Supply, Demand, & Prices

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

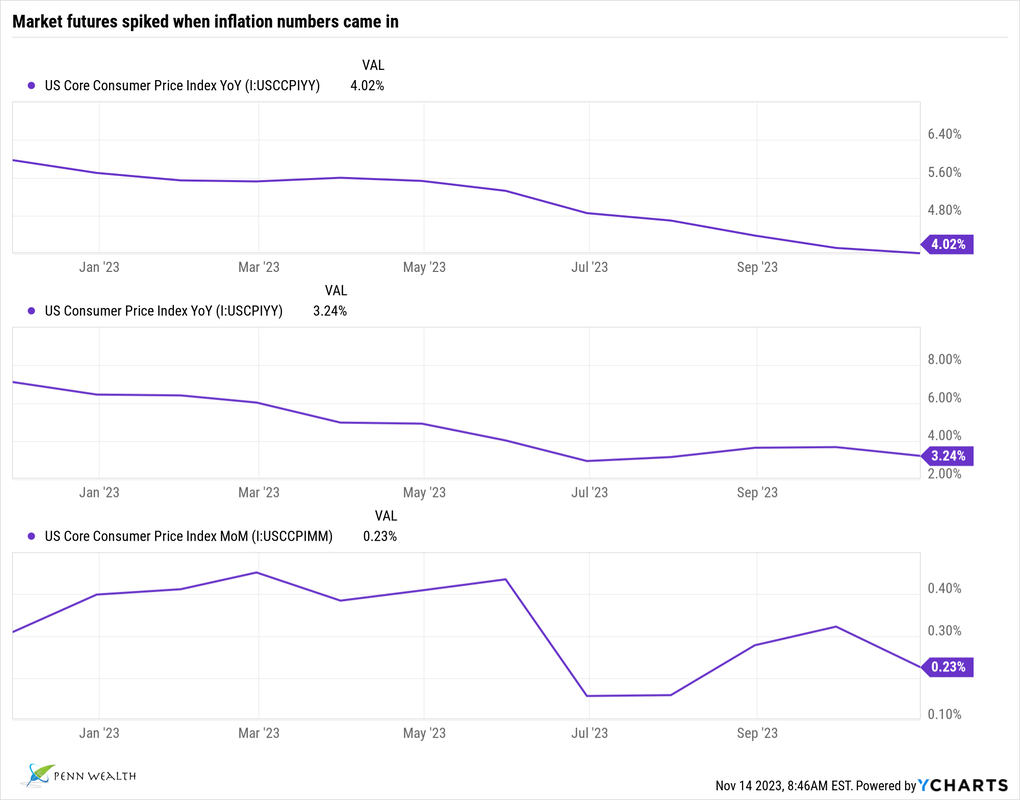

CPI 3.24% YoY

0.23% MoM 14 Nov 2023 |

A great inflation report virtually assures an end to rate hikes

Before the October CPI report was released, futures were flat. Minutes after the release, Dow futures spiked over 300 points, NASDAQ futures rallied 2%, and the small-cap Russell 2000 jumped 4%. Powerful report. Here’s the headline number that gained the most attention: Inflation cooled to 3.2% in October, down from 3.7% in September and well below last October’s scorching 7.75% reading. This report provides clear evidence that inflation is heading back down towards the Fed’s 2% target, all but assuring the rate hike cycle is dead. Core inflation, which removes volatile food and energy costs, fell to 4.02% in October, down from 6.3% a year earlier. Parsing out the energy component, gas prices fell from an average $3.81 per gallon at the start of the month to $3.46 by the end. We have come a long way from the 9% inflation rate we were experiencing in the summer of 2022. Suddenly, talk on the Street has shifted from concern over tightening to how quickly the Fed will begin lowering rates. Could we just take a little time to relish this victory over runaway inflation before going there? Here’s the new narrative being pushed by the likes of Morgan Stanley (a group we respect very little) and UBS: Slower growth, rising unemployment, and disinflation will force the Fed to cut its benchmark rate to a target range between 2.5% and 2.75% by the end of 2024, with the cuts beginning relatively early in the new year. We are currently in a range between 5.25% and 5.5%, meaning that would be the equivalent of eleven 25-basis-point cuts! We may be sliding into a minor recession in 2024, but we sure don’t buy that narrative. That said, rates have peaked so investors should continue picking up higher-yielding bonds to balance their portfolios. |

