhile, Delta has been selling off its non-core businesses to focus exclusively on its key profit drivers. CEO Ed Bastian, arguably the best airline chief in the industry, considers this deal more than a minority stake, he considers it a merger. According to the company's press release, "The transaction will pair Wheels Up's membership programs, innovative digital platform, and world-class lifestyle experiences with Delta's...service and scale." When the dust settles, the unit will operate 190 private aircraft and boast over 8,000 paying members and customers. Wheels Up said it would also like to expand into Europe, a region where Delta owns 49% of Virgin Atlantic Airways. Bravo to Delta on the move. Unlike the inept United (UAL) CEO Oscar Munoz, who (thankfully) announced he would be stepping down in early 2020, Bastian has done a masterful job at leading Delta through turbulent times. Interestingly, Delta was the one major carrier which had no Boeing (BA) 737-MAXs in its fleet.

|

|

DAL

|

Penn Member Delta Air Lines beats expectations for both revenue and profit in Q1. (10 Apr 2019) Delta Air Lines (DAL $45-$57-$61) continues to be our favorite airline, which is one of the reasons we own it in the Penn Global Leaders Club. True to form, the carrier just released Q1 earnings that beat Street expectations on both the top and bottom lines. Against forecasts for $10.42 billion in revenue, the company brought in $10.47 billion—a 5.1% jump from the same quarter last year; earnings came in at $730 million—up from $557 million in Q1 of 2018. A beaming Ed Bastian, the company's CEO, announced that this has been the strongest first quarter (typically the weakest for airlines) in the history of Delta. A fortuitous note: the company was not flying any 737 MAX aircraft at the time of the grounding. Delta has already surpassed our first price target of $55; we have raised our target price to $65 per share.

|

|

DAL

|

Recent Penn addition Delta Airlines jumps on solid earnings, profitability. (12 Jul 2018) We picked up Delta Airlines (DAL 45-$51-$61) in the Penn Intrepid Trading Platform last week after management lobbed an off-the-cuff warning about fuel prices hurting margins this year (Delta does not hedge their fuel). This well-run airline was already undervalued, and that comment forced it down to an easy buy point. Today, as we expected, the company beat on nearly all of its metrics for the quarter. Revenues surged 10% year over year (to $12 billion) and earnings per share rose to $1.77 (against company forecasts for $1.65-$1.75/share). Yes, higher fuel costs certainly hurt the bottom line, but not hedging is a two-way street: if oil does drop, DAL should be the first airline to benefit. For the record, Delta paid $2.17/gallon for jet fuel last quarter, as opposed to $1.66/gallon in the same quarter of 2017. We are up about 5% in our position since adding last week.

|

|

UAL

|

In the great Tomato Juice War, United capitulates

(11 May 2018) It seemed like a benign-enough move: tomato juice was one of the least-requested items on the drink cart at United Airlines (UAL $57-$67-$83), so why not just remove it? In the social media age, not so fast. After the airline yanked the booze-friendly juice, customers went to Twitter to voice their displeasure. After dragging a passenger off a flight last year to make room for an employee, and after killing a dog in-flight this past March, gun-shy United reinstated the little 5.5 ounce cans. In our humble opinion, United's CEO, Oscar Munoz, is a walking disaster, and the fact that he was "magnanimous enough" to forego his bonus this year (what a peach) means nothing. We watched his immediate, on-air response to the passenger incident last year, and it was pompous, tone-deaf, and arrogant. Proof of that was his rush to the microphone to change his tune just a day later. He needs to go before we would consider UAL stock. Yet another clear example of dangerous hubris in the CEO suite. |

|

Flexjet

labor |

Flexjet pilots pushing to decertify union and dump the Teamsters

(10 May 2018) In a government-supervised vote which began Wednesday and will run through the end of the month, pilots at jet-leasing company Flexjet are deciding whether or not they want the Teamsters on their turf any longer. And it is not looking good for organized labor. The Teamsters pushed their way in at Flexjet in a narrowly-won vote two years ago, but pilots now question what has been gained by the move. The decline of organized labor's power in America over the past two generations is dramatic. In the 1950s, nearly one out of every three American private sector workers were members of a union; today, the number sits at about 7%. As for the vote at Flexjet, in a wonderfully ironic bit of hyperbole, union leaders say they have evidence that management has been strong-arming pilots into voting for decertification. |

|

UAL

|

United Continental Holdings plummets on comments, drags competitors down as well

(24 Jan 2018) By all accounts, United Continental's (UAL $57-$69-$83) earnings call was going just fine. The company announced earnings of $1.40 per share for Q4, against expectations for $1.34, and per-seat revenue rose slightly. It was the comments afterwards that spooked investors, driving the company's shares down nearly 12% on the day. United said it plans to increase its capacity by 4%-6% each year between now and 2020, and stop ceding ground to low-cost carriers. To a layman, that sounds great. To an industry expert, like CFRA Research analyst Jim Corridore (who immediately downgraded his "buy" rating on the stock), that meant short-term pain, a probable reduction in UAL's passenger load factor (PLF), and a potential price war. Every other major carrier fell in sympathy, though not near as much as United. |

