Housing

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

See also: Homes & Durables

Mortgage rates just hit 8% for the first time since the summer of 2000

|

30-yr mtg 8%

18 Oct 2023 |

It’s official: the average 30-year mortgage rate just hit 8%

Per industry outlet Mortgage News Daily, the average 30-year mortgage just hit a rate not seen since the summer of 2000: 8%. The news provides yet another hurdle for would-be buyers, who have been facing dwindling inventories, record-high home prices, and inflation around every corner. Let’s put that rate in dollars and cents. The average new home price in America was $430,300 as of the first week of October. After plopping a fat 20% down ($86,060) and adding in the average cost of home insurance, property taxes, and HOA dues, the new owner would be facing a $3,000 monthly mortgage payment. The same house purchased two years ago at the prevailing rate would come with a monthly mortgage payment of $1,865—and that doesn’t even account for inflation over the past two years. In other words, the same home probably would have cost in the neighborhood of $350,000 two years ago, which would bring the payment down to $1,600! We are told that Americans are still flush with cash (a point many would argue), but an extra $1,400 per month for the typical family has got to hurt. And the higher rates are showing up in loan demand. According to the Mortgage Bankers Association, loan applications fell 6% on a seasonally adjusted basis from the end of the first week of October to the end of the second week. Applications to either buy or refinance a home fell 6.9%—the weakest reading since the mid 1990s. Nonetheless, housing starts still rose 7% in September to a seasonally adjusted rate of 1.358 million homes per year. That increase, however, was largely due to an increase in multifamily projects. For renters, the picture isn’t much brighter. According to Rent.com, the national median rent price is now $2,011 per month. Putting this in perspective, the average 30-year mortgage rate in October 1981 was 18.63%. That said, if we are not at or very near the peak for mortgage rates, expect the damage to start slowly creeping throughout the economy. And don’t even get us started on what the US government will have to pay in interest this year on the $33 trillion national debt it has racked up. Several small nations could be purchased for the same amount. |

|

MoM housing starts +21.7%

YoY rent prices -0.57% multifamily unit starts 624k 13 Jul 2023 |

Multifamily housing is going up at a clip not seen since 1986, meaning rental prices should continue to moderate

Something rather amazing happened over the course of the year through this past May: According to apartment search engine and online marketplace Rent.com, monthly rental prices fell 0.57%. That represents the first drop in prices since March 2022, and comes on the heels of a year in which the average renter paid 17.5% more than they did the previous year. Despite this good news, consider this: The national median rent is now $1,995 per month. Rents may finally be moderating, but that is still a lofty figure. More good news may be on the horizon, however. After years of being underdeveloped, construction is soaring once again. In May, privately-owned multifamily unit starts hit 624,000, up from a trough of 234,000 in April 2020. That is the fastest clip of new units since April 1986. Meanwhile, Month-over-month (MoM) housing starts for May rose a robust 21.7%—the fastest pace since October 2016. In addition to supply ramping up, inflation is clearly moderating. One other factor should help put downward pressure on rent prices: the average American budget is getting tighter. Not only are the pandemic piggy banks running out of money after three years of wanton discretionary spending, the resumption of student loan payments this September will further crimp the budget of millions of American families. The supply and demand dynamic of multifamily housing is about to make a rather dramatic shift. In the next issue of The Penn Wealth Report we will take a closer look at this topic and what it means not only for renters, but for developers and those who hold apartment REITs in their portfolios. One housing research firm sees apartment values dropping another 20% between now and the end of next year, meaning investors should pay special attention to this corner of the real estate market and consider placing stops on positions to help protect their principal. |

|

30-year avg mortgage rate

7.12% 07 Mar 2023 |

The Fed is raising rates to cool inflation, but one segment will remain immune

The long-term average 30-year mortgage rate is 7.75%; as of this writing—despite what the accompanying chart shows—we have retaken the 7% level. While 7.75% is the long-term average, the ten-year average mortgage rate sits at 4%; but, for a brief two-year period, we sat in a trench below that level. The typical American may make some poor financial decisions, but a large percentage of the US population did something brilliant over that spell: they either financed a new purchase at rock-bottom rates or they refinanced their existing home with a fixed-rate loan. While 10% of current home loans are the adjustable-rate (ARM) variety, that is well below the historic average (40% of mortgage loans were ARMs back in 2006, for example). For Americans locking in 2.65% to 4% rates, it is time to celebrate. For the Fed, not so much. The Fed has a dual mandate: keep the unemployment rate reasonably low and keep inflation somewhere around the 2% rate. While the first mandate has obviously been met, the central bank continues to raise rates in an effort to bring down the stubbornly high level of inflation. Were they operating in most other countries (a 30-year fixed-rate home loan is a uniquely American experience), they would be having an easier time. However, the 40% of homeowners who took out those low-rate loans in either 2020 or 2021 are immune from the Fed’s actions—at least with respect to their largest expense. They may be locked into their existing home, but that extra purchasing power will remain intact for decades. Sadly, evidence is mounting that many Americans are once again spending beyond their means: credit card balances just hit a new record high. And for anyone who has looked at their credit card interest rates lately, it is clear that the banks wasted no time in spiking those very-adjustable rates. With such a large percentage of homeowners locked into their current homes due to low mortgage rates, the housing industry will continue to be negatively impacted. In a warped sense, this is what the Fed wants to see—lower or stagnate home prices due to reduced demand, and higher unemployment in the industry due to a pullback in construction. Investors should keep in mind that the homebuilders reside in the Consumer Discretionary sector; a segment which is already facing headwinds due to the probable recession on the horizon. We have been underweighting this sector since the middle of last year. |

