Automotive

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

TSLA $250

F $14 GM $37 13 Jun 2023 |

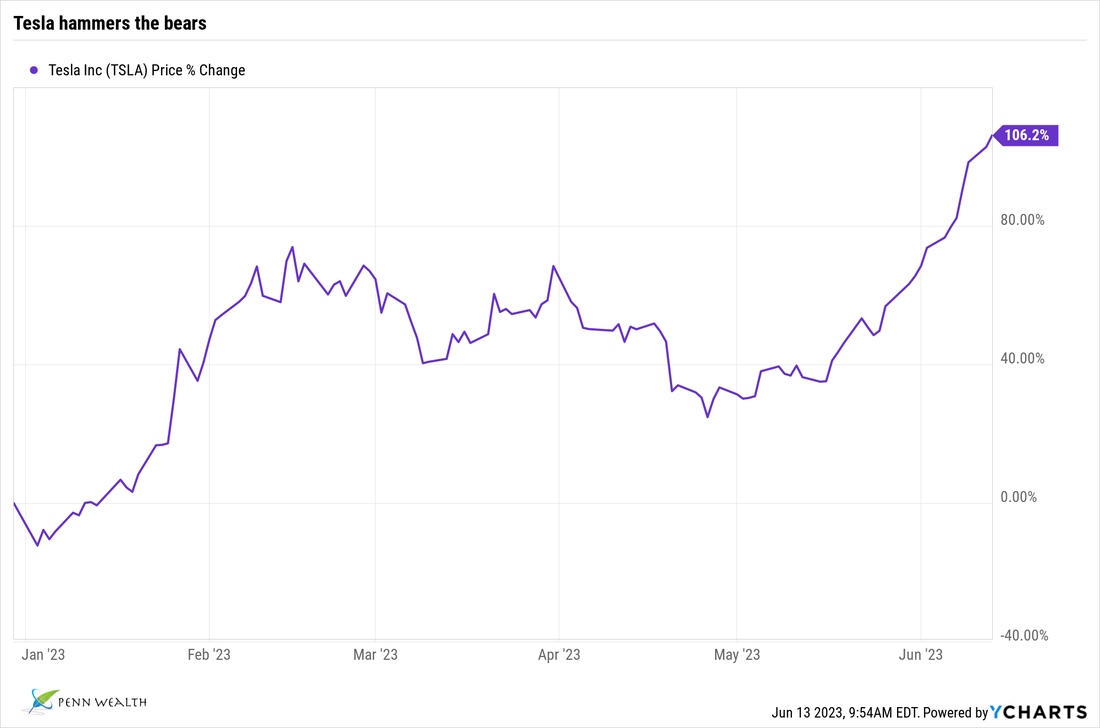

Tesla strikes deal with both Ford and GM for use of its Supercharger network

Over a decade ago, EV leader Tesla (TSLA $250) introduced its Supercharger network to overcome buyer angst over hitting the highways in an electric vehicle. In typical Tesla fashion, the company invited other American automakers to adopt their charging methods (NACS, or North American Charging Standard) to help grow the industry. They were rebuffed in a not-so-polite manner. Now, after a decade of Tesla dominance in the EV race, the competition’s haughty attitude has changed. Drivers of non-Tesla EVs have been forced to use a rather spotty and unreliable system known as CCS, or Combined Charging System. With Ford (F $14) and GM (GM $37) planning on producing millions of electric vehicles per year, this condition has become unacceptable. That is why, over the course of a few weeks, both automakers have inked deals adopting Tesla’s Supercharger standard. Phase one will involve their vehicles coming equipped with an adapter allowing them to use Tesla’s network. Within a few years, compatible plugs will come standard on the vehicles. What does this mean for Tesla? Naysayers argue the move only helps the company’s competitors sell more EVs and catch up to the leader. Baloney. What it really means is a great new source of revenue as Ford and GM vehicles roll up and plug in. It also highlights the leadership of Tesla within the industry. Tesla’s senior director of charging infrastructure, Rebecca Tinucci, reiterated the company’s mission to “accelerate the world’s transition to sustainable energy.” These new deals will help with that acceleration. Tesla currently operates 45,000 Superchargers at over 5,000 locations, and the company’s pre-fab system means a new station can be up and running within eight days. Expect the explosive growth of these locations to continue until they are virtually everywhere on American roads. We own Tesla, which is up 103% year-to-date as of this writing, in the Penn New Frontier Fund. |

|

TSLA $190

31 Jan 2023 |

After its best week in a decade, Tesla is delivering a message to perma-bears

Let’s face it, a rather large number of analysts have been hoping for Tesla’s (TSLA $190) demise just to vindicate their perma-bear positions on the EV maker. Last year provided them a great opportunity to crow, with Tesla shares falling some 65% in 2022. Going into 2023, they were all but writing the company’s epitaph, reminding us of falling production in China and the CEO’s preoccupation with another entity. There’s only one problem with that narrative: Tesla just posted a record quarterly profit and its shares are trading 54% higher this year—six weeks in. Revenue jumped 37%, from $17.7B to $24.32B, with $3.69B flowing down as net income—a 40% spike from the same quarter last year. Both top-line revenue and bottom-line profits hit new records. Guidance was also strong, with management reiterating its goal of 50% CAGR in deliveries. For 2023, the company plans to produce—and sell—some 1.8 million vehicles, with a “potential” to hit the two million mark. The results were simply better than expected, but don’t expect the bears to change their tune. Tesla is currently producing around 3,000 Model Y SUVs at its Austin plant alone, and is preparing that plant to begin producing the highly anticipated Cybertruck. The futuristic-looking all-electric pickup will begin rolling off the assembly line this month, with production ramping up to scale in 2024. While naysayers point to the company’s recent price reductions as evidence of waning demand, we would argue that the price cuts are possible because no other car company can produce electric vehicles at a lower cost, thanks to Tesla’s massive head start and unmatched production efficiencies. If other automakers try to reduce prices to keep pace, they will push their EV margins even further into the red. And that is exactly what we expect them to do—despite their insistence that Tesla has zero influence on their tactics or strategy. Tesla is expected to generate over $12 billion in free cash flow this year, with the next closest car company (Toyota) coming in around $10 billion. With the Cybertruck coming online, as well as a lower-cost vehicle to widen its customer base, Tesla remains in the most enviable position of any car company. And that is not even accounting for the company’s renewable power and battery storage lines—also on the leading edge of their respective businesses. We maintain our $333 price target on TSLA shares, which we own in the Penn New Frontier Fund. |

|

RIVN $31

11 Oct 2022 |

It has been a rough road for Rivian since its IPO, and that was before the massive recall

Talk about lousy timing. Last November, one year ago next month, signaled the peak in the stock market, and it has been a bumpy downhill slog from there. Last November was also when EV maker Rivian (RIVN $31) presented itself to the investment world via an IPO. Initially priced at $78, shares quickly soared to $179.47 on 16 November, just six days after the IPO. Woe to any investor who jumped in then: the current stock price represents an 83% drop from that all-time high. In a tough economic environment, marred by supply chain issues and rising input costs, Rivian has been consistently missing its own production targets; now, on top of that, the company is being forced to recall nearly all its vehicles on the road for steering control issues. While there have been no reported injuries and the fix is relatively straightforward, the problem will divert precious resources away from production at a time when the startup is already under intense scrutiny for over-promising and under-delivering. The first Rivian rolled off the assembly line in September of 2021, and the company has produced just 15,000 vehicles to date. The 2022 full-year production target is 25,000 vehicles, which is all but guaranteed to be another miss. Rivian has a market cap of $28 billion, down from a November high of $153 billion. The company's R1S electric pickup has a price range between $72,500 and $90,000, while the longer-range R1T, fully loaded, will set a buyer back around $100,000. For those who believe Rivian is the next Tesla, $31 per share may seem like a great point at which to buy the stock. While the company has enough cash on hand to weather the production and recall problems, the potential for further price erosion is too great to justify an investment right now. For those willing to take the risk in the automotive industry, Ford (F $11) looks a lot more attractive with its 5.668 forward multiple. |

