Global Trade

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

Editor's

Corner |

Don't wave the American flag while watching your cargo ships roll in...

(18 May 2022) We have preached repeatedly about the irresponsible manner in which so many American companies became overly reliant on a communist nation with respect to trade; how executives became seduced by a massive population for the sale of their goods, and a dirt cheap labor force for the production of those goods. Distressingly, it took a global pandemic originating from that country for many of these companies to (finally) look at reducing their country risk. Still, the narrative these firms weave for public consumption is enough to make us choke. One major US retailer has a "Made in America" campaign running to proudly proclaim how the goods they sell are made in the US. They use a flower grower as an example. Try finding a flashlight or a can opener at this retailer made anywhere around the globe other than China. You won't. We are not xenophobes by any stretch, and we still support companies which source from factories in virtually any country outside of China, Russia, North Korea, or Iran. That being said, more can and should be produced domestically. Especially with the Fourth Industrial Revolution at our doorstep, with many American technology firms and universities leading the charge. What can we, as consumers, do to help the process along? We can get in the habit of checking where the goods we buy are actually produced, and providing feedback via direct contact and social media when we don't like what we see. |

|

US/

China |

Parity must be the US goal with respect to trade with China

(28 May 2021) The press keeps telling us that China is about to reach economic parity with the United States, so here's our question to the collective press: why are we importing over four times as much from China as we export to China? If the economies are of equal scale, shouldn't our trade deficit with the communist nation be relatively balanced? In reality, the United States has a $22 trillion economy compared to China's $15 trillion or so, meaning we could even accept a 50% differential in the transfer of goods; but 400%? Something doesn't smell right. In March, the most recent month on record, we exported $11.27 billion worth of goods to China and imported $48.21 billion worth of goods from China. While those figures are both depressing and outrageous, there is some good news: the US tariffs on Chinese goods are finally forcing US companies to look elsewhere for their purchases. One of the biggest beneficiaries in this shift has been Vietnam, which is now the eighth-largest exporter to the US, moving ahead of India. Vietnam, as we have noted in the past, is no friend to China, with the ongoing South China Sea dispute just the latest bone of contention between the two. The peak in our level of imports from China was $539 billion in 2018; as of the trailing twelve months (TTM) ended 31 March, that figure has dropped to $472 billion. A 12% drop doesn't sound like much, and the pandemic certainly skewed the results to some extent, but at least the needle is moving in the right direction. Fortunately, the Biden administration has shown little inclination toward removing the tariffs on Chinese goods, much to the consternation of the CPC. Americans must keep up the pressure on companies to persuade them to look elsewhere for the wholesale purchase of products and building of new plants. If that pressure continues, China's five-year plan to overtake the US economically will face a much larger hurdle—despite the cheerleading from much of the press. Technology is going to be, far and away, our greatest ally in the fight to curb Chinese imports. From 3D printing to vastly increased efficiency for manufacturing firms, technology is the great disruptor with respect to the balance of trade. Investors should keep a close eye on opportunities in the small- and mid-cap industrials space, those tech-heavy firms which almost always travel under the radar. We will continue to highlight individual names for readers. |

|

UK/

China |

The UK's pro-China trade policy is changing directions at a rapid clip*

(16 Apr 2020) The US has been at odds with the UK recently with respect to the latter's move to court Chinese trade in a post-Brexit world. The most recent dust-up came over Britain's decision to allow Chinese telecom giant Huawei to play a major role in the country's 5G rollout. Now, thanks to British anger over the Chinese coverup of the Covid-19 virus, UK lawmakers from all major parties are demanding that the trade relationship be reviewed. This comes on the heels of a number of African countries filing official complaints with the Chinese government over the way black migrants have been treated in the country since the outbreak. A McDonald's in the industrial city of Guangzhou had a sign on the door barring blacks from entering the restaurant in the wake of the virus. |