|

30-year avg mortgage rate

6% 12 Sep 2022 |

Mortgage rates hit highest level since 2008

This past week, the average interest rate for a 30-year mortgage did something it hasn’t done since November of 2008: hit the 6% mark. Considering rates topped out about three times that level back in the 1980s, the current rate may not seem too daunting, but that figure reflects a 130% spike from just over two years ago. As the Fed works to get inflation under control, this is certainly one of the intended consequences of the tightening cycle. As mortgage rates rise, it should cool the housing market and, hence, runaway home prices. Unfortunately for would-be buyers, that has not happened, leaving them at the mercy of higher rates and higher prices. For those putting their homebuying plans on hold, there is another problem: rents are rising just as fast. We did a double take when we saw this figure, but the national average for renting a single-family home in the US rose 13.4% from 2021 to 2022, to $2,495 per month. For apartment dwellers the picture is nearly as bad: the monthly rent for a multifamily dwelling in the US rose 12.6% from July of 2021 to this past July, to $1,717. And occupancy rates remain high for rental housing, hovering around 96%. It may seem warped, but this is precisely why the Fed must continue to raise rates. Ultimately, something must put downward pressure on home prices. It may seem counterintuitive to look at buying the homebuilders now, but their prices have been so beaten down by the fear of rate hikes and a coming recession that they are beginning to look very attractive. While the builders of lower-end homes will face more difficulty, names like Toll Brothers (TOLL $45) and D.R. Horton (DHI $74, Emerald Homes is its luxury division) look attractive. Both companies have ultra-low P/E ratios—both current and forward—in the 4-6 range, and both have plenty of cash on hand to weather any coming housing storm. |

|

Can the Housing Boom Withstand Both Higher Rates and Inflation?

(15 Dec 2021) Two historically distressing conditions are about to hit home buyers: higher mortgage rates and inflation; but will it matter to a red-hot housing market? (See article in The Penn Wealth Report by clicking button to right) |

Mortgage demand hits 11-year high as low rates entice buyers

(17 Jun 2020) Remember all of the concern about the impact of lockdown on the housing market? At the height of the media's feeding frenzy, we picked up the largest homebuilder (by revenue) in the country: Lennar Corp (LEN $65) at $42.99/share. It didn't seem logical that Americans were suddenly going to shun home ownership due to the health crisis, especially with record-low interest rates. Sure enough, the new mortgage applications count is in, and it is nearly as stunning as the jobs report of a few weeks ago and the retail sales report issued last week. As reported by the Mortgage Bankers Association, mortgage demand rose 21% from a year ago, representing an 11-year high, as the average contract interest rate on a 30-year loan fell to 3.18%. One disappointment was housing starts (up 4.3% vs 22.3% expected), but this was due to the builders' inability to ramp back up in time to meet demand. Unsure of where the virus was headed, the purchase of land on which to build essentially came to a screeching halt between mid-February and the end of April. Additionally, the flow of building materials was also constricted during that time. Builders are now playing a game of catch-up to meet rising demand. The housing market has come roaring back to life.

(17 Jun 2020) Remember all of the concern about the impact of lockdown on the housing market? At the height of the media's feeding frenzy, we picked up the largest homebuilder (by revenue) in the country: Lennar Corp (LEN $65) at $42.99/share. It didn't seem logical that Americans were suddenly going to shun home ownership due to the health crisis, especially with record-low interest rates. Sure enough, the new mortgage applications count is in, and it is nearly as stunning as the jobs report of a few weeks ago and the retail sales report issued last week. As reported by the Mortgage Bankers Association, mortgage demand rose 21% from a year ago, representing an 11-year high, as the average contract interest rate on a 30-year loan fell to 3.18%. One disappointment was housing starts (up 4.3% vs 22.3% expected), but this was due to the builders' inability to ramp back up in time to meet demand. Unsure of where the virus was headed, the purchase of land on which to build essentially came to a screeching halt between mid-February and the end of April. Additionally, the flow of building materials was also constricted during that time. Builders are now playing a game of catch-up to meet rising demand. The housing market has come roaring back to life.

