Metals & Mining

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

X $50

18 Dec 2023 |

Better Japan than China: Nippon Steel to acquire US Steel

It formed out of the merger between Carnegie Steel and Federal Steel 122 years ago, with James Pierpont Morgan structuring the deal. The company established its headquarters in the Empire State Building and remained a major tenant in the building for 75 years. It was, at one time, not only the largest steel producer in the world but also the largest company in the world—the first to reach one billion dollars in size. Alas, it resides in a hyper-competitive industry with plenty of lower-cost producers around the world, one of which will now own them. On Monday, US Steel (X $50) made the announcement that Japan's largest steel producer, Nippon Steel (NPSCY $7), will acquire the firm for $14.1 billion—$55 per share—in an all-cash deal. Nostalgia doesn't travel very far in the modern business environment, and we must face the fact that US Steel had dropped in position to the world's 24th-largest producer of flat-rolled steel and tubular products. In the US, there were about 82 million metric tons of steel produced last year, with X accounting for just one quarter of that amount (Nucor is the largest producer in the country). By contrast, suitor Nippon produced around 45 million tons last year, and a Chinese firm (what a shocker) led production with 132 million metric tons. This is an industry well-poised for contraction via mergers. Nippon has said that, post-merger, the company will retain its name, brand, and headquarters in Pittsburgh, and that it will keep in place all agreements forged with the United Steelworkers (USW) union. We wrote this past summer that the union not only demanded that all labor agreements be honored in any sale, but that it would have a say in who bought the firm (no, really). Despite this deal being twice the size of the $7 billion offered by US competitor Cleveland-Cliffs (CLF $20) in August, the USW doesn't seem happy about it. We imagine union lawyers have already placed calls to their good friend, Lena Khan, at the FTC, but we expect she will lose this fight in the courts should she try and nix the deal. Her legal record is a running joke in the business community. In the end, the deal gets done. Steel prices have been all over the place over the past few years, rising and falling like the price of lumber. If we had to make an investment in the industry right now it would be in Ryerson Holdings (RYI $32), a US-based services company that processes and distributes metals. The company has a foothold in several key areas, from oil and gas, to industrial equipment, to transportation. Better the dealer than the maker. |

|

X $31

CLF $15 YMTKF $32 24 Aug 23 |

US Steel wants to be acquired; the steelworkers union wants to select the winning bidder

Sadly, the US steelmaking industry isn’t what it used to be. Take US Steel (X $31), which was trading around $200 per share in 2008 and bottomed out at $7.21 per share less than a decade later. Competition has become so keen in the industry—China now accounts for nearly half of the world’s output—that the storied US manufacturer, founded in 1901 by a group of potentates including Andrew Carnegie and J.P. Morgan, is actively searching for suitors. This strategic review was fomented by multiple unsolicited bids, most notably Cleveland-Cliffs’ (CLF $15) $7.3 billion takeover offer; a proposal which was quickly rebuffed. All of this acquisition talk quickly drove up the share price of X from $22.50 to $32 in the matter of a week, but one other consideration needs to be factored in: the role of the United Steelworkers union (USW). Esmark, an industrial conglomerate which made an all-cash bid for US Steel at a higher offering price than CLF, has already pulled its offer, citing the union’s support for the original bidder. An agreement between the company and the union specifies that if the USW supports one specific bidder, another company’s offer cannot be accepted unless the board of directors deems it superior. Furthermore, the buyer must either assume the existing labor contract or forge a new deal with the union before a transaction can take place. Needless to say, US Steel disagrees with this wide interpretation of the rules. Yet another concern is the draconian FTC, headed by the anti-business activist Lina Khan. It is all but given that the agency would file lawsuits to stop a merger between two competing US steel companies—even if it meant a stronger hand against Chinese manufacturers. It appears that a deal will eventually get done, but the road ahead will be anything but smooth. Investors who see value in this beaten-down industry (X has a multiple of 6) need to remember just how much the bottom line is affected by commodity prices, higher energy costs, competition from China, and economic conditions. As for US Steel, it is trading at or above fair market value due to the bidding war—in other words, an ultimate sale has already been baked into the price. As for the competitors mentioned, we don’t see any undervalued gems begging for investors to pounce. If we had to hold a position in the industry, it would be Japanese small-cap producer Yamato Kogyo Co Ltd (YMTKF $32, P/E ratio 4.4), which has major markets in Japan, South Korea, and Thailand. Consider any investment in the industry higher risk. |

|

ALB $182

LTHM $22 SGML $34 25 Apr 2023 |

Chile’s radical leftist leader underscores the country risk involved with lithium miners

