Work & Pay

|

150,000

new jobs 3.8% unemp 03 Nov 2023 |

A weaker-than-expected jobs report spurs market rally

We were already having a strong week in the markets; now, if only the October jobs report could come in weaker-than-expected. Voilà, the markets got what they wanted and futures immediately shifted from mildly negative to nicely positive. Against expectations for 180,000 new jobs created, the actual October number came in at a cooler 150,000 rate. The US unemployment rate ticked up from 3.8% to 3.9%, and September's disturbingly strong jobs number was revised downward by about 40,000. The labor force participation rate ticked down from 62.8% to 62.7%, and annualized average hourly earnings dropped from 4.3% to 4.1%. There were 35,000 manufacturing jobs lost, though most of them can be traced back to the rolling UAW strikes. In a normal world, such a report would put downward pressure on stocks; instead, the markets rallied. Here is what investors extrapolated from the report: the Fed is done with its tightening cycle, meaning no more rate hikes. Just look at the ten-year Treasury. Its yield has fallen from 5% to around 4.6%, meaning bond watchers expect the next Fed move to be down, not up. Nearly all of the data points fell in line, capping off a week which had already seen four straight positive days in the market—mostly on the back of Fed expectations. We fully expect to see the labor picture continue to weaken going into 2024, which should help ameliorate the inflation problem. Another "helpful" factor will be Americans' credit card hangover, which should hit in the early months of the year. That will put further downward pressure on inflation. Sticking with this year, however, we believe the Santa Claus rally has already begun. The big wild card for the markets over the coming months won't be monetary policy; it will be fiscal policy. What will Congress do, if anything, to stop the profligate spending? There are a lot of hands out right now, and few seem concerned that the money simply isn't there. Actually, to say the money isn't there implies we have spent all of the income generated by taxpayers over the past year. In reality, we spent $1.7 trillion more than that. The interest payment on our national debt is now $675 billion per year, and rapidly heading to $1 trillion. |

|

Unemp 3.7%

New claims 261k 08 Jun 2023 |

The latest jobless report: another indicator the Fed is done raising rates

The number of Americans who applied for unemployment benefits in early June spiked to 261,000, matching July 2022 figures and representing the highest rate since November 2021. The four-week moving average rose to 237,250, and we expect to see that average continue to climb in the face of a softening economy. While that’s bad news for workers, it is good news for those wishing the Fed would finally end its rate hike cycle, and for Americans looking for lower prices at the pump and in the grocery stores. While the Labor Department didn’t cite specifics for the unexpected jump, the breakdown is interesting: Out of 53 states and territories 26 showed a decrease in claims, 27 had an increase, and two states—California and Ohio—saw a surge in claims. All of the tech layoffs almost certainly accounted for California’s job losses, in addition to companies exiting the state. Rising claims are a leading economic indicator for the economy and often a telltale sign we are nearing a recession. That said, other indicators—such as corporate earnings—point to a quite mild recession, assuming we have one at all. Thanks to his hawkish—and quite unnecessary—recent comments, most analysts believe we will see another rate hike in July. We have changed our tune (thanks to Powell's rhetoric) and agree with that prediction. After either one or two more hikes, we see an elongated pause going well into 2024. We view the 5% federal funds rate as the sweet spot: not high enough to hurt the US economy, but robust enough to provide cash-starved investors with some real yield for the first time in a decade. Sadly, Powell doesn't want to seem to stop his tightening. As for fixed-income maturities, we are moving out our duration sweet spot to 5-7 years. We will continue to buy on the shorter end as well, but now feel comfortable walking up a few more steps on the duration ladder. |

|

Unemp 3.7%

LFPR 62.4% 02 Sep 2022 |

Two key positive takeaways from the August jobs report: unemployment and labor force participation

Here was the conventional thinking as investors awaited the August jobs numbers: if the report was strong, the Fed would continue hiking rates and stocks would be punished; if the report was weak, the Fed might start tapping on the brakes and stocks would celebrate. We ended up with something in the middle, and that was the best possible outcome. First the headline number. There were 315,000 new nonfarm jobs added in the month of August, or slightly fewer than the 318,000 expected. Wages rose 5.2% from a year ago—not a positive sign for inflation, but not as much as expected. There were two key components of the report that helped turn futures from flat to positive. The first was the unemployment rate, which surprised analysts by ticking up from 3.5% to 3.7%. The second was the reason for that jump: the labor force participation rate rose an impressive 0.3%, to 62.4%. That may not seem like much, but it meant another 800,000 Americans began looking for work. One of the biggest causes of inflation has been the scarcity of workers, forcing employers to pay more to attract new help. That pool of workers just got a lot bigger, which should help dampen the recent wage spikes. The prime-age labor force participation rate—workers between 25 and 54—surged to 82.8%, which is great news on that front. Overall, it is hard to imagine a much better report rolling in right now. We still want—and expect—to see a 75-basis-point rate hike coming in September, which would bring the upper band of the Fed funds rate up to 3.25%. We still need to see any combination in subsequent months pushing that rate up to 4%. Then, it will be time to pause until inflation moves back down to an acceptable level. The Fed will also be reducing its $9 trillion balance sheet over the coming year. To be clear, this scenario is what needs to happen, not what the market wants to see. |

|

Unemp 3.5%

22 Aug 2022 |

A wave of layoffs are probably coming soon; how will that affect unionization efforts?

Consulting firm PwC polled over 700 executives from US firms in all industries and of all sizes, and they found that over half plan to reduce headcount and implement hiring freezes within the coming months. While it may seem counterintuitive, many also said they plan on simultaneously increasing their number of contract workers and freelancers. Dig a bit deeper, however, and that makes perfect sense. With a slowing economy, higher inflation, and supply chain issues, many firms suddenly find themselves dealing with a renewed unionization push. And this time around, it is not just industrial names which are in the crosshairs. Consumer discretionary companies like Starbucks (SBUX $87), which are known for their generous benefits like tuition assistance, are bearing the brunt of the push. That is illogical, and we fully expect the inevitable increase in the 3.5% unemployment rate to help quell the movement. Technology will also play a role in dampening successful activism, as advances allow firms to be more productive with a smaller headcount. A McDonald’s (MCD $266) restaurant, for example, might add new ordering kiosks, while an Apple (AAPL $169) might reduce its physical footprint in favor of an enhanced online presence. This is not the 1970s: Companies now have levers to pull in order to maintain their productivity levels—tools which were simply not available back then. Speaking of productivity, it has been going down recently for the first time in a long time, and new studies are indicating that work-from-home is playing a role in the drop. This is one of the reasons why companies such as Apple are now demanding their workers return to the office at least two or three days per week. Right now, that mandate is limited to the area around Apple’s Cupertino headquarters, but we expect the requirement to expand into other areas soon. The back-to-work request has been a hard one to enforce with the low unemployment rate, but now that stimulus funds are depleted—and as the unemployment rate rises—expect more of these policies to come down the pike. We imagine a large percentage of those 700 executives will be watching Apple’s initiative with interest. There is a natural ebb and flow to the unionization movement in America, with undercurrents such as the political environment and economics (the unemployment rate) affecting the efforts. Right now, corporations appear to be up against the ropes, but time and technology are on their side. This is especially true for the companies who treat their employees as fellow stakeholders rather than simply a line on a balance sheet. |

|

Unemp 3.8%

678k jobs |

Huge jobs number: 678,000 new positions created in February

(04 Mar 2022) The US added a whopping 678,000 new payrolls in the month of February, with the unemployment rate dropping down from 4% to 3.8%. Wall Street had been expecting those figures to come in at 440,000 and 3.9%, respectively. This amounts to the best jobs report since last July, before the Omicron variant of the virus hit US shores. Indications that inflation could be starting to cool a bit came from the wage figures in the report: hourly wages grew just $0.01 per hour, or roughly half of what was expected. Year-over-year wage growth is now 5.13%, also below expectations. In a sign that the economy is back on its reopening path, the leisure and hospitality industries led the gains, with 179,000 new jobs created, with the unemployment rate in those two areas dropping from 8.2% to 6.6%. Other areas showing strong gains for the month include professional and business services, health care, construction, and transportation. Not that anyone is expecting the Fed to hold off on rate hikes starting this month, but this report certainly adds fuel to the fire for a normalization of rates, with the terminal number floating somewhere around 2.5% (the lower band sits at 0% right now). Unfortunately, the strong jobs numbers were overshadowed by Russia's attack on the nuclear facility in Ukraine. That story continues to be at center stage. |