Homebuilder sentiment hits highest level since 1999. (16 Dec 2019) US homebuilder confidence is measured by the NAHB/Wells Fargo Housing Market Index on a scale between one and 100. Any reading below 50 represents a negative outlook, 51 or higher reflects a positive outlook. The NAHB Index jumped five points in December, to a highly-impressive reading of 76. Even more impressive, that is the highest reading since the summer of 1999. That figure also represents a 20-point rise since December of 2018. There are a number of reasons for the rosy outlook among homebuilders. The economy is strong, interest rates are low, more US workers have jobs now than at any other time in the last fifty years, and there is a relatively low supply of existing homes on the market. Based on the internals of the index, the good vibe should carry into next year: the "sales expectations in the next six months" reading jumped to 79 on the 100-point scale. Our favorite way to play this industry continues to be ITB ($45.18), the iShares US Home Construction ETF, which includes the likes of PulteGroup (PHM), D.R. Horton (DHI), Lennar (LEN), and Sherwin-Williams (SHW). As for individual housing names, Lennar @ $58 per share still looks nicely undervalued.

Homebuilder sentiment hits highest level since 1999. (16 Dec 2019) US homebuilder confidence is measured by the NAHB/Wells Fargo Housing Market Index on a scale between one and 100. Any reading below 50 represents a negative outlook, 51 or higher reflects a positive outlook. The NAHB Index jumped five points in December, to a highly-impressive reading of 76. Even more impressive, that is the highest reading since the summer of 1999. That figure also represents a 20-point rise since December of 2018. There are a number of reasons for the rosy outlook among homebuilders. The economy is strong, interest rates are low, more US workers have jobs now than at any other time in the last fifty years, and there is a relatively low supply of existing homes on the market. Based on the internals of the index, the good vibe should carry into next year: the "sales expectations in the next six months" reading jumped to 79 on the 100-point scale. Our favorite way to play this industry continues to be ITB ($45.18), the iShares US Home Construction ETF, which includes the likes of PulteGroup (PHM), D.R. Horton (DHI), Lennar (LEN), and Sherwin-Williams (SHW). As for individual housing names, Lennar @ $58 per share still looks nicely undervalued.

The Fed's first rate cut in eleven years causes big spike in mortgage loan activity. (14 Aug 2019) On the last day of July, the Fed did something it hasn't done since December of 2008: lower the Fed funds rate. The lower band of the target now sits at 2%, which would be somewhat remarkable were it not for the $14 trillion worth of bonds and notes around the world which carry negative yields. The Fed's most recent action saw one intended consequence come to fruition: there was a flurry of mortgage loan activity last week. According to new data from the Mortgage Bankers Association, volume in mortgage applications spiked just over 20% last week, or a whopping 81% from the same time last year. The vast majority of this volume came from current homeowners looking to lock in lower rates—and lower monthly payments—on their existing homes, as evidenced by the meager 2% rise in mortgage applications for new purchasers. The average rate on a 30-year fixed mortgage fell to 3.93%, its lowest level since November of 2016. The one disconcerting figure in the data is the lack of any real activity by new buyers. Despite the low mortgage rates and historically-low level of unemployment, rising home prices are making affordability a real issue. An under-supply of new homes, especially at the lower end of the spectrum, appears to be the major culprit. Although we are currently shying away from the homebuilders, D.R. Horton (DHI), which constructs homes ranging in price from $100,000 to over $1,000,000, is our current favorite player in the industry.

Higher prices and higher rates combine to pound down new mortgage applications. (17 Oct 2018) One week does not make a trend, but the 7.1% drop in weekly mortgage applications certainly reflects buyer angst over higher prices and higher rates. Between summer and autumn of 2016, 30-year mortgage rates troughed at about 3.41%; last week, that rate hit 4.95%. To be sure, that one-year high doesn't come close to the long-term average of 8.10%, but it does give buyers one more excuse to pause on that purchase. The bright news for homebuilders and the economy? It doesn't look like rates have much further to go—considering our relatively tame inflation numbers—before they stabilize and the Fed puts the brakes on rate hikes.