High-grade lithium is a critical component to the new generation of batteries which are “fueling” the EV movement, and we have outlined some of our favorite lithium miners in the recent past. However, Chile’s leftist president, Gabriel Boric, provides us a glaring reminder of the country risk involved with investing in this industry. Take Albemarle (ALB $182), the world’s largest lithium miner and an investor darling in the space. This North Carolina-based company (hence, Albemarle) has extensive operations in Chile in the form of salt brine deposits—the source of the mineral—and a major lithium conversion plant. Shares of the company plunged double digits last week after the Chilean leader unveiled plans to create a state-owned lithium company and take a majority stake in private mining companies. That sounds ominously similar to the language we heard out of Venezuela under Chavez and Maduro with respect to private oil operations. Albemarle’s CEO, Jerry Masters, tried to put a spin on the news, saying that existing mining operations wouldn’t be affected, and that the announcement presents an “opportunity to work with the administration” going forward. Yes, because leftist leaders make such great business partners. The company does have operations in Australia and the United States as well, but we see trouble brewing for their Chilean fields. While Australia is the leading lithium producer in the world, Chile holds the world’s largest known reserves of the mineral. Our favorite lithium miner is Livent Corp (LTHM $22), which was spun out of FMC in 2018. The company has major mining operations in Argentina as well as conversion plants in the US, Canada, and China. Investors should keep an eye on Tesla (TSLA $161), as we could see the EV leader purchasing a small-cap player in the space over the next year or two. Brazil-based Sigma Lithium (SGML $34) has been a rumored target, but it is more a speculative play. |

|

SGML $35

ALB $253 LAC $23 23 Feb 2023 |

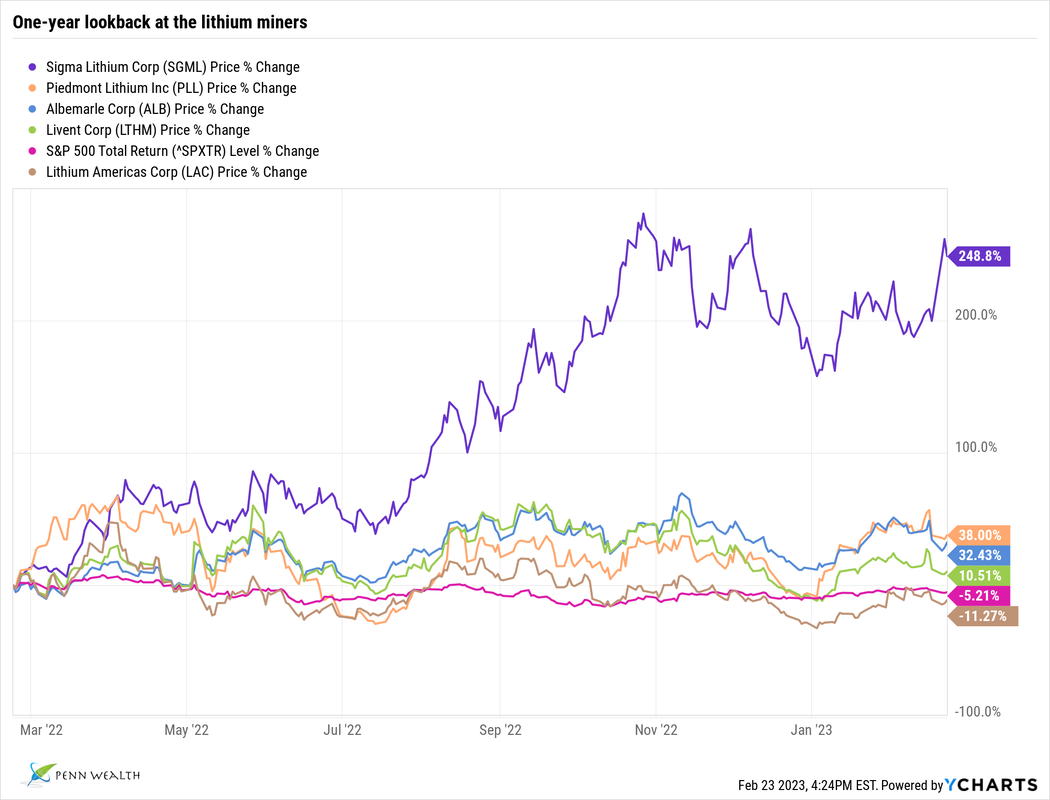

Two catalysts for lithium miners' recent volatility: Tesla and a Chinese battery company