|

US/

China |

Making good on part of the phase one of trade deal, China halves tariffs on $75 billion worth of US products. (10 Feb 2020) Upholding its end of the bargain, China has announced that it will cut in half the tariffs imposed on $75 billion worth of US goods coming into the country—yet another de-escalation of the tensions caused by the trade war, and more welcome news for US manufacturers and investors. Over 1,700 goods are on the affected list, to include agricultural products, oil, and autos. While skeptics still question whether or nor the Chinese will live up to their promise to buy an additional $200 billion worth of US goods over the next two years, this reduction in tariffs is certainly a good sign. While the coronavirus is having a real impact on the Chinese economy, keep in mind that nearly half of that country's pigs have either died from African swine fever or been killed to staunch the outbreak. That sad tragedy means the country must import massive amounts of pork, much of which coming from the US. China has its hands full right now, fighting the coronavirus and political turmoil in Hong Kong and Taiwan. While the virus is a human tragedy, these internal challenges will keep them focused on limiting internal damage, meaning less time to saber-rattle against the US. We fully expect the $200 billion worth of US goods to be purchased, which will certainly help US GDP. Additionally, the USMCA will take effect 90 days after Canada ratifies the treaty, which will provide another shot in the arm to the US economy.

|

|

USMCA

|

An obstinate US Congress wasn't the last hurdle for USMCA—the Canadian Parliament holds that distinction. (29 Jan 2020) For all the concern we had about Mexico's new president, AMLO, taking office before any of the three participating countries had ratified the new North American trade agreement known as USMCA, his country's legislature was actually the first to get the job done. They did so in December, with AMLO's full support. That turned our concerns to DC, where the opposition to President Trump—at least among the majority in the House—is palpable. Somewhat remarkably, with their eyes laser-focused on impeachment, Congress actually ratified the treaty a few weeks ago. Somehow, Canada just seemed like an afterthought. However, while we still fully expect ratification by the Canadian Parliament, it won't be smooth sailing. While Prime Minister Justin Trudeau's Liberal Party of Canada holds a plurality of seats in the lower chamber, it will need to cobble together support from other parties. That shouldn't be a problem, as the Conservative Party of Canada has said it supports the deal. That leaves the upper chamber, which is controlled by the ISG, or Independent Senators Group. Many left-of-center MPs oppose virtually any free trade deal, while the Bloc Quebecois—who hold 32 of the 100 seats in the senate—oppose the deal on grounds it will hurt Quebec's dairy farmers. Ultimately, the deal will get ratified north of the border, but the question becomes one of timing. Opponents can drag the process out, calling witness after witness in an effort to stall passage. As the agreement won't take effect until 90 days after the last country ratifies it, we may be looking at late-year before its impact is felt. Every country is claiming they got the best deal in the USMCA, but it will provide a very real stimulus to the US economy. From forcing Mexico to raise its wages for autoworkers, to US dairy exports to Canada jumping by over 40%, the agreement is full of specific action items that will directly affect our GDP in a positive way.

|

|

US/

France |

Trump's threat to tax French wine and cheese forces Macron to back down on digital tax. (22 Jan 2020) Last year, France unilaterally imposed a 3% "digital tax" on revenue from tech companies with over $832 million (€750M) in global sales. That move was clearly aimed squarely at US tech giants like Google, Amazon, Facebook, and Apple. French President Macron was hoping the rest of the European Union would follow suit, but the confiscatory plan required a unanimous vote, and our friends in the smaller European countries voted against the plan. Then came President Donald Trump's retaliatory strike: the US would tax roughly $2.4 billion worth of French goods coming into the country; goods sitting at the heart of French pride, like cheese and wine. Suddenly, Macron has decided to "pause" the digital tax as long as the US puts its own tax on hold. A clear win for the US. Macron, along with a number of other world leaders, may still be playing the odds that President Trump will not be re-elected, at which time he (Macron) can re-implement the digital tax. That is a dangerous gambit, as Trump has a long memory when it comes to perceived or real personal affronts.