|

CPI 6.45% YoY

-0.8% MoM 12 Jan 2023 |

Enough data points are in: the Fed can (and will) take their foot of the gas

The never-ending blather in the press about the Fed’s tightening cycle has been painful to watch and listen to. We would argue that roughly half of the concerns expressed have been made up by the press itself. Had they simply chosen to adopt the real story (“Rates are at zero; the Fed must raise them to a responsible level to control inflation”) instead of crafting faulty narratives, we don’t believe the markets would have seen the same level of destruction in 2022. So, without regard to what the narrative du jour may be, let’s look at the facts with respect to inflation and rates. Yet another strong data point came in with Thursday’s CPI report. The cost of living dropped 0.8%—a contraction not seen since April of 2020 during the early days of the pandemic—and the annual rate of inflation fell for a sixth-straight month—to 6.45% from a high of 9.1% last summer. If everyone knows that Fed adjustments have a lag, why has the press been freaking out investors since the hikes began? This downward pressure on inflation is precisely what we expected to see take place, and it is evidence that the hikes are having their desired effect. The unemployment rate may not be going up, but (wonderfully) that is not needed, as wages are finally cooling. The price of groceries barely budged in December, and gas prices fell over 9%. The cost of shelter remains a major sticking point, as rents jumped 0.8% in the month and mortgage rates remain substantially higher than they were a year ago. Still, several Fed governors gave a nod to the positive report and indicated a slowing of hikes is probably warranted. That was enough to help the markets cobble together a steadily positive day. Here is what we see happening: The Fed will hike rates just 25 basis points on the 1st of February, another 25 bps in the middle of March, and then halt—putting the upper band of the federal funds rate at 5%. Despite what investors may think, there will be no tightening due to any recession in 2023. Rather, the Fed will sit on that 5% rate for some time. That is not only what we expect, it is also what we want. It is time to start reining in wanton behavior and reduce the Fed’s balance sheet. Maybe we can even hold the $32 trillion national debt steady for a while (insert laugh track here). |

|

CPI 7.7% y/y

Unemp 3.7% 10 Nov 2022 |

Finally! Inflation shows signs of cooling and the market’s reaction is intense

In normal times, a 7.7% year-over-year inflation reading would send the markets reeling. Instead, the latest CPI report led directly to a 1,201-point-gain in the Dow (3.7%), a 208-point-gain in the S&P 500 (5.54%), and an explosive 761-point-gain in the Nasdaq (7.35%). Those remarkable, one-session returns occurred thanks to slowest y/y inflation rate since January. This past June, the 9.1% reading marked the highest rate of inflation in the US in four decades. September’s report wasn’t much better, coming in at 8.2%. Breaking the report down, core CPI—which excludes food and energy—came in at 6.3%, which signaled another slowdown in growth from the previous months. October’s jobs numbers also gave the doves a ray of hope that the current hiking cycle may be on its last legs: the US unemployment rate rose from 3.5% to 3.7%. Wage growth is also easing, going from 5% y/y in September to 4.7% in October. No Fed officials came out and applauded the CPI report, but investors certainly celebrated by giving the market its best day in over two years. While a 75-bps-hike is still expected at the December FOMC meeting, the odds of a smaller, 50-bps-hike are rising. Were the latter to happen, it would probably spell a serious Santa Claus rally going into the last few weeks of the year. |

|

CPI 8.3% YoY

0.1% MoM 13 Sep 2022 |

A hot August CPI report gives the Fed the green light for another 75-bps hike

The seemingly major contingent of investors who believe the Fed is on the cusp of pivoting—moving from rate hikes to a pause to potential rate cuts due to an economic slowdown—befuddles us. In what realm are they living? What metrics possibly back up such a pivot? It is nonsense. With this contingent in mind, it really shouldn’t come as a surprise that Dow futures swung some 700 points, from up over 200 to down over 500, on the back of a higher-than-expected August inflation report. The consumer price index, or CPI, which tracks the price of a large basket of goods and services, rose 8.3% from last year—despite the sharp decline in gas prices for the month. Food, shelter, and medical care costs drove the spike in prices, while the average price for a gallon of gas fell 10.6%. A couple examples of food inflation: eggs are up 40% from last year, while bread is up over 16%. In the auto space, the average price of a new vehicle rose by 0.8% for the month, or 10% annualized. Medical care costs have risen 5.6% from the same period last year. The two-year Treasury note, a proxy for what the Fed might do next, surged from 3.358% to 3.704%, driving bond values down. We have been expecting the Fed to raise rates by 75 basis points at this month’s FOMC meeting; this report all but guarantees that taking place. The August CPI report and subsequent market drop created a great opportunity for investors. The responsible behavior of the Fed will ultimately lead to a reduction in the rate of inflation, a healthier economy, and a stronger stock market. And it won’t take long for that theory to play out. The closer the Fed gets to 4%, the closer a major rally is to manifesting. |

