Industrial Conglomerates

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

MMM $126

29 Aug 2022 |

3M wanted bankruptcy court for one of its subsidiaries; a judge denied the request

Between 2003 and 2015 a 3M (MMM $126) subsidiary by the name of Aearo Technologies manufactured and supplied earplugs to the United States military for troop training and for troops stationed in a combat environment. Production of the earplugs, which were unique in their two-sided design, ceased in 2015. In 2016, a competitor filed a whistleblower lawsuit claiming that 3M knew the plugs were defective, causing hearing loss and tinnitus in scores of soldiers. Two years later, the company agreed to pay over $9 million in a victims’ fund. After that tiny amount was paid, some 230,000 service members began filing lawsuits against the firm; the suits were ultimately consolidated through multidistrict litigation (MDL, somewhat akin to a class action lawsuit but more personalized) and handed off to a bankruptcy court in the Northern District of Florida. In an effort to limit its own liability, 3M declared bankruptcy for its Aearo Technologies unit and threw a gauntlet down to the judge, arguing that it was not within his power to interfere with the proceedings. The judge did not share that opinion. Shares of the company plunged nearly 10% after Judge Jeffrey Graham denied 3M’s attempt to offload the company’s problems in such a manner, keeping the parent company on the hook for a potentially enormous payout. While the cases which have already gone to trial present a mixed picture, it is easy to imagine the ultimate payout to a large percentage of 230,000 plaintiffs dwarfing the $1 billion amount the company has since set aside for settlement. For example, in ten cases which have already been decided, five were won and five were lost by the company, with the successful plaintiffs being awarded between $1.7 million and $22 million each. Here’s a staggering fact to consider: If one out of every three plaintiffs in the case were awarded $1 million, the dollar amount would be roughly equivalent to 3M’s market cap. Over the course of the past nine years, 3M shares are flat. They were trading at $126 back in 2013, and they trade at $126 right now. The company is trying to pull a General Electric (GE $76) move by spinning off its healthcare business (the current GE shouldn't be used as a model for anything, except what not to do), arguing that long-term shareholder value will be created. We don’t buy it. As for the stock, we offer the same recommendation—don’t buy it. |

|

GE $116

|

Following 1-8 reverse split, GE now says it will split into three firms

(09 Nov 2021) Just three months ago, storied industrial giant General Electric (GE $116) performed a 1-8 reverse split, making its shares magically go from $13 to $105 in an instant. Now, GE's management team has announced another split: the company itself will be divided into three parts. The GE name will live on in the new aviation company, while the healthcare and energy units will become separate entities. All of these moves, however, won't allow the disparate companies to escape from the aggregate debt racked up by years of mismanagement; debt which could not be erased by the continual fire-sale of units, such as the 2016 sale of GE Appliances to Chinese conglomerate Haier for $5.6 billion, or the sale of GE lighting to Savant Systems in 2020 for an undisclosed amount. At least Savant is manufacturing the light bulbs in the US (as evidenced by an old package of GE bulbs which reads, "Made in China," versus a newer package we found which reads, "Made in USA"). While the spinoff of the healthcare unit won't take place until 2023, and the energy spinoff won't happen until 2024, investors cheered the move by driving GE shares up 6% in the pre-market following the announcement. CEO Larry Culp told Barron's, "It is a wow sort of day." That is about the response we would have expected. At least we didn't have to listen to Jeffrey Immelt bloviating some long-winded response from the cabin of one of his two personal corporate jets. What would we do if we still held GE shares in any of the Penn strategies? Take the spike in price as an opportunity to exit the position. We certainly wouldn't wait around two years for the completion of the spinoffs. As for GE, with Culp running one company, perhaps the board should invite the other two post-Jack Welch CEOs—Immelt and Flannery—to take the respective helm of the other firms. |

|

GE $13

GE $105 (post 8-1 reverse split) |

A sure sign of desperation: financial engineering has replaced cutting-edge engineering at General Electric

