Financial Terms & Concepts

Often, financial jargon is thrown around with little regard for the audience, or even to confuse the audience. Here, we break down the terms and concepts often used in the financial realm in a simple, straightforward, and easy-to-understand manner. Remember, if you don't understand a term or concept critical to a specific investment or product (e.g. insurance policy), then you should not proceed until you have a clear understanding.

This page is under development...thanks for your patience!

This page is under development...thanks for your patience!

|

all-in sustaining cost (AISC)

mining industry |

The all-in sustaining cost is a relatively new (2013) but very useful metric to consider when investing in mining companies. The idea is to identify the true total cost of mining a mineral, such as gold, expressed in terms of price per ounce. For example, the global AISC of gold production was $936 per oz in 2019. This means that, to break even, gold must be selling for $936 per ounce; any amount above that is profit, any amount below that level is loss. Based on their own unique efficiencies, gold miners hold different AISC figures. For example, Newmont Mining (NEM) had an AISC of $966 in 2019, above the industry average.

|

|

Asset Coverage Ratio

|

The asset coverage ratio is a financial metric which measures how well a company can repay its debts by selling or liquidating its assets. This metric helps determine a company's financial solvency. For example, if a company had $3 billion in assets and $1.5 billion in outstanding debt, its asset coverage ratio would be 2.

|

|

ALM

(Asset/Liability Management) |

An important concept, especially in the wake of the SVB failure. Asset/liability management is the process of managing the use of assets and cash flow to reduce a firm's risk of loss from not paying a liability on time. This concept typically refers to the management of a bank's loan portfolios and the assets on its books. In the case of SVB, the lack of proper risk management led the bank to buy a large percentage of long duration bonds during a time of ultra-low interest rates—a bizarre move, to say the least. As depositors began pulling funds out, the bank was forced to see these assets at heavily discounted prices (discounted because rates had moved up substantially), causing the initial problem. It is a complex undertaking, but a good risk management team is always focused on maintaining a solid asset coverage ratio.

|

|

Austrian School (of economic thought)

|

The Austrian School is an economic concept that attributes all economic activity to the actions and free choice of individuals. The concept rejects all types of intervention in an economy by government forces, and argues that the broader economy is the sum of smaller individual decisions and actions. In other words, true economic power emanates from the smallest unit and works its way up, not the other way around. It is merely the job of government to assure the freedoms of the individual. The Austrian School of thought originated in Vienna during the late 19th century, and is based on the works of economist Carl Menger. For more information on Austrian economics, visit the Mises Institute.

|

|

backwardation

|

Backwardation is a common term in the commodities arena. It is a condition which exists when the futures price of a commodity is lower than the spot price of the asset. For example, if the spot price of crude is $60 per bbl, but a futures contract lists the price of crude two months in the future at $55 per bbl, backwardation exists. Often, this is a bearish signal for a commodity, or falls on the heels of a natural disaster which is expected to affect the future price of the commodity. For example, an extreme cold spell in Florida could force down the price of orange juice futures. The opposite of backwardation is contango.

|

|

base effect

|

The base effect takes place when inflation appears to be running hot, but this is somewhat of a mirage due to an unusually-low rate of inflation in the previous (base) year. The pandemic of 2020 is a great example of a base year followed by—in 2021—a period of a high growth rate of inflation.

|

|

biologics

|

A biologic drug is a medication which is produced from living organisms, derived from human, animal, or microorganisms using biotech methods. When you think of biologic drugs, think of vaccines, gene therapies, Botox, and the like. These drugs literally change/adjust the interaction of cells within the host body.

|

|

biosimilars (drug development)

|

When reviewing pharmaceutical and biotech companies, especially those which produce generic drugs, it is important to understand what biosimilars are, and how they differ from generics. While the FDA requires a generic drug to be chemically identical to the drug it is replicating, this is not possible when it comes to biologics. This is because biologic medicines consist of large, complex molecules which are composed of living material. Therefore, it would be nearly impossible to precisely replicate a biologic, since they are grown in complex living systems. Hence, biosimilars are biologic knock-offs which must be "highly similar," but not identical to, the drug they are trying to replicate. Dr. Michael Morse of Duke University gives a great synopsis, including a three-minute video, of biosimilars, which you can view here.

|

|

book value

|

Here is the simplest and most effective way to look at book value: if a company decided to close and shutter its doors today, the book value of that company would be what is left over after it sold all of its tangible assets and paid off all of its debts. Book value is similar to the assets listed on a company's balance sheet, but it ignores intangible assets which cannot be sold, such as patents and goodwill. The price to book ratio is an effective tool to use when analyzing a company, especially when the price/book is compared to that of similar companies in the same industry.

|

|

break-bulk shipping

(also breakbulk) |

The oldest form of maritime shipping, break-bulk refers to cargo that must be loaded individually, rather than via large, intermodal containers. Break-bulk cargo is carried in bags, crates, boxes, barrels, and the like. The term refers to the method of "breaking up" the goods on a ship rather than transporting in bulk, just like the Phoenician traders did 3,000 years ago.

|

|

brownfield investment (vs greenfield investment)

|

When a company needs to expand its operations, it can go one of two directions. It can make a brownfield investment, in which it purchases or leases the area around an existing production facility to launch a new activity; or it can make a greenfield investment, in which an entirely new plant is built. Interestingly, the term "brownfield" stems from the fact that prior activities on the site may have left the land contaminated, such as areas around old production facilities. The mining industry is well-known for undertaking brownfield expansions due to the difficulty in finding and securing new land or mines for greenfield operations.

|

|

bunkering (maritime)

|

Bunkering is a maritime term referring to the supply of fuel for use by ships. This involves the storage of the fuel, and the logistics involved with refueling the vessels. The term originated in the days of steamships, when the coal used to fuel the ships was stored in special bunkers. Maritime law requires that a ship be seaworthy, and part of that mandatory seaworthiness is assuring the ship is properly bunkered at the starting port of the voyage.

|

|

capacity (transportation)

|

One day in early 2018, United Continental Holdings (UAL) announced that it was increasing capacity to compete with the low-cost carriers. UAL stock plummeted at the open on the news. Why? Airline capacity refers to, as the name implies, the ability to have more passengers on your carrier. This could be done by: buying more (or bigger) aircraft, increasing the seats on existing aircraft, increasing flights on current routes, increasing your number of routes, or reducing fares. Think of the cost to the airline involved with most of those answers. Increasing capacity can also decrease an airline's overall load factor (see definition below). In the case of UAL, investors worried that increasing capacity would be costly and, quite possibly, reduce the load factor—at least in the short run, reducing already razor-thin profit margins. Thus, the 12%, one-day drop in UAL's share price.

|

|

Capitalization (cap) rate

|

We recently wrote about net operating income, which measures the profitability of income generating properties in real (dollar) terms. But, quite obviously, buildings of different sizes will generate different levels of NOI, and just because one is ten times that of another, it really doesn't mean much without being put in context. e.g. a profitable $10 million property should have a much larger NOI than a profitable $1 million property. That is where the capitalization rate (or simply "cap rate") comes into play. Irrespective of the dollar amount of NOI, the cap rate measures the annual return of income-producing properties for easy comparison to others. For REIT investments, as in our Simon Property Group story above, a 6.2% cap rate is decently healthy (in the retail space). As one could imagine, there are two factors which could increase or decrease the cap rate: the NOI or the value of the property, as the proportion is reached by dividing one from the other.