|

|

US/

EU |

After the World Trade Organization hands the US a win, more tariffs scheduled to be slapped on European goods. (03 Oct 2019) The WTO confirmed what the world has known for decades: the European Union has been illegally funneling government subsidies to Boeing (BA) competitor Airbus (EADSY $22-$31-$37). While the world may have already known it, the ruling physically authorizes the US to slap $7.5 billion in sanctions on the EU. As one could imagine in this climate, it didn't take long for the US to announce a 10% penalty on on Airbus-made aircraft and a 25% penalty on other products, such as French cheeses and Irish whiskies. For their part, Boeing wanted a 100% tariff slapped on aircraft coming from Europe, which would have been fully authorized by the WTO ruling. While the new tariffs are scheduled for implementation on the 18th of October, it should be noted that US and EU trade representatives are scheduled to meet four days ahead of this deadline, so there is a chance—albeit a slim one—that the two sides can work an agreement. Interestingly, the WTO will rule on an EU complaint regarding the US government's (alleged) special treatment of Boeing within the next several months, which could provide them with a tool to hit back at US tariffs. A deal should be hammered out with the EU immediately; but, then again, we are still waiting for the USMCA to be brought to the floor of the US House of Representatives for a vote, and that deal was signed by the leaders of the respective countries a year ago.

|

|

US/

France |

Amazon fires back against France's new "digital tax," hits sellers with the full cost. (19 Aug 2019) Last month we wrote about France's plan to place a 3% "digital tax" on big US companies, like Facebook (FB), Amazon (AMZN) and Alphabet (GOOGL), who do business in the country. We also said it will be a fascinating battle to watch unfold. To that end, Amazon has just made the first counterattack, passing along the entire 3% tax to the French businesses who use the company's platform to sell their goods. Thousands of French business owners began receiving emails recently announcing the fee increase, directly linking the new tax to the higher fees. Assuming the companies continue to do business in the Amazon marketplace, they must either eat the new charges or pass them along to consumers in the form of higher prices—precisely what opponents of the tax predicted would happen. The next chapter of the saga? The targeted US firms will testify on Capitol Hill as lawmakers mull retributions, and the US Trade Representative's Office has opened a probe into the tax, which could lead to new tariffs on French goods entering the country. Does anyone really believe the big tech companies will be the ones hurt by this wanton action? As evidenced by Amazon's actions, it will be the small business owners and consumers absorbing the pain.

|

|

US/

France |

Tax our tech and we'll tax your wine. (31 Jul 2019) If you think our politicians hate big tech, try going to Europe. Call it envy, but various EU government entities have had it out for the likes of Facebook (F), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL) for some time. If these American giants aren't in the midst of being slapped with new fines or made-up taxes, they are busy defending themselves against new charges coming from every direction of the continent. The latest example comes to us from our old friends, the French. Not only will that country begin levying a 3% "digital services" tax on big US tech companies (nearly all French companies are exempted based on the way the reg was written), they will make it retroactive to the start of 2019—showing that country's reckless abandon with respect to international business law. But this time, the US is fighting back. The Trump Administration is threatening France where it hurts: it is considering a tax on all French wine entering the country. How big a deal is that? The United States is the largest importer of French wine, accounting for nearly one-quarter of all bottles exported. The French, for their part, say the digital tax should be universally applied to big tech by all countries, but that they are happy to "go it alone" for now. That is a dangerous game, and one which will almost assuredly be met with a more onerous response. This will be a fascinating battle to watch unfold. Most French politicians have an arrogant disdain for Trump, but he holds a much bigger stick than do they. For its part, the US Trade Representative's Office (USTR) will hold a hearing on 19 Aug to delve into the tax and discuss countermeasures to offer the president.

|

|

US/

China |

As predicted, China issues a veiled threat to cut off supply of vital rare earth minerals. (29 May 2019) Last week, we re-ran a story from the summer of 2018 outlining how China has used its abundant supply of mined rare earth materials as a weapon against other nations in the past. Specifically, the communist country cut off the supply of critical materials to Japan in 2010 as part of a territorial dispute. These substances are used in a range of high-tech products, from electric car batteries to wind turbines to smartphones, and they most definitely have a national security component. Now, the country is issuing thinly-veiled threats that it may pull a similar tactic against the West as part of the ongoing trade dispute. It's not that there is a worldwide shortage of these materials outside of China; it is that China has allowed its mining companies free rein to pillage the land in an effort to extract the materials, while other nations have implemented environmental policies which prohibit unfettered mining. It really is that simple. Unfortunately, the West has held a myopic view of the issue despite the warning signs along the way, such as the 2010 action against Japan. We can no longer afford to maintain the illusion of safety—it is time to act. Here's what investors need to unearth: there will be companies which continue to keep their heads buried in the sand and rely on China to an untenable degree (for the sake of short-term profit), and there will be companies which adroitly diversify both their markets and their operations to the point that one non-domestic country cannot threaten their overall success. If you hear a company screaming like a stuck pig that tariffs are threatening their very existence, it is time to do a deeper dive into the strategic vision of that company.