|

GOEV $4

|

EV maker Canoo spikes on Walmart and US Army interest; don’t be fooled

(18 Jul 2022) We can imagine a certain group of investors licking their chops now: EV maker Canoo (GOEV $4) is a dirt-cheap stock in a promising industry with sudden interest from both Walmart (WMT $129) and the US Army. Shares, in fact, were trading around $1.88 when America’s largest retailer said it has plans to buy 4,500 Canoo EVs with an option to buy up to 10,000. The vehicles are to be used for the store’s “last-mile delivery” to customers’ homes. A few days after the Walmart announcement, the US Army selected a Canoo vehicle for analysis and demonstration. Is the company about to have a major breakout? Before jumping in to buy shares at the “low price” of $4.28 (where they trade as we write this), investors should dig a little deeper into the stories. As for Walmart, which stipulated in its deal that Canoo cannot provide competitor Amazon (AMZN $114) with EVs, the company has similar deals with Nikola, Daimler, and Cummins. Furthermore, Canoo has yet to deliver on any vehicles—to anyone. All of the existing vehicles are prototypes. Another major concern we have is that the company is only publicly traded because it is part of a SPAC deal. It never would have been able to go public (anytime soon) through the traditional IPO route. On the financial front, it is common for a young company to have negative earnings, but Canoo’s top-line revenue is zero. Something that made us think back to Nikola’s slick founder, Trevor Milton, was the company’s pie-in-the-sky projections. Canoo told investors it could generate over $300 million in revenue in 2022 and produce 3,000 to 6,000 vehicles this year. The assembly lines are not yet rolling. Two years ago, the company offered revenue projections of $4.13 billion in 2026 alongside profits of $1.18 billion. These “creative” projections are raising some eyebrows in the regulatory community. Walmart and the US Army aside, $4 doesn’t seem cheap considering the potential share price of $0.00. Headlines can spur positive actions by investors, but not always in the way one might imagine. With so many misleading narratives floating around, the ability to think like a contrarian can pay off handsomely. If something doesn’t pass the smell test, a deeper dive might uncover a real opportunity to take advantage of a misguidedly negative sentiment. In the case of the recent Canoo news, a little emotional discipline and some basic research might keep one from joining the lemmings who think they have uncovered a bargain. |

|

CVNA $30

|

Almost unfathomably, Carvana shares dropped 92% in nine months

(11 May 2022) Back in August of last year, used auto platform Carvana (CVNA $30) could do no wrong. Despite a lack of positive net income in any given year over its ten-year history, the company’s sales growth was spectacular, growing from $42 million in 2014 to $11.77 billion in 2021. Investors rewarded the competitor to such names as Carmax (our favorite in the space), Cars.com, and Autotrader by driving CVNA shares up to an intraday high of $376.83 on 10 August 2021. Fast forward precisely nine months, and traders are fleeing the maker of the highly unique Carvana Vending Machines. Shares hit a new 52-week low of $29.13 on the 11th of May after management announced a 12% reduction in its workforce; that price represents a 92% drop from the August highs. Another reason investors soured on the company was news of its acquisition of Adesa US, the wholesale vehicle auction division of KAR Auction Services, for $2.2 billion. Not due the acquisition itself, but the financing scheme: Carvana would be issuing $3.3 billion in junk bonds carrying a yield of 10.25%. In decades gone by, that might seem fine for a junk bond rate; today, it seems too good to be true (for bond buyers). Longtime Carvana investor Apollo Capital Management agreed to secure some $1.6 billion of that paper. As for the layoffs, which equate to roughly 2,500 employees, the company told the SEC that senior management would not collect any salaries for the remainder of the year to help fund the severance packages. We feel for the investors who bought shares in the company last August. Price targets now range from $40 to $470 among analysts on the Street, but we wouldn’t touch the shares right now—or the 10.25% bonds. The company’s cash burn rate will be hard to sustain, even with the new round of funding. |

|

TSLA $1,091

|

With one announcement, and in one session, Tesla gains more in value than Ford Motor Company is worth (28 Mar 2022) Ahh the law of large numbers. It is one thing to say that Tesla (TSLA $1,091) has a market cap of $1.128 trillion versus Ford Motor Company's (F $17) $66 billion, but let's compare their respective sizes with this stunning fact: Tesla's one day change in value is greater than Ford's total value. The reason for the EV maker's 8% gain on the day? The company announced it would perform another stock split to make the shares more accessible to retail investors. Shareholders still need to approve the move, but that is almost a given, and we can assume another 5-1 division is in the works, as was the case with the 2020 split. Speaking of that past event, it led to a 40% rally by Tesla shares and an inclusion in the S&P 500 by year's end. Just as we liked both Google and Amazon's 20-1 stock split, we like this move as well. Of course, the act of splitting a stock doesn't add or subtract one penny of value in and of itself, but it generally garners excitement by the investment community. This is as opposed to GE's financial engineering in which eight shares suddenly became one share, eight times more expensive. That stunt back in the Summer of 2020 has led to an 11% drop in the almost two years since it happened. We own Tesla in the Penn New Frontier Fund, where it continues to perform as expected. Naysayers point to the flood of EVs about to inundate the market; we point to Tesla's growing lead over the pack, and their massive lead in the world of fuel cell technology. |

|

TSLA $1,085

|

Making sense of Elon Musk's tweet asking followers whether or not he should sell 10% of his Tesla shares

(11 Nov 2021) Last Saturday, Elon Musk posed the following question to his 63.3 million Twitter followers: "Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock. Do you support this?" In a roughly 60/40 split, with 3.5 million voters (including us, we voted in the affirmative), the answer was "yes." While we wouldn't label the tweet as a gimmick, as many business journalists have, it is true that Musk really has no choice but to sell a good portion of his shares. Due to Tesla's achievement of some remarkably high targets, Musk has around 23 million vested stock options from 2012 with a strike price of roughly $6 per share. These options will expire next year, so he must exercise them and take the ordinary income (not realized gain) tax hit on the difference between $6 and the share price when he sells. Considering the shares are currently trading around $1,082, that tax bill we be enormous. In fact, it will probably be the largest single tax bill paid by an individual in history. (Though we doubt he will get a thank you card from the IRS or any politicians on the Hill.) Tesla also hit challenging targets which gave Musk options to purchase another 101 million shares at around $70 per share. These were issued in 2018, and represent about 5% of all outstanding shares. In trading action this week, Musk sold approximately 5 million of his Tesla shares, grossing him around $5 billion. Between the federal government and the state of California, and between ordinary income tax and capital gains, about 54% of that amount will disappear in the form of taxes. Musk, who has never taken a salary from Tesla, once famously quipped to his brother Kimbal, who had asked him for a loan, "You do know that I don't actually have any cash, right? I have to borrow." While his trades this week will certainly put some cash in his pocket, we fully expect him to make good on his promise to live by the results of the twitter poll; if for no other reason than to pay the $7 billion or so the IRS will soon come calling for due to his remaining options. Even after all of the sales are complete, Musk will still own around 15% of outstanding TSLA shares, or more than double the amount of the next largest shareholder, Vanguard Group. Last month, Elon Musk became the first person in the world to achieve a net worth in excess of $300 billion, eclipsing that of the second-place Jeff Bezos, who is worth around $200 billion. Even at $1,085 per share, we still consider Tesla, which we own in the Penn New Frontier Fund, a buy. All of the critics who argue that Ford, GM, Volkswagen, and a slew of startups will end up dooming the company seem to assume that Tesla will simply stand still. As usual, they will be proven grossly wrong. We would place the current fair value of TSLA shares at $1,800. |

|

TSLA $1,025

HTZZ $27 |

After landing enormous Hertz deal, Tesla officially reaches the rarified air of the $1T market cap club

(26 Oct 2021) Our favorite graph of EV leader Tesla (TSLA $1,025), surprisingly, isn't the company's share price; rather, it is the percentage of shares held short. In other words, a visual of the percentage of investors betting against the company. We can almost hear the ghost of CNBC's Mark Haines blathering, "Why the hell would anyone want to own this company?" Back in May of 2019, one out of every four shares of Tesla were held short; today, that number is under 3%. You can lose only so many hands before you are forced to walk away from the table. The latest news, which made Musk's vehicle technology firm one of only five American companies with a market cap exceeding $1 trillion (Apple, Microsoft, Alphabet, and Amazon are the others), was the announcement that car rental company Hertz (HTZZ $27) would buy a staggering 100,000 Teslas for nearly full price. Putting that in some perspective, that order would account for one out of every five vehicles the company sold in 2020. The news drove Tesla's share price up 12.66% on Monday, to a new high of $1,024.86, and brought its market cap up to $1.029 trillion. For Hertz, the deal represents a major strategic push to electrify its rental car fleet, to include building out its own charging infrastructure. The order, which will transpire over the next fourteen months, will add roughly $4.2 billion to Tesla's top line, meaning Hertz will pay around $42,000 for each vehicle. Tesla Model 3 sedans should be available to Hertz customers in the US and areas of Western Europe as soon as next month. Ironically, the interim CEO of Hertz is Mark Fields, the former CEO of Ford Motor Company (F $16). For investors, this massive deal represents yet another reason to own shares of Tesla. The news also drove Hertz shares up 10% on the day, but recall that the firm was driven into bankruptcy during the height of the pandemic, just recently emerging. We love the company's strategic push to electrify its fleet, but the $27 share price seems a bit rich. They may be worth another look should they fall back into the teens. |