|

|

Capitalization-weighted index

|

As you review investments, particularly index-based ETFs, you will often notice something along the lines of "...XYZ is a cap-weighted fund which generally corresponds with...." This simply means that the holdings within the fund, or corresponding index, are weighted based on their market capitalization, as opposed to an equal-weighted fund in which all holdings would carry an equal effect on performance. While the Dow Jones Industrial Average is not cap-weighted, the S&P 500 and most other major indexes are. So, for example, if you buy the SPDR S&P 500 ETF (symbol SPY), you will be buying a nice basket of all 500 stocks within the index. However, what you may not realize is that two companies—Apple and Microsoft—make up a full 10% of the fund's weight! That's great when these behemoths are rolling, but if bad news hammers these two stocks, odds are great that the SPY will have a lousy day. So, if you truly want to diversify, consider looking for an equal-weighted ETF. Examples would be the SPDR S&P Biotech ETF (XBI), the Direxion NASDAQ-100 Equal Weighted Index Shares ETF (QQQE), or the ETFMG Prime Cyber Security ETF (HACK).

|

|

CAR-T therapy

|

For generations, the battle to fight cancer has been centered around three rather distasteful pillars: surgery, chemotherapy, and radiation. Targeted therapies, drugs that target cancer cells by homing in on molecular changes primarily seen in those cells, came on the scene about a generation ago. Now, a highly-promising "fifth pillar" of cancer treatment is entering the scene. Known as immunotherapy, this treatment uses the patient's own immune system to attack tumors. One immunotherapy approach, adoptive cell transfer (ACT), collects a patient's immune cells and then "programs" the cells to fight the disease. One type of ACT making strong advances is CAR-T, or chimeric antigen receptor T cell therapy. CAR-T therapy involves removing a patient's immune cells, sending them to a manufacturing facility to be "re-coded", and then sending them back to be placed back in the patient's body. Simply incredible science with enormous potential. The initial development of CAR-T therapies has revolved around childhood leukemia.

|

|

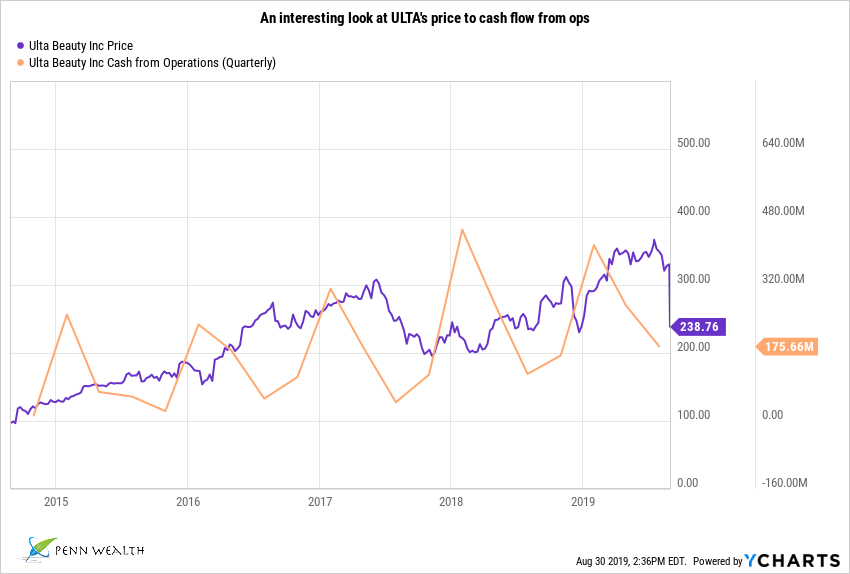

cash flow from operations (aka operating cash flow)

|

Operating cash flow is the amount of cash generated from the normal operations of a business over a specific time frame. To figure this important metric, begin with the net income figure from the income statement. Then, adjust that number for changes in the working capital over that period (receivables, payables, inventories, depreciation, etc.) to arrive at the cash from operations figure—be it positive or negative. For example, ride-hailing service Lyft (LYFT) had net income of -$911M in 2018. after subtracting items such as the amortization of securities and the change in prepaid assets, and adding in items like depreciation and changes in working capital, the cash flow from operations figure was actually -$281M for the year. The operating cash flow figure, which is found on the statement of cash flow, can be a very useful (thanks to its transparency) tool for calculating the real fiscal health of a company. Using a happier example, Apple's (AAPL) fiscal 2018 net income was $59.53B (on revenues of $266B), but its cash flow from operations was actually $77.43B. When evaluating a company for purchase, pull up a trend line of operating cash flow to get an idea of where the company may be headed.

|

|

Contingent liabilities

|

Contingent liabilities are the estimated dollar value of potential debts. These typically include the estimated dollar amount of lawsuits filed against a company but which have yet to come to fruition. Product warranties are another example (think now-defunct Takata and the defective airbag case). While they are not yet liabilities, they must be disclosed within a company's balance sheet if they are probable, and the amount can be estimated. If one of those factors is not present, the contingent liability must still be registered in the footnotes of the financial statement. A contingent liability that is remote (less than 50% odds) is neither listed on the balance sheet nor discussed in the notes. Two companies that come to mind with huge contingent liabilities are Johnson & Johnson (talcum powder and opioid lawsuits) and Altria (MO) due to their Juul ownership. Some companies even have contingent liabilities larger than their market cap. Yet another reason to study a company's balance sheet as part of the investment filtering process.

|

|

cost center

|

A cost center of a business is a unit or division which "consumes" capital rather than producing capital. Two examples would be the company's accounting department or its ESG department. This is as opposed to the profit center: divisions dedicated to adding to a company's bottom line and ultimate success.

|

|

Cost of capital

|

Also known as the weighted average cost of capital (WACC), this metric is used to determine whether or not a company should proceed with a project. Think of cost of capital as the burden a company must overcome before it begins to generate value from an undertaking. If it borrows money from a bank, it must pay interest on the loan. If it issues stock to shareholders, those shareholders will demand something in return for their investment. All of the required outlays are combined to determine the weighted average cost of capital. For a venture to make sense, the projected return on capital must be higher than the cost of capital. If it isn't, the company should not proceed.

