National Debt & Deficit

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

Keep track of the Fed's balance sheet by clicking here.

For related congressional information, see Fiscal Policy

For related Fed information, see Monetary Policy

|

$1.7T Deficit

$33.66T National Debt 24 Oct 2023 |

In the Books: The US just dug itself another $1.7 trillion hole

It’s official: FY23 is behind us, and our government just spent $1.7 trillion more than it took in. That is the third-largest deficit in history, behind only fiscal years 2020 and 2021. Our national debt now sits at $33.66 trillion. We cringe every time we read a story (by the usual suspects) that debt and deficits don’t matter. They sure as hell matter to households trying to stay afloat and maintain a decent credit rating. It really is bordering on criminal; to spend trillions more than you take in from taxpayers each year. Let’s consider the cost of servicing that debt. Just as a household must pay finance charges on any credit card balance not paid off at the end of the statement period, the US government must pay finance charges on its $33.66 trillion of debt. The annual interest due on that debt is currently $671.3 billion, but that will only grow as debt matures and the Treasury is forced to refinance at higher rates. Put another way, a full 15% of the entire budget of the United States goes up in smoke as interest on the debt. Think of what could be done with an extra $671 billion per year. But that’s not the worst of it: Net interest payments on the national debt were $352 billion in 2021 and $475 billion in 2022. See a trend? While few seem to care about this economic disaster waiting to blow, the “bond vigilantes” are sounding the warning sirens by unloading Treasuries at a record clip, thus forcing yields higher. Simple supply and demand: If supply is rising while demand is falling, higher yields are required to entice would-be buyers. The vigilantes are demanding fiscal responsibility, but does anyone believe they will find it in D.C? A balanced budget amendment is needed to force politicians to act responsibly. And that will entail a grassroots movement, as we can’t think of one elected official calling for it. Right now, every state except Vermont (go figure) has some form of a balanced budget provision on the books; it is time to demand the same of our federal government. It is not hyperbole to say that there is a tipping point with respect to the national debt—an event horizon from which there is no coming back. |

|

$2.775T

Deficit $30.7T National Debt 23 Aug 2022 |

Your government spent $2.775 trillion more than it collected last year

If we talk about enormous sums of money too often the brain begins to accept them; or, at least, gloss over them. That is not good. We need to understand the fiscal irresponsibility of our elected officials to have any hope of changing their actions. So, instead of simply saying that this country is currently $30.7 trillion in debt, let’s try this fact: If each US taxpayer were directly responsible for their portion of America’s debt, we would owe $244,315 apiece. Want to add your kids and other non-taxpayers into the mix? In that case, every US citizen owes $92,272. Keeping in mind that 2020—not 2021—was the year we bore the brunt of the pandemic from an economic standpoint, consider how much the US government collected and spent last year. Revenue collected came in at $4.045 trillion. Last year the government spent $6.820 trillion. The difference, or deficit, is how much we grew the national debt last year: $2.775 trillion. At the risk of being redundant, our government spent $2.775 trillion more than it took in last year, in the midst of a rip-roaring economy. What is even more disgusting is that Social Security inflows and outflows are wantonly thrown into the mix rather than being physically separated, as they should have been from the start, from the general funds. Were your company to do that with your 401(k) plan, it would be a criminal act. Understandably, the largest deficit on record took place in 2020. There is no excuse, however, for 2021’s budget-busting numbers. And as interest rates rise, it is going to take a bigger and bigger portion of revenue to simply service the interest on the national debt each year. Right now, a “paltry” ten cents out of every dollar collected goes toward interest payments. Imagine ten cents out of every dollar you earn going towards the interest on your credit card debt! Madness. There are two ways this slow-moving (actually, not-so-slow-moving) train wreck can be avoided: the positive way via a balanced budget amendment and term limits added to the US Constitution, or the negative way through a fiscal meltdown. The fallout from the latter is hard to fathom. |

