Interactive Media & Services

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

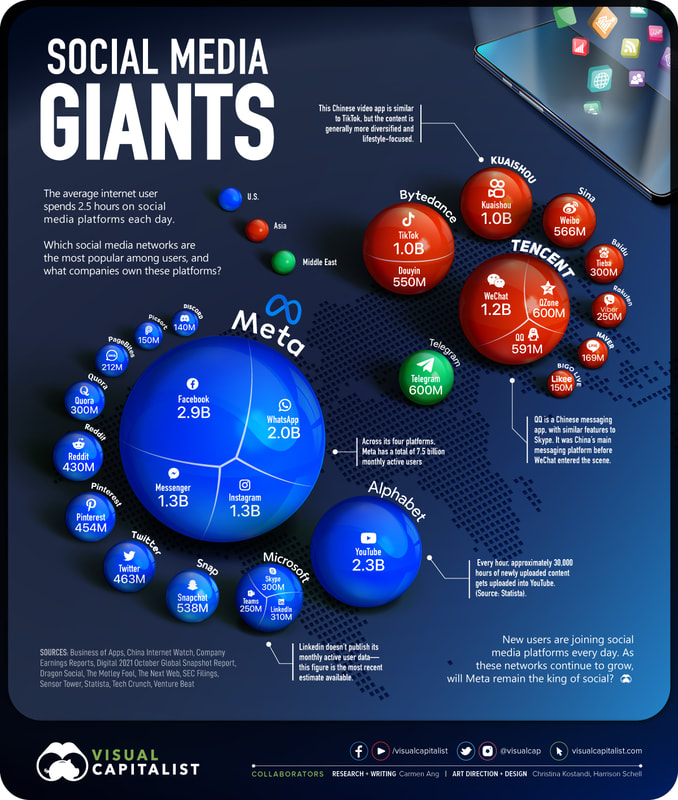

Graphic courtesy of Visual Capitalist

|

RDDT $49

22 Mar 2024 |

It's only fitting that Reddit should soar like a meme stock at open

After all, it was the subreddit r/wallstreetbets that helped push AMC Entertainment (AMC $4) up to $640 per share in the summer of '21, and Radio Shack-like GameStop (GME $13) up to $120 four months prior. Shares of social media platform Reddit (RDDT $49) were priced at $34 in the IPO market, but only the anointed few could have purchased them at that price: they began trading around $48 and the fan base was buying shares at $57.80 exactly six minutes later. When IPO day was complete, shares were sitting just shy of $50—a 48% premium to the IPO price. It's not clear how soon Reddit can turn a profit (it lost $91 million on $800 million of revenue last year), but one financial tidbit which is known is the CEO's salary leading up to the launch. Steve Huffman, who founded the company with Alexis Ohanian while the two were roommates at the University of Virginia, had a salary of $193 million in 2023. Granted, the majority of that largesse was awarded through a complicated scheme that Rube Goldberg would be challenged to draw on paper. Another "known" is the share class structure. We loathe multiple share classes designed to favor the few—why not just stay private if you want to retain that level of control? (We all know the answer to that, of course.) Average, ordinary investors will only be allowed to buy Class A shares, which provide for one vote per share. In addition to owning some 400,000 of those himself, Huffman will also own over 4 million shares of Class B stock—which offer ten votes per share. Class B owners will control some 97% of the total voting power. All of this isn't to say that Reddit won't turn a profit one of these days. Revenue is generated through advertising and ad-free premium memberships, and the company plans to use its IPO windfall to massively increase its advertising effort. But it enters a crowded market of social media giants, and it faced a mini revolt on its last money-making scheme: charging third-party apps fees to retain access. As of yet, we don't see an animal that will become Reddit's cash cow; only an appeal to the content provider's 72 million daily active users to keep buying stock. We are so reminded of our Penn Wealth Report issue entitled "The Show Must Go On." It highlighted schemes like NFTs, SPACs, and meme stocks during their heyday. On that cover was the following warning: "This Will Not End Well." |

|

Twitter

|

Monetizing Twitter: Elon announces a new price plan for Twitter Blue

We were familiar with the white checkmark in a blue circle next to the name of Twitter users, but we never really gave much thought to who gets one and who does not. Introduced in 2009, this verification system was meant to provide a level of validity to notable account holders, such as celebrities, brands, and organizations. Sort of a caste system on the platform to separate the gentry from the hoi polloi, or unwashed masses. Elon Musk, self-proclaimed Chief Twit, is not a fan of such hierarchies, and he sent out a great tweet indicating what he thought of the policy: “Twitter’s current lords and peasants system for who has or doesn’t have a blue checkmark is bulls***. Power to the people! Blue for $8/month.” Twitter Blue has been a subscription-based service which allows users to edit tweets, organize them into folders, and access other member-only perks. While Twitter has some 300 million daily active users and generated $5 billion in revenue last year, only around $6.4 million came from users paying the $4.99 monthly membership fee. Elon Musk has a grand vision for Twitter, and monetizing the platform is paramount. While the fee would go up to $8 per month, qualified users would be virtually guaranteed of receiving the coveted blue checkmark, and we can certainly expect Musk to roll out more perks in the months to come. His ultimate goal is to create what he calls “X, the everything app.” This “super app” would include social media interaction, messaging, payments, and even the ability to order food and drinks. Doubters abound, just as they did with Tesla in the early days, and some companies are indicating they may stop advertising on the platform. They will end up on the wrong side of this story after Musk is done writing it. This past Friday, we saw a tweet which read: “Twitter hasn’t been this much fun in years.” Despite the naysayers, we fully expect Musk to transform what the platform is today into something quite different—and much more powerful. Some users and advertisers won’t come back, but we doubt the new owner, with his “move fast and break things” mentality, will give them a second’s worth of thought. |

|

SNAP $10

26 Oct 22 |

Snap continues to disappoint the Street; is the stock now cheap enough to buy?

It is becoming a quarterly ritual: Snap (SNAP $10) reports earnings, and we report the company’s double-digit share price drop. It just happened again. Last Thursday, for the third consecutive quarter, Snap missed on both revenues and net income, generating $1.128 billion in sales and losing $359.5 million in the process. Management then proceeded to give an outlook so lousy that the company’s shares gapped down some 28% on the day. While they have climbed back a bit from their new 52-week low of $7.33, investors shouldn’t be too eager to jump in at these “bargain basement” prices (shares remain down 80% for the year). Snap has an impressive base of 158 million daily active users, but the company generates nearly all its revenue from advertising; and 88% of those ad dollars emanate from US companies. After surprisingly bad numbers from much larger competitor Alphabet (GOOG $105), particularly in its Snap-like YouTube unit, expect a rough year ahead as the US muddles through a recession. Digital ad spends are among the easiest cuts made by corporations as they hunker down in preparation for an economic downturn, and Snap would be an easier advertising cut to justify as opposed to a pullback in online ads at Google, for example. In short, we fail to see any near-term catalysts that would drive the shares substantially higher from here. We have discussed the comically skewed share class structure (in favor of management) at Snap, so no reason to rehash it now. Suffice to say investors looking for deals among the tech carnage can find better opportunities elsewhere. |

|

TWTR $52

|

Twitter pops after Elon says he will buy the company under original terms

There have been a lot of crazy twists and turns in the Musk/Twitter (TWTR $52) saga, but we didn’t see this one coming. In a surprise move, Musk has said he will buy the social media platform under the original terms agreed upon: $54.20 per share, or $44 billion. Odds were stacked against him in the pending non-jury trial, slated to begin later this month, but it is rather strange that he did not come in with a lower offer. While it may not have been enough of a “smoking gun” to get him out of an ultimate deal, his argument that the company was hiding the enormity of the spam bots and fake accounts problem was substantiated by Twitter’s fired head of security—Musk’s key witness. While Twitter shares spiked 13% on the news and 20% in the ensuing days, the market cap still sits about $5 billion below the offer price. The press is making it sound as though Tesla (TSLA $242) shareholders hated the deal, but shares of the EV maker fell very little after the bombshell announcement. In the next issue of the Penn Wealth Report, we will delve into what Musk hopes to accomplish with his new platform. Hint: think indispensable “super app.” We believe Musk can create a turnaround story at Twitter, a company which was never effectively monetized by erratic found Jack Dorsey and his hand-picked successor, Parag Agrawal. Of course, that will all take place (post deal) with Twitter as a privately held company. As for publicly traded Tesla, shares look like a steal at $242, and we maintain our $333 price target. We own Tesla in the Penn New Frontier Fund. |

|

SNAP $13

|

Snap shares just fell 43% in one day; in 2017, we called the company’s share class structure a sham

