Currencies & Forex

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

euro/dollar

€1.04 |

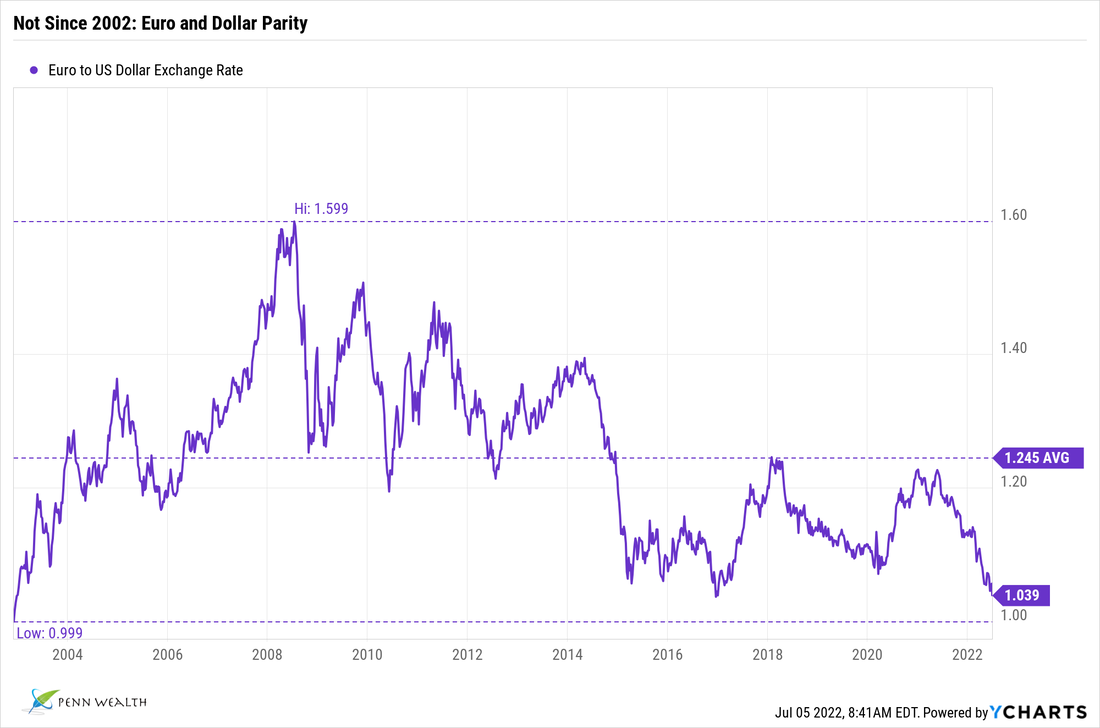

For the first time since 2002, the dollar is reaching parity with the euro

(06 Jul 2022) We always found it bizarre that certain politicians and leading economists would express a desire for a weak US dollar. Yes, our lopsided balance of trade can be aided by a weaker domestic currency, as it makes US goods cheaper for the world to buy, but the root causes of this condition are almost always troublesome. Furthermore, it harms the American consumer because their money doesn’t go as far. In essence, it is a signal that “our economy is weaker than yours.” Hardly bragging rights. For example, as the US was in the midst of the Financial Crisis of 2008/09, the euro, which was created in 1999, hit a high of €1.60 to one greenback. Many Europhiles have since predicted that parity would never be reached again. Lo and behold, the two currencies are now skirting near that level right now, with the euro hitting a two-decade low. This is due to the Fed’s willingness to raise rates until inflation is quelled, while the ECB begrudgingly signaled that it would finally raise rates by 25 basis points in July. The responsible actions on the part of the Fed add to the dollar’s strength, as global investors seek safe haven for their lowest-risk assets. While the US will probably have to battle a recession early next year, at least the Fed will have some fresh ammo; not so much the case in Europe, which is facing a deeper economic trough. US multinational corporations do like a weaker dollar, as it makes their goods cheaper for the world to buy. The best way for an investor to take advantage of a strengthening dollar is through a bullish dollar ETF, such as the Invesco DB US Dollar Bullish fund (UUP $28), or by adjusting their portfolio toward small-cap US companies, most of whom sell overwhelmingly to domestic customers. In this space we use the Invesco S&P SmallCap 600 Revenue ETF (RWJ $103), a value/core fund which owns top revenue-producing smaller US companies. |