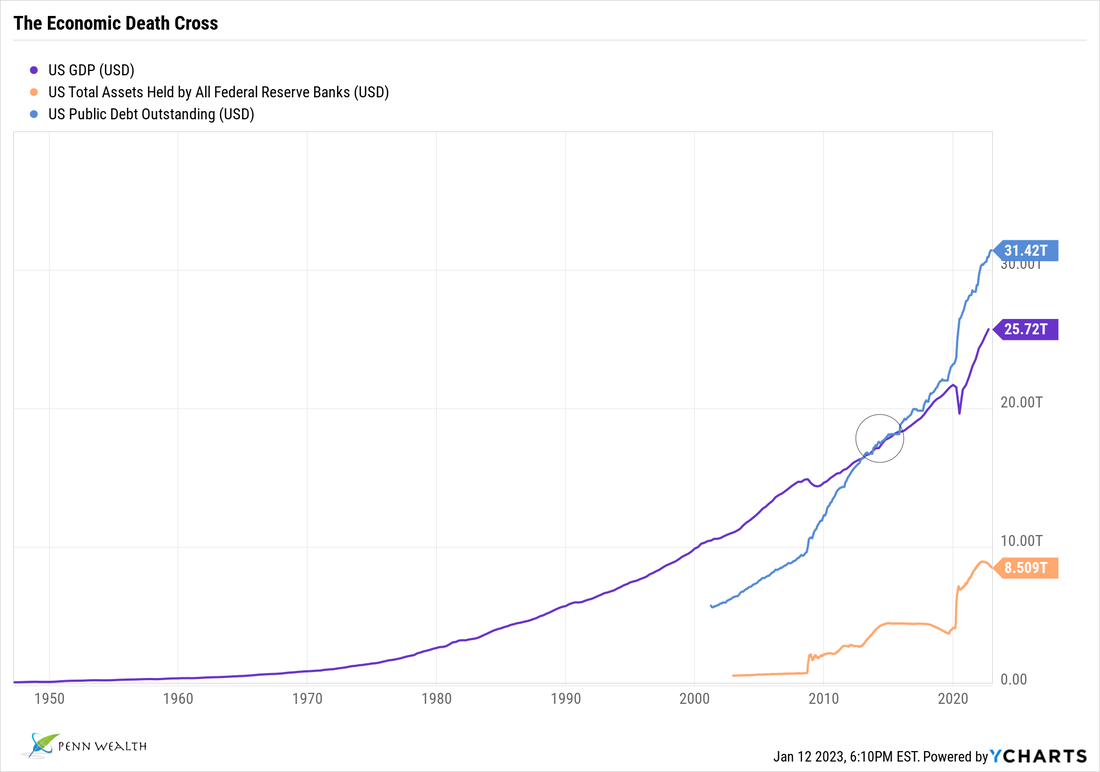

The national debt, Fed balance sheet, budget deficit, and GDP: a quick and dirty guide

(26 Jan 2022) When the terms national debt, budget deficit, Fed balance sheet, and GDP are thrown around, we suspect that many Americans' eyes tend to gloss over. However, just as every American family should know its financial position at any point in time, it is our duty to understand the basics of how the government is spending our money. Spoiler alert: it is not pretty. Let's start with the national debt, the most eye-popping of figures. As of right now, per USDebtClock.org, the United States is indebted to the tune of $30 trillion. We have been hearing a lot about the Fed's balance sheet lately, which currently adds up to just shy of $9 trillion. The "good news" is that this amount, which is a combination of mostly Treasuries and mortgage-backed securities, is included in the $30 trillion national debt. The Fed has already begun tapering its massive spending program, and aims to actually begin reducing that $9 trillion this year. Per a recent CNBC business survey, the general consensus is that the Fed should be able to reduce its balance sheet by $2.8 trillion over three years, which would bring the total down to roughly $6 trillion. Sadly, that is still well ahead of the $4.3 trillion on its books just prior to the pandemic.

So, this means that our federal debt should be reduced by $3 trillion as well, right? Not exactly. The government has estimated that it will receive $4.2 trillion in revenue in fiscal 2022. Unfortunately, the nonpartisan Congressional Budget Office predicts that, out of the $4.2 trillion in revenue, the government will actually spend approximately $6 trillion. This is fully legal, as there is no "balanced budget" amendment in the US Constitution. This means that, in one single year, the United States will have a budget deficit of $1.8 trillion, more that offsetting the Fed's planned balance sheet reduction. Of course, interest must be paid on any debt load ("servicing the debt"). A full 7.3% of all revenue collected by the US government, or some $305 billion, will be needed to service the national debt this year. And that is with historically-low interest rates. As interest rates rise, that 7.3% will grow, and grow, and grow.