(25 May 2022) After social media company Snap (SNAP $13) lowered its outlook for the year—ultimately causing shares of Snapchat’s parent company to fall 43.08% in one day—we immediately began perusing our past notes on the firm. Our first comments came in February of 2017 as the company was about to begin its IPO roadshow. Setting a price target of between $14 and $16 per share, the company would immediately have a $20 billion market cap in what would be the largest US tech offering since Alibaba (BABA $82) went public in 2014. We urged investors not to bite. The roadshow was such a success that the IPO shares were more than ten times oversubscribed. They ultimately priced at $17. Our next note on Snap came just a month later, in March of 2017. This time we said that investors were getting a raw deal with respect to the share class structure. Get this scheme: The company would sell schmucks like us Class A shares, which came with no voting rights but did “entitle” buyers to attend the annual shareholders’ meeting and “ask questions.” Gee, thanks. Executives of the company could acquire Class B shares, which came with one vote each, while Snap’s founders would own the coveted Class C shares which came with ten votes apiece. Talk about some fancy financial engineering. The catalysts for our other notes on Snap were earnings reports. In all but one case, shares had plummeted on lower-than-expected numbers or worse-than-expected guidance. The latter was the cause for Tuesday’s 43.08% drop, taking the shares down to $12.79, or 25% lower than the $17 per share initial offering price. What a mess. SNAP shares now sit 85% off their September 2021 highs. Some might see a bargain; we still see an aristocracy in which the company’s rulers have no idea what they are doing. |

|

TWTR $50

|

Twitter rockets higher after Elon Musk takes 9% stake in the social media platform

(04 Apr 2022) A few weeks ago, Elon Musk took to Twitter (TWTR $50) to throw some shade the company's way. After calling the social media platform the "de facto public town square (for the exchange of ideas)," he asked his 80 million followers, "Do you believe Twitter rigorously adheres to this principle (of free speech)?" For the record, the response was 70% to 30% in the negative. Several months before positing this question, Musk tweeted an altered image of CEO Parag Agrawal seemingly doing away with founder and former CEO Jack Dorsey by pushing him into a river. Our opinion is that the tweet was more of a joke than anything (it was funny), but analysts began questioning whether he had it out for Twitter's new boss. On Monday came the news that, around mid March, Musk had made himself the firm's largest shareholder, with a 9% stake worth around $3 billion. News of the stake sent TWTR shares rocketing 27% higher—to $50—in Monday's session. While his position is classified as a passive stake per his 13G filing, it is hard to imagine Musk making his first major investment in a publicly-traded company (outside of one which he controls) without having a say in how the company is managed going forward. Especially given his record of tweeting what is on his mind. The simple fact that he is the largest shareholder gives him more sway over the company than The Vanguard Group or Morgan Stanley Investment Management—the second and third largest shareholders, respectively. The interesting questions become, what will he do with this power, how might (his chronic nemesis) the SEC respond, and what are his larger designs? Stay tuned. With Twitter shares still down nearly 40% from their highs, even after the Musk bounce, is the platform a buying opportunity? To say we weren't fans of Jack Dorsey would be an understatement, but we have about as much confidence in Agrawal as Musk seems to place in him. Perhaps this new shareholder can be the catalyst the company needs to better monetize its business and actually become the "de facto public town square for the exchange of ideas." Until Musk's plans are a little more clear, we still wouldn't be buyers. |

|

FB $214

|

More trouble for Facebook: Google just pulled an Apple

(17 Feb 2022) Last year, Apple (AAPL $171) made changes to its operating system, iOS, which had a dramatic effect on Meta Platform's (FB $214) Facebook unit. Specifically, thanks to Apple's App Tracking Transparency feature, iPhone users could essentially cut off the wealth of data previously shared with Facebook advertisers to help them reach their target audience. For example, if an iPhone user happened to make regular shoe purchases through various apps, a footwear advertiser on Facebook could reach this potential customer with targeted ads. Now, iPhone users must opt in to having their activities on any given app tracked in such a manner. As could be expected, this is already having an effect on ad spends within the platform. In a stark admission, Facebook said that the changes would be responsible for a roughly $10 billion decrease in revenue this year. That equates to nearly a 10% hit. Now, the second shoe has dropped. Alphabet's (GOOG $2,703) Google unit just announced that it will be rolling out its "Privacy Sandbox" for Android-based devices which will limit cross-site and cross-app tracking. While not quite as draconian as Apple's forced "opt in" measures, these steps will certainly have a negative impact on Facebook's ad business. This move follows a previous Google decision to phase out third-party tracking cookies on its Google Chrome browser. This gives Google Ads, the company's online advertising platform formerly known as Google AdWords, a definitive leg up in the battle for ad dollars. After all, the simple act of searching for goods or services via the browser gives the company user information in an "organic" manner (i.e., no third-party tracking apps required). As if Meta didn't have enough on its plate already. After its shares fell sharply, we re-added Meta Platforms to the Penn Global Leaders Club. Despite its perpetual headwinds, keep in mind that it still controls the world's largest online social network, with nearly 3 billion monthly active users. We also believe the metaverse will be a transformational movement which will reshape both entertainment and business as we know it (we recall many rolling their eyes at the Internet as well), and that Meta Platforms will be a major player. We retain our $442 initial price target on the shares. |

|

GOOG $2,961

|

Alphabet's blowout quarter and a 20-for-1 stock split makes the company look even more attractive

(03 Feb 2022) The $2 trillion holding company of Google, Alphabet (GOOG $2,961), just announced its best quarter ever, easily blowing away pretty hefty expectations for the period. Analysts had predicted revenues of $72.3 billion and earnings of $27.68 per share; instead, the company reported Q4 revenues of $75.3 billion and EPS of $30.69. As if that weren't enough, CFO Ruth Porat announced plans for a 20-for-1 stock split, making the company more attractive to a wider swath of investors and raising the odds that it will soon be included in the Dow Jones Industrial Average. The revenue windfall amounted to a 32% increase from the same quarter last year, and was buoyed by advertising sales of $61 billion. The company's YouTube business, which boasts some 15 billion views per day, accounted for $8.63 billion in sales. The company is far and away the hottest destination for digital advertising dollars, which accounts for some 80% of total revenue, but it also wants to diversify its offerings. Although it barely makes a mark in the lucrative cloud computing business, an area dominated by Amazon Web Services and Microsoft Azure, the company is investing heavily to grow its 6% stake. Google has tapped into its over $140 billion stash of cash, for example, to buy an equity stake in Chicago-based exchange CME Group (CME $241) in return for the company's long-term cloud contracts. This seems like a natural arena for the Internet media giant, and the cloud services pie is only getting bigger. As for other opportunities to widen its scope, recall that Google changed its name to Alphabet for a reason. From the metaverse to self-driving vehicles (it bought autonomous driving tech company Waymo in 2016), we expect the skilled team of CEO Sundar Pichai and CFO Ruth Porat to continue generating stunning quarterly results for investors. We have figuratively banged our heads against the wall trying to explain to certain clients over the years that just because a stock is priced at $10 per share, it is no more undervalued (all other facets being equal) than if the shares were selling for $10,000 apiece. Nonetheless, while the stock split will not add one cent of value, we do applaud the move. Psychology is a powerful tool to use when analyzing investor behavior. Based on the company's current share price, it would be trading around $150 per share were the split completed today. Rather than saying Google shares are worth $6,000 each, let's just say we could see them growing from $150 to $300 in a reasonable amount of time post split. |