Of course, there are all sorts of variables which could play a part in this equation, from unexpected costs arising down the road to simple human error—failure to account for time delays and cost overruns, for example. If a CEO wants to undertake a project badly enough, he or she may put pressure on the finance team to low-ball the WACC or exaggerate the expected return. This is why a fundamental analysis of a company must involve looking at the overall quality of the management team. Three textbook cases of a failure by analysts to adequately perform this step would be WorldCom, Enron, and Tyco. |

|

Current ratio

|

A company's current ratio is derived by dividing its current assets by its current liabilities. The higher that number the better, as it gives us an idea as to which companies are going to be able to weather this storm, and which are fighting to remain in business. For example, if a company has $4.4 billion in current assets and $2 billion in current liabilities (Advanced Micro Devices AMD $53), its current ratio is a very solid 2.2. If, however, a company has $7.9 billion in current assets and $16.09 billion in current liabilities (United Airlines UAL $25), its current ratio is 0.49. Serious trouble brewing. What's a good current ratio to look for? While the number varies from industry to industry, a general rule of thumb is to look for companies with a current ratio of 1.2 or higher.

|

|

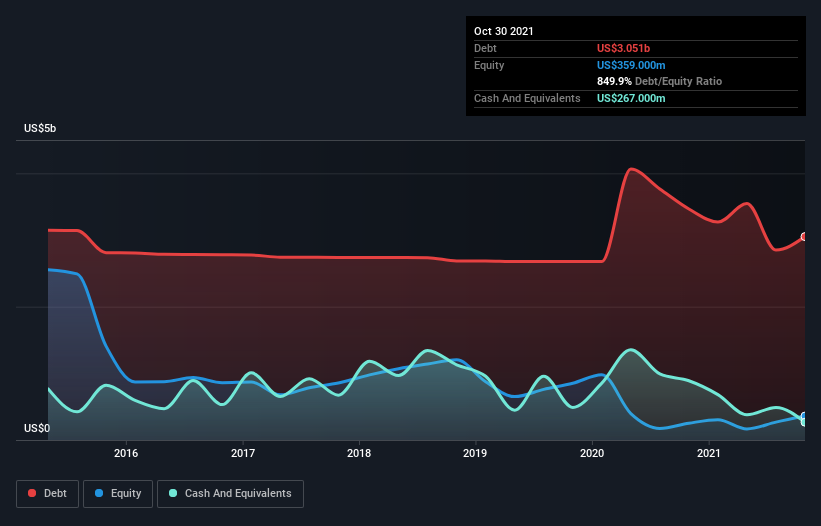

debt-to-equity ratio

|

The debt-to-equity ratio is an important factor when evaluating a company's risk profile; specifically, how much it is using leverage (as opposed to funds on hand) to finance its operations. The higher the D/E ratio, the more potential concern with respect to fiscal solvency. When using this metric, it is important to look at other companies in an industry, as the ratios can be quite different across the entire market. Taking two retailers: At the time of this writing, Nordstrom (JWN) has a D/E ratio of 8.5, while Macy's (M) has a D/E ratio of 0.910. While generally not expressed as a percentage, this would mean that JWN has a debt-to-equity ratio of 850%, while Macy's has a respectable 91% D/E ratio. As a very general rule of thumb, a D/E ratio of 2 or less is considered acceptable (2 would indicate two-thirds of capital financing comes from debt).

|

|

defensive stocks

|

One of our big themes for 2020 is this: "overweight defensives." But what exactly are defensives? In the economic cycle, which runs like a sine wave between expansion, peak, contraction, and trough, defensives are the companies (and their related industries) which continue to hum along throughout all phases. While consumers will cut back on visits to restaurants during lean times, they won't cut back on their needed drugs (health care). Nor will they go home and start turning off lights or heat (utilities). Companies in these industries, which also typically pay a nice dividend yield, are considered defensive names. Besides health care and utility stocks, certain industries in the real estate sector tend to be defensive in nature. For example, apartment REITs such as Mid-America Apartment Communities (MAA) and Apartment Investment & Management Co (AIV) are going to continue collecting rent in good times and bad. In fact, when defensives look most attractive business for such REITs tends to pick up, as more families opt to lease instead of buy. These names also tend to pay higher yields to shareholders. The consumer staples sector also contains some strong defensive names. General Mills (GIS), for example, not only makes a number of staple food items people need to buy in good times and bad, they also now own our favorite dog food company, Blue Buffalo. Defensives are almost always value stocks as opposed to growth stocks.

|

|

direct listing (aka Direct Public Offering)

|

A direct listing, or Direct Public Offering, is a method for a company to become publicly traded without paying through the nose for an underwriter (one of a small cadre of investment banks, such as Goldman Sachs) to take the company public in an Initial Public Offering, or IPO. In essence, this is a company telling the big banks thanks, but we can raise all the money we need to without your assistance. The upside is an easier, less expensive way to go public. The downside is that you lose the protection an underwriter can provide, as your initial share price is at the total whim of investors (there aren't any "lock up" periods during which certain investors must maintain ownership). Our favorite aspect of a DPO lies in the fact that a small, select group of "elite" clients of the big brokerage houses can't get their hands on the shares before the rest of the investing public.

|

|

disinflationary

|

Disinflation is a slowing in the pace of inflation. Unlike inflation and deflation, it refers to the rate of change of inflation rather than a change in direction (such as inflationary or deflationary).

|

|

dividend coverage ratio (DCR)

|

A company's dividend coverage ratio measures the number of times the firm could pay its existing dividend rate to shareholders using its net income (after all expenses, including taxes). For example, if a company had a net income of $1.5 billion and dividends declared for all outstanding shares amounted to $500 million over the same period, the company would have a dividend coverage ratio of 3. As a general rule of thumb, a DCR of 2 or higher is considered healthy. Let's consider how safe AT&T's 5.63% dividend yield is right now. The company has a dividend coverage ratio of 1.2, which should at least send up some yellow cautionary flags to investors. It is important for yield seekers not to get myopic when scouring for high-yielding stocks. We have seen many companies in the past—especially prior to the 2000-2002 downturn—offer sky-high yields to investors while holding outrageously-low DCRs.

|

|

dividend payout ratio

|

The dividend payout ratio is the percentage of net income distributed as dividends to shareholders. For example, if AT&T (T) reported net income of $20 billion TTM, and it paid out $10 billion in dividends TTM, its dividend payout ratio would be 50%. The S&P 500's most consistent dividend payers, the so-called Dividend Aristocrats, have an average payout ratio of 49%.

|

|

Doctor Copper

|

Doctor Copper is a moniker given to the base metal due to its ability (hence, the PhD) to predict inflection points in the global economy. Copper is so widely used throughout the economy, from home building to electronics, that its demand tends to be a leading economic indicator (LEI) of the world's economic health. Persistently dropping copper prices could indicate a global slowdown, while a steadily growing copper price indicates good economic health.

|

|

downside capture ratio

|

One measure of performance is a fund's downside capture ratio, which measures a strategy's performance in down markets relative to an index. For example, if a fund's downside capture ratio is 50%, it declined half of what the index did; it its downside capture ratio is 150%, it declined 50% more than the index. (This definition is from Morningstar.com)

|

|

dual mandate (monetary policy)

|

In the late 1970s, stagflation (the nightmarish scenario of high unemployment coupled with high inflation rates, which seems on its face to be illogical) forced Congress to amend the 1913 Federal Reserve Act. The 1977 Reform Act introduced what would become known as the dual mandate, explicitly laying out the goals of the Fed: maximum employment, and stable consumer prices coupled with moderate long-term interest rates. The last two are treated as one mandate, as inflation is controlled (at least in theory) by adjusting interest rates. As of this writing, the US sits in the sweet spot: generations'-low unemployment coupled with low inflation (1.6%) and moderate interest rates (Fed funds rate at 2.25%-2.5% target). The Fed considers the "natural" rate of unemployment to be between 4.5% and 5%, and 2% is the target range for the annual rate of inflation.

|

|

earnings per share (EPS), basic versus diluted

|

A company's earnings per share (EPS) is one of the most important metrics when performing fundamental analysis of a company. In the most basic terms, EPS is figured by dividing a company's net income, minus any dividends paid on preferred shares, by the number of outstanding shares. For example, FedEx (FDX) made $540 million in net income for its most recent fiscal year. There are 260.87 million shares of FDX outstanding, so the company's basic EPS was $2.07. Diluted EPS, however, considers a "worst case" scenario in which all of a company's convertible instruments (preferreds, warrants, employee equity options, etc.) were suddenly exercised, thus diluting the number of outstanding shares. The resulting figure will obviously be lower than basic EPS.