|

CPI 8.52% YoY

-0.02% MoM PPI -0.05% MoM 11 Aug 2022 |

At long last, the steep inflation trajectory is beginning to moderate

Within seconds of the report’s release, Dow futures soared more than 400 points—led by consumer discretionary names. Finally, after months of ever-growing rates, inflation cooled in July. Following June’s 9.06% YoY rate and 1.32% MoM rate, and against expectations for an 8.7% annual increase, the price of goods and services in the US rose by “only” 8.5% in July. The MoM number, which was expected to rise by 0.2%, actually fell by that precise amount. While the 7.7% drop in gas prices in July helped drive that number down, even when energy and food prices are excluded core CPI still rose less than expected: 5.9% versus the 6.1% expected. Housing costs, which make up around one-third of the CPI, rose 5.7% from a year ago. The report brought a sigh of relief to investors, as the Fed has indicated it will continue raising rates until it tames inflation. Any number above consensus would have increased the odds for an even greater rate hike at the September FOMC meeting. Another 75-basis-point hike is still expected, followed by two or three smaller hikes before the end of 2022. Buttressing the good news on the consumer side of the inflation front, the producer price index (PPI)—a reflection of what producers of goods and services must pay—also fell in July. Instead of the expected 0.2% jump MoM, prices actually fell 0.5% from June. One month does not a trend make, but we believe peak inflation is now behind us. Now, the move downward must be gradual enough so as to not create a more dovish Fed before rates get back up to where they should be. We need decent bond yields in order to build well-balanced portfolios. |

|

CPI 9.06% YoY

|

June inflation came in red hot, but the market drop was misguided

(13 Jul 2022) On Wednesday the 13th, June’s inflation numbers rolled in. They were expected to be high, but investors discounted the spike and futures were up. Within seconds of the scorching 9.1% year-over-year number being released, futures took a U-turn and tumbled some 400 points on the Dow and 200 points (-1.8%) on the Nasdaq. A 75-basis-point rate hike was already expected for July; after the report, odds of another 75-basis-point hike in September (there is no August FOMC meeting) more than doubled to around 78%. Keeping this in perspective, these two probable hikes would just put the upper limit of the Fed funds rate at 3.25%. For all the comparisons to the 1970s and 1980s, consumers could only dream about such low rates back then. The Fed should—must—make these moves. As for the market’s immediate reaction, it was misguided. We believe that peak inflation has now hit, and that prices should begin to stabilize. Commodity prices, which have been on a steep trajectory for the past nine months or so, have turned the corner and are now pulling back at a rapid clip. Auto repossessions are exploding as an inordinate number of Americans who purchased vehicles during the pandemic have suddenly stopped making payments. Buyers and renters are pushing back against the high price of homes and 14% increase in leases by holding off on making a move—or, in the case of younger renters, moving back home. Companies of all sizes, expecting a recession, have begun to pull back on capital expenditures. Smaller companies are really feeling the pinch. Forget the American consumer for a moment: if companies start to pull back on spending, inflation will begin to subside. Copper, a fundamental industrial-use metal, has lost one-third of its value since April. Wheat, corn, and other ag products have also dropped precipitously over the past few months. Even oil has dropped back below the $100 per barrel rate. These are signs that inflation is starting to return to more normal levels. Add a price-wary consumer to the mix, and suddenly the headline narrative begins to deflate, no pun intended. Mild recession or not, the second half of the year could hold some pleasant surprise for investors. At least the ones who resisted the urge to panic. By “resisting the urge to panic,” we mean sticking to one’s proper portfolio diversification. On that front, we are excited by the Fed’s rate hikes as they signal some great bond issues are on the horizon. In the meantime, investors should remember that cash truly is an asset class, and a 20% allocation to that class is not excessively high right now. Dry powder to take advantage of the coming opportunities. |