|

NKLA $11

|

We called it: Nikola's founder, Trevor Milton indicted on fraud charges

(02 Aug 2021) We have been calling EV maker Nikola (NKLA $11) little short of a sham for a couple of years now. Our opinion was cemented after we saw the company's founder, Trevor Milton, in several interviews. Based on decades of CEO-watching, we got a really bad feeling about the founder and his alleged product lineup. While the company was spared in the indictment, the US government has just charged the founder with three counts of fraud, stating that he lied to investors "about nearly all aspects of the business." We may have had a bad feeling about the firm, but investors certainly didn't: NKLA shares went from $10 in March of 2020 to $80 three months later, since dropping back to the $12 range. While at their high, Milton had a paper net worth of roughly $9 billion; that figure is now floating around $1 billion, but we imagine there is plenty more pain ahead. The wheels became to come off the cart last September after Hindenburg Research published a scathing article on the EV firm, pretty much echoing the government case—or vice versa. Shortly after the report was released, Milton was out at the firm he started and a deal the company cobbled together with General Motors fell apart (we excoriated GM when it made the deal). If we want to ignore the company's financials (basically zero revenue) and focus on production, try this on for size: the company has produced zero vehicles for public sale. Tesla was enormously successful, so we should just jump into an EV maker that sounds like the next Tesla, right? Heck, this company even took the famous inventor's first name! Madness. It is understandable that the financials wouldn't look stellar on a nascent company trying to break into an industry with a pretty tall barrier to entry, but we are talking about a company that went public without having one vehicle roll off of an assembly line. NKLA may not have been a meme stock, but the same level of (ir)rational thought went into the purchase of the shares. |

|

TSLA $658

|

Tesla earned over $1 billion this past quarter, ten times more than it made in the second quarter of 2020

(27 Jul 2021) EV maker Tesla (TSLA $658) just achieved its eighth-straight quarter with positive cash flow, earning $1.14 billion in profit between April and June. As if that wasn't impressive enough, the figure represents a ten-fold increase over the $104 million it earned in the same quarter last year. Revenue in Q2 doubled from last year, from $6.04 billion to $11.96 billion. It is difficult to find any flaws in the earnings report, but that didn't stop the chronic naysayers from pointing out why this level of growth is unsustainable. Those comments are rather ironic, considering the company had to weather recalls, a backlash from Chinese consumers, and a chip shortage over the course of the quarter. As for Musk, he hinted that this may be the last earnings conference call he would be taking part in, let alone leading. We can fully understand that decision. Too many analysts continue to view Tesla as just another car company. Granted, were that the case, the multiples for the company are excessively high. We don't buy the premise, however. Tesla earned nearly $1 billion from its energy business last quarter, installing 60% more energy storage systems in homes than it did the previous quarter. Furthermore, we are most excited about the FSD (full self-driving) subscription service that should mushroom after future system upgrades make the company's vehicles fully autonomous. Then there is the company's advanced battery production facilities and its benchmark Supercharger DC fast-charting stations, which it will soon open to non-Tesla vehicles. We believe the Tesla growth story remains fully intact. |

|

RIDE $10

|

Two words investors never want to see in an SEC filing

(09 Jun 2021) Looking at a company's actual financials can be a great way to spot trends, but we love a more nebulous measure as well: watching a CEO in live interviews. That is how we first got an inkling that the likes of bumbling Ron Johnson (JCP), Bernie Ebbers (WCOM), and Jeffrey Immelt (GE) were either blowing smoke or out of their league—to put it nicely. As we watched interviews of EV startup Lordstown Motors' (RIDE $10) CEO Steve Burns on the business networks, we had an uneasy feeling. He came across as a super-nice guy, but one who was banking on hope, not facts. As the meme stock groupies drove RIDE shares up from the $10 range—where they had languished for years—to $31.40, we shook our heads. Here is a company offering a ton of promises and not one vehicle in production. CNBC's Phil Lebeau pressed Burns on the massive number of pre-orders supposedly on the books, and the response was an embarrassing shuffle that made us grimace. Fast forward to this week and the company's required quarterly filing; a filing which was submitted late, and only after the threat of a delisting notice from the Nasdaq. There was a lot of disconcerting language in the filing, but investors' jaws dropped on two words nestled in one ugly sentence: "These conditions raise substantial doubt regarding our ability to continue as a going concern for a period of at least one year...." Going concern. That means staying in business. The company came out and admitted that, failing to raise massive new amounts of capital, it would simply cease to be. RIDE shares plunged after hours on the report. At $10 per share once again, and with a major short interest, isn't it time for the WallStreetBets crowd to pile back in and stick it to "the man" yet again? Such a joke. And emblematic of the ugliness that will soon unfold before our very eyes with a number of other profitless companies. Meme groupie money may staunch the bleeding for awhile, but the inflows only prolong the inevitable. As for Lordstown, we would be surprised if one unit of one product ever leaves the actual assembly line. |

|

TSLA $723

|

Tesla's revenues surged 74% in the first quarter, leading to a record net income for the global EV leader

(27 Apr 2021) We remember listening to CNBC's David Faber ad nauseam: "Yes, Jim, but you do realize the company has never turned a profit, right?" We've never considered Mr. Brooks Brothers a lofty thinker, but his stale comments do make it all the more enjoyable to report that Tesla (TSLA $723) just notched its seventh-straight profitable quarter on the back of blowout numbers. For Q1 of 2021, Tesla generated $10.39 billion in revenue, with a record $438 million of that flowing down as net income. Addressing the new greatest threat to the automakers, the chip shortage, management said it has addressed the issue by moving to new microcontrollers for its vehicles and by developing the firmware required to work with the new chips made by different suppliers. Granted (we can hear Faber now), the company did make over $100 million by selling roughly 10% of its bitcoin stash at a profit, and another $500 million by the sale of tax credits, but the ever-increasing efficiency within their plants is undeniable. Tesla delivered a record 184,800 Model 3 and Model Y vehicles in Q1, and expects a 50% delivery growth rate this year over 2020. On the technical side of the business, Musk sees cameras replacing radar on its full self-driving (FSD) vehicles when they roll out, and expects to completely eliminate the old (radar-based) systems soon. In the earnings conference call, Musk also reiterated his aggressive plans to put more Tesla solar roofs on homes across America, supported by the company's home energy storage system known as Powerwall. The goal is to create a "giant distributed utility" which will ultimately make one's house energy self-sufficient. There are always going to be naysaying journalists and analysts chronically pointing out why Tesla will ultimately fail. Their latest narrative is that increased competition within the EV and autonomous-driving space, along with the end of tax subsidies, will doom the company. Tesla is doing everything right to remain in the pole position going forward, however, and we consider its nationwide Supercharger network to be an enormous advantage over the competition. It should be noted that Tesla offered this technology to other automakers several years ago, but the offer was flatly declined. |

|

GT

CTB |

Goodyear to buy Cooper Tire & Rubber Company for $2.8 billion

(23 Mar 2021) There aren't many tire manufacturers based in the United States these days, so the two biggest might as well join forces. Goodyear Tire & Rubber Company (GT $17) has announced its plans to acquire smaller US rival Cooper Tire (CTB) for $2.8 billion in cash and stock. Goodyear, which trails only France's Michelin and Japan's Bridgestone by sales, will suddenly have a much larger global footprint: 50 factories and 72,000 employees around the world, and sales volume of 64 million replacement tires in the US. With demand for replacement tires expected to grow rapidly in the coming years, the move should allow the new entity to grow market share substantially in both the US and China—the industry's two largest markets. Both companies are based out of Ohio. Obviously, the commodity price of rubber plays a major role in a tire manufacturer's bottom line. Fortunately, global rubber prices have dropped precipitously over the past decade. We would put a fair value on the price of Goodyear shares, post-merger, at $20. |

|

WKHS

OSK |

Investor darling Workhorse has its shares cut in half after losing USPS contract

(24 Feb 2021) It has been one of those "new investor" cult stocks with one of the key buzz phrases, or acronym in this case, that the new wave of retail money flocks to: EV. The company is Workhorse (WKHS $16), which has seen its stock price go from $2 per share a year ago to $43 per share a few weeks ago—all on the back of microscopic revenues and chronic annual losses. The financials didn't matter; pie-in-the-sky promises were enough to bring money flooding into the stock. The latest promise was the imminent contract by the United States Postal Service to replace its fleet of 150,000+ outdated vehicles. To Workhorse devotees, it was a foregone conclusion that their company would be the recipient. When the contract was awarded to the defense unit of $8 billion industrial firm Oshkosh (OSK $117), WKHS shares nosedived more than 50% in one day. The drop was so rapid that any stop order to protect gains would have been essentially worthless: investors would have been stopped-out at the bottom. There are some great lessons in this story. Investors need to understand what they are buying, and they need do have at least some inkling as to a company's fundamentals. Forget the fact that Workhorse had never turned an annual profit, how about the fact that they were barely generating sales? As for "boring" old Oshkosh, the company has a pristine balance sheet and generates solid revenues—and profits—year after year. But who wants boring? Anyone willing to take a little time to do some basic research can be greatly rewarded by the flow of "dumb money" right now. Don't get caught up in the hype and follow the lemmings off the cliff; use their moves to help uncover the value plays present in the market. |

|

F

|

After a century of operations in the country, Ford will close its Brazil plants, taking a $4.1 billion hit