|

|

US/

China |

If China plans to wait out the Trump Administration, it is playing a dangerous game. (13 May 2019) It is hard to say who might be affecting Xi's decision-making process, but a new strategy is beginning to crystallize: the Chinese president believes he can simply wait out President Trump's tenure and deal with the next US administration. He sees himself, after all, as president for life, and exalted ruler over the information seen by the Chinese people. He also, no doubt, reads Chinese translations of New York Times headlines. Xi needs to be careful, however, and think back to early 2017, when his American sources were assuring him that Trump would be impeached within six months. Now that the trade deal—which was all but a fait accompli just a week ago—has imploded, and the new wave of tariffs are set to take effect, the ball is in China's court. Actually, instead of a ball, picture the ACME bomb that always seemed to end up in Wile E. Coyote's hands. The United States imported a whopping $540 billion from China in 2018, but China allowed only $120 billion worth of US goods and services into the mainland last year—22% as much. Three pertinent facts: 1. the United States remains, by far, the largest purchaser of goods and services in the world; 2. China cannot play a game of tit-for-tat with respect to tariffs, it is simply a mathematical impossibility; 3. companies are migrating away from China and to places like Vietnam and India for the manufacture of their goods. Xi may get a warm, fuzzy feeling when he reads the NYT headlines, but The Grapes of Wrath, which portrayed a devastating picture of the American economy during the Great Depression, was one of Hitler's favorite movies—it gave him a false sense of security. Nobody knows who will be sworn in on 20 Jan 2021, but we do know that a lot of damage can be done to the Chinese economy between now and then sans a trade deal. The markets are in pullback mode due to the apparent breakdown in trade talks. We consider this an opportunity to buy on the dip. Consider overweighting small- and mid-caps which are US-centric, and take a look at exchange traded funds focused on the countries which stand to gain by China's bravado, such as Vietnam (no friend to China) and India.

|

|

The US has the least to lose from trade talks, and the most to gain

(02 Sep 2018) Don't believe the false narratives in the press: China cannot withstand a long trade battle with the US. (Members: Select the button to read the brief article in The Penn Wealth Report) |