In the case of FDX, it's diluted EPS was $2.03 for the most recent fiscal year. If a stock is going up in price, holders of the convertible instruments are more likely to exercise their options as they will get the shares at a more lucrative price. If a stock is plummeting in price, however, diluted EPS will be less of a factor—fewer will want to exercise their options. Whether using basic or diluted EPS, the key for an investor is to search for companies with a nice EPS growth rate. You want to see a nice trend of quarterly earnings that are up substantially, as viewed on a percentage basis, from the same quarter in the previous year. Ditto annual EPS growth rates. Using our FDX example, the company had FY 2018 diluted EPS of $16.79, and FY 2019 diluted EPS of $2.03—an 88% decline. Ouch. Wrong trend. |

|

enterprise value

|

An alternative to a company's market cap, enterprise value takes a more comprehensive look at a company's real worth. It adds debt, minority interest, and preferred shares to the market cap, and subtracts cash and cash equivalents. This is a useful metric when a company is being considered for acquisition, as the acquirer would be responsible for the acquired's debt load, minus any cash on hand which could be used to pay down that debt. For example, Diana Shipping (DSX) has a market cap of roughly $500 million but an enterprise value of $1 billion as of the time of this writing. If $40 billion A.P. Moller-Maersk (AMKAF), the world's largest shipping conglomerate, wanted to takeover Diana, they could expect to pay at least double the market cap value of the company. Enterprise value can be very useful when comparing companies in the same industry.

|

|

"Fed put"

|

A "Fed put" is simply knowing that the Fed will come running to the rescue of a big decline in the stock market via quantitative easing and/or rate cuts. The problem with this wager is that during past market downturns when the Fed put was in play, inflation was not the big concern it is right now (as of 2022). At best, investors can hope for the central bank pumping the brakes on reducing its balance sheet or raising rates until the markets gain some footing. If inflation remains hot, however, even that prospect is rather low.

|

|

follow-through day

|

A follow-through day in the markets can signal a demarcation point: the end of a downturn and the beginning of a new upturn. An attempted rally (Day 1) is the first signal that a follow-through day may be at hand. The second signal occurs when subsequent days, even if they consist of losses, do not take out the intraday low of Day 1. Finally, the follow-through occurs on Day 4 or later, when one of the key indexes notch strong gains on the back of heavier volume than what was recorded on the previous day. Historically, this indicator has been at the beginning of every new major market uptrend. A follow-through day occurred this past week within the S&P 500, signalling the potential start of a new uptrend. (This definition is courtesy of Investor's Business Daily)

|

|

foreign direct investment (FDI)

|

Foreign direct investment, or FDI, can be considered the life-blood of an emerging economy. It involves investments made by a company, generally headquartered in a developed nation, into the business interests in another country. These could be greenfield or brownfield investments. For the former, an example would be the creation of a brand new production facility to create automobiles on the recipient nation's soil. An example of the latter might be a merger with an auto company based out of the emerging-market country, thus fostering increased economic activity in that area.

|

|

gross profit margin

(or gross margin) |

A company's gross profit margin is a key financial metric to determine overall fiscal health. It is figured by subtracting the cost of goods sold (COGS) from total revenue and then dividing that number by revenue. For example, if a toymaker brought in $100 million in revenue over the course of a quarter, but it cost them $60 million to make the toys sold that quarter, their gross profit margin would be 40/100, or 40%. Obviously, the higher the gross margin the better, but it is important to compare industry players, as the average gross margin varies widely from industry to industry. Also something to consider if you are starting your own business—the average costs associated with your industry could determine your success or failure. Also, since only the direct costs involved in production are included in the gross margin, it is extremely important to also look at a company's operating profit margin, which includes most other items such as payroll and overhead.

|

|

January Effect, The

|

January is historically one of the best months for the stock market, but why? One probable explanation for this start-of-the-year pop has to do with tax-loss harvesting in December. To avoid going into the new year with taxable gains, many investors will sell positions in which they have a loss, and then pick up new positions in January (being careful, of course, to avoid the 30-day wash sale rule). Other possible explanations for the January pick-up include: investors putting year-end bonuses to good use, New Year's resolutions for one's financial state, and increased fund managers' activity with year-end performance goals in mind. For the record, small-cap (up to $2 billion in size) stocks tend to see heavier buying than equities in larger market cap buckets during January.

|

|

Keynesian Put

|

A Keynesian Put, named after the left's favorite economist, John Maynard Keynes, is an expectation by market participants that the government will step in and do whatever is needed to stimulate a struggling economy. This may include massive spending on new government programs, changes in tax policy, and monetary easing by use of the Fed's three main tools. The European Union offers the best example of a Keynesian Put in action, but our own $23 trillion national debt and ultra-low benchmark rates are also examples. Unfortunately, elected and appointed officials often fail to realize just how easy it is to lose control of these "stimulative" measures. For example, approximately ten cents of every dollar the government takes in via taxes is now required just to service (pay the interest on) the national debt. This is up from 6% just a few years ago, and this is in an environment of ultra-low global rates. Were rates to return to historic norms, that ten percent could easily double. Hence, the Keynesian Put that rates will remain low into the foreseeable future to avoid this situation.

|

|

liner shipping (maritime)

|

Liner shipping is the service of transporting goods via high-capacity, ocean-going ships which operate on fixed schedules and travel regular routes. There are approximately 400 liner services in operation today, transporting 95% of all goods around the world, which account for over $4 trillion worth of product. For more information on this industry, check out the World Shipping Council website.

|

|

load factor (transportation industry)

|

Or passenger load factor (PLF). A measure of the capacity utilization of a mode of transportation, such as an airline. The higher the load factor, the more efficient the company is utilizing their equipment. For example, according to Air Transport World, Delta Airlines (DAL) had one of the best PLF ratios of any major US carrier in 2016, at 86.1%. This means that 86.1% of the seats on an average flight were filled by paying customers.

|

|

loan loss provisions

|

Loan loss provisions, also known as provisions for credit losses (PCLs), is an expense set aside as an allowance to cover for unpaid loans and defaults on loans. For example, if a bank expects a higher default rate on its business loans due to an erosion of economic conditions, it will set aside a larger amount than normal to assure it has the cash on hand to cover those bad loans. In late 2023, with expectations for a potential recession on the horizon, the big four banks had set aside around $6 billion in loan loss provisions.

|

|

loan to value ratio (LTV)

|

The loan-to-value ratio, as the name would indicate, represents the ratio between the total amount of a property's mortgage financing and the property's appraised value or selling price, whichever is less. So, if a buyer wanted to purchase a $500,000 home and was applying for a $300,000 loan, the LTV would be 60%. The maximum LTV (how much a bank will lend you to buy the property) is typically 80% for conventional loans, though private mortgage insurance and certain government programs (such as VA loans for veterans) can bring the acceptable LTV quite a bit closer to 100%. The LTV ratio is a metric used by banks to determine the level of risk they would be taking on by underwriting a mortgage. The acceptable risk tolerance level has changed dramatically since the mortgage crisis, as up to that point the financial institutions would typically offload these loans (passing the risk along) by packaging them as mortgage-backed securities (MBS) and selling them to investors.

|

|

max drawdown

|

Max drawdown is an indicator of the risk of a portfolio chosen based on a certain strategy. It measures the largest single drop from peak to bottom in the value of a portfolio (before a new peak is achieved).