In the mad dash to create more efficient batteries for electric vehicles, few elements, literally, are more important than high-grade lithium. Mining projects to produce this valuable element, however, are costly and can take years to get up and running. These factors should make current lithium miners extremely valuable; and, in fact, a look at the three year returns for the major players shows them far outpacing the performance of their respective benchmark indexes. But last Friday something odd happened: lithium miners got crushed, falling around 10% on average and leaving investors befuddled as to why. It turns out that two companies on different sides of the planet led to the drop. In China, the world’s largest EV battery maker, Contemporary Amperex Technology (aka CATL), pulled a fast one. Without warning, the company changed its pricing structure on batteries to a lithium-based model, which had the effect of greatly reducing the price it charges per unit. Since CATL produces its own lithium from company-owned mines, it has the ability to reduce profit margins on the input side to virtually nothing—a luxury most EV battery makers don’t have. With CATL’s actions in mind, it recently came to light that major US electric battery producer Tesla (TSLA $202) may be interested in acquiring mid-cap ($3.6B) miner Sigma Lithium Corp (SGML $35). This Vancouver-based company mines high-purity lithium from its enormous mining operation in Brazil. While the other miners were watching their shares plunge, SGML shares were busy spiking nearly 20%. While Tesla said that Sigma is but one of many options being considered, it clearly wants to control its own mining operation. For a company with a clear history of vertical integration, the move makes perfect sense. Close to the port city of Corpus Christi, Tesla is in the process of building its own lithium processing plant, scheduled to be up and running by next year. Investors are betting that a company-owned mining firm won’t be far behind. If it doesn’t turn out to be Sigma, however, look for those shares to plunge back to earth. Yes, Tesla shares have doubled in price since January 6th, but we still consider them a bargain. As for the miners, we prefer industry leader Albermarle (ALB $252, $35B market cap) and small-cap miner Lithium Americas Corp (LAC $23, $3.5B market cap). The latter is developing three new lithium production facilities—two in Argentina and one in Nevada—with the ultimate goal of splitting into two companies based on geography. The need to diversify away the risk of relying on China for critical elements and rare earth minerals has never been more evident, which should provide ample opportunity in the space for astute investors looking closer to home. |

|

NEM $44

|

Newmont Mining just had its worst day since 2008

(25 Jul 2022) Despite gold’s recent drop, we remain quite bullish on the precious metal going forward. If we are in some time-warped 1970s redux, keep this in mind: Gold entered the 1970s around $40 per ounce and exited the decade around $500 per ounce; over that same time period, the Dow Jones Industrial Average grew from 800 to 839 (5%)! While not quite as bullish on the gold miners (due to a host of threats, from rising costs to geopolitical trouble around many of the world’s mines), we did see opportunity among the most well-run players. On that note, we added Newmont Mining (NEM $44) to the Penn Global Leaders Club last year and it immediately began trading higher. Wishing to maintain our gains, we placed a stop on the shares. Fortunately, the stop price hit and the position was closed when Newmont shares dropped to a recent price of $60. Highlighting the importance of having protection in place on volatile holdings, the company just had its worst day since 2008, falling some 14% on the heels of the Q2 earnings release. While revenue remained steady YoY at $3.06 billion for the quarter, earnings per share (EPS) tumbled to $0.46 from $0.81 in the same quarter last year. Management reported a 23% increase in costs, to $932 per ounce mined. Furthermore, the company had an all-in sustaining cost of $1,150 per ounce due to inflationary pressures. While gold is off just over 5% thus far in 2022, Newmont finds itself down 27% year-to-date and nearly 50% below its April intraday high of $86.37. Our three favorite gold mining stocks are all presently getting crushed. In addition to Newmont, shares of Barrick Gold Corp (GOLD) have dropped from $26 to $15, while shares of Kinross Gold Corp (KGC) have plunged from $7 to $3. While we are not ready to touch any of them right now, they should all see a nice rebound as costs return to normal. Of course, we can only speculate as to when that might be. |

|

Peru

|

Outcome of Peruvian national election highlights the country risk associated with precious metals and mining stocks

(10 May 2021) Trying to root out socialism from Latin America is a monumental challenge at best, an exercise in futility at worst. For evidence of this, just look to Venezuela. Despite the nightmarish economic situation for Venezuelans (like five hours in line for a few rolls of toilet paper), Hugo Chavez wannabe Nicolas Maduro remains in power, despite having the personality of a single-ply square of...Venezuelan toilet paper. Heading further down the South American continent we have the Republic of Peru: a relative bastion of free trade in the region—at least up until this point. The rather shocking results of the national elections held earlier this month set up socialist candidate Pedro Castillo to coast into the presidency following a June runoff (he holds a 20-point lead over his opponent, the market-friendly Keiko Fujimori). Which leads us to mining companies in general, and Southern Copper (SCCO $72) specifically. Thanks to the global rebound, the outlook for metals—especially those with heavy industrial usage such as copper—is bright. Peru is the world's second-largest source of copper, and a majority of Southern Copper's mining operations reside within that country. While Castillo is trying to temper the harshness of his message leading into the runoff, his talk of nationalizing private companies operating inside the country has spooked investors. His party's platform, in fact, talks of "taking control" of the nation's natural resources. For $57 billion Souther Copper, which recently announced $8 billion in new Peruvian projects, there should be cause for concern. In fact, considering the remainder of their operations are in Mexico, which has been methodically moving left, there should be cause for extreme concern. We remain very bullish on both precious metals/minerals as well as those used for industrial purposes. In fact, if the new Peruvian government were to nationalize the miners (not beyond the realms of possibility), copper prices would shoot even higher than they already are. Great for commodity investors; not so much for those who took a chance on individual miners like Southern Copper. While we do own two gold miners in the Penn Global Leaders Club, it is a safer bet to own sector or thematic ETFs to take advantage of anticipated growth. A few worth looking at are the US Global GO Gold and Precious Metal Miners ETF (GOAU $20), and the SPDR Gold Shares ETF (GLD $165). We own the latter in the Penn Dynamic Growth Strategy as a satellite position, and the current price of gold $1,777) makes it an attractive opportunity right now—in our opinion. There are some excellent mining stocks in which to invest, and they are often in the small- to mid-cap sweet spot. However, investors need to perform their due diligence and understand exactly where the respective company's mines are located, and what the geopolitical risks are within that country or region. |