|

Unemp 4.2%

210k jobs |

Trying to dissect the Rorschach test that was the November jobs report

(04 Dec 2021) It is always difficult to gauge how investors will react to any given monthly jobs release: a positive report often results in a market downturn, while a lousy one can be a catalyst for gains. Go figure. Even by those standards, November's results and subsequent investor response was a bit strange. Immediately after the release of the jobs survey, which showed a paltry 210,000 new jobs being created in the country against expectations for gains of 550,000, futures rose. This was based on the assumption that the Fed would back off of their threat to end their bond buying program quicker than the current reduction of $15 billion per month. Within the details of the report, however, came some good news: the labor force participation rate—the percentage of Americans of working age either already employed or looking for work—rose to 61.80%, which is the highest level since pre-pandemic. That equates to 600,000 or so Americans re-entering the workforce. Buttressing that point was the household survey section of the report showing that payrolls actually rose by 1.1 million in November. Why the discrepancy? The headline figure represents employers reporting how many hires they had in the month, while the household survey includes individuals moving to self-employed status. In other words, a record number of Americans just started working for themselves. This would also explain why the unemployment rate fell more than expected, to 4.2%. The internals were enough to bring back investors' fear of the Fed tightening quicker than expected to help quell inflation, leading to a 500-point intra-day swing in the Dow. But the Dow's reversal was nothing compared to the NASDAQ and Russell 2000 small-cap index, with each benchmark losing around 2% on the day. It was one of those odd weeks where everything fell in tandem: stocks, bonds, gold, cryptos, and the 10-year Treasury all ended the week in the red. Following a negative third quarter of the year, a down November for the markets, and a rough start to December, we revisited our January 1st prediction for the year-end S&P 500: 4,300. That would have represented a healthy 14.5% gain on the year. On the Friday of the jobs report, the S&P 500 closed at 4,538, or 238 points above our projection for the year. Granted, anything can happen in any given market week, but we are still looking at a quite strong 2021. The big question for next year will be how investors digest the end of tapering and two to three probable rate hikes. |

|

Unemp 5.2%

235k jobs |

Payroll growth hit the skids in August, coming up half-a-million jobs short

(03 Sep 2021) It's always thrilling to watch the monthly US Nonfarm Payrolls report roll in, as we never know what kind of surprises it has in store. Take August's figures, released by the US Labor Department Friday morning: Against economists' estimates for 720,000 new jobs, just 235,000 were created over the course of the month. That miss of nearly half-a-million jobs immediately sent the major indexes from positive to negative territory in the pre-market. The only thing that tempered investors' concern was the "bad news equals good news" phenomenon: they calculated that this report will force the Fed to hold off on any potential September tapering of the $120 billion per month T-bill/MBS spending spree. The Delta variant was, most believe, behind the anemic jobs growth for the month, but few believe we are heading back to lockdowns or other draconian measures. In other words, the business world is learning to adapt to a new era in which these variants are, sadly, always going to be around. Buttressing the Delta argument were the internals of the report, showing the biggest misses in industries directly affected by a pandemic resurgence, such as leisure and hospitality. On the bright side, the unemployment rate did drop 20 basis points, to 5.2%. The last time the US economy hit that number—on the way down, that is—was July of 2015. We're not overly concerned about the August jobs report, as it truly does seem to be a direct result of the latest major variant of the disease. Infection rates and hospitalizations have generally peaked in the US and are coming back down, so we expect the robust hiring to pick back up through the remainder of the year. As the extra unemployment benefits fall off, more Americans will be incentivized into going back to work. The major push to create more in-home test kits and, more importantly, develop Covid therapies which can be administered at home should continue to mitigate the economic damage to the economy. |

A strong sign for the US economy: Americans are quitting their jobs in record numbers

(11 Aug 2021) According to the Bureau of Labor Statistics within the US Department of Labor, there have never been more jobs available in the United States than right now. The June JOLTS (Job Openings and Labor Turnover Survey), which was released on Monday the 9th of August, shows a staggering ten million job openings, reflecting the strength of the post-pandemic comeback in the US economy. There is another interesting aspect to the jobs report: a record number of Americans—3.9 million—also quit their jobs, indicating their confidence to find more lucrative positions. While employers added 943,000 new hires in the month of July, the BLS Survey shows just how tight the labor market really is. As the leisure and hospitality industry roars back, even historically lower-paid workers are flexing their muscle, demanding better pay and more perks. Average weekly wages in the sector rose 10.4% from the previous report, which was issued in February. In addition to sweetening the pay benefits, companies are also adding other perks such as paying for higher education. Target (TGT $264) recently unveiled a new program which allows all US-based team members to have their college tuition costs—including books—paid for by the company. Even those team members seeking master's degrees can receive up to $10,000 per year. Despite all of the sweetened perks, however, there are still nearly fifteen million capable Americans claiming unemployment insurance benefits. Nearly twelve million of that number are receiving enhanced benefits payments as part of the pandemic relief effort—a fact that many point to as part of the labor problem. With more and more states cutting off that emergency aid, however, we can expect the number of unemployed Americans to drop precipitously between now and the end of the year. We still have a ways to go before reclaiming the 3.5% unemployment rate reached before the pandemic struck, but we are headed in the right direction. There is another major component of the employment story in the US—the transformational work-from-home movement brought about by the pandemic. Many Americans decided that they rather like the new order and have no desire to return to the office. Meanwhile, employers are embracing the reduced real estate costs required to operate at full capacity. Ultimately, the massive disruptions of 2020 could lead to a win/win situation for both employers and their workforce as new hybrid models become the norm.

(11 Aug 2021) According to the Bureau of Labor Statistics within the US Department of Labor, there have never been more jobs available in the United States than right now. The June JOLTS (Job Openings and Labor Turnover Survey), which was released on Monday the 9th of August, shows a staggering ten million job openings, reflecting the strength of the post-pandemic comeback in the US economy. There is another interesting aspect to the jobs report: a record number of Americans—3.9 million—also quit their jobs, indicating their confidence to find more lucrative positions. While employers added 943,000 new hires in the month of July, the BLS Survey shows just how tight the labor market really is. As the leisure and hospitality industry roars back, even historically lower-paid workers are flexing their muscle, demanding better pay and more perks. Average weekly wages in the sector rose 10.4% from the previous report, which was issued in February. In addition to sweetening the pay benefits, companies are also adding other perks such as paying for higher education. Target (TGT $264) recently unveiled a new program which allows all US-based team members to have their college tuition costs—including books—paid for by the company. Even those team members seeking master's degrees can receive up to $10,000 per year. Despite all of the sweetened perks, however, there are still nearly fifteen million capable Americans claiming unemployment insurance benefits. Nearly twelve million of that number are receiving enhanced benefits payments as part of the pandemic relief effort—a fact that many point to as part of the labor problem. With more and more states cutting off that emergency aid, however, we can expect the number of unemployed Americans to drop precipitously between now and the end of the year. We still have a ways to go before reclaiming the 3.5% unemployment rate reached before the pandemic struck, but we are headed in the right direction. There is another major component of the employment story in the US—the transformational work-from-home movement brought about by the pandemic. Many Americans decided that they rather like the new order and have no desire to return to the office. Meanwhile, employers are embracing the reduced real estate costs required to operate at full capacity. Ultimately, the massive disruptions of 2020 could lead to a win/win situation for both employers and their workforce as new hybrid models become the norm.