(06 Aug 2021) I feel bad for General Electric (GE $105); embarrassed for this once-great American powerhouse. Has Edison's firm really been reduced to this? Some companies have a "move fast and break things" mentality. GE's grand strategic vision is "let's do a reverse stock split at just the right level to move our share price into triple digits like our competition." I mean, that's simply embarrassing. The move is tantamount to an admission that the company can't get its stock price to triple digits the old fashioned way, through hard work, relentless creativity, and a stellar sales force. Instead, management performed the corporate version of breaking into the school's server to change a grade from a C- to an A+. Here's a question: name the last company that regained a leadership role in an industry after performing a reverse stock split? Good luck—we couldn't think of any. General Electric, once a "move fast and break things" company, now makes most of its profits from servicing the equipment it had previously sold to customers. Unlike an Apple, however, the firm isn't introducing the new products necessary to feed an ever-growing services business. When it finds itself in need of a new supply of cash, it simply sells one of its legacy businesses. Jeffrey Immelt, who spent too much time flying around on one of his two corporate jets (the other would travel behind in case of mechanical problems), started the great downturn at General Electric; unfortunately, Larry Culp doesn't seem to be the dynamic disruptor so desperately needed at the firm. Maybe he and Boeing's David Calhoun can have a few adult beverages one of these days and reminisce about the good old days at their respective firms. General Electric was one of those global leaders which always had a place in our portfolios. No longer. GE is a case study in the importance of understanding what you own and why. We have a neighbor who had a gorgeous and enormous white pine in his back yard. One day we noticed that the needles at the top of the tree began turning brown. Instead of calling in a tree expert at the first sign of trouble, he figured the problem would take care of itself. Needless to say, the problem rapidly spread and the tree met its demise. A company used to be able to rest on its laurels and simply weather some boneheaded tactical or even strategic errors by upper management. Those days are gone, but the entrenched members of the board at a company like GE seem content to collect their pay and stay the course. Good luck. Pardon us if we choose not to board your next flight. |

|

GE $9

|

GE will freeze pensions for 20,000 salaried employees as it struggles to fix its broken retirement system. (07 Oct 2019) While companies have been migrating away from the defined benefit plan (think pensions) in favor of the defined contribution plan (think 401k) for decades, struggling industrial conglomerate General Electric (GE $7-$9-$14) still has a major legacy problem with the former. (See our story, Investing in Your Company Plan.) Over 600,000 workers, both current and retired, are covered by the company's pension plan, and GE is on the hook for about $100 billion in payments. Here's the problem: the company only has around $70 billion in assets set aside for the plan, meaning it is $30 billion underfunded. In an effort to reduce this gap, which brings with it increased government scrutiny, GE has announced it will freeze the pensions for 20,000 salaried workers. It will also offer lump-sum buyouts for retired employees who have yet to begin collecting on their pensions. The company hopes to narrow its $30 billion shortfall by about $6 billion with the new plan. GE closed its pension to new employees in 2012. The numbers just don't add up for GE, once the world's largest firm. It now has a market cap of just $75 billion, 25% less than its pension IOUs.

|

|

GE

|

Madoff whistleblower calls GE's accounting practices the biggest case of fraud he has ever witnessed. (16 Aug 2019) General Electric (GE $7-$8-$14) was once our most respected company, with shares sitting in nearly every client's portfolio. A symbol of great American ingenuity and innovation, it topped the list of the world's largest companies back in 2000, with a market cap of nearly $500 billion. How quickly things can change—due to management—in the fast-paced world of business. Today, the company is a shell of its former self, with a market cap of just $70 billion following its largest decline since the financial crisis. The reason for the 11%, one-day drop was a bombshell report issued by the man who blew the lid off the Bernie Madoff Ponzi scheme, Harry Markopolos. The certified fraud analyst calls the company's accounting practices "a bigger fraud than Enron and WorldCom combined," and even set up a website (gefraud.com) to detail the company's purportedly nefarious acts. Markopolos said his team spent seven months analyzing the company's accounting practices, finding $38 billion worth of fraud hidden by bogus financial statements. The company vociferously denied the allegations, with CEO Larry Culp buying over a quarter-of-a-million shares after they fell below the $8 mark. Only time will tell whether or not the analyst's accusations are correct, but the company has been on a downward slide ever since Jack Welch handed over the top spot to Jeffrey Immelt back in 2001. Remarkably, Immelt leapfrogged over Robert Nardelli and James McNerney, two highly-successful business leaders, to be awarded the CEO position from GE's board of directors. Larry Culp succeeded Immelt in October of last year. Whether or not these serious accusations are true, we wouldn't touch GE shares in any of our five strategies. The company continues to flop and flounder in search of a cogent strategic plan that involves more than shedding units to raise cash and lower its debt load.

