Sovereign Debt & Global Fixed Income

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

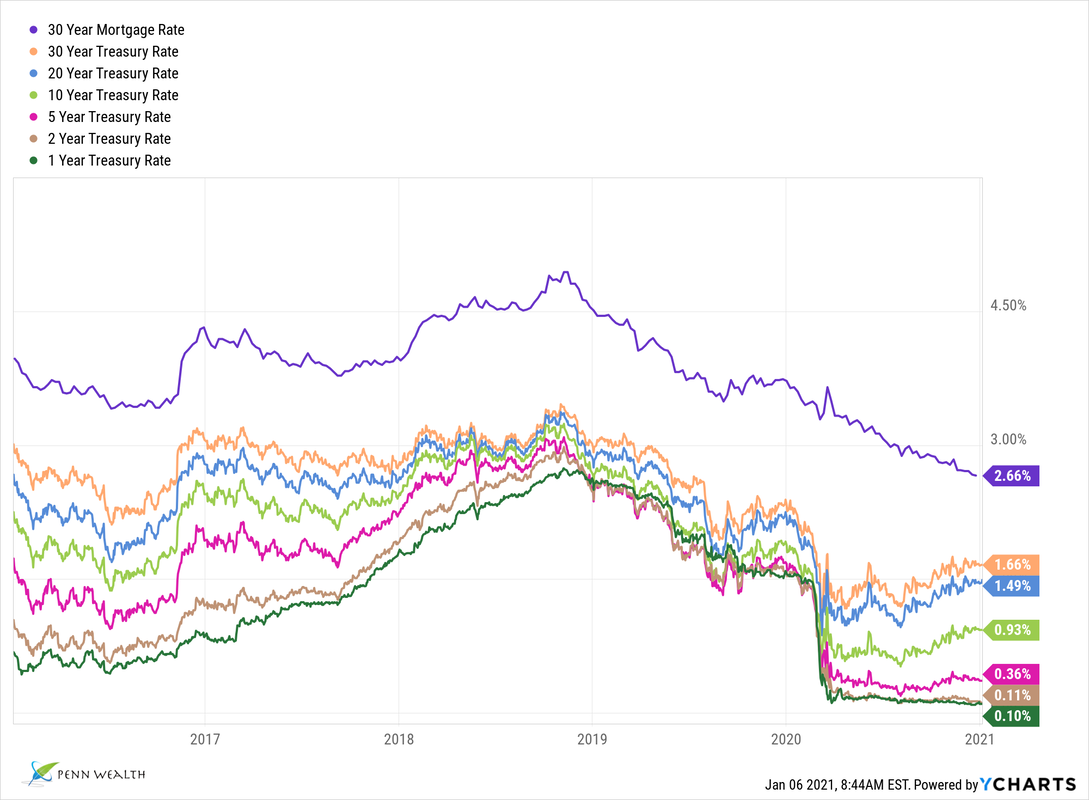

U.S. Interest Rates

|

Denmark

|

Danish banks offering home buyers a mortgage rate that is hard to pass up: 0.0%

(06 Jan 2021) From the country that first introduced the novel concept of negative interest rates comes a new gimmick: the zero percent mortgage loan. Beginning this week, customers of Nordea Bank can get 20-year home loans at 0.0%, and other banks in Denmark have signaled their willingness to follow suit. The country has a pass-through system in which mortgages are directly correlated with the bonds covering the loans. Denmark began issuing 20-year government bonds with a zero percent interest rate a few years ago; hence, the new mortgage loan creatures. For Danish borrowers, this may seem like a dream condition, but it is a symptom of a much bigger problem that few in Europe are willing to grapple with—a mountain of government debt which has become completely unmanageable. While the focus here is on Europe, the situation in the US is not much different. The dirty truth is this: Governments around the world have created so much debt that the central banks cannot afford to raise interest rates—they can barely pay the principal on their aggregate debt load, let alone any servicing costs. This problem will not simply go away, and when it ultimately comes to a head, the shock waves will be massive throughout the economic, fiscal, and political systems. |