|

US

China |

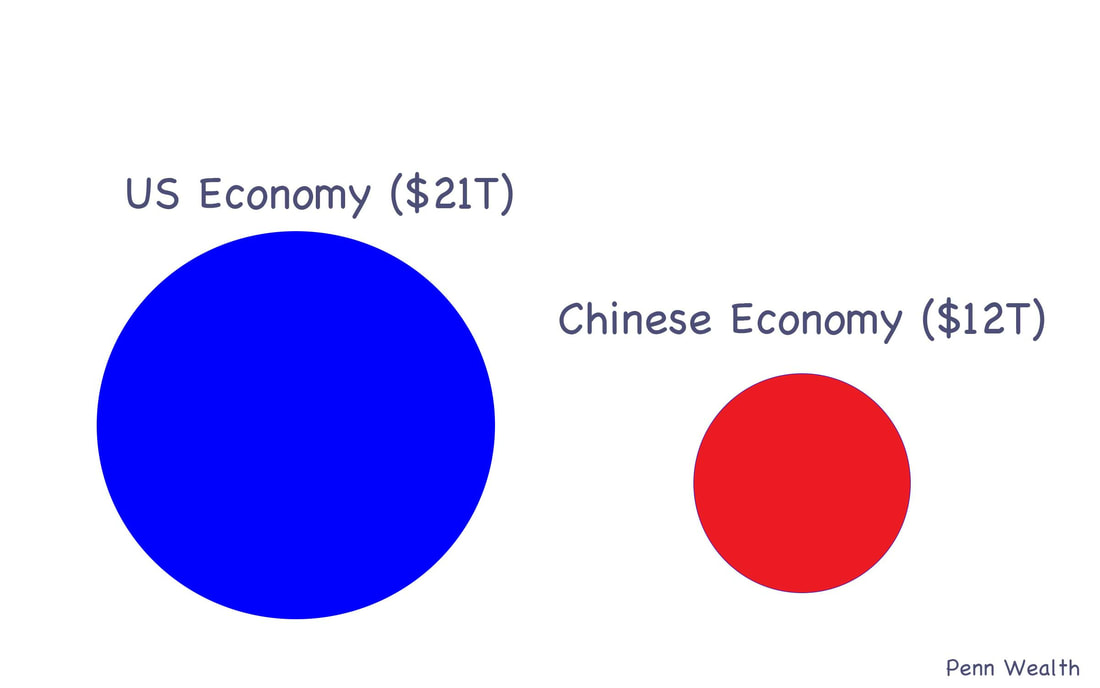

Markets have grossly overreacted to talk of new tariffs. (07 May 2019) The wild swings in the market—mainly to the downside—on Monday and Tuesday can be traced back, almost exclusively, to presidential tweets about new tariffs against Chinese goods being implemented by the end of the week. This understandably spooked investors, who have all but set a new US/China trade deal in stone. What few were reporting on Monday was that the tweets emanated from some critical components of the potential deal being walked back by top Chinese officials. These guarantees, many already in writing, swirled around the sensitive topic of Chinese theft of US intellectual property, or IP. While journalists jumped on rumors that the trade delegation might not even come to the US this Thursday as planned, within a day those rumors were quelled. Not only is the delegation still coming, it will be headed up by Liu Hu, the one person outside of Xi who can authorize a deal be struck. The $20 trillion US economy just notched another 3.2% annualized growth rate in the first quarter; the $12 trillion Chinese economy desperately needs access to the world's most lucrative market. The Chinese may have had cold feet about some of the promises they made, and were almost certainly rattled by US demands for ongoing verification, but they will do what they must to get the deal done. The state of the Chinese economy rides on it. Any market pullbacks in 2019 should be used by investors as an opportunity to scour industries for undervalued gems. When the dust settles on the year, it will look a lot more like 2017 than 2018.

|

|

EU

China |

In a refreshing twist, EU's Juncker points his vitriol at China, not the US. (01 Apr 2019) We have virtually no respect for the clowns running the European Union from Brussels, but every now and again one of them does something which shows a modicum of intelligence. European Commissioner Jean-Claude Juncker, who typically opens his mouth before his brain engages, actually decided to bash China's restrictive trade policies, aiming his vitriol in the right direction for once. After a March meeting with Chinese President Xi Jinping, Juncker excoriated China for its unfair trade practices, stating that the situation—of Europe being open to Chinese business but not vice versa—has to change before real progress can be made. He also condemned China's iron-fisted reaction to any criticism of that country's human rights violations. The entire free world is acutely aware of China's long-running abuses of trade policy; it took the United States to finally stand up and say enough is enough. But don't wait for Juncker to give the US credit for any easing of China's trade practices.

|

|

USMCA

|

Another trade deal done, and this one was huge. (02 Oct 2018) The lousy, 24-year-old NAFTA deal is dead. Long live the US-Mexico-Canada Agreement, or USMCA. While the limited trade agreement reached with the EU a few months back was good, and the US-Korea Free Trade Agreement (KORUS) was better, the new North American deal is huge. It ends the bickering between the three nations with respect to trade, helps America's manufacturing base, and puts the entire continent on better footing with respect to world trade. It also helped the US garner two new allies on the united front against China's unfair trade practices. The stock market agreed, with the Dow jumping a few hundred points after the deal was inked. While legislators in all three nations must still approve the USMCA deal, there is little chance that any will shirk their duties, as that would mean an enormous setback in free trade. While the Democrats might well win the House this November, and they would love to deal a blow to President Trump, we don't believe their constituents would let them pull off something so audacious as killing this trade deal. Their radical fringe would love it, but there are still too many blue collar voters and unions aligned with the party to let that happen, except in the most unhinged districts. Next stops on the trade train: a deal with Japan and a more extensive deal with the unruly and petulant EU, led by the likes of Trump-hater Angela Merkel.