|

CPI 6.8%

|

The highest inflation rate in forty years didn't dampen the markets

(10 Dec 2021) We expected the CPI numbers for November to be bad, and they were. Hitting a rate not seen since 1982, the US Department of Labor announced that the consumer price index (CPI), which measures what consumers pay for a wide swath of goods and services, rose 6.8% annualized in November—the sixth-straight month in which the inflation rate was above 5%. For reference, the Fed's inflation target sits at 2%, and we all recall how "stubbornly low," to use Powell's own words, it was not that long ago. Even stripping food and energy out of the mix, the rate still climbed to 4.9%. What is leading the inflationary charge? Homes are up nearly 20% year-on-year, new vehicles 11%, used vehicles 27%, and fast food prices 8%—just to give a few examples. Unfortunately, while wages have climbed, they are not matching the jump in the price of goods. The Atlanta Fed reported that wage growth was 4.3% in November, annualized. Oddly enough, the markets largely ignored Friday's CPI release, with the three major indexes (the small caps did not participate) gaining ground on the day. For the week, even the beaten-down Russell 2000 pulled out a gain of 0.76%. Meanwhile, the S&P 500, the DJIA, and the NASDAQ all reclaimed ground not seen since before the prior two week market downturn. We have three weeks left in the month, but December is suddenly looking like it might bring its usual dose of holiday cheer to investors. Of course, next week's Fed meeting could throw a monkey wrench into the works: Fed Chair Powell is highly expected to speed up the rate of taper, perhaps from $15 billion per month to $30 billion per month, which would end the bond buying program by March. Stay tuned. With the taper now expected to end by next March, economists are raising their expectations for rate hikes next year. The general consensus is one hike by early summer, and two beyond that in 2022. Where will it end? When the target Fed funds rate gets to 2% to 2.5% (the upper band is at 0.25% now), we expect the Fed to halt. Of course, anything can happen between now and that point in time. |

|

CPI 6.2%

|

Inflation on the price of consumer goods just came in scorchingly hot; is it a blip or cause for serious concern?

(10 Nov 2021) Anyone who fills their tank, shops for groceries, pays their rent, or—gulp—needs a new or used car knows that inflation is a reality. Forget the anecdotal stories, here is the data: the US Department of Labor just announced that consumer prices surged 0.9% from September to October, driving the y/y rate up to 6.2%. That marks the highest rate since December of 1990, and the fastest pace of inflation since the summer of 1982. The rate even exceeded the 5.4% spike economists had projected. As for the ten million missing workers in the US, expect the price of goods to drive them back to their well-paying jobs soon. Serious supply chain issues certainly play a major role in the price spike, but the upward pressure on wages is another major factor; industries across all sectors are being forced to pay their workers more. While the supply chain issues should begin to subside by early next year, the higher wages are probably here to stay, which is good news in itself, but tempered by the fact that inflation is eating away at those wages. Management teams have been echoing the same sentiment: price increases must be passed along to the consumer, and the pricing power is in place to allow those increases without facing much pushback. In other words, Americans seem willing to pay more for lumber, autos, travel, and Christmas gifts this year. The Fed has already implemented its plan to reduce bond buying by $15 billion per month until it hits zero, and telegraphed plans to begin raising interest rates by late next year. If inflation reports keep coming in hot, however, they may need to quicken their pace. And that is a specter investors may not be prepared to handle with aplomb. Products such as gasoline may be inelastic, but we believe inflation across the board will cause shoppers to become more sensitive to higher prices on easily-substituted goods and services. And the online shopping genie is out of the bottle, meaning consumers can perform their due diligence with ease. While the days of the Fed worrying about sub-2% inflation may be gone, the fears of long-lasting and severe price jumps have been overblown. This is not the 1970s all over again. From an investment standpoint, we have increased our allocation to the financial sector, which will be one of the areas poised to gain by higher interest rates. |

Twitter's Jack Dorsey says hyperinflation is coming; we say he is not playing with a full deck