(15 Jan 2021) There are a lot of moving parts at Ford right now, but the jury is still out on whether those machinations will create something bold, new, and profitable, or simply offer up new opportunities for massive breakdowns. The latest twist in the company's $11 billion turnaround effort, put in motion by former (and lackluster) CEO Jim Hackett, is the closure of its three assembly line plants in Brazil—ending a century of operations in the country. The move earned some rather acrimonious comments from Brazilian President Jair Bolsonaro—whom we have a lot of respect for—but the 5,000 unionized workers at the three plants have been turning out a paltry number of new vehicles per year, with the company netting a loss of $700 million in South America in 2019, and nearly $400 million through the first three quarters of 2020. The company will take a write-down of $4.1 billion related to the closures, mostly to give the workers a severance package. While we don't know what that will look like, the company offered workers at its shuttered plant in Russia the equivalent of one-year's salary, though it is unclear whether or not the Brazilian workers' union will accept the terms. Ford claims it is ready to embrace the future of electric and autonomous vehicles, but that is what we were told when Hackett, who headed up the firm's Smart Mobility unit, took the top spot in 2017. What a disappointment his tenure turned out to be. Jim Farley took over for Hackett this past October, but readily embraced his predecessor's turnaround plan. We're not sure what will be different with the automaker under new management. Pardon us if we don't buy what Ford management is trying to sell us; we have been here before with this company, and have heard the same tired lines. We used to at least get a big fat dividend yield for buying shares in the company, but those were suspended last March. |

|

TSLA

|

Tesla misses gargantuan 2020 delivery goal—by 450 vehicles

(05 Jan 2021) It was an insanely-high goal, and the usual suspects scoffed at Elon Musk for even throwing the figure out there. Tesla (TSLA $730) projected it would deliver half-a-million electric vehicles in 2020. At the time of the forecast, the company was producing around 100,000 vehicles per year. As the naysayers predicted, the goal was not reached: just 499,550 vehicles were delivered. Not surprisingly, some pundits actually pointed out the miss. The less than one-tenth of one percent miss. The ramp-up in production is beyond impressive, and it points to one of the reasons why Elon Musk is now the second-richest person in the world, adding roughly $150 billion of wealth to his net worth last year. Analysts are scrambling to raise their 2021 projections for Tesla vehicle deliveries, with the average now calling for 750,000 units to roll off of the assembly lines. Major new plants in Austin, Brandenburg, and Shanghai should make that happen. (Update: With a net worth of $188 billion as of Thursday, Musk has surpassed Jeff Bezos as the world's richest person.) For any investor wishing to get in on the relative ground floor of a Musk entity, look for SpaceX to go public at some point this year. Hopefully the "throw money at anything cool" crowd will not drive the price up to astronomical levels on IPO day, as we plan to buy. |

|

NKLA

|

Nikola shares fall 54% after deal with General Motors is scaled back

(02 Dec 2020) Anyone who has read our columns on a regular basis knows our personal opinion of EV automaker Nikola (NKLA $17)—that the company is a total sham. Nonetheless, "traders" went flooding in, driving the shares up from $10 in March to $94 just three months later. Research be damned, this was going to be the next Tesla (TSLA $585)! Not quite. We mocked General Motors (GM $45) for even considering taking a stake in the firm; a move that only emboldened neophyte traders. It seems as though GM's Mary Barra has seen the light, as the company has backed out of its plan to take an 11% stake in Nikola and will no longer work with the firm to build the Badger, an EV pickup for consumers. Perhaps to keep a little pride intact, GM did rework the deal to keep a fuel cell partnership in place, but this non-binding agreement will probably wither on the vine. In just five sessions, NKLA shares fell from $37.62 to $17.37—a 54% drop. Oh well, at least it is back on the radar screen for those whose investment strategy consists of buying stocks trading for under $25 per share. Shades of 1999. Americans are piling into flashy stocks based on headlines, not research. For astute investors, this will create huge opportunities—especially in the boring value companies which don't garner many headlines, but which generate fat annual profits year after year. 2021 will mark the year of the great rotation back into value. |

|

Musk

|

With Tesla's share price on the rise, Elon Musk is suddenly the world's second-richest person

(24 Nov 2020) According to the Bloomberg Billionaire Index, Tesla (TSLA $522) and SpaceX founder Elon Musk is now worth $128 billion. He can thank the S&P 500 Index committee in a way: their decision to admit Tesla to the benchmark index has pushed that stock noticeably higher in recent days; in fact, Musk's net worth increased by $7.2 billion on Monday alone. But that's comparative peanuts: So far in 2020, Musk's net worth has risen by $100 billion, moving him from the number 35 spot of the world's richest people to the number two spot this week, knocking Microsoft founder Bill Gates to the number three position. We imagine the prestige of being the world's second-richest person doesn't mean too much to Musk; his passion for what he does and his grand strategic vision of "making life multiplanetary" drives his thought process. Those who want to get the most out of life should take this lesson to heart with respect to uncovering and following their own unique passions. Another lesson we can learn from Musk: As all of the critics and naysayers were impugning both him and his audacious goals, he forged ahead relentlessly. |

|

TSLA

|

A major milestone for Tesla: it will be added to the S&P 500 Index

(17 Nov 2020) After five consecutive quarters of net profit, Tesla (TSLA $458) is headed to the S&P 500 Index. While the $434 billion EV maker technically became eligible for the benchmark index this past summer, following its fourth consecutive quarterly profit, the Index committee passed, offering no rationale for their decision. On the 21st of December, however, Tesla will officially become the largest company ever added to the Index, smoothing the way for more investment dollars to flow into Elon Musk's firm. We think of all the Tesla skeptics, many of whom have already expressed their anger over the inclusion, and all of the TSLA short sellers who seem to lose money at every turn. One sour grapes analyst proclaimed that "S&P is making a big mistake and adding lots of downside risk to the index...." Pardon us if we don't put much weight behind the words of an analyst who has proven to be chronically wrong. Despite Ford and GM's push into the EV market, Tesla will maintain its dominant market position for decades to come. As the company's advanced Supercharger network continues its buildout, expect to see an ever-increasing number of Teslas on the road. Projections for vehicle deliveries in 2020 have increased from 800,000 to 950,000, and for 2021 projections have risen from 1.15 million to 1.6 million new vehicles. New plants are nearing completion in Texas, Berlin, and Shanghai. And don't forget about the company's massive battery gigafactories and its growing solar business. |