For example if a portfolio starts being worth $100,000, increases in value to $150,000, decreases to $90,000, increases to $120,000, then decreases to $80,000, then increases to $200,000, the max drawdown is ($150,000-$80,000)/$150,000 = 46.67% Note that the highest peak of $200,000 is not included in the calculation because the drawdown began at a peak of $150,000. Also note that the increase to $120,000 before the drop to $80,000 has no effect on the drawdown, because $120,000 was not a new peak. FormulaMax Drawdown = (Peak value before largest drop - Lowest value before new high established) / (Peak value before largest drop) *Max drawdown adjusts for dividends using the total return value. The maximum drawdown since January 2010 for the S&P 500 Portfolio is 33.72%, recorded on Mar 22, 2020. It took 97 trading sessions for the portfolio to recover. |

|

MBF (lumber)

|

MBF is typically how lumber is priced. The acronym stands for "thousand board feet," with M being the Roman numeral for 1,000, and BF standing for "board feet." For example, in February of 2022, the price of lumber was sitting around $1,277/MBF. So, dividing by one thousand equals a board price of $1.28/BF.

|

|

medical care ratio

(health care services providers) |

The medical care ratio (MCR) is a measurement of a company's cost compared to the premiums received. For example, if a health insurer had revenue from premiums paid by members of $100 million, and it paid out $90 million for members' health care services, it would have an MCR of 90. Obviously, based on this definition, the lower the MCR the better. A medical care ratio of 85% or less is considered acceptable/desirable.

|

|

mercantilism

|

Mercantilism is a national economic policy in which the government plays a heavy hand in commerce and the overall business environment of a country. While most prevalent in Europe during the 17th and 18th centuries, it is clearly visible today with the likes of an Airbus, which is heavily supported by European governments. As with anything, the more the government interferes, the more consumers suffer. In the end, this is a policy doomed to failure, as it creates artificial markets for goods. Trade barriers and regulations on foreign companies, and subsidies to domestic companies are examples of mercantilism.

|

|

Momentum investing

|

By nature, people love bargains. And secret bargains at that. They want the deal that few others know about, and they want to be the ones who identify the beaten-down stock that others are ignoring, just before the massive breakout. Here's the ugly truth, though: Beaten-down stocks tend to move even lower, while stocks that are hitting new highs tend to keep hitting new highs. Momentum investing takes the old axiom "buy low and sell high" and turns it (at least partly) on its head. This investment strategy says, "buy high and sell higher." And to be clear, we are talking about price momentum, not the dollar value of a share. In and of itself, the price of a share is irrelevant. The fact that some people are more attracted to a $10 stock than a $1,000 stock is another issue, and symptoms of a disease we probably cannot cure. Want a great example of momentum investing? How about buying into Amazon (AMZN) right now at $2,308? Odds are excellent that the shares will go higher. Or Advanced Micro Devices (AMD), whose shares have steadily increased from $37 to $55—just $4 below a 52-week high. These are two excellent companies with great fundamentals. However, if you would rather buy General Electric (GE) because shares have steadily fallen from $13 to $6.50 over the past two months, and they "just can't go much lower," then you are not a momentum investor. The problem is, of course, shares of GE have plenty of room to run—to the downside. Momentum investing can be a powerful trading technique, just be sure and define precisely where you want the shares to go, at what price point you are willing to cut your losses if the direction changes, and automatic stops in place to protect your positions.

|

|

monetary base

|

A monetary base is the total amount of currency that is either in general circulation or in commercial bank deposits held in the Fed's reserves. The term refers strictly to the most liquid of funds, such as notes (paper money), coins, and current bank deposits. Right now, the US monetary base sits at $3.260 trillion, down from $3.618 trillion one year ago. The monetary base increases or decreases through the Fed's open market operations; yet another lever the Fed has (besides interest rate changes) to help steer the economy.

|

|

net interest income

|

Net interest income is a performance metric which measures the difference between a bank's interest bearing assets and what it pays out on its interest-bearing liabilities. For example, if a bank paid 2% on a client's savings account worth $50,000, and that same client had a charge card from the bank with a $50,000 balance and a 7% interest rate attached, the net interest income would be the 5% difference. That is a simple example, but it highlights how sensitive banks can be to changes in interest rates. With rates low and going lower, this is an important metric to consider when evaluating different financial institutions.

|

|

net operating income (NOI)

(real estate) (cap rate) |

In real estate, net operating income is a calculation used to analyze the profitability of income-generating properties. We start by adding up all of the recurring rental and other income streams from the property (or portfolio of properties), then subtracting all of the operating expenses associated with the property or portfolio. Examples of operating expenses would be: utilities, insurance, maintenance, taxes, and the like. Not included would be general corporate overhead, interest expenses, etc. (So, essentially the EBIT of EBITDA in other industries.) NOI measures a property's true profitability, without any of the ancillary operating costs of the company muddying the waters. So, if a property brings in $20,000 per year in leases, and has total annual (direct) expenses of $12,000, its NOI would be $8,000. Taking that one step further, If the property were worth $125,000 the return on investment (ROI) or capitalization rate (cap rate) would be 6.4%.

|

|

network effect, the

|

The network effect is an occurrence wherein the more people using a product or service the greater the value or benefit of that product or service becomes. The Internet in general, or Facebook specifically, are two great examples of the network effect. When a limited number of people used Facebook, it was of limited use. When hundreds of millions of people started using the service, however, it became greatly more valuable—both to the users and to the company. Apple and its various services offerings (for Apple hardware) is another great example of a company creating a virtuous circle (or cycle) with its products and services. The key for a company is to generate a network effect with proprietary technology, as the network effect can also benefit an entire industry at the expense of the original company. (Many argue Tesla is such an example, but we don't buy it.)

|

|

nonfarm payrolls

|

Nonfarm payrolls is the term given to all Americans employed in the US, minus farm workers, private household employees, active-duty military, and non-profit employees. It accounts for approximately 80% of the total US workforce, and is used as a gauge of economic health. Going into 2024, the US nonfarm payrolls number was 157 million.