|

Gold

|

Positive vaccine news and calmer political waters have pushed gold prices down; time to look at adding to our position

(30 Nov 2020) We took a hefty position in gold, via the SPDR Gold Shares ETF (GLD $167), back in January of 2019 when the metal was sitting at $1,290 per ounce. After topping out around $2,067 per ounce this summer, prices began falling precipitously when positive Covid vaccine news began flowing in, and the US election was in the rear-view mirror. Scott Wren, now a senior analyst at Wells Fargo, was once our favorite analyst at A.G. Edwards & Sons, and we have tremendous respect for his typically spot-on outlook. When asked about the falling price of gold, he questioned—rhetorically—whether or not central banks around the world would continue to wantonly print money, or if fiscal constraint was suddenly going to supplant massive government spending. The obvious answer to those questions support his thesis that gold will regain its footing and head to $2,150 by the end of next year. He also sees another $100 drop in the price as a good entry point for more investment dollars. Right now, gold is sitting at $1,780 per share. The recent selloff in gold shows, in our opinion, that investors are playing the short game. The precise conditions that led to gold's rise over the past few years will still be in place post-pandemic. In fact, countries around the world are now about $15 trillion deeper in debt thanks to China and the virus which emanated from the country's shores. We remain very bullish on gold. |

|

Gold

|

Our gold investment continues to pay off, and we are not even thinking about taking profits. (06 Jan 2020) On 03 Jan 2019, almost precisely one year ago, we told readers that we were buying gold in the Penn Dynamic Growth Strategy via the SPDR® Gold Shares ETF (GLD $120-$148-$148). One year later and the precious metal, known for its ability to attract buyers during volatile environments, looks as good to us now as it did back then. Despite the fact that gold just hit its highest level since 2013 ($1,590.90 intraday), there are a number of reasons it still has room to run. First and foremost, geopolitical tensions are near the boiling point, and we see that continuing throughout the year. Secondly, fiscal irresponsibility continues to run rampant around the globe. Our own $23 trillion national debt, which grows by $1 trillion per year, is probably the envy of leaders in the EU, who just can't seem to spend enough. Right now, we are nearing in on ten cents out of every dollar the government collects going to servicing the national debt—the "interest" portion. And that is with incredibly-low interest rates. If inflation took off again and interest rates doubled around the world (not a far stretch, considering the $12 trillion worth of negative rate bonds out there), that would mean roughly one-fifth of what the government takes in would go to simply service the debt. Unsustainable. No, really: UNSUSTAINABLE. If the government is taking $2 trillion from us each year in taxes and other revenue, but spending $3 trillion each year via the budget, what happens when the economy contracts again? All more fodder in the bullish case for gold. It may seem like I am going off on a tangent here but I'm not: if three-quarters of the states affirmed two constitutional amendments—term limits and a balanced budget amendment—we could finally begin tackling the problem of our monstrous national debt (and gold might not be such an attractive investment). Here's the problem: two-thirds of both the House and the Senate must propose such amendments before they head out to the states. But, who is even talking about either of these amendments?

|

Washington State wants to stop Montana from exporting coal via its shores; is that legal? (09 Oct 2019) This will be a great judicial battle to watch. The United States produced about 755 million short tons of coal last year. Of that amount, Montana produced 45 million tons, placing it at the number seven spot of coal-producing states. As coal has become a dirty word in this country, states have turned to big consumers in Asia to buy their supply and, subsequently, fund their coal infrastructure and workforce. To get the coal from the supplier to the buyer, landlocked states must, obviously, transport the coal to coastal states via primarily rail, and then via cargo ships to their destination. Now, Washington State has a message to Montana: we don't want your coal, and we won't even allow you to ship it from our ports. Our immediate thought was that this is simply illegal, as it clearly goes against the Commerce Clause in the United States Constitution, which gives the federal government the right to regulate commerce through the various states. Hence the lawsuit.