|

F

|

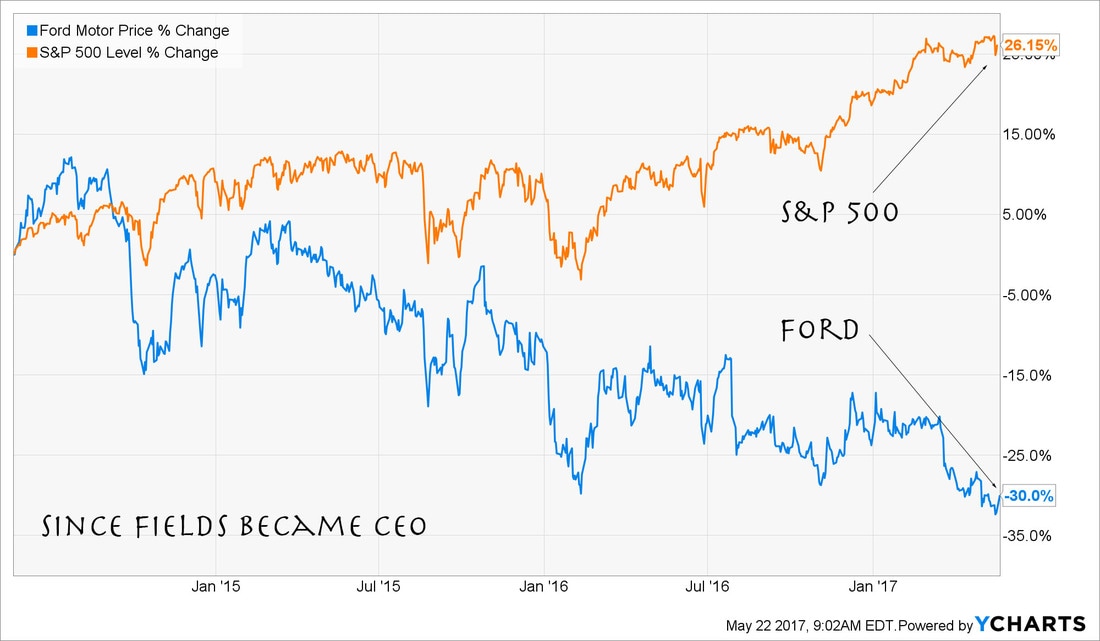

Ford desperately needed new blood, instead they pulled from within

(06 Aug 2020) Let's take a sobering trip down memory lane from the standpoint of Ford Motor Co (F $4-$7-$10), beginning near the start of this century. Between 2001 and 2006, shares of the car company, founded in 1903, fell 50% under Bill Ford Jr., great-grandson of founder Henry Ford. Then came the company's last successful CEO, Alan Mulally, who presided over a 178% rise in the shares. In July of 2014, Mulally retired and handed the reins over to Mark Fields. By the time Fields was ushered out in 2016, shares had dropped another 35%. Finally, we had Jim "Buddy" Hackett, who became CEO in 2017. We had high hopes for this pick, as he had been the head of Ford's Smart Mobility subsidiary, the company's self-driving car initiative. Another 38% drop later, Hackett is gone. Reasonable business minds would fully grasp the need to find new blood to reinvent the car company, which managed to lose $2.123 billion over the trailing twelve months on $130 billion in revenues. So, what dynamic pick did the the board of directors make? They elevated the firm's chief operating officer, Jim Farley, to the CEO role. In a comment apparently designed to instill confidence, Chairman Bill Ford said that Hackett will remain in an advisory role to Farley until next spring. Whew, glad to hear that. Of interesting note: one component of the $2.123 billion in losses was the higher warranty costs (around $5 billion) incurred by the company due to quality control issues on their late model vehicles. Not a comforting sign for an automaker operating in a hyper-competitive industry. Much like Boeing, this once-great company has buried its head in the sand and refuses to accept what needs to be done. What should we expect when the same people who ran the companies into a ditch are the ones responsible for hiring the new blood? |

|

TSLA

|

Tesla will build gigafactory, new production facility in Austin, Texas

(24 Jul 2020) If the location of the new site wasn't telegraphed, it was sure hinted at. Electric vehicle maker Tesla (TSLA $1,415) announced that it would build a new gigafactory and second production facility on 2,000 acres just outside of Austin in what will be one of the biggest economic development programs in the city's history. The $1.1 billion facility will be used to build the Tesla Cybertruck, its Semi, and both the Models 3 and Y for the eastern part of the United States. A few months ago, as California officials were trying to keep Tesla's Fremont location closed due to the pandemic, Musk angrily tweeted out that he may move everything to Texas. While that fight has dissipated, there is clearly a love affair between Musk, whose net worth is now valued at $70 billion, and the state of Texas. Ultimately, the new plant, which will be built along the Colorado River, will employ 5,000 workers with wages starting at $35,000 per year. As for keeping the area pristine, Musk said the factory will be an "ecological paradise," with a boardwalk and a hiking/biking trail. |

|

TSLA

|

Elon Musk's most excellent lawsuit against a local California fiefdom

(12 May 2020) He may have been born a citizen of South Africa, but Elon Musk could teach more than a few people in this country what it means to be an American. The feud between the Tesla (TSLA $177-$831-$969) CEO and Alameda County began when the head of the country health department, a small-time nobody with delusions of grandeur, ordered the company's Fremont factory to remain closed until it—the health department—had reviewed the reopening plan and decreed it acceptable. This led to Musk's first tweet on the matter: "Frankly, this is the final straw. Tesla will move its HQ and future programs to Texas/Nevada immediately. If we even retain Fremont manufacturing activity at all, it will be dependent on how Tesla is treated in the future. Tesla is the last carmaker left in CA." Obviously stewing, and anxious to get his plant reopened, Musk followed up with this one: "Tesla is filing a lawsuit against Alameda County immediately. The unelected & ignorant 'Interim Health Officer' of Alameda is acting contrary to the Governor, the President, our Constitutional freedoms & just plain common sense." Finally, Musk sent his ultimatum: "Tesla is restarting production today against Alameda County rules. I will be on the line with everyone else. If anyone is arrested, I ask that it be only me." The latest? Musk reopened his plant, standing side-by-side with his workers. No arrests reported, though we doubt Alameda will go quietly with its tail between its legs. As for the threat, we heard numerous "experts" weigh in on the near-impossibility of moving a plant the "size of ten Costcos" (as one put it) to another state. They do not understand how Musk thinks. First, it should be noted that Musk has now sold all of his houses in California. Second is the issue of his financial incentives. There are twelve tranches or productivity metric points which, if hit, would put $55 billion in Musk's pocket. I recall journalists laughing at these targets as recently as a year ago; now, they seem fully achievable. Based on California's confiscatory marginal tax rate of 13.3%—the highest in the US, sorry New York—Musk could save somewhere in the ballpark of $7 billion in taxes if he moves to Texas or Nevada! Neither of those states levy personal income taxes. The Texas constitution, in fact, forbids it. Right now, the 48-year-old Musk has a personal fortune of nearly $40 billion. We have heard arrogant California officials laugh off any impact that one individual would have by moving out of the state, lock, stock, and barrel. Let's see how hard they are laughing after they push him too far. |

|

F

|

Ford to suspend all dividend payments, halt North American production. (20 Mar 2020) It seemed as though the situation couldn't get any worse for the traditional American automakers, namely Ford (F $4-$5-$11) and General Motors (GM $14-$19-$42); then the pandemic hit. Ford, which generated a paltry $47 million in profits on $156 billion in revenues over the trailing twelve months, seems to be in a particularly precarious situation. For investors who have witnessed the value of their Ford shares drop by 50% year-to-date, at least they could point to a fat dividend yield. With the share price falling, however, the yield on the dividend rose to an unsustainable 13.13% as of Friday. Which is why it came as little shock when the company's uninspiring CEO, Jim Hackett, announced a suspension of all dividend payments to conserve cash. Additionally, Ford will halt all production in the US, Mexico, and Canada through at least the 30th of March. For its part, the UAW has requested that all US automakers shut down operations for at least two weeks to help assure the safety of its workers. Don't let the $5 share price fool you, Ford is an expensive stock to own. Since the company is still turning a profit, it actually has a P/E ratio, but that metric has been vacillating somewhere between 225 and 465 throughout the past three months. Like we said, expensive.

|

|

Ghosn

|

Ghosn's Great Escape: we feel a Netflix movie coming. (31 Dec 2019) While we have never been big fans of former Nissan/Renault chief Carlos Ghosn due, in part, to his extreme arrogance—even for a French CEO (actually, he is a Brazilian-born French businessman of Lebanese ancestry), we found ourselves actually rooting for him in this case. For over a year, Ghosn has been imprisoned in Japan on charges of corruption and misappropriation of funds while head of the Japanese/European conglomerate (Ghosn was CEO of Alliance, the partnership between Renault, Nissan, and Mitsubishi). For some reason still not fully understood, he was often kept in a small cell with little access to his loved ones or even his lawyer. It looked a little bit more like Midnight Express (great movie, Turkish prison) than it did justice in a democracy. Ghosn, who was finally released from prison and on house arrest while awaiting his trial, which was due to take place sometime in 2020, finally made his great escape. With wild rumors circulating of just how he pulled off the stunt (one involved him being hidden in a crate filled with musical instruments), one thing is certain: Ghosn escaped Japan and is now in his childhood home of Lebanon, hailed as some type of fugitive hero. Not only is he somewhat of a folk hero in Lebanon, which once issued a stamp with his likeness on the face, the country has no extradition arrangement with Japan, so odds are about zero that he will ever up back in Tokyo. As for the charges, Japan argues he misappropriated the funds to fuel his extravagant lifestyle, but others believe Nissan executives set him up as payback for Renault's growing power over the Japanese automaker. Either or both seem plausible to us. Nonetheless, he will now face trial in absentia. It truly is a story ready-made for TV. As Ghosn is not shy of the camera, it will be interesting to hear what he has to say over the coming weeks.