|

|

MMM

|

3M's lousy earnings report single-handedly drove the Dow down triple-digits at open. (25 Apr 2019) Of the 20% or so of companies reporting their Q1 earnings thus far, 80% have exceeded analyst expectations. Then came 3M's (MMM $177-$201-$220) dud. The diversified industrials company missed on nearly every metric and in every business line. Revenues dropped 4.8%, to $7.9 billion, and earnings fell 10.8%, to $2.23 per share. Management pointed to "slowing conditions in key end markets" (read China and Europe) as the culprit for the lousy quarter, and announced job cuts and restructuring to address the problem. The $112 billion, St. Paul-based firm said it would eliminate 2,000 positions worldwide and realign its structure into four distinct business units. Shares of 3M were headed for their worst day since Black Monday, 1987, following the results. We love American industrials; just not the big conglomerates like GE and 3M. For growth, scan the universe of wonderful mid-cap industrials between $2 billion and $10 billion in size.

|

|

GE

|

If General Electric sells all of its units, it will be able to pay down (some of) its debt. (25 Feb 2019) It is so sad what has happened to one of America's great companies. Through rotten "leadership," beginning with Jeffrey Immelt, General Electric (GE $7-$12-$16) has become a comical shell of its former self. Here's the latest: the $88 billion company, once the largest company in the world, has agreed to sell its biotech unit to Danaher (DHR $95-$121-$121) for $21 billion to pay down some of its debt. Once a universe apart in market cap, the two companies are now approximately the same size. It should be noted that GE's current CEO, Larry Culp, was once the CEO of Danaher, which makes this deal all the more interesting. For fun, let's compare the two companies' financials. GE has a market cap, as mentioned, of $88 billion. It has total current liabilities of $110 billion and long-term liabilities of $148 billion. As for Danaher, the company has a market cap of $85 billion, current liabilities of $5 billion, and long-term liabilities of $15 billion. But it gets even better. GE's overhead includes the salaries of 313,000 workers around the world. Costly enough, but that is nothing compared to its underfunded pension plan. GE has over 600,000 past and current workers covered by a defined-benefit pension plan (as opposed to the modern-day defined contribution plan, such as the common 401(k)). While workers have been promised roughly $100 billion in payments by the company, it only has $70 billion set aside for those payments (i.e. it is underfunded to the tune of $30 billion). While the $21 billion it gets from the sale of its biotech unit will help, it will also lose the $3 billion per year in revenue currently generated by that unit. GE was up 15% on the news of this deal. Larry Culp claims to have a strategic plan for GE's turnaround, but it has yet to crystalize in any way we can see. Investors applauded the plan to pay down a bit of the company's massive debt load, but there are so many systemic issues with this company that we still consider it a sucker's bet. One interesting side-note: the sale of this unit means that GE will almost certainly abandon its plans to spin-off its entire health care division into a new publicly-traded entity.

|

|

GE

|

GE fires Flannery after thirteen months on the job. (01 Oct 2018) After it became apparent that General Electric's (GE $11-$12-$25) new boss was a lot like its old boss (who presided over a disastrous period for the once-great company), the board decided enough was enough. After just thirteen months in the role, GE's board of directors fired CEO John Flannery. Not only wasn't the company moving in a positive direction, it appeared as if Flannery was continuing to dig even deeper into the hole in which Jeffrey Immelt placed the company. Great units were being sold off, and a general sense of disarray permeated the company. The final straw came with the 2018 full-year guidance: the company would miss both revenue and profit targets. Additionally, GE announced it would take a $23 billion write-down for its power unit. There is some good news: the board tapped former Danaher CEO—and current GE board member—Larry Culp as the new chairman and CEO. Culp had an impressive record heading up the $76 billion healthcare firm. Is it too late for a turnaround act at General Electric? Perhaps. But, if anyone can pull it off, it is probably Culp. GE was up double-digits on news of Flannery's firing.