|

dollar/yen

$135 |

Japanese yen falls to a 24-year low against the dollar

(22 Jun 2022) If you have been considering a Japanese getaway, now might be the time to book that trip. As of this week, one US dollar will buy 135 yen, up from slightly over 100 at the start of the year. Why does the world’s third-most-traded currency continue to plummet? Because the Bank of Japan’s governor, Haruhiko Kuroda, stands firmly by his commitment to maintain a -0.1% short-term interest rate while the rest of the developed world is raising rates to tamp down runaway inflation. Angering the Japanese public with his recent comments that consumers were becoming more tolerant of higher prices, nearly 60% of the country’s residents now find him unfit for the job. A weak currency due to an easy money policy means that goods and services cost a lot more for consumers within that country, and a lot cheaper for foreign visitors thanks to the generous exchange rate. Yes, a weak currency promotes stronger exports because the goods are less expensive for the world to buy, but the tradeoff can be brutal for the family budget. For a country which imports 94% of its energy, soaring prices and a weaker yen have most cheering the fact that Kuroda is in the final year of his second term as governor of the central bank. For investors, the yen’s weakness also makes the Japanese stock market look more attractive thanks to the currency disparity. One way to potentially take advantage of this weakness is through the WisdomTree Japan Hedged Equity Fund (DXJ $64), which is up 2.35% in value this year against the backdrop of an 18% decline in the MSCI All-Cap World Index, Ex-US. Some of the fund’s top holdings are Toyota Motor Corp, Nintendo, Mitsubishi, and Canon. |

|

pound sterling/

US dollar |

Pound sterling's most recent drop against the dollar exemplifies the emotionality of markets. (28 Aug 2019) Prime Minster Boris Johnson confirmed his plans to delay parliament's return from summer recess this fall, and the pound quickly fell to $1.22 against the US greenback—its weakest level since the mid-1980s. This amounted to currency traders saying "uh oh, this guy is serious about leaving the EU." Really? What gave it away. Boris Johnson has been clear that England is leaving the EU by 31 October, deal or no deal. There has been no waffling, no Theresa May shuffle, no hedging of bets. His fair warning that he intends to ask the queen to delay the end of summer recess for lawmakers makes perfect sense if you have been listening to this man. Perhaps we should give traders the benefit of the doubt and just assume they believe more ugliness will result in this full-on Brexit move, but hasn't the exit already been baked into the pound's weakness? We believe so. So, prepare for two months of ugly headlines of the dire straits (a great Deptford, UK band, by the way) England will find itself in come 01 Nov, and prepare to take action. If you believe the hype has been frothed up by the media and a certain group of British politicians (like we do), then two possible moves to take advantage of the false narratives would a purchase of EWU shares—the iShares MSCI UK ETF, currently at $29.91, and FXB—the Invesco CurrencyShares® British Pound Sterling ETF, currently at $119.14.

|

|

yuan/

dollar |

As if everyone didn't already know it: China has been officially labeled a currency manipulator. (07 Aug 2019) Under the framework of the Trade and Competitiveness Act of 1988, it is the duty of the US Department of Treasury to analyze the exchange rate policies of countries around the world to assure manipulation—to gain an unfair trade advantage—of a national currency is not taking place. To that end, and following the recent weakening of the Chinese yuan by the People's Bank of China (PBOC), Treasury has officially labeled the Chinese a currency manipulator. The weaker a country's currency, the cheaper their goods become for others around the world, making purchases more enticing. Right now, one US dollar will buy 7.02 Chinese yuan—the most since March of 2008, just before the huge market selloff due to the financial crisis. While countries are supposed to let their currency float freely, swayed by the market forces of supply and demand, the communist Chinese have openly stated they are willing to use the yuan's level as a weapon in their arsenal. Talk about admitting guilt. The next step for the United States is to bring the case before two bodies: the International Monetary Fund (IMF), and the World Trade Organization (WTO). While the IMF has little power other than confirming the manipulation claim, the WTO can authorize countries to place punitive tariffs in response to violations. But does that really matter? After all, President Trump has already announced a 10% tariff on the remaining $300 billion worth of goods coming from China as of the 1st of September. Here's an interesting take on China's yuan manipulation, highlighting the tenuous position they are in: If the new tariffs actually see the light of day, it will mean $30 billion in funds flowing to the Treasury Department. The big argument has been that this will be tantamount to a tax on US corporations and the American consumer—to the degree that each will pay for the added costs. However, the weaker China's yuan becomes, the less it will cost to import those goods, thus offsetting a good portion of that 10%.