|

|

TSLA

|

Once again, Elon Musk gets the last laugh as short sellers take it on the chin. (23 Dec 2019) Most automotive industry analysts love to hate Tesla (TSLA $177-$419-$420) and its founder, Elon Musk. Perhaps it is envy, or perhaps their limited imaginations refuse to accept that a successful car company can be created out of thin air in the modern era. Whatever the reason, we have to chuckle every time Musk proves them wrong, as he just did yet again. It was a little over sixteen months ago that Musk made his infamous tweet, "Am considering taking Tesla private at $420. Funding secured." What percentage of the tweet was serious and what percentage was simply a failed attempt at some marijuana humor we may never know, but one thing is certain: the SEC didn't find it funny. The commission fined Tesla $20 million and its CEO $20 million for the pithy comment. Many who wanted Musk barred from running his company—a preposterous notion—were disappointed. Months of personal bashing ensued, and the brouhaha helped drive Tesla stock all the way down to $179 per share by the following summer. We recall analysts predicting the company's demise with unconstrained glee. Then something happened. Suddenly the carmaker began surprising to the upside on sales and deliveries (and even a profitable quarter), and the stock began its incredible 135% upward march over the course of six months. Short sellers got crushed. The funniest part of the run was that Tesla shares hit that magical $420 per share mark. Of course, that was too juicy for Musk to pass up. Within minutes he tweeted, "Whoa the stock is so high lol." Classic. Tesla is the benchmark electric vehicle maker, despite what the old, stodgy, "me too" carmakers are projecting for their own electric fleets. We expect that to continue, and we expect many profitable quarters in Tesla's future. Now, if Musk would only bring SpaceX public.

|

|

TSLA

|

Elon Musk reveals Tesla's new "out of this world" pickup, the Cybertruck. (22 Nov 2019) One never knows what to expect from the fertile mind of Elon Musk, but boring is never an option. The Tesla (TSLA $177-$355-$379) CEO just revealed the company's new pickup, the Cybertruck, and it is nothing short of unreal. With production set to begin in 2021, the company's sixth vehicle will have a starting price of $40,000 with plans to compete in the lucrative Ford F-150 and Chevy Silverado market. Looking beyond the truck's futuristic design, it will offer a range of between 250 and 500 miles per charge, depending on the model, come equipped with Tesla's Autopilot feature, and have a towing capacity of between 7,500 and 14,000 pounds—again, depending on the model. By comparison, the best-selling Ford F-150 offers a towing capacity of between 5,000 and 8,000 pounds. For use at the jobsite, the Cybertruck comes complete with 120-volt and 240-volt power outlets and an onboard air compressor. For off-duty fun, consumers will be able to buy Tesla's new electric all-terrain vehicle, designed to roll up into the back of the Cybertruck. For all his detractors, Elon Musk has been an extreme disruptor within the automotive industry, forcing other automakers to innovate beyond what they would have if Tesla did not exist. They have no problem poking fun at Musk, meanwhile they are constantly scrambling to make "us too!" moves. Incredibly, he is causing the same disruption to the nascent commercial spaceflight industry with his privately-held SpaceX. It is easy to compare Musk to a Henry Ford or a Steve Jobs, but that might not be giving him the credit he is due. In June of this year, TSLA shares were selling at $176.99 and the lemming analysts came after Musk with both barrels. Since 03 Jun, shares are up precisely 100% (as of Friday morning). Short sellers who listened to the analysts' advice on this stock have been decimated.

|

|

F

|

Ford launches its new electric vehicle lineup with the Mustang Mach-E SUV. (19 Nov 2019) The reservation site is now live: consumers can visit the Ford (F $7-$9-$11) website to order their new, all-electric Mustang Mach-E SUV. Starting price: $44,000. The company is late to the party, with Tesla (TSLA) controlling 80% of the EV market and a handful of other players splitting the other 20%, but with Tesla's new electric pickup truck and its Model Y SUV hitting the road soon, at least the $35 billion automaker is now in the game. It was an interesting gamble to launch its $11 billion EV program with an iconic name attached to an SUV, but Ford needs to be bold if it hopes to compete in this space. The company says it will offer 40 all-electric and hybrid vehicles by 2022—an aggressive timeline we highly question. As for the Mustang Mach-E, customers should be able to take delivery by Q4 of next year. How will Ford turn a profit on an all-electric SUV for $44,000 ($60k for the GT)? The vehicles will be built in Mexico, saving thousands per unit on labor costs. We haven't had a lot of faith in Ford CEO Jim Hackett's ability to see the future of the industry, but if the company can make its EV lineup a viable player in the industry, it could spell the beginnings of a turnaround. Let's see how well they execute before investing, however.

|

|

TSLA

|

Stop the presses: Tesla turned a profit! (24 Oct 2019) We have never hidden our admiration and respect for Elon Musk, and we continue to root for all of the companies which have been formed directly out of his visionary mind. Likewise, we have never hidden our disrespect for the established old-school car companies that have taken potshots at Tesla (TSLA $177-$300-$379) as they sat back and rested on their laurels (until Musk forced them to begin to innovate once again—spineless wonders). We will throw many do-nothing analysts in the mix as well, who have all but guaranteed that we will never see Tesla turn a profit. Sorry to disappoint, but against Street expectations for a $0.46 per share loss, Tesla just reported a $1.86 per share profit. The company's blockbuster earnings report shocked just about everyone, and investors responded by pushing TSLA shares up 18% in pre-market action, topping $300 for the first time since the end of February. Since the third of June, shares have now quietly risen 68%, though they were down heavily through the first five months of the year. The company's $1.86 per share profit came on the back of $6.3 billion in Q3 sales, roughly in line with the same quarter last year. Production of the company's Model 3 sedan hit just shy of 80,000 in Q3, versus 53,200 in the same quarter of last year—a 50% spike. The icing on the cake: With Thursday's spike in its share price, Tesla overtook GM (GM) in market cap. Tesla is worth $54 billion; GM, $52 billion; and Ford, $35 billion. While the Model 3 is currently the company's biggest revenue driver, it is gearing up for production of its next big blockbuster, the Model Y crossover utility vehicle (CUV). Tesla is finishing the buildout of its Gigafactory number 3 in Shanghai, in addition to a new production facility in that city. When all facilities are online by the middle of next year, the company is projecting a global production rate of 500,000 vehicles annually. Orders continue to outpace production. We believe short sellers are making a grave error by betting against this firm.

|

|

UAW

GM |

If the UAW strike hasn't hurt GM, the US auto industry, and the unions already, it is just a matter of time. (07 Oct 2019) Talk about a bad time for a walkout. US automaker General Motors (GM $31-$34-$42) has been battling international competitors eating into the company's market share, sagging new auto sales, a global economic slowdown, a trade war, and a costly effort to develop electric and autonomous vehicles. As if Mary Barra's plate wasn't full enough, her management team is now dealing with a four-week-old, UAW-instigated strike by over 46,000 of its unionized workers. Shares of GM are already down over 10% since the strike began, and a senior union chief told reporters that the negotiations have taken a turn for the worst. Perhaps that is just chest-pounding, but the UAW is trying to send a message to Ford (F) and Fiat Chrysler (FCAU)—the next two targets for contract talks—that it won't be rolled over, despite the souring economic landscape. Consulting firm Anderson Economic Group estimates that GM's daily losses from the strike could rise from $10 million per day at the start, to as much as $90 million per day if it goes on much longer. Interestingly, the threat of tariffs being placed on foreign-made autos seems to have emboldened the union in its talks. GM will eventually make it through these negotiations relatively unscathed, but the automation of labor and the reality of global competition are two genies which will never be put back in the bottle. The UAW had better make the most of this walkout; the next one will see them in a weaker position.

|

|

F

GM |

Ford, General Motors slide on Q3 earnings data. (02 Oct 2019) For General Motors (GM $31-$35-$42), which is in the midst of dealing with a UAW-fomented strike, the news wasn't good. Against expectations for a 7.8% jump in sales from Q3 of 2018, the automaker had an increase of just 6.3%. That miss was enough to drive shares of the company down 4% within minutes. But GM's earnings report looks glowing next to that of rival Ford's (F $7-$9-$11), as that company saw sales fall 4.9% from the same quarter last year. Perhaps because shares of Ford had already been beaten down, at least compared to GM, that company's stock also fell 4%. The day before these two automakers reported, The Wall Street Journal ran an extensive article on how the US middle class is being priced out of their vehicles, with just 18% of car buyers able to pay cash for the purchase. The other 82% are forced to resort to financing, and the seven-year auto loan is becoming commonplace. Adding to the downward pressure on the typical family's budget, the average monthly cost of financing a vehicle is around $550. Considering how low interest rates currently sit, that spells big trouble going forward. Furthermore, the average duration for existing auto loans is 69 months, meaning most won't even be paid off by the time the owner is searching for a new one. Most auto loans are packaged, bundled, and offloaded to investors. Does that sound familiar? Granted, the $1.3 trillion in outstanding auto loan debt is nothing compared to the housing loan crisis that caused the 2008 financial meltdown, but it is something to pay close attention to—especially if we go into a recession. Auto loan delinquencies also turned the corner and began rising in the third quarter of 2014. Is anyone paying attention to the warning signs? We don't own any automakers within any of the five Penn strategies, but we do own a couple of used car retailers. A record 41 million used vehicles will probably be sold in 2019, and we expect this trend to continue as more and more Americans are priced out of the new car market.