|

FB $317

TWTR $45 |

A visual of the world's largest social media networks and who owns them

(06 Dec 2021) Thanks to Visual Capitalist for providing this rather stunning graphic of who actually dominates the explosive world of social media. Shortly before they changed their name to Meta (FB $317), we added shares of $900 billion Facebook back into the Penn Global Leaders Club after a hiatus. Looking beyond the ceaseless attacks by politicians on both sides of the aisle, we believe this company's embrace of the metaverse will lead to a long-term growth trajectory beyond the scope of most analysts' imagination. From a social media usage standpoint, nobody comes close: Meta companies (Facebook, Instagram, WhatsApp, and Messenger) have an aggregate 7.5 billion monthly active users (MAUs), which equates to advertising pricing power miles ahead of the competition. (To be clear, if one person uses all four platforms, as we do, they would be counted four times; still, those numbers are remarkable.) From an individual platform standpoint, Alphabet's (GOOG $2,882) YouTube comes in second to Facebook, with 2.3 billion MAUs. We already own the third largest controlling company on the list, Microsoft (MSFT $326; Skype, LinkedIn, Teams), which continues to be one of our highest conviction names. Skipping over Snap (SNAP $48), which we have never been fond of from an investment standpoint, we come to Twitter (TWTR $45) and its 463M MAUs. Now that Dorsey is gone, we are actually considering picking up some shares of TWTR for the Intrepid Trading Platform. We believe the promotion of Chief Technology Officer Parag Agrawal to the CEO role makes sense for a company which hasn't been able to effectively monetize its business model. Then again, we also thought it made sense for JC Penney to hire Ron Johnson—the guy who created the Apple store model—as CEO, so it is always prudent to wait for evidence of leadership abilities before jumping in. As for the red balls on the list, the Asian names, we wouldn't touch any of them. At the risk of being labeled a metaverse fanatic, most truly don't understand how the two-dimensional world of social media will morph over the coming years into something truly interactive. Facebook is proven it is all in, which is why it is our number one play in the interactive media and services space. |

|

FB $315

|

What's in a name? Perhaps we are in the minority, but we are thrilled about Facebook morphing to Meta

(29 Oct 2021) Listening to David Faber (Little Lord Fauntleroy) of CNBC talk about Facebook's (FB $315) push into the metaverse reminded us of his mentor, the late Mark Haines, bashing Apple's new iPad back in 2014. There are creative souls who design and build the future, and then there are the naysayers telling us—every step along the way—all of the reasons failure is inevitable. As for Facebook's grand plans for its future, it all begins with a name change. On the 1st of December, the company Meta, formerly known as Facebook, will begin trading under the symbol MVRS. Predictably, the jeers began immediately after Zuckerberg announced the change, with many (if not most) claiming this was just an attempt to distract the focus away from the endless political attacks on the firm. We simply don't buy that. Already an owner of Oculus, the leading maker of virtual reality hardware, Facebook is ready to embrace the "next evolution of social technology," as the firm labels the metaverse. Imagine communicating and interacting with others not in the 2D environment of a Facebook app, but in a computer-generated digital environment. A "face-to-face" game of golf, a board meeting, "visiting" a digital clothing store—it will all be possible in this new virtual world. While a Faber or a Haines (were he still alive) could never generate the sparks of creativity required to envision such a place, the opportunities will be endless—for participants, involved companies, and investors. Zuckerberg said that the company will now be a "metaverse-first, not a Facebook-first, firm." To that end, Meta has already committed $10 billion to its Reality Labs division, and will begin breaking out the financial results for the two sides of the company. Our bet? As profitable and dominant a player Facebook has become, its metaverse division will, ultimately, eclipse its traditional business. There will be plenty of competition along the way, and we expect Apple (AAPL $150) to roll out its own metaverse hardware soon, but Facebook will be a major player in this nascent industry. We vividly recall the ascent of the personal computer and, subsequently, the Internet. Both of these massive disruptors began as something of a gimmick in the minds of journalists and the business community. Consider how these two "gimmicks" have changed the way we live. Consider living and working through the pandemic without them. The potential of the metaverse is enormous; now is the time for astute investors to begin understanding what it is, and how it will weave its way into the fabric of society. As for MVRS, we can officially say we owned while it was still just a social media platform. |

|

FB $356

|

Facebook joins the Trillion Dollar Club after judge throws out the FTC's complaint

(28 Jun 2021) Talk about some rarified air: Facebook (FB $356) joined an elite group of companies carrying a market cap of over one trillion dollars after a US District Court judge threw out the antitrust complaints against the company filed by the Federal Trade Commission and virtually all states' attorneys general. That dismissal led to a 4.25% pop in the company's share price, giving it a $1.009 trillion valuation. Facebook joins Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) in the tiny group of companies which can boast of a $1 trillion size. While Judge James Boasberg disputed the FTC's claim that Facebook was a monopoly, he did leave the door open for the agency to amend its complaint and submit a revised filing. Had it been successful, the complaint could have forced Facebook to divest itself of both the WhatsApp and Instagram platforms. The court seemed to excoriate the plaintiffs' lack of effort, at one point in the ruling saying that the allegations "do not even provide an estimated figure or range for Facebook's market share at any point over the past ten years...." Ouch. It seems as though the judge felt there was some hubris involved in the suit, with an "expectation" that the court would find fault in Facebook's business practices. Arrogance and hubris among government officials? Shocking. Despite all the bluster among elected officials about cutting these big social media companies down to size, we think very little gets accomplished (to that end) in the near future. As a matter of fact, a 20% investment in each of these five behemoths—beginning today—would probably yield some impressive results if we were to go forward five years in time and gauge the investment bucket's return. |

|

TWTR

|

Twitter suffers massive cyber-attack

(16 Jul 2020) It was the worst security breach in the polarizing social media company's history, causing its shares to plunge. Midweek, some of Twitter's (TWTR $20-$34-$46) most notable users, to include names like Obama, Gates, Buffett, and Bezos, began posting odd requests for money to be sent to bitcoin accounts. "I am giving back to the community," read Joe Biden's tweet, "All Bitcoin sent to the address below will be sent back doubled!" It worked, in fact, as hundreds of thousands of dollars may have been collected from the scam within minutes of the tweets being posted. It appears likely that the hack took place with the help of insiders—Twitter employees who were able to access internal account management tools. At a time when Twitter is under pressure from government officials for its political forays, and activist investors for the underwhelming monetization of its platform, this serious incident was the last thing the company needed. Last year, CEO Jack Dorsey's own personal account was hacked, with bizarre tweets emanating from the founder's handle. Twitter, which began trading in November of 2013, will report earnings this coming Thursday. |

|

GRPN

|

Groupon, dropping 42% in one day alone, becomes a shell of its former self. (19 Feb 2020) Companies have personalities, just like people. Some we love, some we loathe, and some are just...meh. For us, Groupon (GRPN $2-$2-$4) has remained in the second category pretty much ever since it went public. The company (meaning top executives) took some actions early on that made us question everything about the firm. Needless to say, we have never owned the discount "middleman." And that has been a good thing. Once a $5 billion company selling for $26 per share, GRPN now has a market cap of $1 billion and is going for $1.78. The final red flag for investors seemed to come when management telegraphed it would be looking to do a reverse split—almost always a sign of desperation. That is pure financial engineering and window dressing, designed to make a potential disaster-in-the-making look like a more attractive option for investment dollars. (Plus, are you really going to attract more investors with a $4 stock as opposed to a $2 stock?) Yet another red flag was raised this week when Groupon announced it would be exiting the physical goods space altogether, focusing on "local experiences." Stating that the physical goods space was saturated, it saw a $1 trillion market for these experiences. That enormous number may hold true, but who knows what microscopic fraction of the $1 trillion will involve someone using Groupon? And, even if they do, the company receives just a tiny percentage of that amount. As for what really matters, the numbers: Groupon's revenues fell 23% YoY in the most recent quarter. Yikes. There is a lot more I would like to say about this company, but better judgment says to leave it at this: avoid the stock like the plague.