|

|

GE

|

Another sad day in its history: General Electric is booted from the Dow. Admittedly, we hate the Dow Jones Industrial Average. Not the companies in the Dow, just the index itself. For some odd reason, the aggregate pattern of 30 companies has become the benchmark headline at the end of each trading day. We do have one theory as to why that is: the press loves sensationalism, and it is more sensational to say "the Dow dropped 300 points today!" than it is to say "the S&P 500 lost 30." Nonetheless, it is a big headline that the most storied company in the Dow just got booted out of the club. General Electric (GE $13-$13-$28), the company which a milquetoast (our opinion) CEO helped shoot down, just got thrown out of the Dow, to be replaced by Walgreen Boots Alliance (WBA $62-$67-$84). So sad. It did not need to come to this. GE could still be a thriving, vibrant, American powerhouse. Instead, this original member of the Dow (1907) is now just a shell of its former self. Leadership matters.

|

|

GE

|

Another month, another General Electric unit bites the dust

26 Jun 2018 Update) GE just announced it would also be spinning off its healthcare business and divesting itself of its Baker Hughes oil services business. (25 Jun 2018 Update) GE confirmed it had sold the unit to private equity firm Advent International for $3.25 billion. (21 Feb 2018) Some of struggling General Electric's (GE $14-$15-$31) divestitures made sense—like the insurance business it never should have been involved with in the first place. But this one is a head scratcher. The company announced that it would sell off its industrial gas engine unit for around $2 billion. This unit makes multi-ton gas turbines that generate on-site power to industrial plants. GE has manufactured these gas engines for over 80 years. Meanwhile, the company is also selling off its overseas lighting business to a former president of GE Hungary. While its North American and commercial LED lighting businesses remains intact, rumors are swirling that they are on the chopping block as well. We wonder what founder Thomas Edison would have to say about that? |

|

GE

|

After announcing a $6.2 billion write-down on its insurance business, GE drops the bomb

(17 Jan 2018) Why an industrial conglomerate got into the insurance business in the first place belies logic; it is reminiscent of defunct Enron getting into industries which had nothing to do with energy, just before its massive implosion. Nonetheless, General Electric (GE $17-$18-$31) did, and is now paying the price. The company announced it would eat an $11 billion charge in the fourth-quarter, $6.2 billion of which from a reevaluation of its long-term care insurance business. That news was enough to make their stock drop about 3%, but the real news came when CEO John Flannery made it clear the company would be broken up soon. What would that look like? More than likely, a breakup means three separately-traded stocks for GE's three main business lines: power, aviation, and healthcare. The breakup would also mean the company would divest itself of other units, such as GE Capital, oil & gas, and lighting. Shedding the extraneous business lines makes sense, but GE will never again be the giant it once was. It didn't need to be this way. More evidence of the critical importance of strong leadership. |