|

|

UAW

|

UAW members vote to give union right to call strike if demands aren't met during negotiations. (04 Sep 2019) As if dealing with a trade war, new competitors around the globe, and the industry shift to electric vehicles weren't enough, the major US automakers are about to engage in negotiations with their biggest adversary: the United Auto Workers. In a sign of the struggle ahead, UAW member just voted—with a 96% majority—to give the union the right to call a strike if it doesn't get what it wants out of the talks. And expect these talks to be contentious. The UAW will start with GM (GM $31-$37-$42), which recently announced it will close four US plants—a guaranteed flashpoint. Adding an interesting wrinkle to the talks, UAW President Gary Jones had his home raided by federal agents last week as part of a union corruption probe. Charges have already been filed against other union officials as part of the investigation. The current, four-year contract between the automakers and the UAW is set to expire on 15 Sep, but short-term contract extensions are normal as the two sides negotiate. There are currently around 400,000 UAW members, down from 1.5 million in the 1970s. Foreign automakers with plants in the US, along with electric vehicle maker Tesla, have been able to successfully fend off attempts by the UAW to organize workers at their facilities. We wouldn't touch GM, Ford, or Fiat Chrysler as these negotiations get underway. We believe they will be the ugliest in at least twelve years (the UAW last called for a strike against GM in 2007), and we believe neither side will walk away the winner. In other words, there will be a lose/lose result when all is said and done, and tensions between management and workers will be tighter after the talks conclude than they are today. And that is saying a lot.

|

|

GM

|

The 8th-generation Corvette, or C8, should provide a nice boost for shares of General Motors. (22 Jul 2019) I recall when the 4th-generation Corvette came out in 1984; I stared at the futuristic-looking machine in amazement. That old feeling came back last week when General Motors (GM $31-$40-$42) introduced their Corvette C8, the latest iteration of the beast Chevrolet first introduced at the 1953 GM Motorama car show. I also recalled several recent stories detailing how both GM and Ford (F) were, essentially, exiting the car business to focus on SUVs and light trucks. The rollout of this new beauty, whose base price will start out at a very reasonable $60k, seems to fly in the face of that narrative. While it is true that a full 80% of GM's volume now comes from light trucks like the Chevy Silverado, we expect the new Vette to reinvigorate car sales both in North America and around the world. In the meantime, investors can take their nearly 4% dividend yield to the bank. We will review GM's investment outlook in the next issue of The Penn Wealth Report.

|

|

TSLA

|

Tesla hits record production and delivery numbers, stock soars. (03 Jul 2019) Critics in the press, many of whom seem to have a personal animus towards Elon Musk, jumped all over Tesla's (TSLA $177-$238-$387) big deliveries miss two quarters ago, helping to drive shares down to a one-year low of $177. That was not the case this last quarter, however, as the company announced it had produced 87,000 vehicles and delivered another 95,200—both figures blowing by analyst expectations. Furthermore, anticipation is high for Q3 as the company also announced it will be entering the quarter with a large backlog of orders. Shares spiked about 6% after the earnings report was released. The press painted a narrative of empty showrooms and a general loss of enthusiasm for Tesla vehicles. That was simply not the case, giving us another great example of how we can take advantage of misreporting and faulty analysis.

|

|

FCAU

RNSDF |

The merger would create the third-largest automaker in the world, but do you really want to own it? (28 May 2019) For France's Renault (RNSDF $58-$58-$100), which had been trading at its one-year low, and Italy's Fiat Chrysler (FCAU $13-$14-$23), which was sitting just a buck off of its low, it was a joint venture forged out of necessity. The two European car companies announced a "merger of equals" this week, with each side owning 50% of the newly-formed company. Combined, the carmakers sold 8.7 million vehicles last year and generated $9 billion in net profit, but margins are fast-disappearing in an industry beset with challenges. While touting the deal as a way to save nearly $6 billion in annual costs, it will be interesting to see how that is done, considering France's demand that no jobs be cut at the firm following the merger. Both boards, Italy, France, and the automakers' union must all OK the deal, but it will almost assuredly be completed. The fun part will be watching a Northern European carmaker merge with a Southern European one, considering the dichotomy in thinking between the two regions. While stocks of both companies popped on the news, we wouldn't touch the new entity when it is formed. Instead, grab some popcorn and enjoy the show.

|

|

TSLA

|

Tesla's move to online sales makes a great deal of sense for the company. (04 Mar 2019) Every time I walk in a new automobile showroom (which isn't that often, as we buy our vehicles from Carmax (KMX)—an incredible experience), I always look around and wonder what the monthly overhead is on the place. From heating and cooling the behemoth, to the confiscatory rate the owners/landlords are charging each month for all that indoor and outdoor space. That came to mind when I read of Elon Musk's plan to start selling all Tesla (TSLA $245-$285-$387) models online. Additionally, he also announced the company would sell its Model 3's at a starting base price of $35,000—a price that necessitates the need to do away with the showrooms. I went to the Tesla online showroom to check it out, and the process seems incredibly straightforward and simple. Within minutes you can order your car and have it shipped to you within a few weeks. Buyers will be given one week or 1,000 miles to return the car and receive a full refund. Of course (this is Tesla, after all), many will disagree with our opinion, but we find the strategy to be brilliant. Imagine the overhead the company will save, and let's face it, the shopping experience is moving online more rapidly than anyone could have predicted. The pundits will probably claim this is another nail in the coffin of Tesla; we believe just the opposite. Tesla remains a decade ahead of any of the "we sell electric cars, too!" automakers. Tesla is currently selling at $288 per share. While the risk is certainly there, we see this as an outstanding point for investors to jump in at the higher end of their risk/reward spectrum. One more note of interest: Musk will hold an event for the new Model Y unveiling a week from Thursday (on the 14th of March). This may be another catalyst for the stock price to move higher.

|

|

TSLA

|

Tesla misses Q4 production expectations, stock takes a hit. (02 Jan 2019) It seems like an impressive number. Electric-vehicle maker Tesla (TSLA $245-$300-$387) built and sold 1,000 cars per day in the fourth quarter of 2018—90,700 in all. Unfortunately for the company, Wall Street was expecting a 92,000 figure, and that 1.2% miss drove Tesla shares down 10% in early trading. Another concern for not just Tesla, but all EV makers, is the federal tax credit cut that went in place on 01 Jan. The $7,500 credit was halved to $3,750. To counter that loss, Tesla announced it was reducing the price of all models by $2,000. Tesla isn't at risk of insolvency, and the EV market's growth trajectory is only going to get steeper as the march to replace the combustible engine picks up steam. Based on these two factors, is $300 the right price to jump into TSLA? It's hard to say, primarily because emotions are so heavily involved in TSLA trading.

|

|

GM

|

General Motors to shutter five North American plants, slash salaried workforce.

(Update: President Trump has threatened to cut off all subsidies for GM's growing electric car business due to the blue collar cuts.) (26 Nov 2018) General Motors (GM $31-$38-$46) calls it "unallocating," but to the 6,000 factory workers who will lose their jobs, the word is "closing." The $54 billion US automaker announced that it will shutter five North American auto-producing plants—four in the US and one in Canada—by the end of 2019. The plan, which also calls for a 15% cut in the salaried workforce, is part of a global overhaul by the company to account for slowing auto sales, growing SUV and truck sales, and rapidly-increasing autonomous vehicle technology. While the restructuring will cost nearly $4 billion, GM says the moves will improve free cash flow by $6 billion before the end of 2020. Angry union workers at the Canadian plant noted that GM was not slashing any positions at its Mexican facilities. General Motors spiked over 7% on news of the global restructuring, but then gave most of that back after backlash from the White House. |

|

GM

|

Honda will invest nearly $3 billion in GM's autonomous vehicles. (10 Oct 2018) Honda and General Motors (GM $32-$33-$47) are teaming up to build autonomous vehicles, with the former seeding GM with $750 million and the promise of another $2 billion. GM Cruise, LLC will develop autonomous vehicles from conception to design to production, with plans to sell the vehicles around the world and share the revenues (Honda will have a 5.7% stake in the new firm). This is a huge win for GM, and a great plan overall. Honda had been in talks to work with Alphabet's (GOOG) autonomous division, Waymo, so this is quite the coup for GM. It is also another hit to Ford (F), which dropped on the news. We had high hopes for Ford after, ironically, its former smart car boss—Jim Hackett—took over as CEO. It has been a relatively steady decline for Ford shares since Hackett took the helm in May of 2017. If he is not careful, he will go the way of GE's 13-month CEO Flannery and be shown the exit door. The other shoe for Ford will drop when the company's is forced to slash its now 6.7% dividend yield.