|

|

FB

|

"Everyone" hates Facebook, but is anyone concerned about government overreach? (24 Jul 2019) It feels as though we are in the 5% minority on this issue, but we are bothered by the wanton use of force against private-sector companies by the anointed ones in the public sector. The Federal Trade Commission just hit Facebook (FB $123-$204-$219) with a $5 billion fine (er, "settlement") stemming from privacy violations it claims the company committed back in 2012, plus stripped CEO Mark Zuckerberg and the FB board of some rather ordinary leadership powers. The fine is no big deal for the $600 billion firm, but the intrusion into the board room by a bunch of politicians is a big deal. Even more disconcerting is the angry reaction by Democrats sitting on the FTC, who wanted Zuckerberg held personally liable. Is that where we are at right now in this country? How about we start throwing CEOs in prison every time there is a data breach? Why stop there, let's give them ninety days of jail time for an earnings miss. After all, Dodd-Frank put corporate leaders on the hot seat for virtually everything that happens at a company. It may sound facetious, but the scariest component of this story is the percentage of Americans who would be happy placing someone in the pokey because they disagree with their political point of view. We are not talking about real criminals, like Kozlowski of Tyco, Ebbers of Worldcom, or Ken Lay of Enron; we are talking about people simply disliked for the way they think. That sounds a lot more like North Korea than a Western republic. A little more analytical thought and a lot less gulping down of the false narratives presented as fact by a lazy and tainted press corps would go a long way in leading us back down the road toward national sanity. While it was down on news of the settlement, Facebook regained all lost ground after reporting unexpectedly-high revenues of $17 billion for the quarter, and profit roughly equal to the FTC fine (settlement).

|

|

FB

|

We hate bitcoin, but we love Facebook's new move into digital currency. (18 Jun 2019) It is simply a brilliant new strategic move by Facebook (FB $123-$191-$219), the #22 company (out of 40) in the Penn Global Leaders Club. The $547 billion social media firm just created a new subsidiary—Calibra—which will be responsible for creating the digital wallet to house Facebook's new digital currency, the Libra coin. Unlike its tarnished cousin, bitcoin, the Libra will be a stable currency, as its value will be tied to real-world "hard" currencies. The goal (besides Facebook making a ton of money off the proposition), according to Calibra chief David Marcus, is to "provide billions of people around the world with access to a more inclusive, more open financial ecosystem." In other words, the 67 million underbanked (those who manage their finances primarily through cash transactions) Americans out there are about to have an exciting new way to conduct business and buy goods and services. As for privacy, the Calibra division won't share any personal data with the social media side of Facebook (yes, we hear you cynics out there), which means no ad targeting and the like for Libra users. For doubters, consider this: companies already partnering with the Libra include Visa, Mastercard, PayPal, Uber, Lyft, and eBay. Facebook expects the digital wallet to be up and running by next year, and it will be accessible via a standalone app, Facebook Messenger, and WhatsApp. This will be an enormously prosperous global enterprise and Facebook will reap the rewards. Period.

|

|

FB

|

Facebook jumps nearly double-digits as the social media giant posts scorching revenue gains. (25 Apr 2019) As investors were piling on social media behemoth Facebook (FB $123-$200-$219), and as congressional airheads were haranguing company executives on the Hill, we were busy picking up shares of the company near a 52-week low for the Penn Global Leaders Club. Our timing could hardly have been better. After posting a 26% jump in revenue for the quarter, to $15.08 billion, shares jumped nearly 10%, to $200. As for all of the blowhard talk in D.C. actually manifesting into action against the company, management announced it was setting aside $3 billion for a probable ruling against them. That may seem like a lot (and, indeed, it would be one of the biggest fines in corporate history), but keep in mind that FB is sitting on a stockpile of around $42 billion in cash. New ad dollars are going to the digital world—that is simply a fact. And other than Alphabet (GOOGL), no other digital company is raking in those ad dollars like Facebook. We expect $250 per share to be the next stop.

|

|

TWTR

|

Has Twitter finally figured out how to monetize its business? The latest earnings report is a good sign. (23 Apr 2019) Shares of social media company Twitter (TWTR $26-$40-$48) were up around 17% in early Tuesday trading on the back of a strong Q1 earnings report. The company, which is now worth around $28 billion, generated revenues of $787 million versus 2018Q1 revenues of $665 million, and earnings per share of $0.37 versus a paltry $0.08 in the same quarter last year. Keep in mind that 2018 is the first year in which Twitter actually reported positive net cash flow. So, what changed? It appears that the company is finally focusing on bringing ad dollars in rather than simply building their user base. For evidence of that (besides the strong quarterly numbers), Twitter said it will stop reporting on the number of monthly active users (MAUs) and replace it with a new metric: monetizable daily active users (mDAUs). In short, this figure represents how many users are actually paying to advertise on the platform. Ad revenue did, in fact, jump 18.3% year-over-year, to $787 million. In the middle of 2018, TWTR had a P/E ratio of 4,500. Almost incredibly, that number is now a very reasonable 22. That is right in line with Penn Member Facebook's (FB) 24 P/E ratio. If the company continues to clean up abusive tweets and focus on ad dollars, its stock has a lot of room to run.

|

|

GOOGL

|

Despite a massive beat, Alphabet shares tumbled after earnings report. (05 Feb 2019) The figures are staggering. For the fourth quarter, Google parent Alphabet (GOOGL $978-$1,129-$1,291) reported revenue of $39.3 billion—a 22% spike from the same quarter in the previous year. But what about earnings? They came in at $12.77 per share, versus expectations for $10.86 per share. Investors rewarded these glowing numbers by chipping 3% off of the share price after hours. What bothered the fickle investment community? The operating margin contracted a bit (21% versus 29.6% in Q4 of 2017) because of the company's enormous research and development budget. In Q4, Google had $7.1 billion in capital expenditures (CapEx), with $6 billion of that going to R&D. Compare that to the $4.3 billion it spent a year earlier, and we have some spooked investors. Isn't that supposed to be a good thing? A company actually staying on the cutting edge instead of performing some type of financial engineering wizardry to make the numbers look a certain way? Google's very capable CFO, Ruth Porat, did say that CapEx spending should be more in line with previous years' spending for the remainder of 2019, but it costs a lot of money to invest in the type of industries the company sees at the core of its strategic future, like artificial intelligence and autonomous vehicles. In the meantime, advertisers overwhelmingly find Google the most effective way to attract new business, providing the company with a steady revenue stream to fund future ventures. Love 'em or hate 'em, Google remains the dominant player in digital advertising, not to mention its wide array (hence the name change to Alphabet) of other money-making units. It would be fair to consider them the sector's version of General Electric in the 1950s and '60s. With a rock solid management team, the company is undervalued at its current price.

|

|

SNAP

|

Is Snap in a death spiral after more executives flee the company? (17 Jan 2019) Two years ago, social media networking company Snap (SNAP $5-$6-$21), parent company of Snapchat, had a market cap of $31 billion and a share price of $27. Today, the company's size sits at $7 billion (a 77% drop) and its shares are going for $5.71. Its latest double-digit drop came this week after CFO Tim Stone announced he was bolting the firm—after eight months on the job. The fact that Stone will lose 80% of the SNAP stock he was given as part of his new-hire package speaks volumes about where he thinks the company is headed. Over the course of 2018, SNAP has seen the departure of two CFOs, its Chief Strategy Officer, its VP of Content, and its VP of Global Business Solutions. Fourth quarter earnings will be released on the 5th of Feb. Herein lies the beauty of the investment world: while analysts are slashing price targets on SNAP, Morningstar reiterated its $14 fair value figure for the shares, stating that the company may have some surprises in store regarding Q4's performance. The only concrete numbers we have to base an opinion on are the TTM figures through Q3, during which the company had revenue of $1 billion and net income of negative $1.4 billion. Investing in SNAP shares would be a highly speculative undertaking.