|

|

NAFTA

|

US/Mexico trade pact is a big deal; Canada will feel the heat to join the party. (27 Aug 2018) So much for the joint effort against Donald Trump: Mexico just proved that bilateral agreements can be reached. Markets were up, and up big, after President Trump and Mexican President Enrique Pena Nieto held a joint news conference—with the latter on speakerphone—from the Oval Office to announce that the US and Mexico had reached a trade agreement. While the Mexican president still referred to the deal as being part of NAFTA, President Trump called for renaming the pact, due to its negative connotation. Canada is trying to put on a brave face, but this bilateral agreement puts the onus on the Trudeau government to join the party. The Mexican peso was stronger after the deal was announced (as could be expected), but so was the Canadian dollar—implying that Canada will now be more willing to strike a deal.

|

|

NAFTA

|

Hogs, corn, and a railroad jump following news of US/Mexico trade deal. (27 Aug 2018) While the general markets were rallying on news of a US/Mexico trade deal, certain segments did better than others. Kansas City Southern (KSU $99-$118-$119), the "NAFTA" railroad, spiked 4% on the news, while hog and corn prices rose because Mexico is one of the largest importers of American corn and pork. As for Kansas City Southern, the railroad operates a commercial corridor of the Mexican rail system with direct passage between Texas and Mexico City. By far, KSU is the major railroad most affected by North American trade, as it operates primarily on a north/south rail network.

|

|

China

|

They just couldn't help themselves: Chinese bragging and propaganda tactics have hurt them in trade talks with the US. (09 Aug 2018) Apparently, the only people who don't know that communist regimes always use hyperbole to inflate their strengths are the citizens of the particular country in question, and the dolts in the US media. For years, journalists have been telling us that China will soon eclipse the US as the world's top economic power. Yet, as of right now, the US has a nearly $20 trillion economy, while China's sits at $12 trillion. Whatever the government-controlled media in China spew, US journalists lap up like thirsty animals. Here's the problem with this strategy: eventually, the facts simply crack the template (remember Khruschev's famous "we will bury you!" screech at the UN?). China has taken a firm stance against the US on the issue of trade, promising "tit-for-tat" tariffs. As we have pointed out, this is a physical impossibility due to the imbalance of trade. Since US negotiators haven't blinked, the truth is coming home to roost, as evidenced by plummeting Chinese stocks and economic troubles on the mainland. Now, several high-level officials in Beijing are in hot water for "forcing" the US to take a tough stance to counter China's 2025 world domination initiative. They should have remembered Deng Xioping's advice to keep a low profile while they slowly boil the frog that is the US. One also has to wonder how much Xi Jinping has been believing the false narratives generated by the US press corps. Unwittingly, these journalists may have helped subvert the Chinese position. Wouldn't that be sweet irony.

|

One of our favorite global strategists sees a "cease fire" in trade war before mid-terms. (19 Jul 2018) Any time we see David Kelly—J.P. Morgan's chief global strategist—on one of the business networks, we unmute the television and play close attention. He is one of those straight-shooters who never lets politics shape his comments (unlike way too many "experts"), but simply lays out the facts in a cogent manner. We have noted that, in hindsight, he is almost alway right in his analysis. Getting grilled on trade matters while on CNBC, Kelly made the case for a cease-fire in the trade war this summer or fall. He argues that Republicans have no desire going into the mid-term elections with this issue on voters' minds, or hitting domestic companies' pocketbooks. He also sees 5% real GDP growth coming out of the second quarter, and a 27% overall spike in corporate earnings in Q3 over the same quarter last year. Both of these metrics, he argues, would be hurt by ongoing trade disputes. China, meanwhile, responded to Chief Economic Advisor Larry Kudlow's claim during a CNBC Delivering Alpha interview that Xi Jinping has absolutely no interest in "following through" on his promises to help curb intellectual property theft. (We completely agree—he doesn't.) A Chinese government spokesman claimed the comments "distorted the facts and made bogus accusations (which were) shocking and beyond imagination." A bit melodramatic. Sadly, we expect a great percentage of journalists would side with the hyperbolic comments of the Chinese official.