|

|

TSLA

|

Musk settles with SEC, causing shares of Tesla to spike. (01 Oct 2018) The SEC and Elon Musk have settled out of court, and the markets celebrated. Despite the organization's draconian demands in the lawsuit stemming from Musk's boneheaded tweet about taking Tesla (TSLA $245-$305-$387) private, there was every possibility that they would have ultimately won—they are, after all, the government. Musk, who had rejected the initial plea deal offered by the SEC, was convinced by his lawyers to request another plea. The SEC reluctantly agreed, but made the terms stiffer: Musk would have to pay a $20 million fine, the company would have to pay a $20 million fine, and Tesla's founder would be barred from the chairman's seat for three years. Additionally, the company would have to create two new independent board seats, and Musk would have to have any social media comments reviewed before posting. It sounds like a rough pill to swallow, but considering the SEC's lawsuit sought to have Musk banned for life from a management role at Tesla, it had to be taken. This should allow Musk, who was allowed to retain his position as CEO, to return his focus to Model 3 "logistics hell." Tesla spiked over 16% on news of the settlement.

|

|

TSLA

SEC |

Tesla falls 12% after SEC files suit against company, Musk. (28 Sep 2018) The SEC is coming after Elon Musk with a vengeance. Not only do they want to fine Tesla's (TSLA $245-$274-$387) CEO and the company for Musk's tweets about potentially taking the company private ("funding secured"), they also want him removed as the company's CEO. The regulatory agency claims that Musk knew funding was not secure, and initiated the tweets to raise the share price of the company. There is no doubt that sending the tweets was a boneheaded mistake, but the premise that he did so to raise the stock price is ludicrous. Additionally, why not just fine Musk/Tesla; why would the SEC demand that he be removed as CEO? That action would have a direct and negative impact on shareholders. Musk reportedly refused to take a "deal" offered by the SEC which would have involved a fine and him stepping down as chairman for two years—he could have remained CEO, however. Based on the organization's specific and somewhat incredulous claims in the case, and their charges of outright fraud, this is no guaranteed win by the government. Tesla's board issued a statement of strong support for the company's founder, offering full expectations that he and the company will be exonerated. Tesla fell 12% on news of the suit.

|

|

THO

|

Airstream parent makes its biggest purchase ever with German acquisition. (18 SEP 2018) Airstream. That iconic, uniquely-shaped monstrosity which conjures up images of an American family on vacation—circa 1955. It would have been easy for Airstream's parent company, Thor Industries (THO $88-$102-$161), to spiral into a slow demise like so many other generations-old consumer discretionary companies. Instead, through astute strategic planning and slick marketing, the $5 billion mid-cap is flush with cash, and it is about to spend some of that cash to grow internationally. Thor has announced it will acquire German RV-maker Erwin Hymer Group in a $2.2 billion cash and stock deal. Hymer boasts a couple of dozen brands of RVs, campers, caravans, and accessories. The purchase is part of Thor's plan to move into new markets, especially those in Europe and China. THO has a tiny p/e ratio of 12, and booked sales of $8.4 billion worth of equipment over the trailing twelve months—nearly all of which came from the US and Canada.

|

|

AN

|

Under the Radar: We see AutoNation as a potential undervalued gem. (24 Aug 2018) Americans buy roughly 40 million used cars and 20 million new vehicles each year. AutoNation (AN $42-$46-$62) is the largest automotive dealer in the US, with more than 250 dealerships in 16 states. The company brings in over $5 billion year in and year out, and has been profitable as far back as the eye can see. Why, then, with its single-digit p/e ratio, is the company sitting near its 52-week low? Analyst house SunTrust took notice of the company today, initiating coverage on the stock with a "hold" rating and a price target of $48 per share, but the average analyst price target for AN is $53 per share. We believe Michael Jackson, the company's long-tenured CEO, is one of the brightest minds in the industry, and has been called as much by the Automotive Hall of Fame. The company's biggest risk lies in the fact that over 60% of sales come from only three states: California, Texas, and Florida, but we could easily make the case for the share price heading back to the mid 50s—a 20% premium from where they are trading now. AN is a $4 billion mid-cap value play.

|

|

TSLA

|

Musk considers taking Tesla private in a deal valued at $420 per share, shorts getting crushed. (07 Aug 2018) After years of being berated by analysts who aren't worthy of carrying his water, Elon Musk is vocally (on Twitter) considering something that forced shares of Tesla (TSLA $245-$367-$390) to be halted on Monday: taking the company private. Actually, based on subsequent tweets, it sounds like he has made up his mind. The $420 per share price mentioned equates to an $82 billion market cap; the market cap of the company before Musk's tweet was around $58 billion. It was also reported that Saudi Arabia's sovereign wealth fund has a $2B to $3B investment in the firm, fueling speculation that it would go private. In fact, Musk tweeted that "Funding (is) secured." Let's suppose all of the investors who berated and shorted TSLA are actually correct (they aren't). Does it really matter to them at this point—they are getting their shorts handed to them right now. Before trading halted on Monday, short sellers had already lost about $884 million in value in a matter of hours.

|

|

TSLA

|

Tesla hits its target of 5,000 Model 3 sedans produced in one week. Electric carmaker Tesla (TSLA $245-$363-$390) hit an enormous milestone this past week: 5,000 Model 3 vehicles were produced in one, seven-day period. Investors applauded the feat, sending TSLA shares up 6% within the opening few minutes of the trading day. CEO Elon Musk tweeted out, "I think we just became a real car company" shortly after the goal was reached, but now the company must prove it can sustain that rate of production on one vehicle line. There is another concern in play: Tesla is on the cusp of selling its 200,000th electric vehicle; when that mark is reached, the federal tax credit of up to $7,500 per vehicle will begin to dissipate. It will be interesting to see how the loss of that credit impacts sales. Of course, a lot of that has to do with the price of gas at the pump, as EV sales rise when gas prices are elevated, and vice versa. With the spike in share price at the start of the trading week, Tesla now has a market cap of $61 billion, compared to $55 billion for General Motors (GM) and $44 billion for Ford (F).

|

|

GM

|

GM ditching the monthly sales report

(03 Apr 2018) Back in the '90s, automakers reported sales every ten days. Chrysler, tired of the wild gyrations this report could cause in its stock price, became the first major car company to begin reporting monthly. Now, General Motors (GM $32-$36-$47), whose stock price has steadily been declining since last October, is ending that custom and will begin reporting sales only after each quarter ends. The company admitted that the price volatility which often comes with the monthly sales report was one factor for the change. On an annual basis, GM's 2017 sales were off 3.3% from the prior year, and the company has been struggling in the international market—especially South Korea—as of late. At $35.76 per share and with a 4.25% dividend, the shares may look tempting, but the negative $2.60 earnings per share figure sours our appetite. As for the change from monthly to quarterly sales results, look for the other major car companies to follow GM's lead. |

|

TSLA

|

Musk's April Fools' Day joke falls flat

(02 Apr 2018) To say the least, Elon Musk is a far cry from your average, ordinary, run-of-the-mill CEO. For example, could you imagine the hapless former CEO of GE, Jeffrey Immelt, tweeting that his company was going to exit the energy business; or how about Tim Cook coming out with a mea culpa stating that Windows actually is a superior operating system to the Mac OS (it's not, by the way). Those examples are akin to Elon Musk's weekend tweet in which he joked that Tesla (TSLA $245-$252-$390) was close to insolvency after the failure of a "last-ditch Easter Egg sale" to raise capital. Obviously, he was being irreverent. Investors weren't laughing, however, as the share price dropped another 5% on Monday—ominously close to a new 52-week low. Let's hope he has the inside track on some really strong Q1 production numbers which are to be released this week. If that happens, $252.48 might just be a great price to open a position. (UPDATE: Indeed, Tesla reported strong Q1 production numbers on Tuesday, driving the stock price about 6% higher, before settling back down in the $257 range.) |

|

TSLA

|

Tesla shares continue to get pounded after second fatal accident, failure to hit production numbers

(28 Mar 2018) One month ago, electric carmaker Tesla (TSLA $252-$258-$390) was sitting at $350 per share. Today, shares fell another 8%—to $258—following the announcement of an NTSB investigation and the company's failure to hit production numbers. The investigation stems from the Friday morning crash in California of one of the company's coveted Model X SUVs, which left the driver dead. The SUV crashed head-on into a highway barrier, ripping the front end in two. It is unclear whether the vehicle was in autopilot mode at the time of the crash. In addition to the accident, the company also missed its targeted production numbers on its new Model 3 sedan. Tesla bondholders got hit as well, as a downgrade on the company's debt drove Tesla bonds down about 5% in value. |

|

TSLA

|

Musk's $2.6 billion compensation package approved by shareholders

(21 Mar 2018) Tesla (TSLA $250-$317-$390) shareholders voted Wednesday to approve CEO Elon Musk's $2.6 billion compensation package, which is tied to 12 incremental performance metrics over the next ten years. Management's projections call for a rise in Tesla market value from $55 billion to $650 billion over that timeframe. Musk currently owns about one-quarter of the firm's outstanding shares. |

|

TSLA

|

Tesla up about 3.6% after hours on reduced cash burn