Lighthouse Resources, the company trying to build a coal export terminal on the Columbia River—on a site that already allows coal exports, we might add—has been told by Washington State that it will not be given permission to do so. Citing the Commerce Clause, Lighthouse sued Governor Jay Inslee and two state regulators for the seemingly-illegal action. Not surprisingly, a partisan state appeals court upheld the decision, as would (we have no doubt) the comical 9th Circuit Court of Appeals in San Francisco—the most overturned court in the land. Montana is not the first state to have issues with Washington State. Two coal companies in Wyoming went bankrupt after similar antics were pulled in 2017 due to the inability to freely move their supply to the buyers. Eight states, in fact, have filed an amicus brief on the grounds of economic discrimination by coastal states over those which are landlocked.

This is a fascinating and historical case to watch; one which has the flavor of the 1830s rather than the 21st century. We can almost imagine Andrew Jackson sending troops to the shores of the Columbia River to assure safe passage of the cargo to the North Pacific. In the end, we see the Supreme Court of the United States ruling, by a 5-4 or 6-3 decision, in favor of Lighthouse Resources and the landlocked states. In the meantime, how many more coal companies will go belly up? Washington State is hoping that number is large.

Lighthouse Resources, the company trying to build a coal export terminal on the Columbia River—on a site that already allows coal exports, we might add—has been told by Washington State that it will not be given permission to do so. Citing the Commerce Clause, Lighthouse sued Governor Jay Inslee and two state regulators for the seemingly-illegal action. Not surprisingly, a partisan state appeals court upheld the decision, as would (we have no doubt) the comical 9th Circuit Court of Appeals in San Francisco—the most overturned court in the land. Montana is not the first state to have issues with Washington State. Two coal companies in Wyoming went bankrupt after similar antics were pulled in 2017 due to the inability to freely move their supply to the buyers. Eight states, in fact, have filed an amicus brief on the grounds of economic discrimination by coastal states over those which are landlocked.

This is a fascinating and historical case to watch; one which has the flavor of the 1830s rather than the 21st century. We can almost imagine Andrew Jackson sending troops to the shores of the Columbia River to assure safe passage of the cargo to the North Pacific. In the end, we see the Supreme Court of the United States ruling, by a 5-4 or 6-3 decision, in favor of Lighthouse Resources and the landlocked states. In the meantime, how many more coal companies will go belly up? Washington State is hoping that number is large.

Early in the year we bought gold; that precious metal just hit a six-year high. (28 Jun 2019) Despite all of the silly commercials on TV promising wild returns in gold, the precious metal traded precisely flat during the five year period between the beginning of 2014 and the end of 2018. Based on what we saw developing in 2019, both economically and geopolitically, we took a stake in gold, via the SPDR® Gold Shares ETF (GLD $111-$133-$136), on the first trading day of the year. What we saw developing has, in great measure, come to fruition, leading to gold prices hitting a six-year high this week. Gold futures currently sit at $1,420 per ounce, or roughly the highest level since May of 2013. The specter of the Fed lowering rates due to a softening economy, concerns over the trade war, and tensions with Iran have all helped to elevate gold prices, as investors look to shelter some of their money in an asset class considered to be a safer haven. We anticipate holding this investment as a satellite position within the Penn Dynamic Growth Strategy for the remainder of the year, at least.

|

NEM

GOLD GG |

Newmont Mining wants to buy rival Goldcorp for $10 billion. There's just one problem: Barrick wants to take out Newmont first. (26 Feb 2019) The deal would create the world's largest gold producer. And $19 billion Newmont Mining (NEM $29-$35-$42) was even willing to pay a nice premium for a competitor half its size, offering Goldcorp (GG $8-$11-$15) shareholders a $10 billion all-stock deal. It made a lot of sense: Goldcorp has a great growth story—operating large mines in Canada, Mexico, and South America—and it seemed amenable to a takeover. Then Barrick Gold (GOLD $10-$13-$14) felt the need to get in on the action, making a hostile bid for Newmont with an offer below fair value. It was a bizarre twist in an industry deserving of its own Netflix drama series. Barrick, for its part, actually had a smaller market cap than its prey until late last year when it bought South African gold miner Rangold for $6.5 billion. So much for digesting that kill before going on the hunt again. While Newmont has rejected the hostile bid, it's too early to know what will happen. Both miners have big operations virtually right next to each other in Nevada, so the synergies could be huge. In the end, Goldcorp shareholders might be the losers as the dance between the two bigger miners plays itself out. One reason we are following this story so closely, beyond the sheer intrigue, is our bullish call on gold this year. After five years of flat gold prices, a spike should equal a nice jump in revenues—and net income—at the top firms.