(01 Nov 2021) For anyone who hasn't seen a recent picture of Twitter (TWTR $54) and Square (SQ $255) CEO Jack Dorsey, picture a younger version of Howard Hughes shortly before his death. This brilliant economic mind has been studying the US and global landscape and has issued an edict from on high: "Hyperinflation is going to change everything. It's happening." Really? Yes, inflation is here, and for some very specific reasons—from a seemingly endless supply of new money to the temporarily-broken global supply chain; but hyperinflation? The textbook definition of the term is the persistent, rapidly-rising cost of goods and services, to the tune of over 50% per month. A textbook example of hyperinflation would be the conditions in the Weimar Republic in the 1920s, when the German government ran their printing presses nonstop. A loaf of bread that cost a shopper 250 marks in January of 1923 had risen to a price of 200,000,000,000 marks—that is 200B—by November of the same year. Wages for German workers were renegotiated daily, as their pay was typically worthless by the following day. We doubt it is still taught in school, but many of us remember seeing the photos of German homeowners wallpapering their houses with worthless currency. That, Mr. Dorsey, is hyperinflation. What you are spewing is called hyperbole. To be sure, the Fed—and the Treasury Department and the politicians—should be concerned about the 5% inflation rate we have witnessed for the past three months. Instead of making silly claims, Mr. Dorsey (leave that to the real economists), focus on how you can better monetize your social media platform. Speaking of Germany, inflation in that country just hit its highest mark in three decades: 4%. Perhaps the specter of inflation, which Germans are hypersensitive to considering past events, is the reason the 10-year German Bund is nearing 0%—on the way up, that is. Monetary policy around the world is in a state of wanton madness. Tightening needs to occur, but the markets won't like it when it finally happens. While the first rate hike may still be a year away, we could see the Fed tapering its $120B per month spending spree within the next three months. It will be fascinating to gauge how the markets react when it does.

(01 Nov 2021) For anyone who hasn't seen a recent picture of Twitter (TWTR $54) and Square (SQ $255) CEO Jack Dorsey, picture a younger version of Howard Hughes shortly before his death. This brilliant economic mind has been studying the US and global landscape and has issued an edict from on high: "Hyperinflation is going to change everything. It's happening." Really? Yes, inflation is here, and for some very specific reasons—from a seemingly endless supply of new money to the temporarily-broken global supply chain; but hyperinflation? The textbook definition of the term is the persistent, rapidly-rising cost of goods and services, to the tune of over 50% per month. A textbook example of hyperinflation would be the conditions in the Weimar Republic in the 1920s, when the German government ran their printing presses nonstop. A loaf of bread that cost a shopper 250 marks in January of 1923 had risen to a price of 200,000,000,000 marks—that is 200B—by November of the same year. Wages for German workers were renegotiated daily, as their pay was typically worthless by the following day. We doubt it is still taught in school, but many of us remember seeing the photos of German homeowners wallpapering their houses with worthless currency. That, Mr. Dorsey, is hyperinflation. What you are spewing is called hyperbole. To be sure, the Fed—and the Treasury Department and the politicians—should be concerned about the 5% inflation rate we have witnessed for the past three months. Instead of making silly claims, Mr. Dorsey (leave that to the real economists), focus on how you can better monetize your social media platform. Speaking of Germany, inflation in that country just hit its highest mark in three decades: 4%. Perhaps the specter of inflation, which Germans are hypersensitive to considering past events, is the reason the 10-year German Bund is nearing 0%—on the way up, that is. Monetary policy around the world is in a state of wanton madness. Tightening needs to occur, but the markets won't like it when it finally happens. While the first rate hike may still be a year away, we could see the Fed tapering its $120B per month spending spree within the next three months. It will be fascinating to gauge how the markets react when it does.

Inflation just hit its highest rate since 2008; here's why the Fed isn't worried

(10 Jun 21) The average price of goods purchased by Americans rose 0.6% month-over-month in May, following a 0.8% jump in April. That may not sound like much, but May's Consumer Price Index number equates to a 7.2% annualized rate. The MoM figures represent the fastest rate of inflation since August of 2008. Leading the charge was the price of used cars and trucks, which rose a whopping 7.2% in May on the heels of a double-digit price jump in April. Why doesn't Jerome Powell's Fed, which has a 2% target inflation range, seem worried by these numbers? One major reason is a phenomenon known as the base effect. Simply put, this condition argues that if inflation was too low in the same period a year earlier, even a small rise in CPI will mathematically show a high current rate of inflation. Indeed, the pandemic put a short-term clamp on economic activity, so it is understandable that the rate of inflation would appear worrisome at the moment. Here's the real question on the mind of economists, however: as we work through this blip, will the rate stabilize or continue to grow? Another factor to consider is wage growth. Wage push inflation is an overall jump in inflation as a result of companies needing to pay more to their workforce. Evidence of wage push inflation is everywhere, with the latest example coming from Chipotle. The fast casual chain said it must hike menu prices by around 4% to cover the higher cost of paying its employees. By the end of the month, the average hourly wage for employees at the restaurant will hit $15. With a record number of job openings, this condition will certainly gain momentum as companies struggle to find the workers they need to handle the growing demand for their products and services. While the Fed has indicated it probably won't raise rates until 2023, we expect the central bank to begin signaling a slowdown in its bond buying program at some point in the second half of the year—a very important step to help staunch the unsustainable level of federal spending. The Fed has been buying $120 billion per month worth of treasuries and mortgage-backed securities, leading to its bloated $8 trillion balance sheet. The market should be prepared for this step, but expect at least a short-term fit when the tapering is announced.