|

|

off-balance sheet (OBS) financing

|

Anyone who has ever leased a car probably knows that one benefit to this financing is the fact that the liability (what you owe on the vehicle) is not shown on your balance sheet. So, if you have your credit report pulled when going in for a loan, the reviewer would not see this liability, even though it actually exists. For an individual, this is dangerous. For a company, this can be extremely detrimental to the health of the company and, of course, to unaware investors. Enron is a textbook example of a company which used OBS financing to fatally lever itself while keeping shareholders in the dark.

|

|

operating profit margin

(operating margin) |

Operating profit takes the gross profit and subtracts all overhead, administrative, and operational expenses. The latter includes items such as rent, utilities, payroll, benefits, and insurance premiums. Essentially, everything is subtracted except interest on debt and taxes. This is a different metric than gross margin, which only subtracts the direct cost to produce the goods sold (COGS). For example, Eli Lilly (LLY) has a current (at the time written) gross margin of 72%, which seems outstanding. The operating margin, however, is just 19%, reflecting SG&A (selling, general, and administrative) and R&D (research and development) costs. (Net margin is even further down the totem pole, as it includes the cost of servicing the debt and paying corporate taxes. So, it goes: gross margin, operating margin, and net margin. And each should be considered when weighing the fiscal health of a company.)

|

|

opportunity cost

|

The cost of giving up the benefit of owning another option after the current option has been selected. For example, if a health care stock is purchased and goes up 8% within one year, but another health care stock which was being considered goes up 20% over that same timeframe, the opportunity cost would be 12%. In other words, it defines the benefit which would have been received—over and above—had another course of action been taken.

|

|

options, put

|

So, you are worried that your high-flying stock has run-up so rapidly that it is due a serious pullback. You don't particularly want to part with this position, but you really don't want to chance losing your gains. You put a stop loss on the position to head for the exits if it drops to a certain price. That is certainly one way to protect your gains, but what about buying some "insurance" on a drop in the company's share price by purchasing some puts? A put option is a contract which gives you, the owner of the underlying security, the right (but not the obligation—important!) to sell your position at a predetermined price within a specified time frame. Each option you buy gives you the right to sell 100 shares of the security. Let's consider a real-life example. After everyone else had written off FedEx (FDX) following the withering attacks by former partner Amazon (AMZN), you bought 400 shares at $140 apiece, right near the 52-week low. (Nice job, you astute value investor!) FDX has steamrolled ahead to $163 per share, but, fearing a pullback, you buy four puts with a $162.50 strike price for $2.32 each (remember, each put is equal to 100 shares, so you will be charged $232 to open each of these options) and a 17 April expiration. A few weeks later, FedEx reports dour earnings and the share price drops to $150. You "put" your shares on someone else (i.e. close the position) for the $162.50 and make up for the losses you incurred with your 400 shares of actual stock. You can now (hopefully) ride the shares back up. Of course, had FedEx continued to rise in price after you opened the puts, they would have gone downhill at an ever-increasing speed (time value), and you could have either sold them for a loss or let them expire worthless. Either way, this "insurance policy" did its job.

|

|

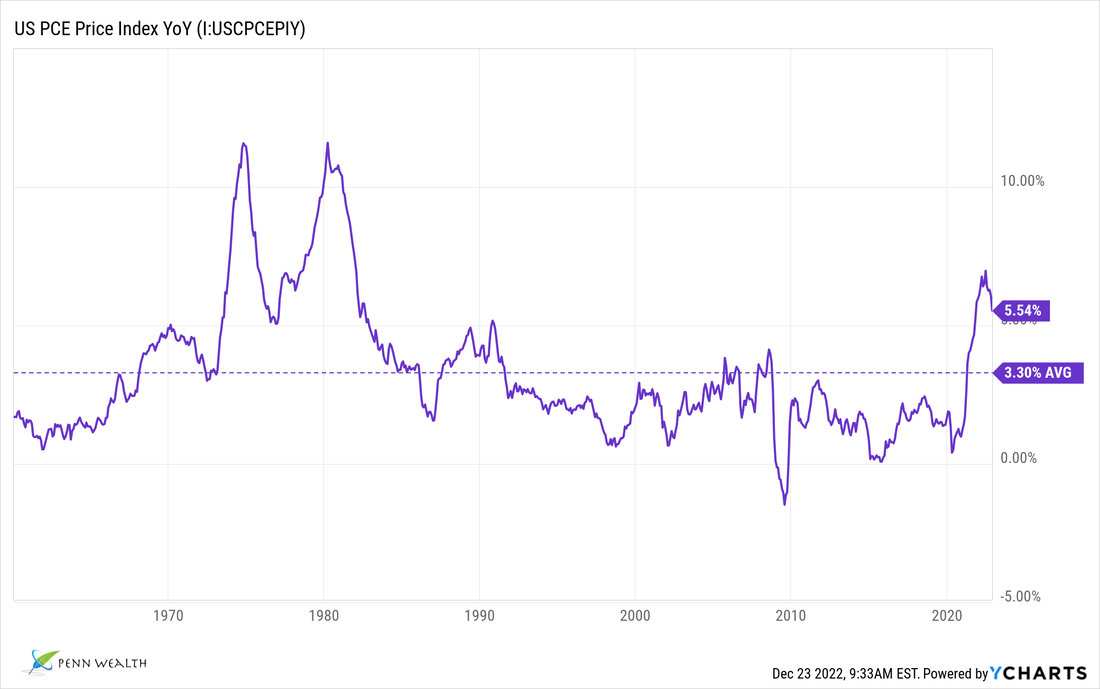

PCE index (Personal Consumption Expenditures)

|

The PCE index, an inflation gauge, is a measure of the prices Americans pay for goods and services. Unlike the CPI, the PCE gauge takes into account how consumers change their buying habits due to rising prices. For example, they may substitute store-branded foods versus premium names, or ground beef versus steak. PCE includes how much is spent on durable and non-durable goods, as well as services. The PCE index is the Fed's preferred inflation indicator.