|

|

ARNC

|

Arconic melts down after announcing it is no longer up for sale. (23 Jan 2019) Admittedly, we lost interest in Alcoa (AA) after it spun its downstream aluminum products division off into a new publicly-traded company, Arconic (ARNC $16-$17-$31). Then we really lost interest when the former CEO of the combined entity, Klaus Kleinfeld, got canned from his role leading Arconic. Apparently, we are not the only ones who are now indifferent to the once-great aluminum-products maker. Arconic dropped 20% after management announced that the company was no longer looking for a suitor, with CEO John Plant indicating a dearth of interest by potential buyers. Somewhat ironically, the company's major challenge stems from the rising cost of aluminum—the raw product it was once able to provide itself. Down 43% over the past year, shares of ARNC are now trading right about where they were after the split from Alcoa back in November of 2016. The company probably should have taken Apollo's $11 billion offer, which would have made Arconic a private entity. While a global trade deal (and a subsequent end to tariffs) would help the firm's revenue, a global slowdown will present another major problem for the New York-based firm. For investors, this is a complete speculative play—if another buyer comes along, the shares could have a 30% upside.

|

|

NEM

GG |

Another huge gold mining merger brings more consolidation to the industry. (16 Jan 2019) Near the end of last year, we reported that Barrick Gold (now symbol GOLD) would acquire Randgold Resources in a $6 billion deal. Now comes news of an even bigger merger within the industry: gold producer Newmont Mining (NEM $29-$31-$42) announced plans to acquire Goldcorp (GG) in a $10 billion deal. This latest action will create the world's largest gold producer by output. Five years of stagnation in the price of the metal plus higher extraction costs have forced these companies to act. How bad has it been? Take a look at the one-year chart comparing gold prices to the performance of Barrick and Newmont: gold has remained essentially flat, while both companies' shares have been reduced by one-fifth. We like the deal. Another great lesson for investors: Just because gold prices rise doesn't mean your gold mining stocks will follow suit. Think about the location of some of the world's biggest mines and then consider the instability within the countries where they are located. Also, the operational challenges within the industry are enormous. While we don't currently own any gold mining companies in our portfolios, we did just buy Gold—the commodity—within the Penn Dynamic Growth Strategy as a satellite position.

|

|

ABX

GOLD |

Barrick Gold to buy Randgold, creating an $18 billion mining behemoth. (24 Sep 2018) The world's largest gold miner, Toronto-based Barrick Gold Corp (ABX $10-$11-$17), will acquire Randgold Resources Limited (GOLD $60-$68-$104), primarily a Sub-Saharan Africa miner, in a deal which will value the combined company at $18 billion. Under the terms of the deal, Randgold shareholders will receive just over six shares of Barrick for each share of GOLD they own. Barrick shareholders will then control two-thirds of the combined company, with CEO John Thornton becoming the executive chairman of the new entity. Considering that both of these companies have lost one-third of their market value over the past year, this was a good move. The synergies should allow the new entity to operate more efficiently; a critically important factor considering the recent drop in the price of gold. The market agreed—both companies rose about 7% on the news.

|

|

Japan's Massive Rare-Earth Discovery will Threaten China's Choke-Hold

(15 Jul 2018) The US imports 100% of its rare-earth needs for advanced electronics and equipment; China is responsible for an unacceptable 70% of that amount. This find is a game-changer. (See article in The Penn Wealth Report by clicking button to right) |

|

ARNC

|

Is floundering Arconic about to go private? Potential interest pushes stock up by double digits. (16 Jul 2018) We have written scathingly about Alcoa (AA) since the company spun off its downstream aluminum products division into a new company, Arconic (ARNC $16-$19-$31), and fired longtime CEO Klaus Kleinfeld (he technically resigned, but for all intents and purposes he was canned). Both of these events, we believe, severely damaged this formerly-great US company. So, what can make a floundering company spike double digits in one morning? A buyout rumor. Private equity firm Apollo Global Management is sitting on over $24 billion in cash it has raised from investors, and they are hungry for an acquisition. The purchase of $9 billion Arconic would be a relatively easy task for the buyout company. In the right hands, it can certainly return to profitability. What would really be funny to see is Apollo buy the firm, and then reinstate Klaus Kleinfeld as CEO. Sadly, that won't happen; Klaus is now working for Saudi Arabia's transformative leader, Crown Prince Mohammed bin Salman, and leading the effort to build an advanced new city (NEOM) along the Red Sea.

|

|

X

|

US Steel to re-open blast furnace B in Granite City, and workers are thrilled. "We have been in a trade war for 30 years." Those are not the words of President Trump (though he may have well said it); rather, they are the words of US Steel (X $20-$37-$48) CEO David Burritt to one of our favorite reporters, CNBC's Jackie DeAngelis, during her recent visit to the company's Granite City, Illinois plant. The company was forced to shutter its Granite City plant back in 2015, but it now plans to have both of the facility's blast furnaces back online by the end of the year, and workers are thrilled to be going back to work. Burritt estimates that 800 new jobs will be created by the action, and notes that the positive impact will ripple throughout the local economy. The US steel and aluminum industries have been pounded over the past decade by the dumping of both metals on the US market. US Steel topped out at $196 per share one decade ago.

