Market Downturns Cause & Effect

Understanding the cause and effect of past market downturns can help us navigate current or future ones. While each downturn has a unique set of circumstances, certain psychological and behavioral trends are almost always present. It is rather difficult to keep everything in perspective while in the midst of a storm simply because we don't know what is ahead, but by studying past turmoil we can help assure the proper course of action is taken this time around.

2020 Q1: Coronavirus Downturn with Energy Price Plummet

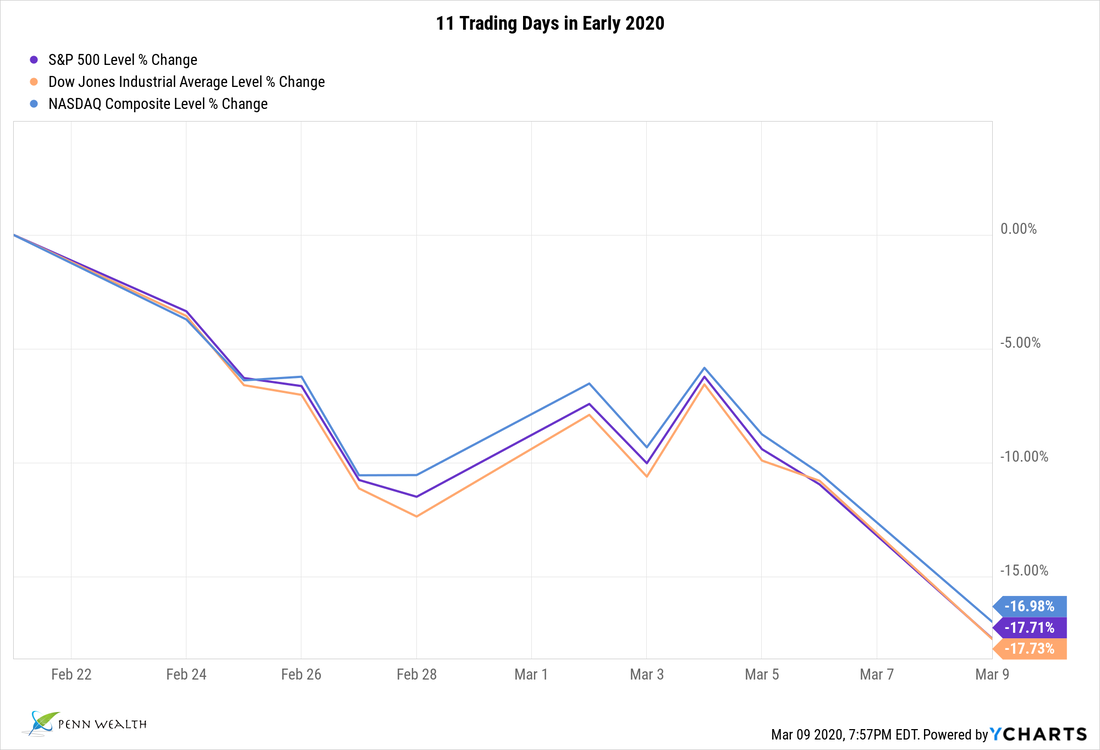

Mo, 09 Mar 2020: Virus spread rapidly around the world over the weekend. As if this wasn't enough, Saudi Arabia slashed oil production to punish Russia for refusing to go along with an OPEC cut. Crude falls 23% at the open, to $31 per barrel, and the Dow closes down over 2,000 points on the day. All major indexes fall over 7% in the session, with energy names getting crushed. Occidental Petroleum (OXY) falls 51.60%, while Marathon Oil Corp (MRO) falls 44.51%. It was the biggest percentage drop in crude since day one of Operation Desert Storm. In eleven trading days, the indexes have gone from record highs to nearly bear market (20%) territory. Odds of a recession have rocked up to 60%, and the ten-year Treasury briefly hit 0.42%.

Mo, 09 Mar 2020: Virus spread rapidly around the world over the weekend. As if this wasn't enough, Saudi Arabia slashed oil production to punish Russia for refusing to go along with an OPEC cut. Crude falls 23% at the open, to $31 per barrel, and the Dow closes down over 2,000 points on the day. All major indexes fall over 7% in the session, with energy names getting crushed. Occidental Petroleum (OXY) falls 51.60%, while Marathon Oil Corp (MRO) falls 44.51%. It was the biggest percentage drop in crude since day one of Operation Desert Storm. In eleven trading days, the indexes have gone from record highs to nearly bear market (20%) territory. Odds of a recession have rocked up to 60%, and the ten-year Treasury briefly hit 0.42%.