|

|

pound/

dollar |

The British pound looks tempting as anti-Brexit fear-mongers drive its value down. Listening to the pundits, you would think that England is set to sink into the North Atlantic if the country blows out of the hapless EU this fall without a deal in place. That is precisely the kind of drivel we heard surrounding the actual Brexit vote back in 2016—if England leaves the sanctity of the Union, it was doomed. Of course, we now know that the dire predictions never came to pass (like the mass exodus of companies to mainland Europe), but that hasn't stopped the doomsayers from spewing their vacuous warnings all over again. All of this talk has had a detrimental effect on the jittery British pound, which has fallen against the US dollar to levels it really hasn't seen (with the exception of the period immediately following the Brexit vote) since the mid-'80s. One British pound will now fetch approximately 1.21 US dollars. Granted, that is still about 20% from the relative parity the pound reached with the dollar some 35 years ago, but expect it to weaken further as a no-deal Brexit becomes more likely. We heard one FOREX trader predict a trading range for the pound/US dollar of 1.10 to 1.40—the former if a "no-deal" exit takes place, and the latter if a deal gets done. FXB is the symbol for the Invesco CurrencyShares® British Pound Sterling Trust. This exchange-traded instrument has dropped nearly 30% over the past five years, and is entering an interesting trading range—which will probably get more favorable as we get closer to the current 31 October Brexit deadline.

|

|

Bitcoin

|

Bitcoin theft highlights the severe challenges of dealing in "non-physical" currencies. (08 May 2019) The value of one bitcoin peaked just before Christmas, 2017, just shy of $20,000. One year later, the same unit of digital currency was worth $3,200—an 85% drop. Beyond a shadow of a doubt, the greatest threat to this new currency is the ability of hackers to break into the exchanges and commit large-scale theft. The latest case-in-point came this Tuesday when Binance, one of the largest cryptocurrency exchanges, discovered that 7,000 bitcoins had been stolen from one wallet. While the company has promised to make good on the missing money, this is a condition which must be rectified before any large-scale adoption of cryptocurrencies will take place. To date, nearly $2 billion worth of cryptocurrencies have been reported stolen, and that doesn't count the massive number of hidden thefts not reported. Bitcoins currently trade at $5,839 per unit. For traders not afraid of risk, the Grayscale Bitcoin Trust (GBTC $7.81) is the easiest way to play the currency. But beware: GBTC was trading at $38.05 in December of 2017.

|

|

euro/

dollar |

For a snapshot of America versus Europe, economically speaking, simply look to the latter's two-year currency slide. (26 Apr 2019) For all of the blather coming from Brussels about rosy economic growth returning soon to the eurozone, it is important to stick to the facts. Here's one to try on: the euro just hit a fresh two-year low against the US dollar. That means that the US economy is getting stronger, while the EU economy continues to languish. Specifically, one euro will now buy just $1.12, and it seems to be heading closer to parity. Considering the fact that weak auto sales in Germany can be traced directly to fewer exports to China, the EU commissioners probably blame Trump's trade war for the problem. Additionally, they explicitly point to Brexit (damn Brexiteers) as a reason for the continent's economic woes. Perhaps one day they will look in the mirror as they search for solutions. Then again, probably not. We continue to underweight developed Europe. The first step to fixing a problem is to correctly identify its causes, and the clownish Jean-Claude Juncker and his troupe of buffoons aren't willing to do that—it is too easy to point fingers elsewhere.