|

|

FB

|

Is Facebook about to pick up a major cybersecurity firm? (22 Oct 2018) The rumor mill is abuzz with stories of Facebook's (FB $149-$155-$219) interest in buying a major cybersecurity firm to take on the herculean task of strengthening its users' data security. With all of the company's recent problems and negative headlines, it is easy to forget that its market cap still hovers around half-a-trillion dollars. Only five publicly-traded entities in the world are larger than Facebook. So, which cybersecurity firm might they go after? Odds are good the target company is owned within both of our two favorite cyber ETFs, HACK ($36.75) and CIBR ($25.60). Within the field, we like Fortinet (FTNT), FireEye (FEYE), Palo Alto Networks (PANW), and Proofpoint (PFPT). Of those, FireEye would be the easiest pill for investors to swallow, as the company has a relatively small $3.5 billion market cap. For the record, we own CIBR as a satellite position in the Penn Dynamic Growth Strategy, so we are prepared for one to have a nice pop.

|

|

TWTR

|

Twitter falls after analyst downgrades, calls accounting into question. (17 Sep 2018) “Smoke and mirrors” was the term Michael Nathanson at MoffettNathanson used to describe some aspects of Twitter’s (TWTR $17-$29-$48) financial accounting for the first half of the year. Nathanson noted that investors will soon take into account the growing demand for the vast amount of cash needed to run the business—cash the company doesn’t have on hand. In the end, the analyst reduced his rating on the stock to a “sell,” and reduced the price target from $23 to $21 per share—a 28% drop from the current price. (Note: this story falls into the new GICS category "Interactive Media & Services," formerly "Internet Software & Services." The industry can be found under the new "Communication Services" sector.)

|

|

MTCH

|

Online dating site provider Match jumps 18% on unexpectedly strong earnings. (08 Aug 2018) The Match Group (MTCH $18-$46-$49), parent of such dating sites as Match.com, Tinder, OkCupid, and PlentyOfFish, just had a blowout quarter, and investors rewarded the company with an 18% spike in the share price. Revenue jumped an impressive 36% from the same quarter last year, and net income rose from $51.43 million in Q2 of 2017 to $132.5 million this past quarter—a 158% jump. What was the catalyst? The company's Tinder unit notched an 81% subscription growth rate and a 136% revenue spike. Tinder now has nearly 3.8 million paying subscribers, creating an enormous annuitized income stream for the company. Operating revenue for Match has consistently grown year after year since the company went public. Unlike most other players in the space, the company has a decent p/e ratio of just 26.

|

|

TWTR

|

Going in the opposite direction from Google and Amazon, Twitter joins Facebook in the dumpster. (27 Jul 2018) Yesterday it was the shockingly-bad earnings report from Facebook (FB $149-$178-$219), sending that company's shares down 20%. Today, it was Twitter's (TWTR $16-$35-$48) turn, and the numbers were almost as bad. As soon as the earnings report hit the wires, Twitter's shares plummeted 17%, recovering just a few percentage points at the open, then falling back down to session lows. Monthly active users (MAU) of the social media platform dropped by one million in Q2, bringing the total number down to 335 million. Furthermore, the company expects that number to drop again in Q3, on the back of new GDPR rules in Europe and an intensified effort to clean up both phony accounts and abusive users. As for the financials over the course of the quarter, revenue did increase by 24%, to $710 million, and net income went from a $116.49 million loss in Q2 of 2017 to a gain of $100 million. What's the current p/e of the company, you ask? Try 4,294. Hey, at least they have one. Interestingly, check out our last post on Twitter (below) and see where we saw the fair value range for TWTR, then compare to where it is trading now.

|

|

FB

|

Facebook loses one-quarter of its value in a matter of minutes. (26 Jul 2018) We were watching as the numbers rolled in, and it was a bloodbath. Within minutes of Facebook's (FB $149-$173-$219) after-hours train wreck that was the second-quarter conference call, shares were plummeting 25%—the largest ever drop for the $630 billion social media giant. What went wrong? Just about everything. For the first quarter in the company's history, the active daily users (ADU) number stagnated in North America and actually fell in Europe. Of course, this comes on the heels of the data privacy scandal which has plagued the firm, and the onerous new GDPR rules rolled out in Europe. The nail in the coffin of the conference call came when CFO David Wehner made it clear that revenue growth would continue to decline over the last two quarter of 2018, and that bottom line profits would be negatively affected—perhaps for the next few years—by the massive expenditures the company will make to enhance data security. While the 25% drop in the share price didn't quite follow through to the morning open, does the fall make the company look attractive for investors? We don't believe so. We would place fair value of the firm at around $200/share, and that small gain wouldn't be worth the current risk an investor would have to accept

|

|

GOOG

|

What $5 billion fine? Alphabet rocks the second quarter. (23 Jul 2018) Despite the $5 billion shakedown by the thugs in the European Union, internet giant Alphabet (GOOG $903-$1,244-$1,205) blew past its 52-week high in after-hours trading following what could only be described as simply stellar quarterly results. Revenue for the quarter came in at $26.24 billion, and the company's ad business grew 24% from Q2 of 2017. Just how big was the quarter? Due to the outrageous EU fine (which it will fight), the company offered investors a look at two different profit numbers: one ex-fine and one taking it into account. Even after adjusting for the $5 billion, Alphabet generated $3.2 billion in net income during the three-month period. That is crazy-good. It looks like the company is still in the running to become the world's first $1 trillion enterprise—after the 5% price pop it has a market cap of nearly $900 billion

|

|

TWTR

|

Twitter quietly hits one-year high as it prepares to join S&P 500 index. (05 Jun 2018) Sure, with its $0.01 per share earnings, which equates to a 3,788 p/e ratio, social media platform Twitter (TWTR $16-$38-$38) hasn't been on too many bullish analyst lists over the past few years. But, while everyone is telling us how the company doesn't have an effective plan to monetize their business (and who cares how many users there are if you can't turn a profit on them), the company quietly just hit a 52-week high price of $37.98 per share. Additionally, the $30 billion firm is set to replace Monsanto (MON), which is being gobbled up by Germany's Bayer, on the S&P 500 index this Thursday. Looking back, we wish we would have purchased TWTR in the Intrepid Trading Platform last summer (we would be sitting on a 100% gain right now) but, alas, we did not. The company had been bleeding about $500 million per year in losses on roughly $1.5 billion in annual revenues, and we just didn't see a clear strategic path forward. Where do we place the fair value of the company? Somewhere between $25 and $30 per share.

|

|

SNAP

|

Snap plummets 22% after big revenue miss, analyst downgrades

(03 May 2018) The last time we mentioned Snapchat parent company Snap (SNAP $11-$11-$24), the stock was in the midst of falling to $17 per share after Kylie Jenner's disparaging comments on the app's redesign. That price is looking pretty good right now. SNAP fell another 22%—to a 52-week low of $11 per share—after revenue growth failed to meet analysts' expectations. While the company's net loss did narrow from the same quarter last year (-$386 million versus 2017's Q1 loss of $2.2 billion), analysts rushed in en masse to downgrade the company. Evercore cut its price target to $9 per share, while Morgan Stanley dropped their target price to $8 per share. Gutsy bargain hunters, this may be your chance: a return to SNAP's 52-week high would represent a 100% gain for investors. |

|

FB

|

Facebook's blowout results help push markets higher

(26 Apr 2018) What great timing for a stellar earnings report from Facebook (FB $144-$176-%195). Shares of the social media stalwart rose 10% on Thursday following first quarter's metrics, to include: a 50% spike in ad revenues, a 49% jump in revenue, and plans for an additional $9 billion (on top of the $6 billion already in the works) worth of stock buybacks. Perhaps most impressive, considering the first quarter saw the social media hashtag campaign to persuade users to close their accounts, monthly active users rose by 13% from the same quarter last year—to 2.2 billion. The share price crater left after the Cambridge Analytica narrative was pushed by the press in March has been completely re-filled. |

|

SNAP

|

Kylie Jenner slams Snapchat, parent company's stock falls 7%

(22 Feb 2018) Kylie Jenner took to Twitter to slam Snapchat's (SNAP $11-$17-$29) redesign, and investors were apparently listening. The $21 billion social media platform was off 7% following Jenner's Twitter tirade, which read, "sooo (sic) does anyone else not open Snapchat anymore? Or is it just me...ugh this is so sad." She was referring to the app's recent redesign, and apparently she is not alone. The overwhelming response to the changes, which include muddling some features together and promoting sponsored content, has been negative. As for Kylie, who has 24 million Twitter followers by the way, the Twitter bots began attacking her immediately with links to malicious sites. Damned Russians. Snap has lost $3 billion in market cap since the changes were made. |

|

HUBS

|

Cloud-based sales and marketing platform HubSpot records its first quarterly profit