|

EU

GOOG |

For the second time in two years, the EU hits Google with massive fine. (18 Jul 2018) It helps to put large numbers in perspective. For example, most people cannot really wrap their minds around the $21.2 trillion US national debt figure; it is simply too big. So, with this new case of the European Union versus Google (GOOG $903-$1,197-$1,205), let's try this visual: the EU just fined Google an amount roughly equal to the market cap of Goodyear Tire. $5 billion. The press is trying to mitigate the ridiculous fine amount by pointing out that Google is an $842 billion company, so they could easily absorb the cost. That is ludicrous, and Google must fight the EU to the bitter end. At the heart of the EU's antitrust case is the Android mobile operating system and its dominance in the space. Chronic troublemaker Margrethe Vestager, the European competition commissioner, claims that Google forces smartphone makers to pre-install apps such as search engine Google Chrome on their devices before they are sold because these apps come in a bundle with the company's app store, Play. The company has countered that this in no way stops users from choosing other search engines. It should be noted that Apple (AAPL) does the same thing—it pre-installs a number of its apps on each iPhone produced. Google will vigorously fight the astronomical fine, but the EU has given the company only 90 days to come up with the dough—or face a daily penalty of 5% of average daily worldwide revenue! Extortion to the largest degree. Europe is such a beautiful continent; it is so bad that they have embraced, unwittingly, a socialist government structure which answers to no one. Perhaps that is why Britons chose to leave the Union. Last year, by the way, Vestager hit Google with a $2.7 billion fine which the company is still appealing.

|

|

China

|

China ends anti-dumping probe into US sorghum imports

(18 May 2018) In what could possibly be a hopeful sign for trade negotiations currently going on between the United States and China, the latter has decided to drop its anti-dumping probe into sorghum imports from the US. In a clear act of retribution, China had imposed a nearly 200% "deposit" on the imports last month. China imported nearly $1 billion of sorghum from the US last year, but has increasingly been turning to Russian sorghum as the trade battle heats up. Despite the rhetoric coming from the Communist Chinese government, we continue to reiterate that China will be the biggest loser in a trade war. For anyone who doubts that, simply look at the (im)balance of trade between the two nations. Furthermore, as the Indian economy continues to build steam, the US will have an increasingly-viable alternative to the Chinese goods entering this country. |

|

China

|

What the press refuses to acknowledge: America's bat is a lot bigger than China's

(04 Apr 2018) China is threatening to "use the same level of force" to hit back at the United States if the proposed tariffs on roughly $60 billion of Chinese goods actually go through, and the press has been making the most of that threat. It reminds me of a political cartoon I saw in the Kansas City Star back in the 1980s. The cartoon depicted a fella sitting on a bus reading a paper with the headline: "Terrorists bomb, kidnap, and kill innocent civilians—US to strike back." He responds to the headline by ruminating, "But won't that just make them mad?" Here's the simple fact: China does not have the power to "use the same level of force," because China's bat is seventy-five percent smaller. It is simple mathematics. In 2016, the US allowed $462.6 billion worth of Chinese goods to be imported into the country. On the flip side, China allowed only $115.6 billion worth of US goods into their country. On top of that extremely skewed equation, add the government-enforced intellectual property theft from US companies, and the issue becomes burning-hot. So let the US swing their bat, and let the communist Chinese swing theirs, and let's see which has more force. Fortunately, the Chinese government understands this equation, and it will never let an all-out trade war occur. Sadly, the dupes in the media not only don't report this, the don't get it. |

|

South

Korea |

Tariff victory number one: US and South Korea revise trade deal

(28 Mar 2018) The US has notched its first measurable victory with respect to the steel and aluminum tariffs, which were clearly meant to be a bargaining tool. South Korea has agreed to double the number of cars US automakers can export to the East Asian country without meeting the highly political "local safety standards" typically imposed on imported vehicles. South Korea also agreed to place a cap of 2.7 million tons per year on the steel it exports to the US. As for the balance of trade between the two countries, the US had a $23 billion trade deficit with South Korea in 2016; that fell to $18 billion last year—a 22% drop. |