|

Yes, China is weakening its currency, but there are several factors at play. (23 Jul 2018) The Trump Administration has leveled a charge that the Chinese government has been devaluing its currency, the yuan, in an effort to prop up its global exports in the face of real and proposed US sanctions. The weaker a country's currency gets, the cheaper its products become for other countries to import. While there is no doubt that the government has been purposefully devaluing the yuan, which is now worth about $0.15 on the dollar, a slowing of China's economy has also played a factor. Couple that with the roaring US economy and the Fed raising interest rates, and the yuan's slide makes more sense. As for China, a weak currency is a double-edged sword. A weak currency can help bring about inflation, and it hurts the buying power of a nation's citizens. It also presents a less attractive environment for investors, pushing them toward countries with stronger currencies e.g. away from the yuan and toward the US dollar. If Larry Kudlow is right, Xi Jinping has no interest in negotiating a more-balanced trade deal with the US. If he is relying on the forces of a weaker yuan to come to his rescue, he might just be surprised at how quickly those forces can be decimated—"leader for life" moniker or not.

Bitcoin plunges another 20% in early trading, now down 40% from high

(16 Jan 2018) Just about the time we began receiving increased call volume on bitcoin as an investment, the bottom dropped out of the digital currency. Peaking at $19,780 a few days before Christmas, the cryptocurrency was trading below $12,000 in early Tuesday trading—a 40% drop. So what's the most recent pin prick in the bitcoin bubble? Increased regulation by governments around the world, and an increasing belief that the currency is, indeed, a bubble waiting to burst. South Korea's government has considered banning all bitcoin trading, which would have a major impact on the market considering the country's citizens are responsible for about one-third of all bitcoin transactions. The vice chair of the People's Bank of China also issued warnings and hinted of a crackdown in an internal bank memo. How did the other cryptocurrencies deal with bitcoin's plunge? They traded down in sympathy. More evidence that the real gold mine in digital currencies revolves around the blockchain technology, not the invisible coins.

(16 Jan 2018) Just about the time we began receiving increased call volume on bitcoin as an investment, the bottom dropped out of the digital currency. Peaking at $19,780 a few days before Christmas, the cryptocurrency was trading below $12,000 in early Tuesday trading—a 40% drop. So what's the most recent pin prick in the bitcoin bubble? Increased regulation by governments around the world, and an increasing belief that the currency is, indeed, a bubble waiting to burst. South Korea's government has considered banning all bitcoin trading, which would have a major impact on the market considering the country's citizens are responsible for about one-third of all bitcoin transactions. The vice chair of the People's Bank of China also issued warnings and hinted of a crackdown in an internal bank memo. How did the other cryptocurrencies deal with bitcoin's plunge? They traded down in sympathy. More evidence that the real gold mine in digital currencies revolves around the blockchain technology, not the invisible coins.

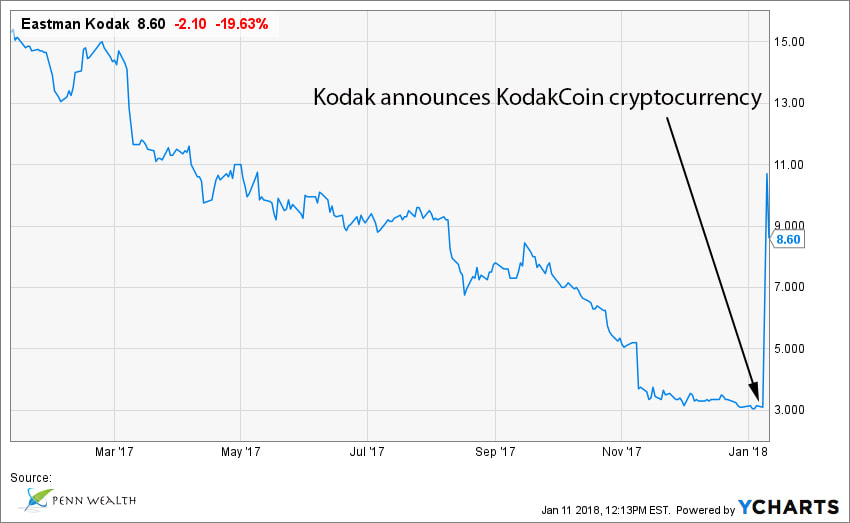

Need more proof that cryptocurrencies are a bubble waiting to burst? Consider Kodak...