(10 Jun 21) The average price of goods purchased by Americans rose 0.6% month-over-month in May, following a 0.8% jump in April. That may not sound like much, but May's Consumer Price Index number equates to a 7.2% annualized rate. The MoM figures represent the fastest rate of inflation since August of 2008. Leading the charge was the price of used cars and trucks, which rose a whopping 7.2% in May on the heels of a double-digit price jump in April. Why doesn't Jerome Powell's Fed, which has a 2% target inflation range, seem worried by these numbers? One major reason is a phenomenon known as the base effect. Simply put, this condition argues that if inflation was too low in the same period a year earlier, even a small rise in CPI will mathematically show a high current rate of inflation. Indeed, the pandemic put a short-term clamp on economic activity, so it is understandable that the rate of inflation would appear worrisome at the moment. Here's the real question on the mind of economists, however: as we work through this blip, will the rate stabilize or continue to grow? Another factor to consider is wage growth. Wage push inflation is an overall jump in inflation as a result of companies needing to pay more to their workforce. Evidence of wage push inflation is everywhere, with the latest example coming from Chipotle. The fast casual chain said it must hike menu prices by around 4% to cover the higher cost of paying its employees. By the end of the month, the average hourly wage for employees at the restaurant will hit $15. With a record number of job openings, this condition will certainly gain momentum as companies struggle to find the workers they need to handle the growing demand for their products and services. While the Fed has indicated it probably won't raise rates until 2023, we expect the central bank to begin signaling a slowdown in its bond buying program at some point in the second half of the year—a very important step to help staunch the unsustainable level of federal spending. The Fed has been buying $120 billion per month worth of treasuries and mortgage-backed securities, leading to its bloated $8 trillion balance sheet. The market should be prepared for this step, but expect at least a short-term fit when the tapering is announced.

Retail sales come roaring back in June as more shops opened

(17 Jul 2020) Against expectations for a 5.2% gain, US retail sales came in at a scorching 7.5% increase in June, showing pent up consumer demand needs an outlet—with or without mask requirements. According to the Commerce Department numbers, total retail sales in June clocked in at $524 billion, which was up from $487 billion in May and virtually inline with pre-pandemic levels. Breaking it down by category, clothing made the strongest comeback, with a 105% increase in sales from the previous month; consumer electronics purchases rose 37% from May, while furniture sales were up 32.5%. Despite the mandated wearing of masks in cities around the country, restaurants and bars are showing signs of life—receipts rose 20% from May to June. A 15% increase in gas sales for the month supported the thesis that Americans are ready to get out of the house and resume some semblance of normalcy. Consider this: these impressive numbers occurred in the absence of a Covid-19 therapy or vaccine; imagine the coming spike in economic activity when we these last two pieces of the puzzle are in place.

(17 Jul 2020) Against expectations for a 5.2% gain, US retail sales came in at a scorching 7.5% increase in June, showing pent up consumer demand needs an outlet—with or without mask requirements. According to the Commerce Department numbers, total retail sales in June clocked in at $524 billion, which was up from $487 billion in May and virtually inline with pre-pandemic levels. Breaking it down by category, clothing made the strongest comeback, with a 105% increase in sales from the previous month; consumer electronics purchases rose 37% from May, while furniture sales were up 32.5%. Despite the mandated wearing of masks in cities around the country, restaurants and bars are showing signs of life—receipts rose 20% from May to June. A 15% increase in gas sales for the month supported the thesis that Americans are ready to get out of the house and resume some semblance of normalcy. Consider this: these impressive numbers occurred in the absence of a Covid-19 therapy or vaccine; imagine the coming spike in economic activity when we these last two pieces of the puzzle are in place.

Shoppers are back! May retail sales figure reflects biggest surge ever

(16 Jun 2020) Futures were already heavily in the green early Tuesday morning on news that the Trump administration was going to float a $1 trillion infrastructure bill to spur the economy, then the retail sales numbers for May hit the wires. Expectations called a month-over-month gain of around 8%; instead, sales rocketed 17.7%—the highest monthly spike on record. Delving into the report, sales of motor vehicles led the charge, with that group jumping 44.1%. Restaurants also staged a remarkable comeback, with receipts jumping by 29.1%. Interestingly, even though the home improvement retailers remained open during the height of the pandemic, that segment also notched an impressive 16% gain in May. Within minutes of the report's release, futures doubled their gains on all three major indexes.

