Consumer Finance

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

COF $130

DFS $123 20 Feb 2024 |

Why we are not excited about a Capital One, Discover merger

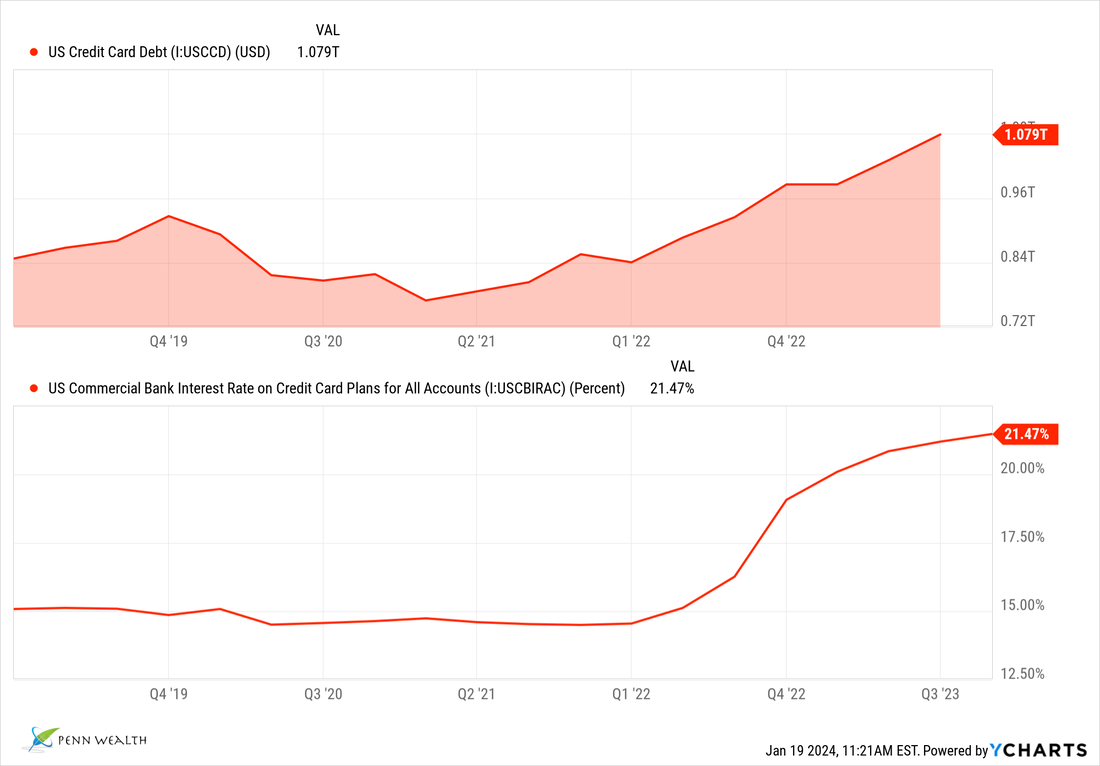

From a mergers and acquisitions standpoint, it is a big deal. Consumer and commercial lender Capital One Financial (COF $130) has agreed to buy credit card issuer Discover Financial Services (DFS $123) in a deal valued at $35 billion. The all-stock offer represents a 25% premium to Discover's previous week close, and is the biggest M&A deal of the year. Furthermore, the merger would create the largest US credit card company by loan volume. Yawn. The deal does make sense for Capital One, which relies on Visa and Mastercard for credit card issuance. This will give the company its own payment network, which is quite different than simply being a card issuer. Furthermore, it would leapfrog over lending giants JP Morgan, Citigroup, and American Express to become the largest lender in the US. So why are we underwhelmed by the news? Let us count the ways. Precisely one month ago, we wrote of Discover's share price drop—from $110 to $97—after the financial services provider reported a massive 62% plunge in profits in the fourth quarter. The company also set aside an extra $1 billion in preparation for net charge-offs, i.e., bad loans coming down the pike. Ironically, based on that added reserve for bad loans, it should be noted that Capital One's average customer has a significantly lower credit score than the typical Discover customer. It should also be noted that Discover's stated APR range is between 17.24% and 28.24%, which we consider appalling. Credit card debt is a scourge, and this deal will do nothing to alleviate it; it will merely "streamline" the collection process for the combined company. Does anyone believe those efficiencies will result in lower rates to the consumer? Then we have the simple logistics of the deal. It isn't expected to close before late 2024 or early 2025, but we question whether or not it will close at all. There has never been a more hostile FTC (to business and enterprise) than the current cabal headed by the inept Lina Khan. And that is saying a lot, considering the commission was founded under the Woodrow Wilson administration. We put the odds of approval at 50%. While we fully understand why Capital One wants to make this deal, we see no value in buying either company right now. Discover shares spiked to within about $4 billion of the offer price, so some may see a merger arbitrage opportunity, but that seems like a risky rationalization for buying the acquiree. As for Capital One, we consider it fairly valued. One more note: We may avoid a recession, but the $1.129 trillion Americans have racked up on credit cards—at an average current rate of 21.47%—is going to come back to haunt these companies. It is simply a matter of time. |