|

GE

|

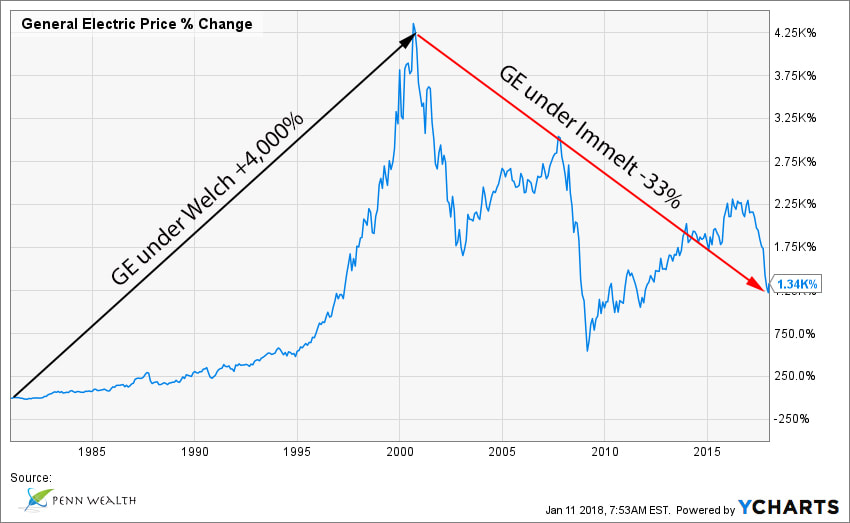

Case study in Leadership: Welch vs Immelt at General Electric

(11 Jan 2018) While they play nice in public view, there is an ongoing feud between the two former CEOs of industrial giant General Electric. The legendary Jack Welch regrets grooming his replacement, Jeffrey Immelt, and Immelt thinks that Welch left him a lumbering giant whose best days were behind it. Whose right? All metrics support Welch. The only question now is whether or not the company can return to greatness—and whether or not John Flannery is the right person to head the turnaround effort. |

|

GE

|

GE slashes dividend by 50%

(13 Nov 2017) Beleaguered industrials giant General Electric (GE $20-$20-$32) had one thing going for it from an investment standpoint—its nearly 5% dividend yield. Well, investors can say goodbye to that perk, as the former "largest company in the world" slashes its dividend from $0.24 to $0.12 per share. Shares of GE are down 35% year-to-date. How much money did clown-faced Jeffrey Immelt rake in for running this company into the ground? Sad. |

|

EMR

ROK |

Rockwell rebuffs Emerson bid, but investors still drove its stock price up 7.5%

(01 Nov 2017) St. Louis-based Emerson Electric (EMR $49-$64-$68) really wants to merge with Milwaukee's Rockwell Automation (ROK $117-$201-$222). The feeling is not mutual. Rockwell has, once again, rebuffed an offer by Emerson to acquire the industrial automation firm for about $215 per share, citing Emerson's shaky merger history. As manufacturing becomes less mechanical and more digital, it could be argued that Emerson really does need to acquire a firm like Rockwell to remain relevant in the new industrial environment. Rockwell, on the other hand, really doesn't need Emerson. Over the past year, ROK shares have soared 68% while EMR shares have risen 27%. We agree with Rockwell's management. |

|

GE

|

General Electric gets pounded at the open on yet another lousy earnings report

(20 Oct 2017) General Electric (GE $23-$22-$32) should bring back former CEO Jeffrey Immelt just to ceremoniously fire his goofy mug again. Except, they really didn't fire him the first time; he simply stepped down before his 20-year tenure was over. And why is GE's management run like a communist party apparatchik anyway? The last quarterly earnings report for the Immelt era was released Friday morning, and it is a doozy. The company earned $0.29 per share against expectations for $0.49 per share. GE's power business (think energy) saw a profit decline of 51% from last year, and its direct oil and gas business swung from a $353 million gain a year ago to a $36 million loss this past quarter. Get this: the 20-year return for GE's stock price is negative 8%, and the 10-year return for the stock is negative 46%. What was GE's return between 1981 and 2001, when Jack Welch ran the business? 4,000%. GE was down roughly 8% in pre-market trading after the earnings release. |

|

GE

|

(21 Jul 2017) How much further can once-mighty General Electric fall?

If our memory serves, there was a time not so long ago when General Electric (GE $25-$25-$32) was the largest company in the world by market cap. Then Jack Welch retired, along with the 4,000% jump in value of GE during his tenure, and the hapless Jeffrey Immelt took over for his twenty-year reign. What a disaster that has been. The company's market cap now sits at just $231 billion, down another 4% at Friday's open. At $25 per share, this could be a golden opportunity to buy the company, but that would be a bet that incoming CEO John Flannery is closer on the spectrum to Welch, not Immelt. We just don't know the answer to that question yet. At $25, with a 3.5% dividend yield, we are tempted. However, something tells us the market will give us time to gauge the 54-year-old Flannery (he has to be there twenty years, right?) before any spike in the stock. The reason for today's drop? A 12% decline in revenue from last year. |