(13 Feb 2018) Barely a day goes by where we don't get an informational email from inbound sales and marketing platform HubSpot (HUBS $56-$99-$102). And the information is always useful; full of tips and ideas for building an online presence and making a name for your company. While we don't use this smaller version of Salesforce ($3.7 billion market cap versus CRM's $77.6 billion), their easygoing tactics are apparently attracting a lot of new customers—they just notched their first quarterly profit. Quarterly revenue for the subscription-oriented firm rose 39%, to $106.5 million, and earnings came in at $0.12 per share, or roughly $4.5 million. Shares were trading up after hours. |

|

SNAP

|

Snap pops nearly 40% as it actually beats revenue expectations for the first time ever

(07 Feb 2018) OK, in fairness, we must admit that Snapchat parent Snap (SNAP $11-$19-$29) has only issued three earnings reports since going public last year, but the first few missed the mark badly. Not this time: SNAP is trading up 37% on a lofty revenue beat of $285.7 million, which reflects a 72% annual jump. While EPS is still negative, the $0.28 loss per share was better than the $0.33 loss expected. Shares of the smartphone camera app company are finally trading above their IPO price of $17, but for us poor schlubs who weren't able to get in on the IPO, the current price is still well below the $24 opening trade after going public. (Actually, we weren't interested in the stock then, and certainly aren't now, for reasons we outlined on 02 Mar 2017—see below.) |

|

FCC

|

It's official: FCC will eliminate Obama-era net neutrality regulations

(21 Nov 2017) The new head of the FCC, Ajit Pai, made it abundantly clear over the course of the past year that he thought net neutrality rules put in place by the previous administration were onerous and another case of government run amuck. On Tuesday, he did something about it. The FCC announced it would repeal all net neutrality rules in place, handing a huge win to the telecommunications industry. Pai also ended FCC oversight of the internet service providers, handing the job back to the Federal Trade Commission where it belonged. While the FCC must formally vote on the proposal in early December, the regulations are as good as gone. At least AT&T should be happy about that win (this occurred on the same day the DoJ filed suit against their merger with Time Warner). |

|

TWTR

|

Twitter shares soar as losses narrow

(26 Oct 2017) Beaten-up social media firm Twitter (TWTR $14-$19-$21) jumped double-digits on Thursday's open after reporting a narrower loss ($21.1 million) than expected. That may seem like a lot, but compared to last year's same-quarter loss of $103 million, it is chump change. It also represents the company's smallest quarterly loss as a publicly-traded entity. The company had revenues of $590 million, narrowly beating expectations. Twitter added four million monthly users over the course of the quarter, bringing their total user base up to 330 million. We would like to see Disney buy the firm and put an executive in place who actually knows how to monetize a company. |

|

SPLK

|

Under the Radar: Splunk Inc.

(21 Sep 2017) Splunk (SPLK $51-$69-$69) is a software-as-a-service (SaaS) company very close to breaking out of its mid-cap shell to join the rarified air (at least for application software companies) of a large-cap growth stock. While we could be very detailed with what the company does, let’s break it down into its simplest form. Imagine you are a systems administrator for a firm. Pick the industry. Your system hardware begins acting odd, but the voluminous machine data alerting you of the problem reads like a Greek novel. And, despite your experience in the industry, the data is virtually impossible to decipher. That is where your subscription (we love the annuitized revenue subscriptions provide) to Splunk comes into play. All of the data in question is fed into their enterprise software designed specifically for your industry, and easy-to-understand (for a computer geek) answers come out. Real time processing reduces the “bottlenecking” of data between your company systems and your Splunk software. That really is a big deal. While the company is not yet turning a profit, its revenues have been increasing rapidly, nearly doubling every year for the past seven years (to just shy of $1 billion in 2016). Finally, the versatility of the company’s software makes it extremely customizable for a specific industry, which means more customer “stickiness.” Despite its size, the company poses a real threat to larger competitors. |

|

AMZN

TGT MSFT |

This retailer is fighting Amazon’s grocery push by dumping AWS

(30 Aug 2017) Amazon Web Services (AWS) has been an enormous profit-generator for the $460 billion juggernaut, but when the company bought Whole Foods to compete head-to-head with brick and mortar retailers, Target (TGT $49-$55-$79) said enough is enough. It’s not that the multiline retailer can do anything about the purchase, but they can sure pull their dollars from AWS, which Target has been using to manage its cloud infrastructure. And that is exactly what they are doing throughout the rest of this year. Microsoft (MSFT $56-$73-$74) didn’t miss the opportunity. They immediately telegraphed to Target that the Microsoft Azure cloud solution is ready to fill the void. |

|

BABA

AMZN |

Alibaba hits new 52-week high as earnings, cloud computing spike

(17 Aug 2017) Get this: in the second quarter of 2016, Chinese Internet giant Alibaba (BABA $86-$167-$176) had revenues of $4.84 billion. Fast forward to the same quarter, one year later, and the company generated $7.4 billion in revenues. That equates to a 53% spike in sales. Mobile monthly active users of the company’s online retail marketplaces rose to 529 million. What should be of more concern to Amazon (AMZN), which has been touting its cloud-based computing service known as Amazon Web Services (AWS), is BABA’s 96% year-over-year increase in its own cloud computing business. As of right now, however, it’s still no contest: AWS is raking in $3 billion per quarter in sales, while Alibaba’s cloud platform is at $359 million in the most recent quarter. |

|

CSCO

|

One of our least favorite tech names, Cisco, fails to deliver...again

(16 Jul 2017) Our main gripe with Cisco Systems (CSCO $29-$32-$35) over the past few years, and a major reason we would not own the routers and network software firm in any portfolio, has been the leadership void at the company. From goofy John Chambers to relatively-new CEO Chuck Robbins, we have little confidence in management’s grasp of the industry in which they operate. Today’s earnings report provides yet another piece of evidence to that end. Revenue was down 4% year-over-year, and has now declined for seven straight quarters (annualized). The company also announced it would be laying off 1,100 workers. Shares were down after hours. |

|

TCEHY

|

China’s largest tech company, Tencent, sees revenues soar by 59%

(16 Aug 2017) Chinese gaming and Internet giant Tencent (TCEHY $23-$41-$42), which made news recently for buying 5% of outstanding Tesla (TSLA) shares, just reported a 59% spike in revenues for the quarter. The company’s sales of $8.5 billion easily topped estimates calling for $7.8 billion, and represented a 59% jump from the same quarter in 2016. Tencent is a dominant provider of mobile gaming, and its WeChat mobile messaging platform has 963 million (repeat: 963 million) active monthly users. Incredibly, that is about half the number of active monthly users on Facebook (FB). Tencent’s main listing is on the Hong Kong Stock Exchange, but it trades on the US over-the-counter market. |

|

ORCL

|

(22 Jun 2017) Oracle's transition to cloud finally coming to fruition. Some digital companies embraced "the cloud" immediately, while others, like Redwood City, Calif.-based Oracle (ORCL $38-$46-$47), have taken a more cautious approach. The company's slow-and-steady approach might finally be paying off, as they just reported a 15% spike in net earnings this past quarter over the same quarter last year. On revenues of $10.89 billion, Oracle earned $3.23 billion, for a healthy operating margin of 30%. CEO Mark Hurd was thrilled with his company's results, saying on the conference call that "It's the best quarter we've ever had." The company has some stiff competition in the cloud-infrastructure business, however, namely Amazon Web Services.