|

DFS $97

19 Jan 2024 |

Discover shares plunge on bad debt worries, weakening income

Shares of Discover Financial Services (DFS $97), one of the country's largest credit card issuers, fell double digits on Thursday after the company reported a 62% plunge in profits for the fourth quarter. The company also set aside an additional $1 billion (from the same quarter a year earlier) in preparation for net charge-offs. That's financial lingo for debt it doesn't believe will be repaid. Revenue did increase 13% from the previous year and 3.7% from the previous quarter, but net income fell to a paltry $388 million on $4.2 billion of revenue. That's the company's slimmest margin in years, and a stark contrast to the $1 billion it made in the fourth quarter of 2022. The jump in revenue is due to an increase in net interest income, or the extra money the company earns from its ability to charge higher rates. Charge-offs doubled in the fourth quarter, from around 2% to over 4%, and the company's increased provisions for credit losses show they expect that trend to continue. There is at least a two-fold reason for that. First, Americans have now racked up a record amount of credit card debt—$1.08 trillion. Secondly, interest rates on these cards have skyrocketed. Discover advertises a standard purchase APR between 17.24% and 28.24%. That is staggering. Imagine the financial condition of the poor soul who has maxed out their Discover card and is paying 28.24% per year in interest! Odds are great that they have no idea that is their rate, as few check their statements. We know someone with an 850 credit score, no balance on their card, and a stated interest rate of 17.49% (29.24% for cash advances). With a 5.5% federal funds rate upper limit, that is highway robbery. Assuming the Federal Reserve lowers interest rates this year, which investors are banking on, how much do you think Discover will lower those confiscatory rates? We shed no tears for the 10.8% drop in its share price. Americans have got to work their way out of consumer debt, and that begins with an understanding of their precise debt load each month and the interest they are paying on each bucket of that debt. The pain and anger of carrying that burden must be stronger than the desire to add something new on their credit card. A simple monthly budget is the first step to financial freedom. |

|

KMX $59

AAP $120 ALLY $25 21 Mar 2023 |

The end of easy money: auto loan rejection rate spikes

If the Fed is still looking for evidence that its tightening policy is working, look no further than the auto market. More and more consumers are being rejected for auto loans, with the 9.1% rate marking the highest level in six years. Furthermore, the trajectory has been steep: last October the rejection rate was 5.8%. Auto loan delinquency rates are also rising, going from roughly 2% at the end of 2021 to nearly 4% at the end of last year. We never thought the 72-month loan was a good idea; now, with the average new vehicle going for nearly $50,000 and interest rates substantially higher, it may take some borrowers that long to pay off the loans. In fact, according to consumer finance services company Bankrate.com, the average payment for a new vehicle is $716 per month, with nearly one in five buyers paying over $1,000 per month. Not long ago, that was a house payment. Sticker shock has sent many consumers to the used car lots, but that picture isn’t much rosier. The average used car price is $30,000 (substantially higher in many states), and the lack of new vehicles produced during the first year of the pandemic has added strain to the system. Most buyers prefer a late model used vehicle with under 50,000 miles of wear and tear. Of course, another reason for the dearth of vehicles—and higher used car prices—is the fact that would-be sellers realize they would have to pay a much higher interest rate for their new ride—the same challenge the housing market is facing right now. Perhaps it is time to take another look at the do-it-yourself auto repair retailers. Eventually, this problem will work itself out. While rates will almost certainly stay higher for longer, the trajectory of inflation in this market is unsustainable. Our favorite used car dealership remains CarMax (KMX $59), which is down 62% from its high share price and trading at a reasonable multiple of seventeen. Our favorite DIY shop is Advance Auto Parts (AAP $120), which has a tiny forward P/E of ten, and a solid customer mix of 60% commercial and 40% consumer clients. By the way, the largest auto finance company is Ally Financial (ALLY $25). |