|

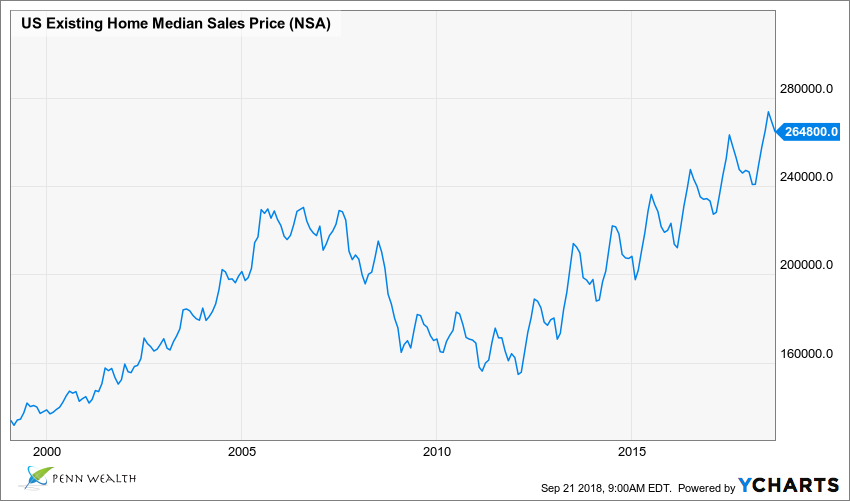

Mortgage rates hit their highest level in seven years, forcing would-be buyers into action. (21 Sep 2018) One year ago, the average 30-year mortgage rate in the US was 3.78%. As of right now, that figure sits at 4.87%—the highest it has been since the spring of 2011. Something else has been going up this year: the cost of buying a home. In the first quarter of 2018, the US existing home median sales price was $240,800. That figure has spiked 10% since January, and now sits at $264,800. With the promise of more Fed rate hikes coming between now and the end of 2019, the Mortgage Bankers Association reported a 1.6% rise in mortgage applications within the past week. Here's the simple fact, however: this rate hike cycle has a definite cap on it, and it is in the 4% or less range for the fed funds rate—a far cry from the 7% or higher rates we have seen in the past. This should set up a Goldilocks scenario for the housing market, homebuilders, and new homeowners over the next several years.

|

|

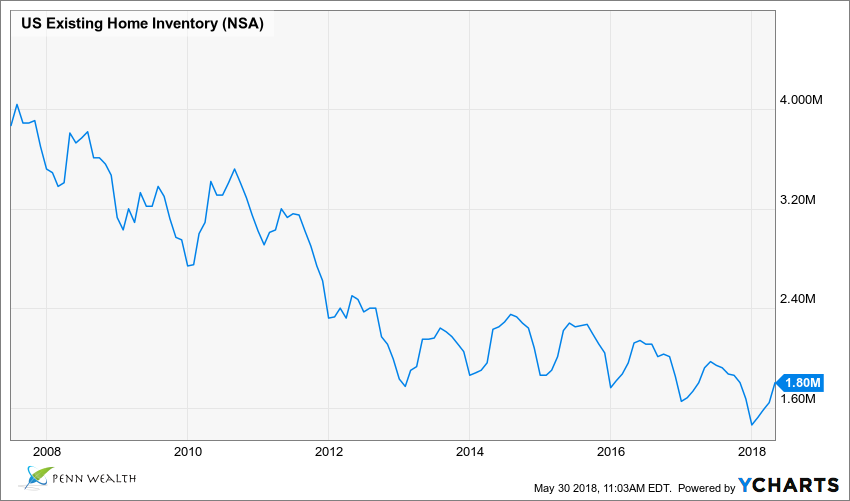

Existing-home prices rose 5.3% in April from previous year, fastest clip in 12 years

(30 May 2018) The median sales price for existing homes in the US hit $257,900 in April, which represents a 5.3% increase from April of 2017 and the fastest pace of growth since the summer of 2006. This rapid jump in the cost of home ownership, along with a shortage of houses on the market and an increase in mortgage rates, led to a 2.5% decline in existing-home sales from March to April. There were 1.8 million existing homes on the market in April, which is not enough to keep up with demand, and less than half the number on the market in July of 2007 when inventory peaked. |

For those still on the fence: mortgage rates just hit a seven-year high and are not stopping there

(18 May 2018) Two years ago we were fortunate enough to be in the market for a new home, and fortunate enough to qualify for a VA loan. We locked in a fixed rate of 3.25%. Based on the historical trend, it could be two generations before we see rates like that again. With a strong and growing economy, unemployment at 30-year lows, and the Fed keeping a keen eye on inflation, the average 30-year mortgage rate just spiked to 4.61%. The jump has been a catalyst for many home "lookers" to become home buyers, as we expect to see at least two more rate hikes this year and as many as four in 2019. Even after those six potential hikes, the Fed's benchmark rate would still only be 3.25%—a long cry from the 20% (yes, you read that right) we saw around the time of the 1980 election, and well below the 5% historical average. From a 30-year mortgage rate standpoint, expect to pay over 6% if you put off purchasing your home until 2020. At least fixed income investors will be getting a decent income stream once again.

(18 May 2018) Two years ago we were fortunate enough to be in the market for a new home, and fortunate enough to qualify for a VA loan. We locked in a fixed rate of 3.25%. Based on the historical trend, it could be two generations before we see rates like that again. With a strong and growing economy, unemployment at 30-year lows, and the Fed keeping a keen eye on inflation, the average 30-year mortgage rate just spiked to 4.61%. The jump has been a catalyst for many home "lookers" to become home buyers, as we expect to see at least two more rate hikes this year and as many as four in 2019. Even after those six potential hikes, the Fed's benchmark rate would still only be 3.25%—a long cry from the 20% (yes, you read that right) we saw around the time of the 1980 election, and well below the 5% historical average. From a 30-year mortgage rate standpoint, expect to pay over 6% if you put off purchasing your home until 2020. At least fixed income investors will be getting a decent income stream once again.