|

|

BATT

LIT |

There's an ETF for that: battery fund launches. (07 Jun 2018) Admittedly, I love exchange-traded funds. Not only are they typically cheaper to own than open-ended mutual funds and trade intra-day (unlike mutual funds), odds are you can find one for that tiny little niche area of the market you are really interested in. Take the brand new Amplify Advanced Battery Metals and Materials ETF (BATT $20), which began trading this week. This actively-managed fund seeks out companies engaged in the business of mining, producing, developing, processing, and recycling advanced battery metals and materials, according to fund house Amplify. The investment could also fill your probable commodities void, as it provides exposure to lithium, cobalt, nickel, manganese, and graphite via the underlying mining stocks held in the fund. You probably won't recognize many of the 41 or so holdings in BATT (Katanga Mining, LTD is the top holding), but it will be fun to see how it does this year. Its closest competitor would be the Global X Lithium & Battery Tech ETF, symbol LIT, which is up 15% over the past year. Of course, as our disclaimers indicate, this is not a solicitation or a recommendation to buy BATT, and it is certainly a high-risk proposition, but it illustrates just how expansive the ETF market has become.

|

|

X

|

US Steel jumps 7% after US Department of Commerce ruling

(06 Dec 2017) The US Department of Commerce issued a preliminary ruling Wednesday that finds Chinese steel which is finished in Vietnam and then exported to the United States is, indeed, still considered to be Chinese steel. This means that these assets would be covered by US antidumping rules. There were two immediate affects from the ruling. First, US importers of cold-rolled and galvanized steel from Vietnam must make cash deposits which are equal to the duties on the books. Secondly, the decision caused shares of United States Steel (X $19-$32-$42) to spike over 7%. |

|

ARNC

AA |

Arconic falls over 8% as the metals company misses EPS estimates, announces new CEO

(23 Oct 2017) We have lost a lot of interest in the former conglomerate Alcoa (AA $20-$48-$49) since the company split into two and the second part of the equation, Arconic (ARNC $17-$25-$31), fired one of our favorite CEOs, Klaus Kleinfeld. Here's a simple way to look at what each company does: consider Alcoa upstream, and Arconic downstream. Alcoa focuses on the mining and smelting of aluminum, while Arconic creates the value-added aluminum products. The latter, Arconic, just reported a miss in earnings, and the stock immediately fell over 8% on Monday. While revenues were a bit higher than last year, earnings came in at $0.22 per share—versus expectations for $0.27 per share. The company also announced it has hired former GE executive Chip Blankenship as its new CEO. Each company, AA and ARNC, is now worth about $10 billion, and we wouldn't touch either with a roll of 110-foot long sheet aluminum. |

|

X

AKS CMC |

US steel companies spike on Kobe troubles, reduced Chinese exports

(16 Oct 2017) Several factors led to a rally in US steel stocks last week, with United States Steel (X $17-$27-$42) surging 9%, followed by AK Steel's (AKS $4-$6-$11) 7% jump. One factor was the greatly-reduced tonnage exported by China in recent months, as trade barriers placed on the commodity by the US, EU, and India take hold. Chinese steel exports have fallen by one-third over the past year. Another factor hit last week when Japanese steel giant Kobe Steel admitted to fudging its numbers. The company falsified data about the strength and durability of its steel and copper products used in the aerospace and transportation industries. Finally, the stocks got a bump on news that Commercial Metals (CMC $15-$21-$25) may be interested in buying the rebar unit of Brazil's Gerdau, an iron and steel conglomerate. |

|

ARNC

AA |

(17 Apr 2017) Arconic CEO loses final battle with hedge fund bully. Hedge fund manager Paul Singer, through his Elliott Management Corp, has been gunning for one of our favorite CEOs, Arconic's (ARNC $17-$27-$31) Klaus Kleinfeld, ever since the company spun-off from its parent company, Alcoa (AA $19-$31-$40), this past November. Singer finally got his way: Kleinfeld was forced out after sending a letter to Elliott without the board's permission. Singer claims the letter was "threatening," and the board used that action as an excuse to force Kleinfeld out. Please. The "threatening" letter was probably just Kleinfeld telling Singer to back off and let him do his job. Interesting that Singer did not release the letter for the public to see. We wouldn't touch Arconic.