|

Credit card APR

17.25% 03 Aug 2022 |

Credit card interest rates are nearing record highs

It really belies logic, and certainly underscores the importance of Americans keeping their personal finances in check. The average annual percentage rate (APR) on credit cards in the US has risen to 17.25%, which is not far from the record high 17.87% rate hit in April of 2019. The figure also represents a 1.5% increase from the start of the year. What makes this rate so astonishing is the fact that the Fed funds rate, even after two 75-basis-point hikes, sits at 2.5%. That makes for some “impressive” margins for credit card issuers such as Visa, Mastercard, American Express, JP Morgan Chase, and Capital One. Here’s the real question: what happens when the US enters recession? Americans have an outstanding credit card balance of $841 billion—down slightly from the all-time high of $927 billion in the quarter before the pandemic hit—and that number is on the rise. Delinquency rates have already begun ticking up, and that is with a 3.6% unemployment rate. As more companies begin to forecast layoffs, the 8.42% delinquency rate will certainly go up, especially with the crushing weight of inflation hitting pocketbooks. More evidence of the trouble brewing can be found in the US personal savings rate, which has dropped from a long-term average of 8.78% to 5.2% in the second quarter of this year. The trendlines are concerning. While rising rates tend to help financial services firms, we remain neutral to bearish on the credit card issuers. We expect credit card write-offs to rise, and the industry finds itself under intense pressure from the new buy now, pay later (with no interest) firms such as Affirm and Afterpay. |

|

MA $376

|

And the world's dumbest new idea goes to...drumroll, please...the credit card designed to pay your rent*

(23 Jun 2021) I love history. Reading about the brilliant successes and colorful failures of the past and considering how their lessons can be applied to current, real-world situations. This can be an effective tool in separating the right course of action from the wrong, or the smart from incredibly stupid. In the latter camp, fintech startup Kairos just launched a new loyalty program, Bilt Rewards, tied to its co-branded Bilt Mastercard which is being affectionately labeled "the renter's credit card." Kairos founder and CEO Ankur Jain said it's not fair that credit card users gain rewards for traveling or shopping (paraphrasing), but that renters haven't been able to earn rewards on their largest expenditure, their rent payment. That is some stunningly convoluted thinking. The concept is straightforward: pay your rent using your Bilt Mastercard and start earning 250 rewards points per rent payment, along with any other perks your landlord wants to throw in. And don't worry about checking whether or not your apartment is a qualifying property; if it is, you should automatically receive an email within the next six months informing you of your eligibility. And the more you use your card, the higher you can climb in the membership levels of Blue, Silver, Gold, and Platinum status. Bilt Rewards can be redeemed for such things as travel, fitness classes, even art purchases through the Bilt Collection. When pressed on the credit card's interest rate, Jain said that it should be in the "14-22% range...it's standard." Remember when it was a sign of prestige to carry an American Express card that had to be paid off each month? This card is not that. The idea of putting rent on a credit card is one of the most irresponsible concepts to manifest as of late, and that is saying a lot. Rewarding people for doing the wrong thing, encouraging them to put their rent on a credit card when odds are strong they don't even have an IRA set up, is sickening. Shame on the founder of this company, and on Mastercard for going along with the deal. And the same goes for the Bilt Rewards Alliance of property owners participating in this scheme. |

|

AXP $158

|

American Express has a new hybrid work model we can get behind

(18 Jun 2021) We have all witnessed how the pandemic has uprooted the traditional work/office relationship in a dramatic fashion. Companies which would never would have considered allowing a meaningful percentage of their workforce to perform their duties at home are suddenly rethinking those policies—and discovering just how much they can save in overhead through a reduced real estate footprint. One of our favorite new hybrid models comes to us from American Express (AXP $158), a global financial services firm operating in 130 countries. Most of the company's US and UK workers will be required to show up at the office just three days a week, Tuesday through Thursday, with the choice to work from home every Monday and Friday. Thinking back on some past jobs, that seems like a dream scenario to us. The new AmEx policy, which will begin this fall, stands in stark contrast to Goldman Sachs' (GS $349) demand that all employees return to the office by the 14th of July. Goldman Sachs CEO David Solomon (of which we have never been a fan) went so far as to call remote work "an aberration," and harmful to productivity. Based on some rather ugly employee feedback over the past few years, neither the company's policy nor the CEO's imperious comments surprise us. In a memo to employees, AmEx CEO Steve Squeri said that the new hybrid model will allow for both in-office collaboration and an increased work-life balance. Between the two firms, we know who we would rather work for. Goldman Sachs has a notorious history of corporate arrogance. Thanks to technology and a shifting demographic landscape, the company is facing increased competition in areas it used to dominate, such as mergers and acquisition and securities underwriting. Counter that with American Express (granted, not exactly an apples-to-apples comparison), whose strong position within the small business community should provide a nice tailwind going forward. |