A spectacular jobs report pushes equities higher

(05 Apr 2021) Yes, yes, we know it will take like ten more jobs reports similar to the one we got for March to get us back anywhere near where we were in February of 2020, but let's take some time and savor this one. While the markets were closed on Good Friday, futures shot up nonetheless on news that the US added 916,000 new jobs in the month of March against economists' expectations for 618,000. Even better, the hiring was broad-based, spread out among virtually every corner of the private sector. Notable strength was seen in leisure and hospitality (the group hit hardest during the heart of the pandemic), education, health care, and construction. The US unemployment rate dropped from 6.2% to 6%, while the more comprehensive U-6 rate (which includes all persons marginally attached to the labor force) dropped from 11.1% to 10.7%. Even better than simply a stunning report, the areas of weakness (such as wages) gave investors confidence that the Fed wouldn't accelerate plans to raise rates. Even after digesting the news for three days, investors were still applauding the report on Monday morning, as all major indexes rose in excess of 1% out of the gates. Warmer weather, more vaccines, strong hiring—we can feel the momentum building. Out litmus test for the great economic comeback will be full NFL stadiums this fall; and yes, we expect that to be the case. Our dual goals, post-pandemic? More "shop local," and less "Made in China."

(05 Apr 2021) Yes, yes, we know it will take like ten more jobs reports similar to the one we got for March to get us back anywhere near where we were in February of 2020, but let's take some time and savor this one. While the markets were closed on Good Friday, futures shot up nonetheless on news that the US added 916,000 new jobs in the month of March against economists' expectations for 618,000. Even better, the hiring was broad-based, spread out among virtually every corner of the private sector. Notable strength was seen in leisure and hospitality (the group hit hardest during the heart of the pandemic), education, health care, and construction. The US unemployment rate dropped from 6.2% to 6%, while the more comprehensive U-6 rate (which includes all persons marginally attached to the labor force) dropped from 11.1% to 10.7%. Even better than simply a stunning report, the areas of weakness (such as wages) gave investors confidence that the Fed wouldn't accelerate plans to raise rates. Even after digesting the news for three days, investors were still applauding the report on Monday morning, as all major indexes rose in excess of 1% out of the gates. Warmer weather, more vaccines, strong hiring—we can feel the momentum building. Out litmus test for the great economic comeback will be full NFL stadiums this fall; and yes, we expect that to be the case. Our dual goals, post-pandemic? More "shop local," and less "Made in China."

A strong jobs report for July and increased retail hiring

(07 Aug 2020) Handily beating estimates, the highly-anticipated July jobs report provided more evidence that the US economy is returning to normal—despite the dire warnings of record Covid-19 cases foisted upon us daily by the media. After peaking at a 14.7%, the unemployment rate in the US fell to 10.2% in July—certainly still unacceptably high, but better than the 10.6% rate expected. A staggering 1.763 million new jobs were created in the month, with the labor force participation remaining relatively steady, at 61.2%. The leisure and hospitality industries accounted for a plurality of the new jobs created, adding 592,000 positions in the month, with government and retail coming in second and third, respectively. Big restaurant chains are about to embark on a massive hiring spree as well, with Chipotle (CMG) announcing it will hire 10,000 new employees in the coming months. McDonald's, Starbucks, Yum Brands (Taco Bell), Papa Johns, and Dunkin Brands announced similar plans. Meanwhile, after Congress failed to reach a new deal on pandemic relief, President Trump signed an executive order extending unemployment benefits to include an extra $400 per week (down from the extra $600, which expired on 31 Jul), deferring student loans through 2020, and extending the moratorium on evictions. The next big litmus test for the economy will come over the next several weeks as students—at least some of them—head back to school.

(07 Aug 2020) Handily beating estimates, the highly-anticipated July jobs report provided more evidence that the US economy is returning to normal—despite the dire warnings of record Covid-19 cases foisted upon us daily by the media. After peaking at a 14.7%, the unemployment rate in the US fell to 10.2% in July—certainly still unacceptably high, but better than the 10.6% rate expected. A staggering 1.763 million new jobs were created in the month, with the labor force participation remaining relatively steady, at 61.2%. The leisure and hospitality industries accounted for a plurality of the new jobs created, adding 592,000 positions in the month, with government and retail coming in second and third, respectively. Big restaurant chains are about to embark on a massive hiring spree as well, with Chipotle (CMG) announcing it will hire 10,000 new employees in the coming months. McDonald's, Starbucks, Yum Brands (Taco Bell), Papa Johns, and Dunkin Brands announced similar plans. Meanwhile, after Congress failed to reach a new deal on pandemic relief, President Trump signed an executive order extending unemployment benefits to include an extra $400 per week (down from the extra $600, which expired on 31 Jul), deferring student loans through 2020, and extending the moratorium on evictions. The next big litmus test for the economy will come over the next several weeks as students—at least some of them—head back to school.

Initial jobless claims number comes in better than expected

(09 Jul 2020) On the heels of two surprisingly-strong jobs reports, the US economy got another bit of hopeful news this week as initial jobless claims came in cooler than expected. The 1.314 million figure was better than the expected 1.39 million economists had predicted for new claims, and that number is 99,000 fewer than the previous week. Continuing jobless claims fell by 698,000, to 18.06 million. To be sure, these numbers still represent a staggering amount of Americans who are out of work, but at least they are moving in the right direction. Over the past two months, 7.5 million jobs have been created—both months blowing estimates out of the water—and the unemployment rate has dropped from 14.7% to 11.1%. The CARES Act, which adds an additional $600 per week to the unemployment benefits, is set to expire on the 31st of July. It will be interesting to track the continuing claims number from the first week of August through the remainder of the year. Our best guess is that these numbers will continue to improve as the economy and the schools ramp back up, masks and all.

(09 Jul 2020) On the heels of two surprisingly-strong jobs reports, the US economy got another bit of hopeful news this week as initial jobless claims came in cooler than expected. The 1.314 million figure was better than the expected 1.39 million economists had predicted for new claims, and that number is 99,000 fewer than the previous week. Continuing jobless claims fell by 698,000, to 18.06 million. To be sure, these numbers still represent a staggering amount of Americans who are out of work, but at least they are moving in the right direction. Over the past two months, 7.5 million jobs have been created—both months blowing estimates out of the water—and the unemployment rate has dropped from 14.7% to 11.1%. The CARES Act, which adds an additional $600 per week to the unemployment benefits, is set to expire on the 31st of July. It will be interesting to track the continuing claims number from the first week of August through the remainder of the year. Our best guess is that these numbers will continue to improve as the economy and the schools ramp back up, masks and all.

A simply incredible May jobs report—to the upside—shocks analysts

(05 Jun 2020) All morning long, well before the monthly jobs report came out, the press was preparing us for the worst. We were told to expect to see 7.5 million jobs lost in the country, sending the US unemployment rate up to 19.5%. Oddly, market futures seemed to be shrugging off the impending doom—all three major averages were in the green pre-market. As the numbers hit, I happened to be watching two different business channels—CNBC and Bloomberg. The looks on the faces of the two respective economics reporters were priceless. Instead of losing 7.5 million jobs, the US economy actually added 2.51 million jobs. Steve Liesman on CNBC looked at the figures twice to assure there wasn't a negative sign in front of the number. Instead of hitting a 20% unemployment rate, that figure dropped from 14.7% to 13.3%. Still horrendous, to be sure, but very, very few people predicted this v-shaped jobs rebound, especially after we lost 21 million jobs in April. Virtually all of the metrics in the report looked good. A large percentage of the jobs gain were in the services sector—the area most beaten down by the virus—and manufacturing jobs also made a big comeback. In other words, the workers seeing the strongest gains were those in the lower- to middle-income brackets. How did the markets react to these spectacular numbers? As we write this the Dow is up over 900 points (3.43%) and the NASDAQ is up 224 (2.33%). Now we must wonder...what else that the press has been selling us will prove to be dead wrong?