|

Canada

|

Canada loses its triple-A rating on a key sovereign debt metric

(24 Jun 2020) Believe it or not, considering the country's $26 trillion (and growing) debt load, the United States still carries a triple-A debt rating by the major credit rating agencies. I recall the hubbub back in 2013 when Fitch put our credit rating on "negative watch," citing budget battles and debt level concerns. This week, Fitch did more than warn Canada about its own fiscal problems—it actually stripped the country of its AAA "long-term foreign currency issuer default rating," lowering it to AA+. The ratings agency cited big annual deficits and higher-than-expected post-Covid public debt levels. As a sign of the country's challenges, new manufacturing orders within Canada have fallen to the lowest levels since the 2008/09 financial meltdown. While lower ratings generally make it more expensive for a nation to finance its activities, one has to wonder if it will matter much with the ultra-low rates prevalent around the world; rates which probably won't go up for years. |

|

20-yr

T-bond |

Back to the 80s: Treasury is bringing back the 20-year bond this week

(20 May 2020) Back in January, we wrote that the Treasury Department would be issuing 20-year T bonds for the first time since 1986 to help fund the growing deficit. At the time, we anticipated the yield to investors would be somewhere between the 1.84% yield on the 10-year and the 2.29% yield on the 30-year. The big week has arrived: $20 billion worth of the the new debt went up for auction on Wednesday the 20th. The only factor that has changed since January is the yield. In exchange for your principal, you will earn around 1.15% each year for the next twenty years. Thanks to the pandemic, the federal deficit is projected to hit $3.4 trillion this fiscal year. The US government, like governments around the world, literally cannot afford to have interest rates rise. That should lead to an interesting situation when inflation begins to get out of control once again—which it inevitably will—and the Fed is forced to raise rates to control it. What an ugly corner we have been painted into. |

|

20-yr

T-bond |

For the first time since 1986, the US Treasury will issue 20-year bonds. (21 Jan 2020) Yet again, the government is facing a trillion dollar deficit—as in our collective US Representatives are going to spend $1 trillion more in a year than the government will take from taxpayers. Sadly, the answer is never to actually balance the budget. To pay for that cool trillion, the Treasury is about to do something it hasn't done since the mid-1980s—issue 20-year Treasury bonds to fund the deficit. There is some good news that comes with this decision: the Treasury Department squelched the idea it was floating of issuing 50-year bonds or even 100-year "century" bonds. They no doubt got the idea for the latter from countries in developed Europe who are already issuing these 100-year paperweights. The new bonds will start trading in May, with more details to be released on 05 Feb. As for the offered rate, we can obviously expect something between the current 10-year Treasury yield of 1.84%, and the current 30-year yield of 2.29%. If you're keeping tally, the Treasury issued $2.7 trillion worth of new debt in 2019, a figure that goes directly to the waistline of the $23 trillion national debt. We recently added TLT, the iShares 20+ Year Treasury Bond ETF, to the Strategic Income Portfolio. We feel relatively safe in stating that the Fed cannot afford to raise rates any time soon.

|

|

Riksbank

Sweden |

Sweden's central bank actually raises rates (to zero). (20 Dec 2019) The central bank which first introduced the warped, insane concept of negative interest rates, the oldest central bank in the world, is apparently done with the grand experiment. Five years ago, Sveriges (Sweden) Riksbank, founded in 1668, began charging commercial banks to hold deposits instead of paying them interest on the funds in a desperate effort to spur the economy. Starting out with a -0.10% rate in 2015, the nation's federal funds rate fell all the way to -0.50% a year later. But there has been growing concern by more reasonable minds that negative rates would have deleterious unintended consequences (you think?), such as creating "zombie companies" which would have otherwise met their natural demise. With essentially free money, these debt-laden companies could go even deeper in the red until that magical day in which they became profitable and paid back their debts. That's typically the way that scenario plays out, right? These concerns finally began to change some minds at the Riksbank, and on Thursday the national interest rate was raised from -0.25% to 0.00%. Riksbank Governor Stefan Ingves said the negative interest rate policy had worked well, and that the bank reserved the right to go below zero again. They might need to: by using all of their weapons, countries with zero-to-negative rates leave themselves relatively helpless should another major financial crisis hit. At the height of the craze, there was roughly $17 trillion worth of sovereign debt carrying negative yields. Little wonder that fixed income investors around the world have flocked to American debt—we now have a federal funds rate of 1.5% (lower channel).