Buyers and sellers agree: now is a great time to buy or sell a home

(07 May 2018) Fannie Mae's Home Purchase Sentiment Index® just hit a record high in the month of April, indicating that demand for residential housing is still red-hot. The HPSI rose 3.4 points in the month, to 91.7 on a scale of 1 to 100. Sellers see a strong upward trajectory for home prices, while buyers see the writing on the wall that rates are only going up from here. Additionally, a tight supply on the market has added impetus to making a move right now. For all of the talk we heard recently about millennials shunning home ownership, this demographic group is now solidly in the "we want a home" camp—proving once again how false narratives can take hold and warp investors' thinking. The average new home price for houses sold in March of this year was $369,900, and the average 30-year mortgage rate as of this week is 4.54%.

(07 May 2018) Fannie Mae's Home Purchase Sentiment Index® just hit a record high in the month of April, indicating that demand for residential housing is still red-hot. The HPSI rose 3.4 points in the month, to 91.7 on a scale of 1 to 100. Sellers see a strong upward trajectory for home prices, while buyers see the writing on the wall that rates are only going up from here. Additionally, a tight supply on the market has added impetus to making a move right now. For all of the talk we heard recently about millennials shunning home ownership, this demographic group is now solidly in the "we want a home" camp—proving once again how false narratives can take hold and warp investors' thinking. The average new home price for houses sold in March of this year was $369,900, and the average 30-year mortgage rate as of this week is 4.54%.

Home ownership rate hits highest level in three years

(01 Nov 2017) Despite a lack of supply, rising prices, and higher mortgage rates, the rate of home ownership in the US hit its highest level in three years. A full 63.9% of American families now own their own home, a rising trend that began in the third-quarter of 2016. The rate hit its statistical peak in the third-quarter of 2004, when 69% of US households were also homeowners. Further evidence of the shift back into homes: the national apartment vacancy rate jumped from 4.1% in Q3 of 2016 to 4.5% in the same quarter this year.

(01 Nov 2017) Despite a lack of supply, rising prices, and higher mortgage rates, the rate of home ownership in the US hit its highest level in three years. A full 63.9% of American families now own their own home, a rising trend that began in the third-quarter of 2016. The rate hit its statistical peak in the third-quarter of 2004, when 69% of US households were also homeowners. Further evidence of the shift back into homes: the national apartment vacancy rate jumped from 4.1% in Q3 of 2016 to 4.5% in the same quarter this year.

New phishing scam targets homebuyers' escrow funds at closing

(19 Oct 2017) There's an insidious new scam out there, and it could cost a new homebuyer tens of thousands of dollars. The scammers first get into a real estate agent's email account via a phishing email. If the agent opens a link in the email, downloads a file, or even replies, the scammer is given access to a goldmine of client data. Then, as a particular buyer is set to wire closing costs to the appropriate account, the hackers send an authentic-looking email telling the buyer of a change in the bank account information. Since the email appears to have come directly from their real estate agent, they often comply with the request, and the funds are transferred into the criminal's account. Law enforcement officials are warning homebuyers to always call their agent's office to assure they actually sent the change request.

(19 Oct 2017) There's an insidious new scam out there, and it could cost a new homebuyer tens of thousands of dollars. The scammers first get into a real estate agent's email account via a phishing email. If the agent opens a link in the email, downloads a file, or even replies, the scammer is given access to a goldmine of client data. Then, as a particular buyer is set to wire closing costs to the appropriate account, the hackers send an authentic-looking email telling the buyer of a change in the bank account information. Since the email appears to have come directly from their real estate agent, they often comply with the request, and the funds are transferred into the criminal's account. Law enforcement officials are warning homebuyers to always call their agent's office to assure they actually sent the change request.

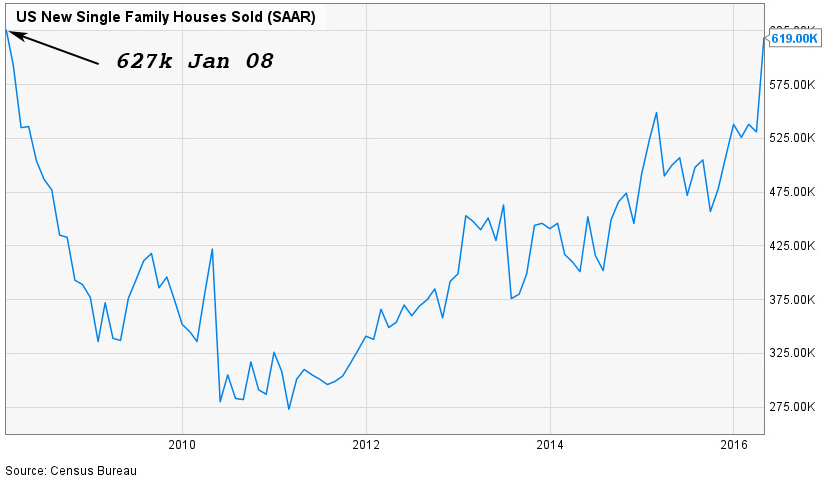

Best numbers since 2008 boost homebuilders, portend good things for GDP

(25 May 16) Just when it seems as though the economy is sputtering along at a turtle’s pace and Americans are hesitant to open their wallets, a report like this comes along. The Commerce Department announced that new home sales rocketed in April to their highest level since January, 2008—over eight years ago and before the Great Recession seized up the American economy.