(05 Jun 2020) All morning long, well before the monthly jobs report came out, the press was preparing us for the worst. We were told to expect to see 7.5 million jobs lost in the country, sending the US unemployment rate up to 19.5%. Oddly, market futures seemed to be shrugging off the impending doom—all three major averages were in the green pre-market. As the numbers hit, I happened to be watching two different business channels—CNBC and Bloomberg. The looks on the faces of the two respective economics reporters were priceless. Instead of losing 7.5 million jobs, the US economy actually added 2.51 million jobs. Steve Liesman on CNBC looked at the figures twice to assure there wasn't a negative sign in front of the number. Instead of hitting a 20% unemployment rate, that figure dropped from 14.7% to 13.3%. Still horrendous, to be sure, but very, very few people predicted this v-shaped jobs rebound, especially after we lost 21 million jobs in April. Virtually all of the metrics in the report looked good. A large percentage of the jobs gain were in the services sector—the area most beaten down by the virus—and manufacturing jobs also made a big comeback. In other words, the workers seeing the strongest gains were those in the lower- to middle-income brackets. How did the markets react to these spectacular numbers? As we write this the Dow is up over 900 points (3.43%) and the NASDAQ is up 224 (2.33%). Now we must wonder...what else that the press has been selling us will prove to be dead wrong?

A record number of Americans file for unemployment, stocks spike

(09 May 2020) One thing we have learned in this business, after being hit in the face with hundreds of examples, is that good economic news often brings a market drop, while dour news often leads to a market rally. This bizarre relationship surfaced yet again on Friday, when a record-bad jobs report led to a 455-point Dow rally. The report was unfathomably bad: 20.5 million Americans filed for unemployment, and the unemployment rate went from a 50-year low to rates not seen since the Great Depression. So, with nearly one in five Americans out of work, and with many of those still working seeing their hours or pay reduced, why the big rally on the day and the week? Americans are generally beginning to see some light at the end of the tunnel. With lockdowns coming to an end soon, barring a major spike in new infections, there is a real sense that things will begin returning to some semblance of normalcy. A growing number of economists believe that April will end up being the worst month for job losses, and that it will be a slow but sure climb back from here. A full 88% of those laid off in April, in fact, believe they will be returning to their same jobs over the coming months. That optimism led to another strong week in the markets: the Dow was up 2.56%, the S&P 500 rose 3.5%, and the NASDAQ spiked an impressive 6%.

(09 May 2020) One thing we have learned in this business, after being hit in the face with hundreds of examples, is that good economic news often brings a market drop, while dour news often leads to a market rally. This bizarre relationship surfaced yet again on Friday, when a record-bad jobs report led to a 455-point Dow rally. The report was unfathomably bad: 20.5 million Americans filed for unemployment, and the unemployment rate went from a 50-year low to rates not seen since the Great Depression. So, with nearly one in five Americans out of work, and with many of those still working seeing their hours or pay reduced, why the big rally on the day and the week? Americans are generally beginning to see some light at the end of the tunnel. With lockdowns coming to an end soon, barring a major spike in new infections, there is a real sense that things will begin returning to some semblance of normalcy. A growing number of economists believe that April will end up being the worst month for job losses, and that it will be a slow but sure climb back from here. A full 88% of those laid off in April, in fact, believe they will be returning to their same jobs over the coming months. That optimism led to another strong week in the markets: the Dow was up 2.56%, the S&P 500 rose 3.5%, and the NASDAQ spiked an impressive 6%.

Another month, another excellent jobs report. (07 Feb 2020) Employers in the US added a whopping 225,000 new jobs in January, far exceeding what was predicted, and 183,000 formerly-discouraged workers moved back in. That was the upshot of a simply excellent jobs report, which was released by the Labor Department on Friday. While the unemployment rate did tick up one notch, from 3.5% to 3.6%, that was a direct result of so many Americans piling back into the workforce. The three-month rolling average rose to 212,000 new jobs created per month. The most impressive new-hires figure came from the health care and education sectors, which added 72,000 new workers. Construction and the leisure/hospitality sectors also came in hot, adding 44,000 and 36,000 new jobs, respectively. Wages also grew more than expected, hitting a 3.1% year-over-year pace. Despite the strong jobs report, the Fed is unlikely to raise rates anytime soon. Inflation remains below their 2% target rate, and that seems to be their central focus right now. Some have been predicting a rate cut, but it would be hard to justify that move.

American workers are making more money, and the bottom 25% of earners are seeing the biggest spike. (27 Dec 2019) According to the Federal Reserve Bank of Atlanta, pay for the lowest 25% of American workers rose 4.5% over the past year—the biggest spike in over a decade. On the other side of the spectrum, the top 25% of wage earners also saw a nice jump, with a 2.9% increase year-over-year (Y/Y). This report from the Fed supports the Labor Department statistics we reported on a few weeks ago: average hourly wages for nonsupervisory and production workers (excluding government workers) rose 3.7% Y/Y. What does that equate to in dollars and cents? The average nonsupervisory worker earned just under $24 per hour in November. There are a number of reasons for the pay raises, chief among them being the lowest unemployment level in fifty years. Companies are being forced to pony up higher pay to attract or retain qualified workers, even with more formerly-discouraged workers (as tracked in the U-6 unemployment rate) re-entering the job market. All of this good news looks to carry into the new year, as the job market remains extremely tight at all levels and in all corners—with the possible exception of government workers—and the economy remains strong. For all of the talk of robots and AI stealing jobs from workers across virtually every industry, we have statistical full employment in the US right now. That being said, now is not the time for workers to get complacent. By performing a little market research, individuals can uncover developing trends within their respective line of work and take steps to remain as proficient as possible, or even seek out more promising industries.

Was last week's jobs report really a "game-changer"? (04 Nov 2019) I recall a presidential election years back in which the echo chamber that is the America press became enamored with the word "gravitas" and used it until it was lying dead on the floor, void of any meaning. Members of the media have a tendency to hear a word or phrase uttered by one of their fellow "professionals" and borrow it for their own use. I thought back to the "gravitas" case last week when I either read or heard at least three different outlets refer to Friday's October jobs report as a game-changer. After reviewing the internals of the report, however, the description seems fitting. Nonfarm payrolls rose by 128,000, well above the 85,000 predicted by economists, and all the more impressive because the GM strike took over 40,000 jobs away from that figure. Additionally, 20,000 temp US Census workers fell off, as did 3,000 other government jobs. The icing on the cake was the upward revision to both the August and September jobs numbers. While the jobless rate ticked up one notch to 3.6%, even that was good news: more Americans were lured back into the workforce, thus reducing the U6 "discouraged worker" rate. In other words, more people are flowing in to fuel the US economy, and that means more money for consumers to spend this Christmas. Following the release of past strong reports, markets fell on fears that the Fed would use the respective report as an excuse to stop lowering rates. But, with rates already so low, investors didn't even register that fear; instead, they celebrated by driving the Dow nearly 400 points higher. The October jobs report was yet another bullish sign for the US economy and another sign that we will probably avoid a near-term recession. A lot can happen in two months, but so far the markets are in a much happier place than they were during this period last year. Now, we look to Phase 1 of the trade deal and a new election in England as the next potential catalysts. As for elections in the UK, we fully expect pro-Brexit forces to gain more seats.

A stronger-than-expected jobs report...so Dow futures drop nearly triple digits. (05 Jul 2019) It appears as though we have entered that crazy alternate universe again, where bad news is good and good news drives the markets lower. Friday morning brought us the June payrolls number, and it was good: nonfarm payrolls rose 224,000, or 36% better than the 165,000 figure expected. That number sent shivers down the spines of Fed watchers, who are geared up for a potential 50-basis-point rate cut at this month's FOMC meeting. (For the record, the most we ever expected in July was a cut of 25 basis points.) The rosy report has many fearing the Fed will use it as an excuse to keep rates where they are—at historically low levels, for the record. Breaking down the numbers in the report, professional services and the health care sector led the charge, adding 51,000 and 35,000 jobs, respectively. The unemployment rate did tick up one notch, to 3.7%, but that was due to a jump in the labor force participation rate. Suddenly, the US economy isn't living up to the narrative that it is slowing. We still don't see the case for lowering rates—which now sit at 2.25% (target Fed funds rate lower limit).