|

COF

|

Kick 'em when they're down: Capital One cuts credit card limits

(28 Aug 2020) We closed credit card company Capital One (COF $38-$71-$108) on 17 Jan of this year from the Penn Global Leaders Club at $104.13, taking our double digit gains. We took issue with some moves that management had been making. Our timing was spot-on—shares began tumbling to $38 a few months later. This week, the company made a move that buttresses our decision: As Americans are struggling due to the pandemic, Capital One began slashing the credit card limits of a large number of customers. And these customers have been expressing their outrage on social media. Many saw their credit limits cut by one-third or even two-thirds, with the effect of damaging their loan balance to limit ratio and, in turn, dragging down their credit scores. The company said the move was simply part of a periodic review of accounts it performs on a regular basis, but the timing certainly seems suspect. Capital One is the third-largest credit card issuer behind JP Morgan (JPM) and Citigroup (C). For their part, investors liked the move, pushing shares up just shy of 2%. We are currently underweighting Financials, and COF certainly isn't on our radar screen. |

Hey, at least they turned a profit: Freddie Mac's income down 88%

(30 Apr 2020) US government-sponsored enterprise (GSE) Federal Home Loan Mortgage Corp, affectionately (not) known as Freddie Mac (FMCC $1-$2-$4), actually turned a profit in the first quarter. That's the good news. The bad news is that it fell from $1.4 billion in Q1 of 2019 to $173 million for the same period this year—an 88% drop. Obviously, the virus was the culprit, which forced FMCC to book $1.1B worth of credit-related expenses. Single-family home loans, the company's bread and butter, took an enormous hit due to the lockdown, which means we can expect an ugly second quarter as well. Freddie has been under government control since the slew of bad loans emanating from the 2008 financial crisis began to manifest, but it was moving ever-closer to privatization going into the year. Sadly, that movement has been stopped dead in its tracks. Then again, the same taxpayer bailout that led to the government taking control in 2008 would probably have circled back around thanks to the pandemic, so the organization might as well remain a government albatross for the foreseeable future. Europe would be proud.

(30 Apr 2020) US government-sponsored enterprise (GSE) Federal Home Loan Mortgage Corp, affectionately (not) known as Freddie Mac (FMCC $1-$2-$4), actually turned a profit in the first quarter. That's the good news. The bad news is that it fell from $1.4 billion in Q1 of 2019 to $173 million for the same period this year—an 88% drop. Obviously, the virus was the culprit, which forced FMCC to book $1.1B worth of credit-related expenses. Single-family home loans, the company's bread and butter, took an enormous hit due to the lockdown, which means we can expect an ugly second quarter as well. Freddie has been under government control since the slew of bad loans emanating from the 2008 financial crisis began to manifest, but it was moving ever-closer to privatization going into the year. Sadly, that movement has been stopped dead in its tracks. Then again, the same taxpayer bailout that led to the government taking control in 2008 would probably have circled back around thanks to the pandemic, so the organization might as well remain a government albatross for the foreseeable future. Europe would be proud.

|

V

MC |

Merchants notch a victory over credit card swipe fees. (18 Sep 2018) For years, merchants have been held hostage to the arbitrary fees they get hit with every time a customer swipes a Visa (V) or Mastercard (MC) piece of plastic through a machine at their respective establishments. Now, as a result of a thirteen-year-old class action lawsuit, the card issuers will pay a tiny bit of those fees back. The two big credit card issuers and a number of banks have agreed to pay $6.2 billion to settle the fight. Visa will pay the lion's share of the agreement—$4.1 billion—with the remaining companies ponying up the rest. Don't feel too bad for the credit card issuers, however, as they have had a strong run over the past year and their shares seem to be shrugging off the news of this settlement.