|

|

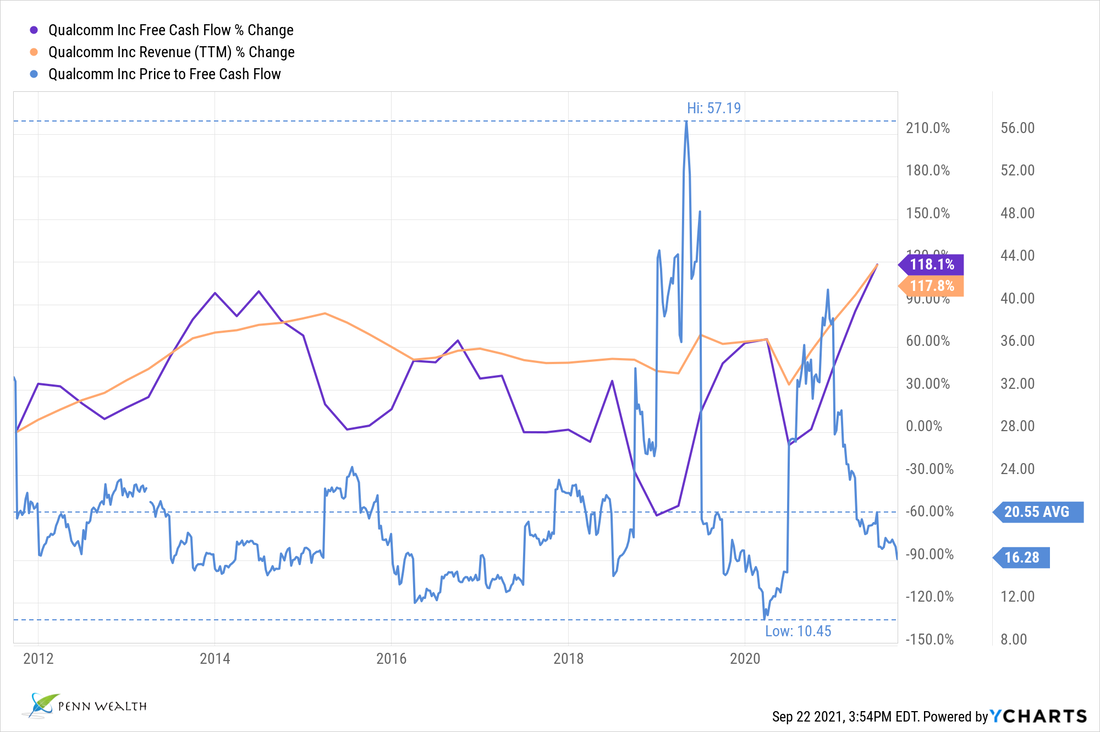

price to free cash flow

|

The price to free cash flow (equation: p/FCF = Market Cap / Free Cash Flow) is an equity valuation metric used to identify whether a company's share price appears under- or overvalued. Since free cash flow equals operating cash flow minus capital expenditures, this metric can point to the financial health of a company as well. The lower the p/FCF metric, especially as compared to a company's peers within the industry, the more undervalued the shares may be. For example: A company has a market cap of $1B, operating cash flow of $200M, and capital expenditures of $100M. the equation would be $1B / (200M - 100M) = p/FCF of 10. That would indicate a very healthy condition, especially if the average p/FCF of the company was, for example, 30.

|

|

price to book value, or P/B value

|

Price to book value is a financial ratio used to compare a company's book value to its current market price. The book value of a company, as opposed to its market cap, is an accounting term which denotes the portion of the company held by its shareholders at accounting value. In other words, book value equates to a firm's total tangible assets minus its total liabilities. There are two ways in which the P/B value can be calculated. The first simply divides the market cap by the firm's total book value as taken from the balance sheet. The second method uses per-share values and divides the company's current share price by the book value per share. As one would imagine, the lower a company's P/B value the more desirable it may be as an undervalued stock to consider buying. This ratio can also be a quick-and-dirty gauge to whether or not a market is over- or undervalued. Right now, the S&P 500 carries a P/B ratio of 3.433, down from a high of 5 in Q1 of 2000 and up from a low of 1.6 in the midst of the financial crisis in Q1 of 2009. In other words, slightly overvalued by this metric.

|

|

Price-to-sales ratio, or P/S or PSR

|

Price-to-sales ratio is figured by simply dividing a company's market cap by its trailing twelve months revenue. It comes in especially handy for companies yet to turn a profit, as they have no P/E ratio. For example, Lockheed Martin LMT has a market cap of roughly $130 billion and sales over the past year of $65 billion, so the company's P/S ratio is 2. The company's P/E ratio, however, is 22, meaning it would take 22 years of equivalent profits to equal what the company is valued at. While the P/S ratio is useful, it must be taken in consideration with other factors such as debt load, especially for unprofitable companies.

|

|

profit center

|

A profit center is a branch of a company expected to directly add to the bottom line of the organization. A sales department or a widget production facility would be two examples of a profit center. This is contrasted by the cost center, which consumes resources. The accounting department or the ESG department would be two examples of cost centers.

|

|

profit margin

(net margin) |

Quick and easy example: Canadian Imperial Bank of Commerce (CM) had revenues of $12.37 billion in 2017. $3.393 billion of that amount flowed down as net income. Divide net income by revenues and you get 29%. So, CM had a profit margin of 29% in 2017.

Deeper dive: A company's net profit margin is simply the operating margin after subtracting the interest paid on corporate debt and the taxes paid. It amounts to what money is left over at the bottom of the funnel, divided by the company's total sales or revenue figure. Example: Boeing (BA) currently has a gross margin of 20%, an operating margin of 11%, and a net margin of 9%. |

|

Relative strength index (RSI)

|

When you are looking at a technical graph of a stock's share price, you will often notice a pane at the bottom labeled "RSI" or "RSI 14." Within the pane you will see a line charting the price of the shares, a vertical/y-axis value between 1 and 100, and two horizontal lines at the 30 and 70 values. This is the relative strength index (RSI), a momentum-driven technical indicator which portrays when a stock might be oversold (undervalued) or overbought (overvalued). Relative strength measures the average gain of up periods during a specified (typically 14 day) time period divided by the average loss of down periods during that timeframe. In theory, a positive momentum which drives the RSI above the 70 line may mean the stock has been overbought and is due to revert to the mean (a trend reversal). Likewise, negative trading momentum which drives a stock's RS below the 30 mark may mean it has been oversold and is due to reverse upward. While RSI shouldn't be the sole buy or sell indicator on a position, it can be a great tool to support or dissuade a decision.

|

|

return on equity (ROE)

|

Return on equity, or ROE, can be a great metric to gauge how efficiently a management team is using the funds entrusted to it by investors. It is a measure of financial performance which is derived by dividing net income by shareholders' equity. In other words, based on the amount of shareholders' money management has been given, what percentage is coming back as profit. Let's use the case of the casinos. Wynn Resorts' (WYNN) ROE is 42.37% for the trailing twelve months (TTM). That sounds pretty good, but it is important to compare this figure to that of industry peers, as some industries can be much more efficient than others based on the nature of what they do. Las Vegas Sands (LVS) has a TTM ROE of 31.46%; MGM Resorts (MGM), 2.90%; and Caesar's Entertainment (CZR), -7.31%. Yep, Wynn is the clear winner in this category. ROE is just one measurement used to gauge the health of a company, but it should always be considered before making an investment.

|

|

risk parity (portfolio)

|

Asset allocation is typically thought of as a way to spread capital around between the various asset classes based on market conditions and an investor's risk tolerance. For example, a conservative growth portfolio might look like this: 60% equities, 25% fixed income, 10% cash, and 5% alternatives (such as commodities). Risk parity, on the other hand, focuses on the proper allocation of risk, rather than by asset class. If equities currently carry 90% of a portfolio's risk, and fixed income the other 10%, a risk parity portfolio would reallocate until both pieces are in "risk parity." Which, in this simple example, would mean greatly reducing the equity holdings and reallocating the capital to fixed income. Risk parity portfolios also include other asset classes (commodities, real estate, convertibles, etc.), with the goal of equalizing risk between these classes. When stock market risk rises, using a real world example, risk parity funds will be forced to sell out of equities to keep the equilibrium, further exacerbating a market selloff. Two examples of a risk parity investments are AQRIX, the AQR Risk Parity fund, and HRA, the Horizons Global Risk Parity ETF.