The US had stellar jobs growth in December, but how will the Fed read that? (04 Jan 2019) Expectations were for 176,000 new jobs created in the month of December. The economists got it wrong by some 77%. The US added a whopping 312,000 new jobs in the last month of 2018, and 419,000 new workers entered the workforce. That latter fact helped drive unemployment back up to 3.9% (from 3.7%), but any way you parse the numbers, the report was great. Of that 312,000 figure, 301,000 new private sector jobs were created. Of course, any time we get a strong jobs report we must now be concerned that the Fed will use this as rationale for yet another rate hike, but futures stayed steady (the Dow was up around 300) after the number came out. Inflation is not on the horizon, and the global economy is slowing; those are the data points the Fed should be looking at, not a rosy jobs number. If Powell and company continue to blather on about two more rate hikes in 2019, any market gains won't hold. If they simply shut up about predicting new rate hikes, the market will cheer. Back to the jobs report: the December figure capped off the creation of a whopping 2.6 million new jobs in 2018, and average hourly earnings rose 3.2% for the year—an impressive feat. Don't expect another 312k number soon. If we could maintain an average of 150,000 to 200,000 new jobs created each month in 2019, it will be a good year. If the Fed presses pause on any further rate hikes, the markets will have a year of double-digit gains. Could once, just once, the eggheads at the Fed celebrate a good jobs report and keep their respective mouths shut about more rate hikes? (Update: Fed Chair Powell actually did a great job in walking back last week's disastrous speech, and the Dow responded by going from +300 to +700 by the time he was done.)

Job openings in the United States just hit an all-time high, and it wasn't even close. (16 Oct 2018) The US Department of Labor just released a remarkable statistic: there were 7.14 million new job openings in the month of August. Not only hasn't that figure ever surpassed seven million before, it only surpassed the six million number for the first time in history in April of 2017. The JOLTS (Job Openings and Labor Turnover Survey) figure also showed a record number of new hires in August: 5.78 million. The jobless rate in the US fell to 3.7% in September—the lowest rate in nearly half a century.

Now hiring: nearly 7 million new positions available as of this past March

(08 May 2018) In the aftermath of the Great Financial Crisis of 2008, there were nearly seven unemployed Americans for every one job available. What a difference a decade makes. According to the US Department of Labor, there were 6.6 million private sector jobs available as of March, 2018, or basically one job for each unemployed worker in the country. While wage inflation has remained muted during this cycle of economic growth, this statistic is almost guaranteed to change the dynamic, forcing companies to pay more—both to retain their existing workforce and to hire new staff. With the official US unemployment rate sitting at 3.9% and the working-age population on the decline, employees are back in the driver's seat. What are some of the hottest industries for job seekers? Health care, information technology, and the retail services sector are posting the highest number of new job openings, according to the US Department of Labor.

(08 May 2018) In the aftermath of the Great Financial Crisis of 2008, there were nearly seven unemployed Americans for every one job available. What a difference a decade makes. According to the US Department of Labor, there were 6.6 million private sector jobs available as of March, 2018, or basically one job for each unemployed worker in the country. While wage inflation has remained muted during this cycle of economic growth, this statistic is almost guaranteed to change the dynamic, forcing companies to pay more—both to retain their existing workforce and to hire new staff. With the official US unemployment rate sitting at 3.9% and the working-age population on the decline, employees are back in the driver's seat. What are some of the hottest industries for job seekers? Health care, information technology, and the retail services sector are posting the highest number of new job openings, according to the US Department of Labor.

Why a modest jobs report may be good news for the markets

(04 May 2018) The US added 164,000 new non-farm payrolls in the month of April, against a backdrop of 192,000 positions expected. While the number may seem ho-hum, it may signal many positive outcomes, especially when you dive a little deeper into the report. In the first place, the US unemployment rate ticked down to 3.9%—the lowest level since 2000. The all-important U-6 number, which includes discouraged workers who have left the workforce, dropped to 7.8%, the lowest rate since 2001. Not only will the Fed consider the jobs growth number for the month as it tweaks its rate-hike trajectory, it will also look at inflation with respect to hourly wages. The hourly earnings number for April rose by just 4 cents, which equals a 2.6% annual gain in pay. That is down a bit from March, and should ease Fed concerns about inflation. The services industry, followed by manufacturing and health care, reported the most new hires for the month. Is a June rate hike still a "go"? Probably. But the trajectory for hikes going forward may have just flattened out a bit, which the markets should celebrate.

(04 May 2018) The US added 164,000 new non-farm payrolls in the month of April, against a backdrop of 192,000 positions expected. While the number may seem ho-hum, it may signal many positive outcomes, especially when you dive a little deeper into the report. In the first place, the US unemployment rate ticked down to 3.9%—the lowest level since 2000. The all-important U-6 number, which includes discouraged workers who have left the workforce, dropped to 7.8%, the lowest rate since 2001. Not only will the Fed consider the jobs growth number for the month as it tweaks its rate-hike trajectory, it will also look at inflation with respect to hourly wages. The hourly earnings number for April rose by just 4 cents, which equals a 2.6% annual gain in pay. That is down a bit from March, and should ease Fed concerns about inflation. The services industry, followed by manufacturing and health care, reported the most new hires for the month. Is a June rate hike still a "go"? Probably. But the trajectory for hikes going forward may have just flattened out a bit, which the markets should celebrate.

Market spikes after outstanding jobs report

(09 Mar 2018) We were watching the Dow Jones Industrial Average futures when the jobs number hit: they went from negative to up over 200 points within five minutes. Against expectations for 200,000 new jobs, February non-farm payrolls spiked to 313,000—simply an outstanding number—and the previous two months' figures were strongly upgraded. Just a terrific report from virtually every aspect. Retail jobs jumped 50,000, the average workweek for employees increased, and more discouraged workers (the U6 number) entered the ranks of the employed. Unemployment dropped to its lowest rate since December, 2000. Perversely, we were concerned that the markets would react negatively to this great news, as the specter of increased rate hikes spooked investors; that did not happen this time. Perhaps three rate hikes in 2018 have already been baked into the equation.

(09 Mar 2018) We were watching the Dow Jones Industrial Average futures when the jobs number hit: they went from negative to up over 200 points within five minutes. Against expectations for 200,000 new jobs, February non-farm payrolls spiked to 313,000—simply an outstanding number—and the previous two months' figures were strongly upgraded. Just a terrific report from virtually every aspect. Retail jobs jumped 50,000, the average workweek for employees increased, and more discouraged workers (the U6 number) entered the ranks of the employed. Unemployment dropped to its lowest rate since December, 2000. Perversely, we were concerned that the markets would react negatively to this great news, as the specter of increased rate hikes spooked investors; that did not happen this time. Perhaps three rate hikes in 2018 have already been baked into the equation.

The odd dynamic between jobs, wage growth, inflation, and the markets all seen in the January jobs report

(02 Feb 2018) It has become somewhat of a running joke that, from a market perspective, good news equals bad news and bad news equals good news. Let's apply that aphorism to today's jobs report. The US economy added 200,000 new positions in the month of January, handily beating expectations for 180,000. More importantly, the annualized gain for average hourly earnings was 2.9%—the strongest wage growth since the Great Recession. This wage growth stoked inflation fears and caused a bond selloff, leading to a spike in the 10-year Treasury yield (though its 2.84% rate is still well below historical norms). So, the great news of more job creation and higher wages, in a warped way, helped drive the Dow down 300 points in early Friday trading. We continue to argue that any pullback in the markets this year will offer sound buying opportunities to pick up some quality names for a little bit less. Which one, great holding did we add to the Penn Global Leaders Club on a pullback today? Members or clients can find out by visiting the Trading Desk.

(02 Feb 2018) It has become somewhat of a running joke that, from a market perspective, good news equals bad news and bad news equals good news. Let's apply that aphorism to today's jobs report. The US economy added 200,000 new positions in the month of January, handily beating expectations for 180,000. More importantly, the annualized gain for average hourly earnings was 2.9%—the strongest wage growth since the Great Recession. This wage growth stoked inflation fears and caused a bond selloff, leading to a spike in the 10-year Treasury yield (though its 2.84% rate is still well below historical norms). So, the great news of more job creation and higher wages, in a warped way, helped drive the Dow down 300 points in early Friday trading. We continue to argue that any pullback in the markets this year will offer sound buying opportunities to pick up some quality names for a little bit less. Which one, great holding did we add to the Penn Global Leaders Club on a pullback today? Members or clients can find out by visiting the Trading Desk.