Gross Domestic Product, or GDP, measures the total value of goods and services produced in a country in a single year. For the United States, that figure is sitting right at $23 trillion—far ahead of second place you-know-who, and certainly the envy of the world. The debt-to-GDP ratio is easily determined by dividing the amount of debt a country owes by the amount of its GDP in a given year. For historical perspective, America's debt-to-GDP ratio at the time of the Stock Market Crash of 1929 was 16%; upon entering World War II it was 44%; during the 1973 oil embargo it was 33%; and during the 9/11 attacks it was 55%. In 2012, something ominous happened; an economic "death cross," if you will. That is the year our national debt overtook—chronically and perennially—our GDP. Right now, America's debt-to-GDP ratio sits at 130%, and projections have that figure steadily rising over the coming years. For comparison, Venezuela's ratio is 214% and the United Kingdom's is 85%. China's debt-to-GDP ratio in 2021, according to the IMF, was roughly 70%. That country has responded by growing its spending by the weakest rate (0.3% y/y) in nearly two decades—a feat much more easily accomplished in a one-party communist dictatorship than in a representative republic.

And there we have it: a quick and dirty guide to federal debt, balance sheets, budget deficits, and GDP. Understanding these numbers and ratios is the first step in solving the problem. The next step is actually admitting that these numbers represent an unacceptable condition and will ultimately lead to an existential national threat. The third and fourth steps involve brainstorming for solutions and then implementing actions which will increase income and reduce expenditures. It is time to hold those in charge of the national credit cards accountable for their actions, and to demand more responsible behavior. But that would take yet another "stick" (in addition to a balanced budget amendment) in the form of mandatory term limits.

(26 Jan 2022) When the terms national debt, budget deficit, Fed balance sheet, and GDP are thrown around, we suspect that many Americans' eyes tend to gloss over. However, just as every American family should know its financial position at any point in time, it is our duty to understand the basics of how the government is spending our money. Spoiler alert: it is not pretty. Let's start with the national debt, the most eye-popping of figures. As of right now, per USDebtClock.org, the United States is indebted to the tune of $30 trillion. We have been hearing a lot about the Fed's balance sheet lately, which currently adds up to just shy of $9 trillion. The "good news" is that this amount, which is a combination of mostly Treasuries and mortgage-backed securities, is included in the $30 trillion national debt. The Fed has already begun tapering its massive spending program, and aims to actually begin reducing that $9 trillion this year. Per a recent CNBC business survey, the general consensus is that the Fed should be able to reduce its balance sheet by $2.8 trillion over three years, which would bring the total down to roughly $6 trillion. Sadly, that is still well ahead of the $4.3 trillion on its books just prior to the pandemic.

So, this means that our federal debt should be reduced by $3 trillion as well, right? Not exactly. The government has estimated that it will receive $4.2 trillion in revenue in fiscal 2022. Unfortunately, the nonpartisan Congressional Budget Office predicts that, out of the $4.2 trillion in revenue, the government will actually spend approximately $6 trillion. This is fully legal, as there is no "balanced budget" amendment in the US Constitution. This means that, in one single year, the United States will have a budget deficit of $1.8 trillion, more that offsetting the Fed's planned balance sheet reduction. Of course, interest must be paid on any debt load ("servicing the debt"). A full 7.3% of all revenue collected by the US government, or some $305 billion, will be needed to service the national debt this year. And that is with historically-low interest rates. As interest rates rise, that 7.3% will grow, and grow, and grow.

Gross Domestic Product, or GDP, measures the total value of goods and services produced in a country in a single year. For the United States, that figure is sitting right at $23 trillion—far ahead of second place you-know-who, and certainly the envy of the world. The debt-to-GDP ratio is easily determined by dividing the amount of debt a country owes by the amount of its GDP in a given year. For historical perspective, America's debt-to-GDP ratio at the time of the Stock Market Crash of 1929 was 16%; upon entering World War II it was 44%; during the 1973 oil embargo it was 33%; and during the 9/11 attacks it was 55%. In 2012, something ominous happened; an economic "death cross," if you will. That is the year our national debt overtook—chronically and perennially—our GDP. Right now, America's debt-to-GDP ratio sits at 130%, and projections have that figure steadily rising over the coming years. For comparison, Venezuela's ratio is 214% and the United Kingdom's is 85%. China's debt-to-GDP ratio in 2021, according to the IMF, was roughly 70%. That country has responded by growing its spending by the weakest rate (0.3% y/y) in nearly two decades—a feat much more easily accomplished in a one-party communist dictatorship than in a representative republic.

And there we have it: a quick and dirty guide to federal debt, balance sheets, budget deficits, and GDP. Understanding these numbers and ratios is the first step in solving the problem. The next step is actually admitting that these numbers represent an unacceptable condition and will ultimately lead to an existential national threat. The third and fourth steps involve brainstorming for solutions and then implementing actions which will increase income and reduce expenditures. It is time to hold those in charge of the national credit cards accountable for their actions, and to demand more responsible behavior. But that would take yet another "stick" (in addition to a balanced budget amendment) in the form of mandatory term limits.