(20 Apr 2017) UPDATE: OK, the letter was really bizarre. Here it is... Dear Mr Singer, In the last eighteen months, we have enjoyed the unique attention and unlimited pleasure of multiple exchanges with various representatives of yours in every such way remarkable firm. Unfortunately. we have not yet had the pleasure to meet. More than once have I been wondering what a special person the founder of such a firm must be. It was much to my delight when I recently learned from Berlin what a phenomenal soccer enthusiast you must be. Quite a few people who accompanied you in Berlin in 2006 during and especially after the many matches you attended are still full of colorful memories about this obviously remarkable time; it indeed seems to have the strong potential to become lastingly legendary. How you celebrated your soccer enthusiasm and the "great time" you must have had in your Berlin weeks - unforgettable without a doubt - left a deep impression on them. As a token of my appreciation to learn about this completely "other side" of you, I allow myself to send you a little souvenir, which might bring back some "vivid (hopefully positive) memories": The official match ball of the FIFA World Championships 2006 (called "Teamgeist", in English "Team spirit"). I would be honored if it found an adequate place on your memorabilia shelfs. Sincerely, Klaus Kleinfeld PS: If I manage to find a native American Indian's feather head-dress I will send this additional essential part of the memories. And by the way: "Singing in the rain" is indeed a wonderful classic — even though I have never tried to sing it in a fountain. |

It’s here! Q2 Earnings Season Launches with Alcoa Profit

(09 Jul 15) The much-anticipated second-quarter earnings season has finally arrived...woot woot! AlcoaAA got the party started Wednesday night with a slight increase in profit, despite the global aluminum glut. The firm, founded by Andrew Mellon in 1886, posted top-line revenues of $5.9 billion for the quarter, which filtered down to a bottom-line profit of $140 million.

The company’s strong aerospace and automotive sales made up for the price pressure put on the metal from Chinese dumping tactics. The raw price for aluminum has fallen 10% since the start of the year, and China’s exports of the metal are up 30% from last year. The US is the largest market for China’s aluminum exports, which compete directly with Alcoa’s products. Another case of free trade on our end and restrictive trade by the Chinese.

Alcoa, under the venerable leadership of CEO Klaus Kleinfeld, has done a good job at cutting costs in response to the Chinese dumping, to include shutting the doors on its Brazilian smelter. Additionally, the firm has benefited from the automakers’ demand for increased aluminum body parts in an effort to comply with fuel-efficiency standards.

At $10.59 per share (down from $40 in 2008), bargain hunters may be tempted to jump in. However, the Chinese are starting to panic about their economic situation, and certainly their stock market (though their spurious market doesn’t play much of a role in Chinese GDP). This means that the dumping of commodities on the world market will only increase, potentially driving the cost down further.

In real terms, we see the fair value of Alcoa at around $15 per share, but that does not mean it won’t go into single digits. We are holding off on purchasing the company, both for our Intrepid Trading Platform and our Global Leaders Club (it has been in both at different times in the past). There will be ample opportunity to pick up shares at a discounted price in the future, as the Chinese problem is not going away anytime soon.

(Reprinted from the Journal of Wealth & Success, Vol. 3, Issue 27.)

(OK, got it. Take me back to the Penn Wealth Hub!)

(09 Jul 15) The much-anticipated second-quarter earnings season has finally arrived...woot woot! AlcoaAA got the party started Wednesday night with a slight increase in profit, despite the global aluminum glut. The firm, founded by Andrew Mellon in 1886, posted top-line revenues of $5.9 billion for the quarter, which filtered down to a bottom-line profit of $140 million.

The company’s strong aerospace and automotive sales made up for the price pressure put on the metal from Chinese dumping tactics. The raw price for aluminum has fallen 10% since the start of the year, and China’s exports of the metal are up 30% from last year. The US is the largest market for China’s aluminum exports, which compete directly with Alcoa’s products. Another case of free trade on our end and restrictive trade by the Chinese.

Alcoa, under the venerable leadership of CEO Klaus Kleinfeld, has done a good job at cutting costs in response to the Chinese dumping, to include shutting the doors on its Brazilian smelter. Additionally, the firm has benefited from the automakers’ demand for increased aluminum body parts in an effort to comply with fuel-efficiency standards.

At $10.59 per share (down from $40 in 2008), bargain hunters may be tempted to jump in. However, the Chinese are starting to panic about their economic situation, and certainly their stock market (though their spurious market doesn’t play much of a role in Chinese GDP). This means that the dumping of commodities on the world market will only increase, potentially driving the cost down further.

In real terms, we see the fair value of Alcoa at around $15 per share, but that does not mean it won’t go into single digits. We are holding off on purchasing the company, both for our Intrepid Trading Platform and our Global Leaders Club (it has been in both at different times in the past). There will be ample opportunity to pick up shares at a discounted price in the future, as the Chinese problem is not going away anytime soon.

(Reprinted from the Journal of Wealth & Success, Vol. 3, Issue 27.)

(OK, got it. Take me back to the Penn Wealth Hub!)