Jobless claims fall to lowest number in nearly two generations

(18 Jan 2018) Americans filing for first-time unemployment "unexpectedly" dropped by 41,000, to a seasonally-adjusted 220,000. That is the lowest rate in—get ready for it—45 years. February of 1973 was the last time the unemployment claims were this low. This glowing jobs report will add fuel to the Fed's fire for raising rates sooner rather than later. We are expecting three interest rate hikes in 2018, which this economy can easily absorb. If the Fed doesn't keep raising rates, inflation will rear its ugly head more rapidly than most expect, causing serious economic issues.

(18 Jan 2018) Americans filing for first-time unemployment "unexpectedly" dropped by 41,000, to a seasonally-adjusted 220,000. That is the lowest rate in—get ready for it—45 years. February of 1973 was the last time the unemployment claims were this low. This glowing jobs report will add fuel to the Fed's fire for raising rates sooner rather than later. We are expecting three interest rate hikes in 2018, which this economy can easily absorb. If the Fed doesn't keep raising rates, inflation will rear its ugly head more rapidly than most expect, causing serious economic issues.

Walmart, Capital One raise minimum wage for workers

(11 Jan 2018) Retailer Walmart (WMT $65-$100-$102) announced that it would be raising its minimum hourly wage for US employees to $11 per hour and dishing out bonuses of up to $1,000, based on time at the company. The moves, which will cost the company around $700 million, are in response to the recently-passed tax reform bill and the increasingly competitive environment brought about by the country's 4.1% unemployment rate. Capital One Financial Corp (COF $76-$104-$104) also announced it would be raising its minimum wage to $15 per hour. Over 100 major companies have announced wage hikes or bonuses since tax reform was signed into law.

(11 Jan 2018) Retailer Walmart (WMT $65-$100-$102) announced that it would be raising its minimum hourly wage for US employees to $11 per hour and dishing out bonuses of up to $1,000, based on time at the company. The moves, which will cost the company around $700 million, are in response to the recently-passed tax reform bill and the increasingly competitive environment brought about by the country's 4.1% unemployment rate. Capital One Financial Corp (COF $76-$104-$104) also announced it would be raising its minimum wage to $15 per hour. Over 100 major companies have announced wage hikes or bonuses since tax reform was signed into law.

Job creation in 2017 provides strong foundation for US economic growth in 2018

(08 Jan 2018) December's job report may have been a little soft, with just 148,000 new hires, but the 2.1 million new jobs created throughout 2017 brought the US unemployment rate down to its lowest level in 17 years—and portends good things for the year ahead. The unemployment rate is the lowest its been since 2000 (4.1%), and the black unemployment rate (6.8%) is suddenly the lowest it has been since the government began tracking the stats. All of this occurred in the face of dire warnings of machines taking jobs away from humans, and economists' predictions that US manufacturing was on a downhill slide. If there is one concern we have, it is not the lack of jobs in America; it is the inability of US companies to find qualified American workers to fill the increasingly-technical jobs being created. To that end, we look for a major overhaul of the way we educate and train the young, especially those who reside in the lowest two quintiles of the economic spectrum. And the answer does not lie in throwing more money at the problem.

(08 Jan 2018) December's job report may have been a little soft, with just 148,000 new hires, but the 2.1 million new jobs created throughout 2017 brought the US unemployment rate down to its lowest level in 17 years—and portends good things for the year ahead. The unemployment rate is the lowest its been since 2000 (4.1%), and the black unemployment rate (6.8%) is suddenly the lowest it has been since the government began tracking the stats. All of this occurred in the face of dire warnings of machines taking jobs away from humans, and economists' predictions that US manufacturing was on a downhill slide. If there is one concern we have, it is not the lack of jobs in America; it is the inability of US companies to find qualified American workers to fill the increasingly-technical jobs being created. To that end, we look for a major overhaul of the way we educate and train the young, especially those who reside in the lowest two quintiles of the economic spectrum. And the answer does not lie in throwing more money at the problem.

Markets unfazed by a quite lousy October jobs report

(03 Nov 2017) Expectations were for 310,000 new jobs created in the month of October. Talk about a miss—the actual figure came in at a paltry 261,000. Oddly, the Dow Jones Industrial Average, which had been sitting up about 20 points in the pre-market, actually gained about ten points following the early morning announcement. Why is that? Perhaps investors believe that the odds of a December rate hike just went down. Actually, despite the bad October figure, both August and September's jobs reports were revised higher. August went from 169,000 to 208,000, and September went from a loss of 33,000 jobs (hurricane-related) to plus 18,000. Despite the markets shrugging off October's number, we really do need to see some 300k+ numbers in the coming months if we want to maintain a 3% or better economic growth rate.

(03 Nov 2017) Expectations were for 310,000 new jobs created in the month of October. Talk about a miss—the actual figure came in at a paltry 261,000. Oddly, the Dow Jones Industrial Average, which had been sitting up about 20 points in the pre-market, actually gained about ten points following the early morning announcement. Why is that? Perhaps investors believe that the odds of a December rate hike just went down. Actually, despite the bad October figure, both August and September's jobs reports were revised higher. August went from 169,000 to 208,000, and September went from a loss of 33,000 jobs (hurricane-related) to plus 18,000. Despite the markets shrugging off October's number, we really do need to see some 300k+ numbers in the coming months if we want to maintain a 3% or better economic growth rate.

Initial Jobless claims and continuing claims fall to a 44-year low

(19 Oct 2017) Initial jobless claims fell to 222,000 for the week of 8-14 Oct, representing the lowest level since March of 1973. Continuing claims, representing those already receiving unemployment benefits, dropped to 1.89 million for the week—also a 44-year low. Couple these numbers with the 4.2% unemployment rate, and we can paint a picture of a very healthy economy. The biggest challenge for American businesses right now? Finding skilled workers to fill the record number of new job openings.

(19 Oct 2017) Initial jobless claims fell to 222,000 for the week of 8-14 Oct, representing the lowest level since March of 1973. Continuing claims, representing those already receiving unemployment benefits, dropped to 1.89 million for the week—also a 44-year low. Couple these numbers with the 4.2% unemployment rate, and we can paint a picture of a very healthy economy. The biggest challenge for American businesses right now? Finding skilled workers to fill the record number of new job openings.

Youth employment in US having strongest summer since 1969

(16 Aug 2017) Ahh, those wonderful summer jobs. Between the school years, a chance to pad the pocket and have a little fun with your friends. For me, the job was dishwasher and busboy at a local country club, making $2.65 an hour. At age 13, I had to lie about my age to get on. For the past eight years or so, summer youth employment levels hit the skids, with a dearth of job availability. Something changed that this summer. In fact, the unemployment rate for students on summer break fell to its lowest level since Neil Armstrong was making his “one historic step….” Yet another sign that the US economy is finally making a real recovery.

(16 Aug 2017) Ahh, those wonderful summer jobs. Between the school years, a chance to pad the pocket and have a little fun with your friends. For me, the job was dishwasher and busboy at a local country club, making $2.65 an hour. At age 13, I had to lie about my age to get on. For the past eight years or so, summer youth employment levels hit the skids, with a dearth of job availability. Something changed that this summer. In fact, the unemployment rate for students on summer break fell to its lowest level since Neil Armstrong was making his “one historic step….” Yet another sign that the US economy is finally making a real recovery.

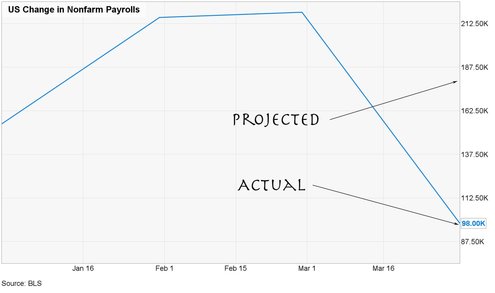

(07 Apr 2017) March jobs number misses mark—big time. Economists were predicting a new-jobs-created number of 180,000 for the month of March. The real number was about half of that. The US added just 98,000 private sector jobs in March, but the unemployment rate did fall to the lowest rate since May, 2007: 4.5%. The odd March weather did play a major role in the jobs miss, with about 80,000 fewer jobs directly connected to this factor. For example, in February the construction industry added 59,000 new jobs; in March, despite the hot building market, the industry added just 6,000 new positions. That is purely weather-related. The most concerning number in the report is the drop in retail positions: that industry lost 30,000 slots, and they aren't likely to come back. So much for Thursday's ADP report.