Versus expectations of a 1.8% jump in sales, contracts for new homes surged 16.6% in the month to an annually-adjusted rate of 619,000 units—the biggest percentage jump in a generation. But this was not the only impressive number in the report. The median price of new homes sold (meaning half were below this number and half above) rose to a record $321,000. The average price of a new home sold in April rose to a whopping $385,000.

What is responsible for the spike?

Not only are Americans feeling more comfortable about their own job stability, they are also getting a sense that they will not see interest rates this low again for long, long, time. With the average 30-year mortgage rate hovering around 3.9%, up 30 basis points from one week ago, there is a growing sense that the Fed will soon make their second rate hike in precisely ten years (May of 2006 was the last hike before the Fed moved last December). We predict a July hike of 25 basis points, even though (or precisely because) there is no Fed press conference after that particular meeting.

What does this portend for the economy?

In the first quarter of 2016, the US economy grew at an abysmal annualized pace of 0.5%—pretty ugly for an economy that should be chugging along at 3-4% per year. These stellar new-home sales figures should, however, help raise the second quarter GDP number. Furthermore, the foundation of a housing comeback will be more solid this time around, as the government-induced lower qualification standards for mortgage loans are no longer present. If a trendline can now be established around the 600,000 annualized new home sales mark, it will be a big shot in the arm to the economy.

As one could imagine, the homebuilding industry will be a key beneficiary to a housing rebound. In fact, on the same day that the Commerce Department announced new home sales, luxury homebuilder Toll BrothersTOL reported surprise top-line revenue and bottom-line profit in the second quarter, surpassing the rosiest analyst forecasts. Although TOL’s peers didn’t announce earnings on that day, D.R. HortonDHI, LennarLEN, and PultePHM also spiked on the news.

To be sure, tougher standards and a wary base of potential homeowners led to an explosion of apartment dwellers over the past eight years, but even that may be changing (see “Millennials Fueling Apartment Boom”). While we are currently neutral on the big, publicly-traded builders, that may change soon as well. (Reprinted from this coming Sunday’s Penn Wealth Report, Vol. 4, Issue 21. For subscription information, click here.)

(OK, got it. Take me back to the Penn Wealth Hub!)

(25 May 16) Just when it seems as though the economy is sputtering along at a turtle’s pace and Americans are hesitant to open their wallets, a report like this comes along. The Commerce Department announced that new home sales rocketed in April to their highest level since January, 2008—over eight years ago and before the Great Recession seized up the American economy.

Versus expectations of a 1.8% jump in sales, contracts for new homes surged 16.6% in the month to an annually-adjusted rate of 619,000 units—the biggest percentage jump in a generation. But this was not the only impressive number in the report. The median price of new homes sold (meaning half were below this number and half above) rose to a record $321,000. The average price of a new home sold in April rose to a whopping $385,000.

What is responsible for the spike?

Not only are Americans feeling more comfortable about their own job stability, they are also getting a sense that they will not see interest rates this low again for long, long, time. With the average 30-year mortgage rate hovering around 3.9%, up 30 basis points from one week ago, there is a growing sense that the Fed will soon make their second rate hike in precisely ten years (May of 2006 was the last hike before the Fed moved last December). We predict a July hike of 25 basis points, even though (or precisely because) there is no Fed press conference after that particular meeting.

What does this portend for the economy?

In the first quarter of 2016, the US economy grew at an abysmal annualized pace of 0.5%—pretty ugly for an economy that should be chugging along at 3-4% per year. These stellar new-home sales figures should, however, help raise the second quarter GDP number. Furthermore, the foundation of a housing comeback will be more solid this time around, as the government-induced lower qualification standards for mortgage loans are no longer present. If a trendline can now be established around the 600,000 annualized new home sales mark, it will be a big shot in the arm to the economy.

As one could imagine, the homebuilding industry will be a key beneficiary to a housing rebound. In fact, on the same day that the Commerce Department announced new home sales, luxury homebuilder Toll BrothersTOL reported surprise top-line revenue and bottom-line profit in the second quarter, surpassing the rosiest analyst forecasts. Although TOL’s peers didn’t announce earnings on that day, D.R. HortonDHI, LennarLEN, and PultePHM also spiked on the news.