|

LUV

|

Southwest Airlines beats expectations, sees solid travel demand

(26 Oct 2017) While natural disasters yanked $100 million in potential revenue from Southwest Airlines' (LUV $38-$58-$64) pockets over the course of the quarter, the Penn Intrepid member said its Q3 revenues still rose. Furthermore, the company sees strong travel demand for the fourth quarter, meaning fewer forced discounts for the carrier. Despite the 5,000 hurricane-related cancelled flights, Southwest still raked in $5.3 billion in Q3—a 2.6% jump. As for bottom-line profits, the company kept $503 million of that figure, sharply up from 2016's $388 million profit during the same period. Our position is about 25% of the way to our target price since we purchased the company almost precisely three months ago. (Members see the Trading Desk.) |

|

LUV

HA |

Southwest Airlines to enter Hawaiian airspace

(17 Oct 2017) Great news for Average Joe travelers: everyone's favorite discount airline is about to begin service to Hawaii. Southwest Airlines (LUV $40-$59-$64) announced that it would begin service to the island destination as soon as next year, following FAA approval for the company's extended-range operations (ETOPS) and a number of other regulatory hoops it must jump through. That announcement was bad news for Hawaiian Airlines (HA $36-$40-$61), which is already down 30% year-to-date. When Southwest enters a market, prices among the carriers flying that route inevitably drop. As for Hawaiian Holdings, it has a P/E of 9.5; half that of LUV. At sub-$40 per share, it may actually be a good value play. Between the two, however, we still have to go with Southwest. |

|

AAL

|

(23 Jun 2017) American Airlines' classic response to Qatar Airways. Yesterday we reported on Qatar Airways' intent to buy a 10% stake in American Airlines (AAL $25-49-52), and our recommendation that they be told to go pound sand. Well, a day later CEO Doug Parker echoed those sentiments. In a letter of response to his employees, Parker said the offer was "puzzling at best and concerning at worst." He went on to say that the company will continue to "...stand up to companies that are illegally subsidized by their governments." YES! We love this CEO. Needless to say, there is no way Qatar is getting the green light by AAL's board to buy the shares (though they could legally buy up to a 4.75% stake without board approval).

|

|

AAL

|

(22 Jun 2017) State-owned Qatar Airways wants to buy 10% of American Airlines. American Airlines' (AAL $25-$49-$52) CEO Doug Parker doesn't mince words when it comes to what he thinks of Gulf carriers like Qatar Airways. He is outraged that these state-controlled entities are propped up with government subsidies designed to stifle US competition in the region. Qatar has also been in the news after five US allies in the region cut ties with the nation over their nuanced support of terrorist organizations. Now comes the interesting part: Qatar announced plans to buy a 10% stake in American Airlines, sending up a plethora of red flags. A couple of legal factors: a foreign entity may not buy more than 24.9% of voting shares in a US airline. Also, American prohibits anyone from acquiring more than 4.75% of outstanding stock without a written request and subsequent approval from the board. American stock is up 5% on the news, but something smells with this deal, and we believe it should be quashed. Anti-free enterprise? Not at all. How many shares of Qatar Airways could an American investor buy?

|

|

UAL

|

Airlines. United Airlines suspends all air service to Venezuela. North America's fourth-largest airline (and Penn Global Leaders Club member), United (UAL $37-$81-$82), has announced suspension of all service to Venezuela beginning next month. In typical leftist fashion, the administration of President Nicolas Maduro has failed to reimburse United, and other airlines, in hard currency for ticket sales. The company claims the travel ban has less to do with the payments and more to do with the political instability in the country and safety concerns. United has (soon "had") a daily flight between George Bush Intercontinental Airport in Houston and Caracas, Venezuela.

(Photo: United Airlines Boeing 737-800) |

|

UAL

|

United Airlines sends unusually blunt safety memo to pilots

(25 Feb 15) United Continental issued a safety warning to all of its pilots last month, spurred on by a number of serious incidents caused by pilot error. Four separate safety incidents had taken place in the months leading up to the safety notice, including an emergency pull-up maneuver to avoid an aircraft crashing into the ground, and another aircraft landing with less than the minimum required fuel. The safety warning mentioned the crash of a UPS cargo jet that slammed into a hill near the runway at the Birmingham-Shuttlesworth International Airport two years ago, killing the two pilots aboard the aircraft. The memo made it clear that everything appeared fine, right before it was too late for the pilots to react. It has been over 20 years since either a United or a Continental aircraft has been involved in a fatal accident, and corporate leadership should be commended for not trying to minimize the prior incidents. We will delve into this deeper to see if we can pinpoint something that might be unique to this carrier, or if there have been any spikes in the number of preventable mishaps of late. United and Continental merged back in 2010 and is the second largest carrier in the nation. The Chicago-based carrier employs over 12,000 pilots and plans to hire an additional 700 or so this year. |