(06 Apr 2017) Enormous drop in initial jobless claims. New apps for unemployment benefits dropped to their lowest level in two years, a 25,000 drop to 234,000 new claims. Not only is this well below economists' expectations for 251,000 new claims, it also comes on the heels of a blowout ADP jobs report Wednesday showing the private sector created 263,000 jobs in March. That number blew the doors off the forecast for 170,000 new jobs. The ADP report made the market shoot up nearly 200 points on Wednesday, before it plummeted into negative territory on hawkish Fed comments.

(10 Mar 2017) US economy added 235,000 new jobs last month, futures immediately soared triple digits on Dow. According to the Bureau of Labor Statistics, the US added 235,000 new jobs in February and the unemployment rate dropped to 4.7%. There was news to cheer throughout the report: 340,000 Americans re-entered the workforce, 58,000 jobs were created in the construction industry—the most in a decade, and the jobs number beat estimates by 24%. When the numbers hit, Dow futures jumped triple digits.

(16 Feb 2017) Organized labor dealt blow at Boeing's South Carolina plant. Big labor got a slap in the face by Boeing (BA $113-$169-$170) workers at the company's enormous South Carolina aircraft factory, with nearly three out of four employees voting to reject union representation. The secret ballot (something union leaders fought hard to disallow—they wanted to know the names of workers voting against the union) showed just 26% of the workers voting to organize. With union representation in the corporate world at generational lows, this is yet another nail in the coffin.

(15 Feb 2017) Carl's Junior head withdraws name from Secretary of Labor position. The last thing Andy Puzder needed was the pay cut and the lack of respect that came with the job he was asked to apply for. While he doesn't have the $5 billion net worth of our new Secretary of Education, Betsy DeVos, he is pulling in about $7 mil per year as CEO of CKE Restaurants. Ultimately, the battle he was facing in congress over his promotion of an automated workforce and his employment of an undocumented housekeeper placed his confirmation on a tenuous footing. He did the right thing in pulling out. Who, other than a power-hungry career politician, would take that load of manure from the dimwits who would have been grilling him just so he could sit at a government job? Good luck, Andy...your gain is America's loss.

(Keep up the good work on the advertising, Andy)

(Keep up the good work on the advertising, Andy)

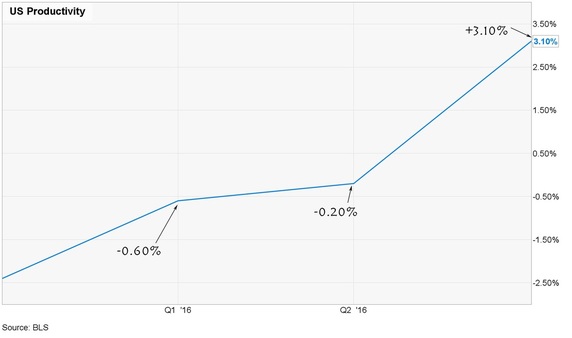

Strong US productivity in the third quarter

US productivity, an economic measure of output per unit of input, increased a healthy 3.1% in the third quarter, following three straight soft quarters. Put another way, there was a strong increase in worker output over the quarter, despite the fact that worker hours increased very slightly (productivity = output divided by an index of hours worked by all persons, including employees, business owners, and unpaid family workers).

In a vacuum, this is good news. Unfortunately, this report follows a Q1 productivity reading of -0.6% and a Q2 reading of -0.2%. For a year-on-year comparison, the reading for Q3 of 2015 was 2.00%.

The streak of negative readings leading up to the third quarter was the longest since the 1970s, reflecting a weak business environment and an economy mired in over-regulation and over-taxation.

So, does this one data point mean healthy US productivity is back? Probably not. One of the positive factors in the report was an anomaly: the figure was aided by record exports of agricultural products like corn and soybeans, which occurred because the US had a bumper crop—not because the business environment is getting better. We predict a lower productivity reading in Q4.

US productivity, an economic measure of output per unit of input, increased a healthy 3.1% in the third quarter, following three straight soft quarters. Put another way, there was a strong increase in worker output over the quarter, despite the fact that worker hours increased very slightly (productivity = output divided by an index of hours worked by all persons, including employees, business owners, and unpaid family workers).

In a vacuum, this is good news. Unfortunately, this report follows a Q1 productivity reading of -0.6% and a Q2 reading of -0.2%. For a year-on-year comparison, the reading for Q3 of 2015 was 2.00%.

The streak of negative readings leading up to the third quarter was the longest since the 1970s, reflecting a weak business environment and an economy mired in over-regulation and over-taxation.

So, does this one data point mean healthy US productivity is back? Probably not. One of the positive factors in the report was an anomaly: the figure was aided by record exports of agricultural products like corn and soybeans, which occurred because the US had a bumper crop—not because the business environment is getting better. We predict a lower productivity reading in Q4.

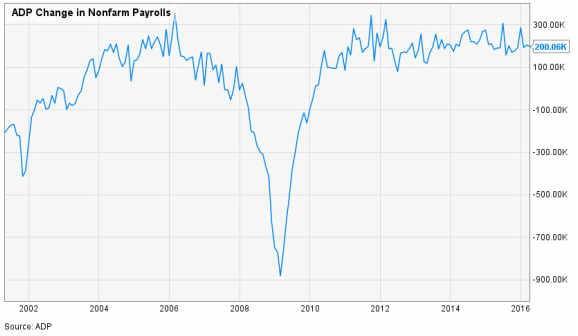

Private Sector Job Growth Solid in March

(30 Mar 16) Private-sector hiring continues its steady, methodical pace forward following the great downturn of 2008-2009. Private employers added 200,000 new jobs in March, and February’s figures were revised up slightly to 205,000. Sure, 400,000 per month would be better, but we will take slow and steady.

(Reprinted from this coming Sunday’s Journal of Wealth & Success, Vol. 4, Issue 4.)

(30 Mar 16) Private-sector hiring continues its steady, methodical pace forward following the great downturn of 2008-2009. Private employers added 200,000 new jobs in March, and February’s figures were revised up slightly to 205,000. Sure, 400,000 per month would be better, but we will take slow and steady.

(Reprinted from this coming Sunday’s Journal of Wealth & Success, Vol. 4, Issue 4.)

The Unemployment Rate in America is a Lot Worse than the Numbers Indicate; Here’s Why

(10 Sep 15) So the unemployment rate fell to 5.1% last week; why aren’t we breaking out the champagne and doing an economic victory lap? The answer lies in the convoluted way the US Department of Labor measures unemployment. Hint: they are making it appear a lot rosier than it is in reality.

You may have heard of something called the labor force participation rate. Most people assume that this number reflects the number of working Americans divided by the number of Americans who could be working (generally, any able-bodied citizen between the ages of 18 and 65). But this is not the case.

The 62% labor force participation rate is the lowest it has been since a former peanut farmer was president. So who is in this group? Certainly, anyone working would be a member. Also, anyone who is unemployed but looking for a job is in the group. And that’s about it. Anyone no longer looking for a job, even though they are capable, are considered to have dropped out of the labor force and are not in the group. Think that is a statistically insignificant figure? Try this on for size: 94 million Americans are no longer in the labor force, even though they may be able-bodied. Needless to say, that is a national record.

Who are these 94 million people, and why aren’t they working or looking for a job? Certainly, a large portion of this number can be accounted for by members of the baby-boom generation who have simply retired. Young people also account for a good percentage, especially since a record number of young adults are either staying in college longer, or leaving their jobs to become stay-at-home parents.

Now that we have whittled the number down, we arrive at the big elephant in the room. There exists, in modern-day America, a $200-billion-per-year disability monster that has eroded our global competitiveness and eaten away at the human dignity of millions. It is also keeping assets out of the hands of those who are genuinely and truly disabled.