(16 Jun 2020) Futures were already heavily in the green early Tuesday morning on news that the Trump administration was going to float a $1 trillion infrastructure bill to spur the economy, then the retail sales numbers for May hit the wires. Expectations called a month-over-month gain of around 8%; instead, sales rocketed 17.7%—the highest monthly spike on record. Delving into the report, sales of motor vehicles led the charge, with that group jumping 44.1%. Restaurants also staged a remarkable comeback, with receipts jumping by 29.1%. Interestingly, even though the home improvement retailers remained open during the height of the pandemic, that segment also notched an impressive 16% gain in May. Within minutes of the report's release, futures doubled their gains on all three major indexes.

US month-over-month retail sales drops most on record

(15 May 2020) Take a look at the chart above representing month-over-month changes in retail spending dating back to 1992. Within the parameters of this data we have the tech bubble bursting, the financial meltdown, and any number of other adverse conditions. Then we come to the pandemic, with its accompanying lockdown. What a powerful visual of exactly what we are facing right now. Spending fell 16.45% from March to April, while US industrial production fell 11.2% for the month—also a record decline. Clothing sales, despite the existence of online shopping, fell 80%; electronics and furniture sales dropped by 60%. Even grocery stores, despite remaining open and in spite of the run on toilet paper, food items, and disinfectants, saw a 13% drop in sales. For what it's worth, the rest of the world is now poring through similar data, so we are all in this together. A further potential bright spot in the carnage: most economists believe that April will end up being the worst month, as stores slowly begin to reopen. Let the (muted) comeback begin. It may be tempting to buy some beaten down retail names, from Under Armour (UA, was $46 four years ago, now $6.90) to Macy's (M, was $73 five years ago, now $5.25), but we would hold off—just because the stores are reopening doesn't mean sunny skies are on the horizon. We should have ample opportunity to get back in as the situation begins to normalize a bit.

(15 May 2020) Take a look at the chart above representing month-over-month changes in retail spending dating back to 1992. Within the parameters of this data we have the tech bubble bursting, the financial meltdown, and any number of other adverse conditions. Then we come to the pandemic, with its accompanying lockdown. What a powerful visual of exactly what we are facing right now. Spending fell 16.45% from March to April, while US industrial production fell 11.2% for the month—also a record decline. Clothing sales, despite the existence of online shopping, fell 80%; electronics and furniture sales dropped by 60%. Even grocery stores, despite remaining open and in spite of the run on toilet paper, food items, and disinfectants, saw a 13% drop in sales. For what it's worth, the rest of the world is now poring through similar data, so we are all in this together. A further potential bright spot in the carnage: most economists believe that April will end up being the worst month, as stores slowly begin to reopen. Let the (muted) comeback begin. It may be tempting to buy some beaten down retail names, from Under Armour (UA, was $46 four years ago, now $6.90) to Macy's (M, was $73 five years ago, now $5.25), but we would hold off—just because the stores are reopening doesn't mean sunny skies are on the horizon. We should have ample opportunity to get back in as the situation begins to normalize a bit.

Inflation came in muted, and the markets love it

(13 Mar 2018) US consumer prices did rise in February, but less than in the prior month, and in the sweet spot from an inflationary standpoint. The consumer price index (CPI) rose 0.2% in February, following a 0.5% jump in January—remember how that spooked the markets? Excluding the two wildcards, food and energy, the numbers were precisely the same for February. For the previous twelve months, inflation is now sitting at 2.2%, which is well within the Fed's comfort zone. This put another nail in the coffin of any projected fourth rate hike for the year, which comforted investors. Futures rose about 185 points after the Commerce Department report was released.

(13 Mar 2018) US consumer prices did rise in February, but less than in the prior month, and in the sweet spot from an inflationary standpoint. The consumer price index (CPI) rose 0.2% in February, following a 0.5% jump in January—remember how that spooked the markets? Excluding the two wildcards, food and energy, the numbers were precisely the same for February. For the previous twelve months, inflation is now sitting at 2.2%, which is well within the Fed's comfort zone. This put another nail in the coffin of any projected fourth rate hike for the year, which comforted investors. Futures rose about 185 points after the Commerce Department report was released.

Can technology really tame inflation?