To be sure, tougher standards and a wary base of potential homeowners led to an explosion of apartment dwellers over the past eight years, but even that may be changing (see “Millennials Fueling Apartment Boom”). While we are currently neutral on the big, publicly-traded builders, that may change soon as well. (Reprinted from this coming Sunday’s Penn Wealth Report, Vol. 4, Issue 21. For subscription information, click here.)

(OK, got it. Take me back to the Penn Wealth Hub!)

Millennials fueling apartment boom—but how much gas is left in the tank?

(28 Mar 16) In the 1940s and 1950s a major demographic shift was occurring in the United States. In rural areas, which comprised the vast swath of the American landscape, farm life was the norm. For those living near big industrial cities, however, tenement living was typically the only option. Increased pay and a building boom changed all of that in the 1940s and ‘50s, however. Suddenly, home ownership became the American Dream. The concept of the modern mortgage gave ordinary workers the ability to raise their family in their own home.

Following the implosion of the mortgage industry in 2008, home ownership suddenly went out of vogue for millions of so-called Millennials—those born after 1980. They flocked to apartment complexes in droves, especially those located in urban areas. As rents become higher, however, this generation is reconsidering its stance on home ownership.

Their income is also rising, along with crime in the inner cities, and their kids are growing older. They learned from the mistakes of others and may now qualify for a low-rate mortgage. For many, the hustle and bustle of the inner city will lose its luster as their kids begin going to the local public school. Suburbia is back.

(Reprinted from the Journal of Wealth & Success, Vol. 4, Issue 3, from a larger story on the current housing situation.)

(28 Mar 16) In the 1940s and 1950s a major demographic shift was occurring in the United States. In rural areas, which comprised the vast swath of the American landscape, farm life was the norm. For those living near big industrial cities, however, tenement living was typically the only option. Increased pay and a building boom changed all of that in the 1940s and ‘50s, however. Suddenly, home ownership became the American Dream. The concept of the modern mortgage gave ordinary workers the ability to raise their family in their own home.

Following the implosion of the mortgage industry in 2008, home ownership suddenly went out of vogue for millions of so-called Millennials—those born after 1980. They flocked to apartment complexes in droves, especially those located in urban areas. As rents become higher, however, this generation is reconsidering its stance on home ownership.

Their income is also rising, along with crime in the inner cities, and their kids are growing older. They learned from the mistakes of others and may now qualify for a low-rate mortgage. For many, the hustle and bustle of the inner city will lose its luster as their kids begin going to the local public school. Suburbia is back.

(Reprinted from the Journal of Wealth & Success, Vol. 4, Issue 3, from a larger story on the current housing situation.)

Home Building Surges in April

(21 May 15) US new home construction surged 20% in April, the largest percentage increase since 1991 and the highest reading of new starts since 2007.

As the markets enter their “worst six months,” historically, of the year, the housing news helped quell investor fears that the markets have far outpaced true economic activity and are due a pullback.

But what of the great shift away from home ownership and to apartment and condominium living? While the April figures did show a healthy growth rate in the construction of single-family homes (up 16.7%), the rapid pace of multifamily dwellings continued, rising 27.2%.

Is this really bad news, however, or a sign that Americans are becoming more adept at living within their means? For the past two generations, the typical American worker has counted their home as a big part of their overall financial portfolio; perhaps the shift into multifamily dwellings will also mean a spike in retirement savings. Time will tell.

Certainly, low interest rates have had an effect on new home construction and overall real estate activity, which is one of the reasons the Fed has continued to keep rates at historically low levels. One year ago, the average 30-year mortgage rate was floating around 4.3%—good by nearly any measure. Today, however, that rate has fallen to 3.85%, enticing more American families to make the plunge.

When rates inevitably go up, economists worry that the number of new mortgage apps will fall precipitously, with a ripple effect being felt throughout the economy. That is one reason we do not see the Fed pulling the trigger on rate hikes until late this year or early next.

According to real estate firm Zillow, the median home value has risen 3% over the past year, to $178,400. The firm is projecting another 2% rise in values over the next 12 months.

(Read what percentage of the typical American worker’s salary is used to pay the monthly mortgage bill in this Sunday’s Journal of Wealth & Success, Vol. 3, Issue 21.)

(21 May 15) US new home construction surged 20% in April, the largest percentage increase since 1991 and the highest reading of new starts since 2007.

As the markets enter their “worst six months,” historically, of the year, the housing news helped quell investor fears that the markets have far outpaced true economic activity and are due a pullback.

But what of the great shift away from home ownership and to apartment and condominium living? While the April figures did show a healthy growth rate in the construction of single-family homes (up 16.7%), the rapid pace of multifamily dwellings continued, rising 27.2%.

Is this really bad news, however, or a sign that Americans are becoming more adept at living within their means? For the past two generations, the typical American worker has counted their home as a big part of their overall financial portfolio; perhaps the shift into multifamily dwellings will also mean a spike in retirement savings. Time will tell.