The problem began when the government loosened the term “disabled,” but it burgeoned after the 2008 financial crisis displaced millions of workers. Suddenly, an enormous number of out-of-work Americans discovered that they could apply for, and receive, Social Security disability payments for life.

With the baby-boomer population getting older, it would make sense that more Americans would be afflicted with age-related diseases. Research has found, however, that advances in medical technology more than offset this factor. Rather, the answer becomes clear when we look at the diagnoses of workers on disability now versus 50 years ago.

Back then, heart disease, stroke, and similar disorders accounted for the lion’s share of disability checks generated. Today, over 50% of disability cases come from a physician’s definition of back pain, mental disorder, or “developmental disability.” In other words, a cottage industry has sprung up, with a cabal of doctors and disability attorneys gaming the system for financial gain. Who are the real victims? Everyone who pays into Social Security, the individuals who are duped into taking part in the scheme, and, most importantly, the truly disabled. Interestingly, a similar set of circumstances took shape in Greece two generations ago. (Reprinted from the Journal of Wealth & Success, Vol. 3 Issue 36.)

West Coast Port Strike

We were told it wasn’t a strike, or even a slowdown. Then why are tens of dozens of ships still sitting by West Coast ports?

(28 Feb 15) This week fourth-quarter GDP was revised downward to a paltry 2.2% from the previously downgraded 2.6% annualized rate. For an economy still trying to grasp on to some semblance of a recovery, that is pitiful. No doubt, one reason for that gloomy report was the West Coast ports strike (and yes, that is what it was, despite the lack of picket signs) that tentatively ended with an agreement last week.

Background.

There are 29 ports along the West Coast, from San Diego on the south to Bellingham, Washington up north. These conduits of commerce handle 350 million tons of goods, or 50% of the containerized cargo ($1 trillion worth) entering all US ports. The dockworkers are unionized—members of the International Longshore and Warehouse Union (ILWU). The Pacific Maritime Association, or PMA, represents all of the companies which ship goods through the West Coast ports. In July of 2014, the labor contract expired and had to be renewed. That is when the trouble began…

(Read the entire story in the Journal of Wealth & Success, Vol. 3, Issue 9. Not a member? Click Here.)

Why did Organized Labor Admit Defeat at the Tennessee Volkswagen Plant?

(21 Apr 14) In a stunning defeat for organized labor, workers at a VW plant in Tennessee voted in February against organizing. Hard to comprehend for the union heads--that workers might actually be happy with their employer. What made this case so odd was that the German automaker handed pro-union forces the flogging stick and bent over the assembly line. Some companies, especially those of a European flavor, are so intimidated by labor unions that they seem to have a case of Stockholm Syndrome. The wise workers at the plant would have none of it, voting down the union.

The UAW promised, in typical spittle-flying-out-of-the-mouth fashion, to fight the "rigged" vote and forge ahead until the workers came to their senses. Rigged? The UAW calling an election rigged is like a schoolyard bully standing over a bloodied lightweight on the pavement, proclaiming that the docile string bean started the whole thing. So why, today, did the innocent little UAW drop the case it brought before the National Labor Relations Board--for all intents and purposes a complete ally of big labor?

There are a couple of possibilities. In a year with a critical mid-term election, the union may have decided it could not afford the costs--in time, money, and public opinion--of a protracted fight. Additionally, the UAW may have feared a federal lawsuit filed by the winners in the vote, claiming that VW violated the Taft-Hartley Act, which prohibits "things of value" being given by a company to a group seeking to organize its workers. VW clearly gave the UAW free reign at the plant in its efforts, to include giving the group access to personal information of the workers. This unseemly action was not duplicated for those wishing to lobby against the union.

Whatever the catalyst for the capitulation, the union clearly failed in Tennessee. Pity the big-three automakers as the UAW attempts to renegotiate labor deals with them later this year. The knives will be drawn.

What is the Connection Between a Bad Jobs Report and a Racially Motivated AG?

(10 Jan 14) Against a backdrop of expectations for 200,000 new jobs, U.S. payrolls rose by a paltry 74,000 in December, catching nearly every economic analyst off guard. While the Labor Department did say that the unemployment rate in the U.S. dropped from 7% to 6.7% in December, this decline was almost exclusively due to more Americans leaving the workforce or giving up on looking for a job. In fact, a whopping 347,000 people simply exited the workforce in December. This factor is not figured into the government's U2 unemployment rate of 6.7%, but it is calculated in the U6 rate of 13.1% real unemployment.

It was just last month that the Fed announced it was tapering its bond buying program by $10 billion per month due to an improved economic outlook--a move we applauded. While that action might not have been taken had they known the December jobs report would be so bad, we do believe this number is somewhat of an outlier. In other words, expect better jobs reports to come.

While we remain relatively rosy on 2014, there are serious structural issues we must consider. For example, the labor participation rate--those who are either working or looking for work--fell to 62.8% of the possible American labor pool. This figure represents the lowest rate since the late 1970s--not exactly a booming time for the U.S. economy.

So what's the real story with the numbers? Unemployment benefit time horizons are part of the equation. During the height of the financial crisis, the federal government extended unemployment benefits for up to 99 weeks. Today, the equation is more complex and varies from state to state, but studies indicate that unemployed workers who expect to remain in the workforce will, on average, begin looking harder for work as they get closer to the benefits cutoff period. That is called human nature, and Labor Secretary Perez is not being forthcoming when he argues otherwise.

Another big factor revolves around the education level of those who are unemployed. We are in the information age, and the day of the giant corporation hiring tens of thousands of assembly line worker and offering them a pension when they retire has passed. Despite the efforts of organized labor and its allies in D.C., we are now in a global economy where a company can employ workers just about anywhere they like. Yes, the government/organized labor cabal can turn up the heat on companies that hire in right-to-work states (think Boeing) or outside of the country, but that will backfire anywhere it takes place outside the walls of a Beltway think tank.

This puts a target on the back of America's public education system. Ironically, this global economic transformation is taking place at a time when Attorney General Eric Holder is crying discrimination with respect to disciplining kids in our public schools. He doesn't get it, or he doesn't want to get it. In a power struggle between a racially-motivated Department of Justice in the United States and a global economic transformation, Holder is a tiny mosquito in the jungle, irritating many but having no real impact on the ecosystem. Unfortunately, it is largely minority kids in the U.S. who will pay for his myopic behavior. In the meantime, the U.S. economy will continue to grow while many Americans remain trapped behind the figurative prison walls put in place by elected officials with an agenda.

Why Employers will Drop their Health Plans due to Obamacare

(02 Oct 13) With the comically-named "Affordable" Care Act (Obamacare) being implemented, we recall the assurances given just a few short years ago that now seem to be crumbling to the ground. For example, anyone suggesting that employers would drop their own health insurance plans to dump employees into Obamacare were quickly impugned. Unfortunately, the writing is on the wall that many companies are getting ready to go down that path.

Companies are not forced to offer health care now, though most do. Under the new law, firms that provide health care can be fined if the government deems that their coverage is too costly or does not provide sufficient coverage. To meet the law's standards, these companies can simply drop out of the group coverage game and inform employees that they must go to the health care exchanges for coverage. For those of us familiar with VA health care, we understand what a nightmarish scenario this will be for millions of American workers. As one critic put it, "if you like dealing with the DMV, you are going to love working with the health care exchanges."

The dirty little secret is that the government needs younger, healthier individuals to participate on the exchanges to help defray the costs for older Americans in the plan who often have greater health care needs. That is one of the great ironies--that younger, healthier workers will face higher premiums than they generally would have in a company plan.

A McKinsey report from two years ago put the percentage of companies which would shut down their own plans at just about one-third. One argument against that figure has been that companies do not wish to alienate their workforce that way. However, with the government portraying its own program as such a wonderful creation, they are giving firms plenty of fodder to use when they drop their own plans.

Household Income Down from 2009

(01 Oct 13) A report based on analysis of data from the U.S. Census Bureau shows that the average American household is earning 5% less than it was in early 2009. U.S. median household income is currently sitting at $52,089, down from about $55,000 four years ago.