|

|

AXP

|

The Supreme Court sides with American Express; here's what that means. A narrow, 5-4 decision by the US Supreme Court handed a victory to American Express (AXP $83-$99-$103) and a potentially-costly loss to merchants. More than a dozen states and the US Department of Justice filed antitrust charges against the credit card provider, claiming that the company unfairly prohibited retailers from offering incentives to customers who paid by a cheaper method. American Express notoriously charges merchants higher swipe fees, technically known as interchange fees and processing rates, than those charged by Visa (V) and Mastercard (MA). For example, if a merchant has to pay 3% of the total sale value to American Express should a customer uses that card, as opposed to 1.5% to Visa or Mastercard, that merchant might offer an incentive for using one of the latter's cards. The Supreme Court prohibited that practice. It seems crazy, but the majority's argument was that Amex uses those fees to help fund customer incentive programs, and that the firm relies less on interest from revolving credit balances and more on swipe fees and annual fees for its revenue stream. In the end, this may be a mute point. With the likes of Amazon (AMZN) getting into the card transaction business (potentially linking cards directly to Prime members' bank accounts) we should expect new competition to drive down these swipe fees.

|

President to sign Senior Safe Act to help protect senior citizens from financial fraud

(24 May 2018) One of the most rampant problems in the country with respect to financial malfeasance is the bilking of senior citizens out of their hard-earned savings. From abuse at the hands of beneficiaries and family members who are out for financial gain, to the sale of financial products to individuals who neither understand nor need them, this problem has become enormous—and for many, financially devastating. To combat this abuse, the US House of Representatives has passed the Senior Safe Act, which the president has already said he will sign. The Act eliminates the threat of liability or the violation of privacy laws for financial advisors who report observed fraud being perpetrated on their clients. In addition to the protection provisions, the Act also entices and encourages financial firms to provide training to employees for the detection of suspected abuse. It is estimated that fraud committed by nefarious agents costs senior citizens over $3 billion per year in the United States alone. If managed properly, this Act could go a long way toward solving this growing problem.

(24 May 2018) One of the most rampant problems in the country with respect to financial malfeasance is the bilking of senior citizens out of their hard-earned savings. From abuse at the hands of beneficiaries and family members who are out for financial gain, to the sale of financial products to individuals who neither understand nor need them, this problem has become enormous—and for many, financially devastating. To combat this abuse, the US House of Representatives has passed the Senior Safe Act, which the president has already said he will sign. The Act eliminates the threat of liability or the violation of privacy laws for financial advisors who report observed fraud being perpetrated on their clients. In addition to the protection provisions, the Act also entices and encourages financial firms to provide training to employees for the detection of suspected abuse. It is estimated that fraud committed by nefarious agents costs senior citizens over $3 billion per year in the United States alone. If managed properly, this Act could go a long way toward solving this growing problem.

Despite rising rates, Americans are signing for a record amount of auto loans, and wait til you see the terms

(02 Mar 2018) According to credit monitoring service Experian, the average size of a new vehicle loan hit a record high $31,100 in the fourth quarter, with the average monthly payment for that loan hitting an all-time high of $515. For those wanting to take the less expensive route of buying a used vehicle, the numbers aren't much better. The average used auto loan taken out in the fourth quarter was nearly $20,000, with the average monthly payment sitting at $371. But that's not the worst part. Remember when you winced at making car payments for 48 months, or four whole years? The average length of a vehicle loan just rose above 69 months. That's right, in just five years and nine months that beauty is all yours; just in time to start paying the mechanic for the chronic repairs.

(02 Mar 2018) According to credit monitoring service Experian, the average size of a new vehicle loan hit a record high $31,100 in the fourth quarter, with the average monthly payment for that loan hitting an all-time high of $515. For those wanting to take the less expensive route of buying a used vehicle, the numbers aren't much better. The average used auto loan taken out in the fourth quarter was nearly $20,000, with the average monthly payment sitting at $371. But that's not the worst part. Remember when you winced at making car payments for 48 months, or four whole years? The average length of a vehicle loan just rose above 69 months. That's right, in just five years and nine months that beauty is all yours; just in time to start paying the mechanic for the chronic repairs.

|

SYF

WMT |

In slam at Synchrony, Wal-Mart in talks with Affirm for credit offers

(22 Aug 2017) Synchrony Financial (SYF $26-$30-$38, formerly GE Capital) is the exclusive issuer of credit cards for the largest retailer in the world: Wal-Mart. That being the case, the company has to feel a bit uneasy about Wal-Mart’s (WMT) new alliance with Affirm, Inc.—a startup run by PayPal (PYPL) co-founder Max Levchin. Wal-Mart is in talks with Affirm to offer installment loans to the retailer’s customers for larger purchases (over $200) on items such as tires, lawnmowers, and furniture items. The finance company would not issue actual cards; rather, it would simply make installment loans to customers with all levels of creditworthiness, with the 10% to 30% interest rate being determined by credit score. Synchrony, which Warren Buffett’s Berkshire took a stake in last quarter, is down 17% YTD. |