Certainly, low interest rates have had an effect on new home construction and overall real estate activity, which is one of the reasons the Fed has continued to keep rates at historically low levels. One year ago, the average 30-year mortgage rate was floating around 4.3%—good by nearly any measure. Today, however, that rate has fallen to 3.85%, enticing more American families to make the plunge.

When rates inevitably go up, economists worry that the number of new mortgage apps will fall precipitously, with a ripple effect being felt throughout the economy. That is one reason we do not see the Fed pulling the trigger on rate hikes until late this year or early next.

According to real estate firm Zillow, the median home value has risen 3% over the past year, to $178,400. The firm is projecting another 2% rise in values over the next 12 months.

(Read what percentage of the typical American worker’s salary is used to pay the monthly mortgage bill in this Sunday’s Journal of Wealth & Success, Vol. 3, Issue 21.)

LGI Homes Exceeded our Price Target; we are Taking Profits in the Intrepid Trading Platform

(08 Sep 15) On 21 May of this year, 3 ½ months ago, we purchased LGI HomesLGIH for the Intrepid Trading Platform. The stock price of the company has risen 55.5% since purchase; we are taking our short-term profits and exiting the company.

LGIH is a maker of affordable homes, primarily in cities across the southwestern region of the United States.

Rents Continue to Rise as Vacancy Rates Shrink

(07 Jan 14) According to a report from real estate research firm Reis (REIS), landlords are pushing rents higher as apartment vacancy rates continue to fall. Nationwide, rental prices rose by nearly one percent per month in the last quarter of 2013, spiking the average price of an apartment to $1,083 per month.

As the credit crunch (and the over-extending of credit) forced millions from homes they could no longer afford, many families fled to apartment living, driving the national vacancy rate down from 9% in 2009 to just 4.1% today. Until recently, developers have been unwilling or unable to undertake massive new building programs, but with the economy on the mend the race is on to build hundreds of thousands of new units. In the fourth quarter alone, over 40,000 new units were completed across the nation--the highest pace in over a decade.

While the law of supply and demand will eventually make it tougher for landlords to hike prices, the rate at which the government is pumping new money into the economy means that inflation may take over where the landlord left off. On top of that, real estate experts do not expect rental increases to ever be reversed. One agent likened it to the United States Postal Service announcing a price cut in the cost of mailing a letter, or a state transportation department closing down a toll bridge.

There are a number of interesting factors at work putting pressure on the old adage of the American Dream. Many former homeowners who were burnt by the drop in real estate values simply do not want to go through that pain again. For others, the tightening credit standards will make it impossible (or at least a lot more difficult) to qualify for a home loan. Another factor is the aging of baby boomers. At a certain age, many "empty-nesters" are ready to give up the work and capital requirements needed to keep a house in good repair. Additionally, many new real estate developments incorporate apartments and condominiums into smartly-designed communities, complete with shopping and office space. The stigma of apartment living for the American family is largely dissipating. Unfortunately, rental rates are following a quite different path.

(08 Sep 15) On 21 May of this year, 3 ½ months ago, we purchased LGI HomesLGIH for the Intrepid Trading Platform. The stock price of the company has risen 55.5% since purchase; we are taking our short-term profits and exiting the company.

LGIH is a maker of affordable homes, primarily in cities across the southwestern region of the United States.

Rents Continue to Rise as Vacancy Rates Shrink

(07 Jan 14) According to a report from real estate research firm Reis (REIS), landlords are pushing rents higher as apartment vacancy rates continue to fall. Nationwide, rental prices rose by nearly one percent per month in the last quarter of 2013, spiking the average price of an apartment to $1,083 per month.

As the credit crunch (and the over-extending of credit) forced millions from homes they could no longer afford, many families fled to apartment living, driving the national vacancy rate down from 9% in 2009 to just 4.1% today. Until recently, developers have been unwilling or unable to undertake massive new building programs, but with the economy on the mend the race is on to build hundreds of thousands of new units. In the fourth quarter alone, over 40,000 new units were completed across the nation--the highest pace in over a decade.

While the law of supply and demand will eventually make it tougher for landlords to hike prices, the rate at which the government is pumping new money into the economy means that inflation may take over where the landlord left off. On top of that, real estate experts do not expect rental increases to ever be reversed. One agent likened it to the United States Postal Service announcing a price cut in the cost of mailing a letter, or a state transportation department closing down a toll bridge.

There are a number of interesting factors at work putting pressure on the old adage of the American Dream. Many former homeowners who were burnt by the drop in real estate values simply do not want to go through that pain again. For others, the tightening credit standards will make it impossible (or at least a lot more difficult) to qualify for a home loan. Another factor is the aging of baby boomers. At a certain age, many "empty-nesters" are ready to give up the work and capital requirements needed to keep a house in good repair. Additionally, many new real estate developments incorporate apartments and condominiums into smartly-designed communities, complete with shopping and office space. The stigma of apartment living for the American family is largely dissipating. Unfortunately, rental rates are following a quite different path.