|

|

JUCIX

|

Investors fleeing the "Bond King's" fund like rats from a sinking ship. (08 Aug 2018) A few months ago we reported on "Bond King" Bill Gross' disastrous week for his Janus Henderson Global Unconstrained Bond Fund (JUCIX). It seems investors got the message as well. The fund, which is now down just two bps shy of 7% for the year, cannot seem to staunch the bleeding from investors yanking their money out. As of right now, the global bond fund has roughly $1.325 billion in assets under management. That represents a $188.5 million net outflow in one month, and a $583.83 million net outflow—roughly half of AUM—year-to-date. In our opinion, Bill Gross was (and probably still is) one of the cockiest fund managers out there. We feel bad for the investors, but this kind of hubris nearly always ends with a thud.

|

|

Janus

Gross JUCIX |

While other fixed-income managers were having a banner week, Bill Gross's fund was plummeting

(31 May 2018) "Bill Gross is the undisputed 'Bond King.'" People sometimes ask me what I mean when I say the media deals in false narratives. That quote is a perfect, glittering example of precisely what I mean. Journalists repeat something so often, and in such a "well everyone knows..." manner that people just begin to accept it as fact. Truth is, PIMCO's co-founder, who was either fired from or abruptly quit the firm and bolted for Janus three years ago, was built up more by slick marketing than actual bond brilliance. Case in point: look at what just happened to his Janus Henderson Global Unconstrained Bond Fund (JUCIX) this week. Granted, bond fund managers are going through turbulent times. As rates rise, the value of their holdings (and, hence, their funds) generally drop, and vice versa. This past Tuesday, however, bond managers hit the jackpot, as concerns that Italy might leave the euro jumped, sending bond yields down and bond values up. Many bond funds saw their biggest one-day gain in nearly a decade. Not so for Gross's Unconstrained fund. It got pounded, dropping over 3% in one day. While neither Janus nor Gross would comment on the fall, some believe that Gross made a hefty bet that the spread between Italian bonds and German bonds would contract—the precise opposite of what happened Tuesday. The much-hyped Unconstrained Bond Fund is now down nearly 6% year-to-date, placing it in the bottom 1% of its category. The major takeaway for fixed income investors? Be extremely selective when choosing your bond funds, looking more at the macroeconomic environment and listening less to the hyperbole from the lemmings in the press. |

|

China

|

China gets a credit rating downgrade due to soaring debt levels

(21 Sep 2017) We always got a chuckle out of dunderheaded business journalists extrapolating out China’s 7% growth rate versus America’s 2%, and then telling us when China’s economic might would surpass that of America’s. What they fail to understand is that an emerging market economy worth its salt will almost always outperform an enormous, developed one. Furthermore, as the developing economy gets bigger, its GDP slows. We thought of those journalists when we read the Standard & Poor’s report outlining why the company downgraded China’s credit rating to A+ from AA-, thus aligning with Moody’s and Fitch Ratings, which had already issued downgrades. S&P cited China’s soaring debt levels as the primary driver for the downgrade. |

|

Portugal

|

Portuguese bonds pop after S&P upgrades the country's economy

(20 Sep 2017) Remember the acronym PIGS, coined by the Wall Street wizards of smart? It stood for the economic dogs of southern Europe: Portugal, Italy, Greece, and Spain. Well, it may be time to drop the “P,” as Portugal just received a lofty upgrade from Standard & Poor’s (though IGS doesn’t sound near as marketable—maybe they can add Finland and make it “FIGS”). The ratings agency upgraded Portugal back to “investment grade,” citing its improving economy and the steps taken by government officials to shore up the country’s fiscal house. S&P’s ratings jump for the country, from BB+ to BBB-, the lowest investment grade mark, widens the stable of possible investors for the country’s debt, as many major fixed income investors must follow strict quality guidelines. Following the upgrade, Portuguese government bonds spiked, with yields hitting ten-year lows. Greece remains the one “pig” yet to be upgraded by at least one of the three major ratings companies. |