(16 Feb 2018) If there is one trigger word for the volatility in the stock market over the past two weeks it is this: INFLATION. After all, it was the unexpectedly strong wage-growth report that immediately got investors worried that the Fed would have to take dramatic steps to tame the (inevitable) coming inflation. That led to the bond selloff as the 10-year Treasury inched nearer to 3%, and the big market drop. But there's an interesting opposing viewpoint gaining steam out there. This idea that technology is putting downward pressure on prices, altering the supply/demand dynamic, and keeping inflation at bay. Amazon (AMZN) provides a great example of this theory. In the old days (like, a decade ago), increased wages meant more consumer spending, which meant more demand, which meant higher prices. But, thanks to technology, a company like Amazon can continue to undercut the competitors, forcing them to keep prices low. And the number of industries affected by the likes of Amazon, Alibaba, and Wal-Mart (with its jet.com purchase) continue to grow, increasing the impact. But what about non-consumer segments of the economy? Technological automation has revolutionized the manufacturing sector. Not only can parts be built quicker and in more locations (reduced shipping costs), industrial robots have replaced human workers, keeping the wages/inflation spiral in check. Finally, advances in communications technology now allow a small organization to compete with much larger competitors without spending anywhere near as much. Ultimately, can technology really reduce the effects of inflation on society? Time will tell, but early results are promising. We will discuss this topic in depth in an upcoming issue of The Penn Wealth Report.

(16 Feb 2018) If there is one trigger word for the volatility in the stock market over the past two weeks it is this: INFLATION. After all, it was the unexpectedly strong wage-growth report that immediately got investors worried that the Fed would have to take dramatic steps to tame the (inevitable) coming inflation. That led to the bond selloff as the 10-year Treasury inched nearer to 3%, and the big market drop. But there's an interesting opposing viewpoint gaining steam out there. This idea that technology is putting downward pressure on prices, altering the supply/demand dynamic, and keeping inflation at bay. Amazon (AMZN) provides a great example of this theory. In the old days (like, a decade ago), increased wages meant more consumer spending, which meant more demand, which meant higher prices. But, thanks to technology, a company like Amazon can continue to undercut the competitors, forcing them to keep prices low. And the number of industries affected by the likes of Amazon, Alibaba, and Wal-Mart (with its jet.com purchase) continue to grow, increasing the impact. But what about non-consumer segments of the economy? Technological automation has revolutionized the manufacturing sector. Not only can parts be built quicker and in more locations (reduced shipping costs), industrial robots have replaced human workers, keeping the wages/inflation spiral in check. Finally, advances in communications technology now allow a small organization to compete with much larger competitors without spending anywhere near as much. Ultimately, can technology really reduce the effects of inflation on society? Time will tell, but early results are promising. We will discuss this topic in depth in an upcoming issue of The Penn Wealth Report.

Inflation effect: CPI figures made futures swing 500 points to the downside

(14 Feb 2018) Before the Consumer Price Index figures came in Wednesday morning, futures had been up as much as 166 points; within minutes of the CPI showing inflation swirling faster than expected, futures dropped around 350 points—a 500-plus point swing. This is a great learning experience, and further evidence that the efficient market hypothesis is bunk. Opportunities immediately arise when the market overreacts, either to the upside or the downside. The headline Consumer Price Index number, which includes food and energy, rose 0.5% in January versus the expected 0.3% jump, making the trailing twelve months' rate 2.1% versus the 1.9% expected. That isn't much above the 2% inflation target the Fed wants. Certainly, the 2.1% rate isn't high enough for the Fed to change its methodical interest rate hike trajectory. Inflation will eventually exceed what the Fed wants, but expect this game to play out in years, not months. In the meantime, take the opportunities as irrational market reactions offer them up.

(14 Feb 2018) Before the Consumer Price Index figures came in Wednesday morning, futures had been up as much as 166 points; within minutes of the CPI showing inflation swirling faster than expected, futures dropped around 350 points—a 500-plus point swing. This is a great learning experience, and further evidence that the efficient market hypothesis is bunk. Opportunities immediately arise when the market overreacts, either to the upside or the downside. The headline Consumer Price Index number, which includes food and energy, rose 0.5% in January versus the expected 0.3% jump, making the trailing twelve months' rate 2.1% versus the 1.9% expected. That isn't much above the 2% inflation target the Fed wants. Certainly, the 2.1% rate isn't high enough for the Fed to change its methodical interest rate hike trajectory. Inflation will eventually exceed what the Fed wants, but expect this game to play out in years, not months. In the meantime, take the opportunities as irrational market reactions offer them up.