|

|

Rule of 20

|

The Rule of 20 is a calculation which attempts to discern the fair value of the stock market. The Rule says that the approximate fair value of equities hits equilibrium when the sum of the market's overall P/E ratio and the rate of inflation add up to 20. So, if the P/E ratio is 18 and the current rate of inflation is 2%, the market is fairly valued. Anything above 20 means valuations are rich; anything below 20 indicates an undervalued condition may exist.

|

|

special purpose acquisition company

(SPAC) |

Virgin Galactic will be going public this year (2019). It will do so with the help of a SPAC, or special purpose acquisition company. This type of publicly-traded entity accumulates capital for the purpose of acquiring all or part of an existing company. As money is raised in a blind pool, investors are banking on the unique expertise of the asset manager(s). Consider these entities shell companies to be filled with a target company to be identified at some later date. For example, in the case of Virgin Galactic, SPAC Social Capital Hedosophia (IPOA), which has been around nearly two years, will help bring the company public and own a 49% stake. As it has been an empty "shell" for two years, IPOA has hovered quietly around the $10/share range.

|

|

spot price

|

The current price of a specific asset, such as a currency or commodity.

|

|

stagflation

|

Stagflation is a nasty condition in which inflation is running hot, but economic conditions are weak and unemployment is relatively high. The condition was first labeled back in the 1970s as economies around the world were facing recession, but inflation was running hot due to oil shock.

|

|

takeaway capacity

(energy services) |

The total capacity for moving crude oil out of a region, such as the Permian Basin, via pipeline, rail, and truck.

|

|

term premium

|

The added compensation investors expect to receive for the unknowns associated with holding longer-term debt. For example, if an investor buys a 30-year Treasury bond yielding 5% and the economy begins soaring, forcing the Fed to hike rates to curb inflation, that particular Treasury would fall precipitously in value. This is why most advisors recommend laddering maturities to mitigate risk within a bond portfolio.

|

|

terminalling

(oil & gas storage & transportation) |

Terminalling refers to the midstream process of transporting/storing natural gas and crude oil. Terminals are the tank farms (picture the large, round, white storage tanks you have probably driven by any number of times) where LNG, gas, and crude oil is temporarily stored to facilitate its movement from or to refineries. Terminals play an essential role in getting raw energy from its source to its ultimate destination.

|

|

time charter equivalent (TCE)

|

A maritime term, time charter equivalent is a metric used to calculate the average daily revenue performance of a a vessel. To calculate: take total revenue for a voyage and subtract all costs, then divide by the voyage duration in days. For example, the TCE for a Suezmax oil tanker in 1Q2018 might be $13,500.

|

|

total addressable market (TAM)

|

Total addressable market reflects the total possible market for a good or service, expressed in terms of annual revenue or unit sales. For example, analysts at Barclays recently expressed a belief that the total addressable market for plant-based meats would reach $140 billion in ten years. If Beyond Meat (BYND) only controlled 10% of TAM, it would generate the company $14 billion in revenues. TAM is slightly different than the serviceable available market (SAM), which limits the universe to the portion of TAM served by a company's specific products or services.

|

|

trailing stop-loss

|

Stop-loss orders can be an excellent way to protect your gains and limit your losses on specific holdings. However, unless you have time to constantly monitor your stops—adjusting as needed—you might want to consider a trailing stop-loss. With a trailing stop, you specify the percentage or dollar amount at which you will exit a position, and this order "sticks with" the underlying position should it continue to move higher. For example, suppose you pick up shares of drugmaker Pfizer (PFE) at $35. You expect the shares to go up, but if they fall to $30 you want out. You could set a trailing stop ($) at $5, or a trailing stop (%) at 15%. Either way, if the stock drops from $35 to $30 or less, either order will trigger. If Pfizer goes up to $50, however, both orders will stick with the position, but with different effects. On the $5 trailing stop, your position would trigger if the share price falls to $45. However, with the 15% trailing stop it would trigger at $42.50 (15% less than the $50 share price). You want to consider the typical fluctuation of the underlying security so that you do not get knocked out due to normal volatility of the shares. That fluctuation can vary widely from position to position.

|

|

Unrelated Business Taxable Income (UBTI) as related to IRA accounts

|

Limited partnerships can spit out unrelated business taxable income (UBTI) each year, which is reported on the K-1. UBTI is income regularly generated by a tax-exempt entity due to taxable activities not related to the main business of that entity. Without getting any deeper into the weeds, there is one important aspect to consider when looking at the UBTI box on the K-1: as long as the total amount of UBTI for any given qualified account ( not owner ) is under $1,000, no tax obligation is triggered. This is almost always the case, which is why it is perfectly acceptable to hold limited partnerships in an IRA. That being said, it is always important to have your tax preparer or CPA review all K-1 documents, even if they do arrive a month after your taxes have been filed.

|

|

Veblen goods

|

Thanks to Mike Santoli of CNBC for today's financial term. A Veblen good, named after economist Thorstein Veblen, is a luxury item which sees its demand actually rise as its price rises. This turns the traditional demand curve on its head, which says that price and demand have an inverse relationship. Veblen goods are typically luxury items which serve as status symbols for the affluent. For example, demand for a piece of artwork might go up as its price goes up as wealthy art buyers want to own something which few others could afford. Another example would be a rise in demand for high-end Rolex watches as they are released at higher price points.

|

|

vertical integration

|

Vertical integration takes place when a company begins buying up or otherwise taking control of the various levels required to move its product(s) along the sequential stages required to bring it to market. Traditionally, a company might design a product, but it must then find various companies to produce, package, distribute, and sell the product to generate revenue. To better control the entire process and to improve efficiencies, the designing company might purchase a firm that does each of these steps, thus becoming vertically integrated. Backward integration takes place when a company expands backward to the production phase. Forward integration is when a company takes direct control of the distribution and final sale of their product(s). Perhaps the greatest historical example of vertical integration involved John D. Rockefeller's Standard Oil. Rockefeller's goal was not only to create a high level of efficiency, it was also to control the industry. This led to the government breaking up Standard Oil, as it had become a monopoly. Vertical integration should not be confused with horizontal integration, which takes place when a company begins buying up its competitors in an attempt to control its respective industry or market.

|

|

wage-price spiral

|

An overall rise in the cost of goods due to a general rise in wages. To maintain profits after an increase in wages, companies generally need to pass along those costs to customers via higher rates for goods and services. In a vicious cycle, higher wages cause higher prices, which in turn cause workers to demand even higher wages.

|

|

wash-sale rule

|

Suppose an investor has a loss in an equity position. He or she wishes to utilize the loss on their taxes for the year, but they do not want to necessarily part with the position. If they sell the position for the loss, then buy it back within 30 days, they are violating the IRS regulation known as the "wash-sale rule." One way around this rule would be for the investor to sell the position in question, and then buy another company in the same industry, or perhaps an ETF with the same characteristics as the liquidated position, instead of the exact same position.

|

|

wealth effect

|

(Behavioral economics) The wealth effect is a theory which suggests that people spend more as the value of their assets—such as their home and company 401(k) plan—rise. This can happen despite the fact that their income has not risen and their fixed costs have not gone down.

|