(11 Jan 2018) When you hear the word Kodak, what do you immediately think of? For most of us, the iconic (and outdated) Kodak camera or those cylindrical rolls of yellow and black film come to mind. Not anymore. The long-beleaguered imaging company (KODK $3-$9-$16), whose stock price has been steadily declining for years, decided that it would create and begin mining its own cryptocurrency. From film to currencies? How did investors react to the news? KODK spiked from $3.10 per share to over $11 per share almost instantly (though the price has fallen back to $9.40 as of the time of this writing). KodakCoins are tokens inside of the blockchain technology KodakOne platform, with the tokens being used by photographers to make and receive payments. We can see cannabis companies creating their own cryptocurrencies next (actually, they probably already have). As crazy and out-of-control as all of this is, the underlying blockchain technology, we believe, will actually transform the Forex landscape forever.

(11 Jan 2018) When you hear the word Kodak, what do you immediately think of? For most of us, the iconic (and outdated) Kodak camera or those cylindrical rolls of yellow and black film come to mind. Not anymore. The long-beleaguered imaging company (KODK $3-$9-$16), whose stock price has been steadily declining for years, decided that it would create and begin mining its own cryptocurrency. From film to currencies? How did investors react to the news? KODK spiked from $3.10 per share to over $11 per share almost instantly (though the price has fallen back to $9.40 as of the time of this writing). KodakCoins are tokens inside of the blockchain technology KodakOne platform, with the tokens being used by photographers to make and receive payments. We can see cannabis companies creating their own cryptocurrencies next (actually, they probably already have). As crazy and out-of-control as all of this is, the underlying blockchain technology, we believe, will actually transform the Forex landscape forever.

Bitcoin plunges 25% as cryptocurrencies get hammered around the world

(22 Dec 2017) Following a massive selloff of the digital currency in Asia, the Bitcoin Investment Trust (GBTC $102-$1,772-$3,523) was down nearly 26% in pre-market trading on Friday. GBTC is one of the most liquid methods to track bitcoins. As more cryptocurrencies enter the scene, and various government agencies around the world consider ways to regulate digital currencies, these types of drops are inevitable. Additionally, as more exchanges begin offering bitcoin futures contracts, the ability to short the currency will further add to its price volatility.

(22 Dec 2017) Following a massive selloff of the digital currency in Asia, the Bitcoin Investment Trust (GBTC $102-$1,772-$3,523) was down nearly 26% in pre-market trading on Friday. GBTC is one of the most liquid methods to track bitcoins. As more cryptocurrencies enter the scene, and various government agencies around the world consider ways to regulate digital currencies, these types of drops are inevitable. Additionally, as more exchanges begin offering bitcoin futures contracts, the ability to short the currency will further add to its price volatility.

Bitcoin futures begin trading on the Chicago Board Options Exchange

(11 Dec 2017) It has been a crazy ride this year for the world’s first major digital currency known as bitcoin. The NYSE Bitcoin Index is up in the ballpark of 1,500% this year, and the currency began futures trading on the CBOE on Monday the 11th of December. After crashing the CBOE’s system Sunday night, bitcoin futures opened up around 15% on their first morning of trading. CBOE’s rival exchange, the CME Group, plans to launch its own bitcoin futures operation next week.

(11 Dec 2017) It has been a crazy ride this year for the world’s first major digital currency known as bitcoin. The NYSE Bitcoin Index is up in the ballpark of 1,500% this year, and the currency began futures trading on the CBOE on Monday the 11th of December. After crashing the CBOE’s system Sunday night, bitcoin futures opened up around 15% on their first morning of trading. CBOE’s rival exchange, the CME Group, plans to launch its own bitcoin futures operation next week.