|

|

CSCO

|

(18 May 2017) Cisco drops 8% on lousy guidance. The numbers weren't that bad, but it was Cisco's (CSCO $26-$31-$35) forward guidance that had investors spooked, knocking the stock down 8% at the open. The networking company said that revenue would decline at a faster rate than previously expected, 4-6% from last year, largely due to decreased government contracts. If you are not a CSCO shareholder, is that a bad thing?

|

|

FCC

|

(27 Apr 2017) New FCC chairman moves to eliminate politically-motivated Net Neutrality rules. After losing two major court battles on the issue, former President Obama returned to his MO and simply had his "independent" FCC chairman, hack Tom Wheeler, write regulations allowing the federal government to control the Internet (odd that there weren't any marches and protests on that move). Net Neutrality, or "Title II" in legal-speak, is to the Internet what socialized medicine is to healthcare: everyone is given poorer service and less options at a higher cost. Now that Obama and Wheeler are gone, Net Neutrality no longer has its schoolyard bullies to protect it. The FCC's new chairman, Ajit Pai (pron. "pie"), in fact, will bring the issue up at the committee's 18 May meeting, with a final vote to kill the monstrosity coming later this year. More trash taken out.

|

|

SNAP

TWTR FB |

(29 Mar 2017) Uh oh, Snap, Facebook is cloning your bread-and-butter. We'd like to get excited about Snap (SNAP $19-$22-$29), parent company of Millennial darling Snapchat, but its dearth of revenue makes us think of Twitter (TWTR $15-$15-$25). Sure, there will probably be investors around to dig the stock out of any major downturn for the next several years, but Facebook (FB $106-$142-$142) just launched some features that should send chills through the spines of SNAP investors. In what has been called a blatant copy of Snapchat's key feature, Facebook users now have the ability to send disappearing photos. The company also added a clone of Snap's "Stories" feature to its Instagram, WhatsApp, and Messenger brands. The good news is that Snap's average user demographic group has little interest in switching to FB. On the other hand, do advertisers want to spend money trying to reach that group?

|

|

GOOGL

|

(24 Mar 2017) Companies are suspending Google, YouTube ads over offensive placement. More and more US companies are moving their critical ad dollars out of Alphabet's (GOOGL $673-$841-$874) Google and YouTube units due to the placement of their ads next to objectionable, or downright hideous, content. Johnson & Johnson, GlaxoSmithKline, JP Morgan, AT&T, and Verizon are just five of the latest companies yanking ads, though the latter two do have nascent competing platforms. The placement next to terrorism-related or other hate videos involves the ads being circulated by Google to third-party websites (a growing revenue stream for the firm), not the paid ads which sit atop search results. Analysts at equity research firm Nomura Instinet have projected that Google could lose up to $750 million from the advertiser boycott.

|

|

ORCL

|

(16 Mar 2017) Oracle jumps over 7% on open, hits new record high. Perennial Penn Global Leaders Club member Oracle (ORCL $38-$46-$47) hit a new, all-time high shortly after Thursday's open following a blowout earnings report and a slew of upgrades. Revenue rose 3% in Q3, to $9.2 billion, with $2.24 billion of that funneling down to net profit. About three years ago Oracle made a strategic move into cloud computing, and its software-as-a-service (SaaS) business has been on a strong growth trajectory ever since. With one of the best management teams in the industry, we expect that momentum to carry this $190 billion company forward with strong, consistent growth.

|

|

YHOO

|

(14 Mar 2017) Marissa Mayer will get $23 million golden parachute for destroying Yahoo. A few weeks ago we told you that Yahoo's (YHOO $33-$47-$47) inept CEO, Marissa Mayer, would take a pay cut over at least one of that company's massive security breaches. Now, Yahoo has outlined its leadership structure, post Verizon (VZ $46-$49-$57) buyout, which includes a $23 million golden parachute to Mayer as she departs the scene. Maybe she can go into politics. (In fairness, Yahoo was in bad shape before Mayer arrived.)

|

|

SNAP

|

(07 Mar 2017) Investor group wants to bar Snap from being included in indexes—we agree. An investor group representing large institutional investors has approached both S&P Dow Jones and MSCI, providers of benchmark stock indexes, to encourage the barring of Snapchat's parent Snap, Inc. (SNAP $24-$21-$29) from entry into any index. They are making this argument because the company only sells non-voting, Class-A, shares to the public, while executives at the company are offered Class-B or Class-C voting shares. "They're tapping public markets but giving public shareholders no say," says a spokesman for the group. We agree. After rocketing the day of the IPO, SNAP has now fallen back down below its opening price (though still above the $17 per share mark where the select group of IPO investors were able to buy). The IPO system is already broken, but offering only non-voting shares to the public really takes the cake.

|

|

YHOO

|

(02 Mar 2017) CEO Mayer will get pay cut over Yahoo security breaches. We had such high hopes for Marissa Mayer when she took over the helm at Yahoo (YHOO $32-$46-$47) five years ago. What a bust that turned out to be. Now, after several cybersecurity hacks compromising the personal information of over 500 million accounts, a board investigation found that she, along with other top executives, failed to "properly comprehend or investigate" the massive 2014 breach. As a result of the review, the Yahoo board won't award Mayer her 2016 cash bonus, nor will she receive her 2017 equity awards. Were it not for the Verizon (VZ $46-$50-$57) takeover, we suspect Mayer would have been broomed by now. But save the tears—her 2015 pay package was $36 million.

|

|

SNAP

|

(02 Mar 2017) Snapchat prices at $17/share, implying valuation of $24 billion. Snap, Inc. just finished raising 3.4 billion for its upcoming IPO, valuing its shares at $17 for an initial market cap of $24 billion. Despite all of the concerns in the press regarding Facebook's (FB $104-$137-$137) possible erosion of Snap's market share, the book during the company's roadshow was more than 10 times oversubscribed, meaning the shares could have been priced at $19 or $20 per share.

We really don't like the fact that investors who buy shares of the tech company will have zero (yes, zero) voting rights, while executives of the company who buy Class-B shares get one vote each, and the founders will own Class-C shares with 10 votes per share. To our knowledge, this has never been done before. In fact, the company alluded to that in its IPO paperwork. This will be a fascinating launch to watch. Our guess is that early investors will be rewarded in the short term, and face a dramatic downturn at some point in the first year as the shine wears off. |

|

SNAP

|

(16 Feb 2017) Snapchat parent seeks $20 billion IPO valuation. In what would be the largest US tech offering since Alibaba three years ago, Snap, Inc., parent company of Snapchat, set a target price range for its IPO debut between $14-$16 per share. If that comes to fruition, it would give the company a market cap of roughly $20 billion. Snap (which will trade under the Nasdaq symbol SNAP) will begin its roadshow Monday in London, wooing the likes of hedge fund and mutual fund managers. It will then move to hotel ballrooms in New York and other cities. Expect the IPO to happen in early March. Is the initial investment worth it? We don't think so. Then again, we held off on Facebook (FB $100-$133-$135) for awhile as well, so....

|

|

CSCO

|

(15 Feb 2017) Cisco Systems turns to subscription model. More and more companies are coming to the realization that recurring streams of "sticky" revenue are the best way to combat lagging core product sales. In that vein, Cisco Systems (CSCO $25-$33-$32) CEO Chuck Robbins has outlined the company's strategic plans to convert more of the company's hardware revenue to a subscription model. This will be interesting to watch, as this type of annuitized business plan normally revolves around software services, not hardware products. With the stock hitting a one-year high, we are taking a breather to see if the company's plans gain traction with its customer base.