|

Tariffs

|

Euro-fight: Germany wants to deal with US on tariffs, France does not

(28 Mar 2018) President Trump's steel and aluminum tariffs, which are currently on a moratorium, are causing a rift between the European Union's two biggest members. Right now, the EU slaps a 10% tariff on American cars entering the zone. The US places just a 2.5% tariff on European cars coming to America. When you think of how many German cars enter the US market versus French autos (do they even make real cars?), it is easy to understand the rift. While Germany's Merkel is talking with auto manufacturers on how they would feel about a reduction in the onerous 10% import tax, France believes no concessions should be made to the US. The bloc is fighting against the clock: the moratorium on steel and aluminum tariffs is set to end on 30 April. |

|

EU

GOOG |

EU slaps Google with record fine over its search engine dominance

(27 Jun 2017) The European Union’s antitrust chief, Margrethe Vestager, says the $2.72 billion fine the body levied against Alphabet (GOOG) subsidiary Google is a simple case of fairness. In reality, it is a case of an envious EU trying to punish successful US tech companies who are light years ahead of their European counterparts. To further prove this case simply look back to last year’s $14.5 billion fine against Apple (AAPL), which an EU official admitted was nothing but political payback, or the $1 billion EU fine against Intel (INTC) back in 2009 for “abusing its market position.” The issue with respect to Google, ostensibly, is the search engine’s ability to steer search results toward companies which reward Google and away from resources which do not provide a source of revenue to the firm. Comparison shopping engines (CSEs) like the one used by Google do not offer the merchandise themselves; rather, the company will often earn a commission when users follow the links from the results page and make a purchase. Among the demands being made by the EU’s watchdog group, in addition to the extortion payment, is the promotion of rival comparison shopping engines like Germany’s Ciao!, the UK’s Kelkoo, and the Dutch site Beslist.nl. Under the ruling, if Google does not change its practices within 90 days and begin promoting competitive CSEs, it will face an ongoing fine of 5% of the company’s global annual revenue (Google had sales of $90 billion last year). That is one of the most ludicrous demands ever made, and ranks right up there with Jean-Claude Juncker’s threat to “break up the United States” for promoting Brexit. As for Alphabet, the company vehemently denies the charges but sees a very small window for successfully fighting the decision. In an 8-K filing with the SEC, the company “expects to accrue the fine in the second quarter of 2017.” The EU is at odds with President Trump’s trade policy and his stated goal of reducing America’s trade deficit with countries like Germany. This decision, if not a result of these threats, is an initial salvo in the coming global trade battle. Europe must be very careful, however: most big European companies need access to the US market to survive. (Reprinted from this coming Sunday's Penn Wealth Report, Vol. 5, Issue 02) |

Trump picks China hawk to head National Trade Council.

(22 Dec 2016) For a generation we have allowed an economy one half the size of our own to dictate trade rules. We have made perplexingly bad deals, and we have listened to a mainstream media tell us how we had better not upset the communist Chinese with respect to trade. Warped. That is about to come to an end. President-Elect Donald Trump has placed an incredibly smart China hawk, Peter Navarro, as the head of his newly formed White House National Trade Council. Navarro, a UC-Irvine professor, has outlined four of the most egregious trade violations committed by China: currency manipulation, intellectual property theft, sweatshop labor, and pollution havens." China can squeal all they want, but there is a new sheriff in town, and his gun is at least twice as big as theirs.

(22 Dec 2016) For a generation we have allowed an economy one half the size of our own to dictate trade rules. We have made perplexingly bad deals, and we have listened to a mainstream media tell us how we had better not upset the communist Chinese with respect to trade. Warped. That is about to come to an end. President-Elect Donald Trump has placed an incredibly smart China hawk, Peter Navarro, as the head of his newly formed White House National Trade Council. Navarro, a UC-Irvine professor, has outlined four of the most egregious trade violations committed by China: currency manipulation, intellectual property theft, sweatshop labor, and pollution havens." China can squeal all they want, but there is a new sheriff in town, and his gun is at least twice as big as theirs.