|

|

TWTR

|

(09 Feb 2017) Twitter has more users but less revenue. Social media outlet Twitter (TWTR $14-$19-$25) reported top line earnings of $717 million for the fourth quarter, missing Wall Street expectations for $740 million. The company's monthly active users (MAU) number did grow to 319 million, up 11% from last year, but the company still cannot figure out how to monetize their product. Shares are off over 6% in pre-market.

|

|

YHOO

VZ |

(15 Dec 2016) Verizon should pull out of Yahoo deal while they can. Yahoo (YHOO $26-$38-$45) just announced that it had yet another security breach back in 2013, affecting an incredible one billion user accounts. The company "still hasn't identified the source of the attacks." This is a great (and probably last) chance for Verizon (VZ $44-$52-$57) to pull out of its planned $4.83 billion purchase of the internet firm. Run. Run fast and run far.

|

|

(27 Jul 16) Jerry Yang was a young student at Stanford University in 1994 when he had a brainstorm. The fledgling Internet, at the time, was a hodgepodge of disparate Sites, with no effective way to navigate through the winding maze. Yang and a buddy, David Filo, launched “Jerry’s Guide to the World Wide Web” as a curated list of websites to help ordinary people find what they were looking for—even if they didn’t know what that was. Two years later Yang took his re-named company public, with the stock rocketing up 270% on the first day of trading. By January of 2000, Yahoo! (YHOO) hit a peak market cap of $140 billion. It was, at the time, as big as Google (GOOG) or Facebook (FB) are today.

Fast forward sixteen years and take a look at the carnage. Under the leadership of a lackluster CEO, Marissa Mayer, the company has witnessed an unprecedented loss of revenue—and talent. When Americans need to surf the Web, they instinctively now go to Google. When they need to communicate via social media, they turn to Facebook. And the advertisers know it. Now, the slow-motion train wreck is nearing its final impact. The company has announced that it will accept an offer by wireless giant Verizon (VZ) to buy its core operating business for a paltry $4.8 billion in cash. The formerly-independent company will become just another retired warhorse in Verizon’s stable, next to the likes of AOL (remember that futuristic sound you heard when you connected via dial up?), which the company bought last year for $4.4 billion. The odd twist in the story surrounds a masterful strategic move by Yang back in 2005, when he was still Yahoo’s CEO. The affable founder became deeply interested in a tiny Chinese startup. Over a giant glass of sake that he bought for the company’s chairman, Jack Ma, he began to negotiate what would become a 40% ownership position in the Chinese firm for $1 billion. Today, that 40% stake in Alibaba (BABA) is worth about $83 billion. While BABA re-purchased many of the shares, Yahoo’s 15% stake is still worth about $32 billion; add that to the $8 billion or so in Yahoo! Japan, and shareholders will be left with a $40 billion yet-to-be-named holding company, sans Mayer. Don’t feel too bad for Mayer—despite doing nothing for the company (except wasting $1 billion of the firm’s money to buy Tumblr), she will walk away with a $50 million golden parachute. Plus, she will always have the seductive Vogue photo shoot to fondly look back on. As for Verizon, the victor in the bidding war, its purchase of Yahoo’s operating assets will play a major role in its strategic plan to transform from a wireless carrier to a digital advertising juggernaut. Mayer can sit back on a beach and watch how that is accomplished. (Reprinted from this coming Sunday’s Penn Wealth Report, Vol. 4, Issue 30. Which one of these companies is in a Penn portfolio, and why? See this Sunday's Report.) (OK, got it. Take me back to the Penn Wealth Hub!) |

Yahoo continues down the path to a slow death—will cut seven digital magazines

(18 Feb 16) It wasn’t all that long ago that MicrosoftMSFT put a juicy offer on the table to buy the company for $45 billion or so. In hindsight, YahooYHOO should have taken the money and run. Now, with Marissa Mayer at the helm, the company is ominously close to running aground for the last time.

Not that it is all Mayer’s fault. The former Internet giant was already in big trouble when she took the helm in 2012, but a bold vision put forth by a strong leader could have turned their luck around. She was not that leader.

The latest hit came this week as the company announced it would shutter seven digital magazines, to include Yahoo Food, Yahoo Health, and Yahoo Real Estate. Along with the closures will come a stack of pink slips to employees at the Sunnyvale headquarters in Silicon Valley. Considering that the average net income (not revenue) for each of the firm’s 12,500 employees is -$350,000, the layoffs are understandable.

The rate at which Yahoo is burning through cash leaves, in the absence of a bold new plan, only one option: try to sell the firm to a big media player quickly, and don’t look back. Unfortunately, management remains blind to that clear path out of the woods.

Citing the rapid deterioration of consumers’ use of the company’s home page and other “core properties,” SunTrust industry analyst Robert Peck wrote a scathing report on Yahoo’s fiduciary duty to entertain incoming bids. He calls Yahoo a “melting ice cube” that will soon dissolve into nothing.

For its part, management recently announced a new restructuring effort focusing on global platforms (like Tumblr), verticals (like Yahoo Finance), and growth offerings (like Mavens). This reminds us a lot of Ron Johnson’s embarrassingly-inept plans to turn around J.C. Penney. He was fired shortly thereafter. Should that happen in this case, at least Mayer will walk away with a severance package north of $100 million for her feeble efforts.

(Reprinted from the Journal of Wealth & Success, Vol. 4, Issue 2.)

(OK, got it. Take me back to the Penn Wealth Hub!)

Yahoo Continues to Struggle

The big spike in earnings came from the Alibaba sale. It makes this past quarter's $76 million look sad.

(20 Oct 15) Yahoo Inc.YHOO reported an underwhelming 6.8% top line increase in revenue, and a bottom line profit of a paltry $76 million during its earnings call mid-week. But it was a profit, nonetheless, which looks almost hefty compared to last quarter’s $21.5 million loss. It is hard to compare these Q3 numbers to last year’s, as that was when the firm took a $6.77 billion profit from the sale of its Alibaba shares following the IPO.

It appears to us that the company is grasping at straws, adrift in the sea and devoid of a clear heading. CEO Mayer has certainly been spending money, but most of it has been on buying into someone else’s action.

The latest example of this is a partnership with Google to use the latter’s desktop and mobile platform advertising space. This follows another deal with Microsoft that may face DOJ hurdles. Perhaps this is why both the marketing and M&A heads just quit. (Reprinted from this coming Sunday’s Journal of Wealth & Success, Vol. 3, Issue 41.)

(OK, got it. Take me back to the Penn Wealth Hub!)

Ever-Disruptive Google Creates Parent Company named Alphabet

(10 Aug 15) Google Inc. dropped a bomb on the markets Monday when it announced that it will create a parent company, Alphabet, which will be the publicly-traded face of the mega-firm.

According to Larry Page, Google’s co-founder and new CEO of Alphabet, the new entity will be a “collection of companies,” with the largest one being Google. Fellow co-founder Sergey Brin and Executive Chairman Eric Schmidt will also join Page, with Sundar Pichai (sounds like “pick EYE”) ascending to CEO status at Google.

This dramatic move makes sense. From Google Glasses to drones to its secretive Google X facility, the company wants to be on the cutting edge of technology, not just the world’s largest Web browser. By splitting the firm up and adopting a holding company philosophy, clear lines of concentration can be established. While the stock symbols will remain the same (GOOGL and GOOG), one share of Google will become one share of Alphabet when the dust settles.

Disclaimer: We added Google to the Penn Global Leaders Club at $558 per share on 24 Jun 15. It is $7 away from our $670 per share price target.

(Reprinted from the Journal of Wealth & Success, Vol. 3, Issue 32.)

(OK, got it. Take me back to the Penn Wealth Hub!)