Energy Commodities

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

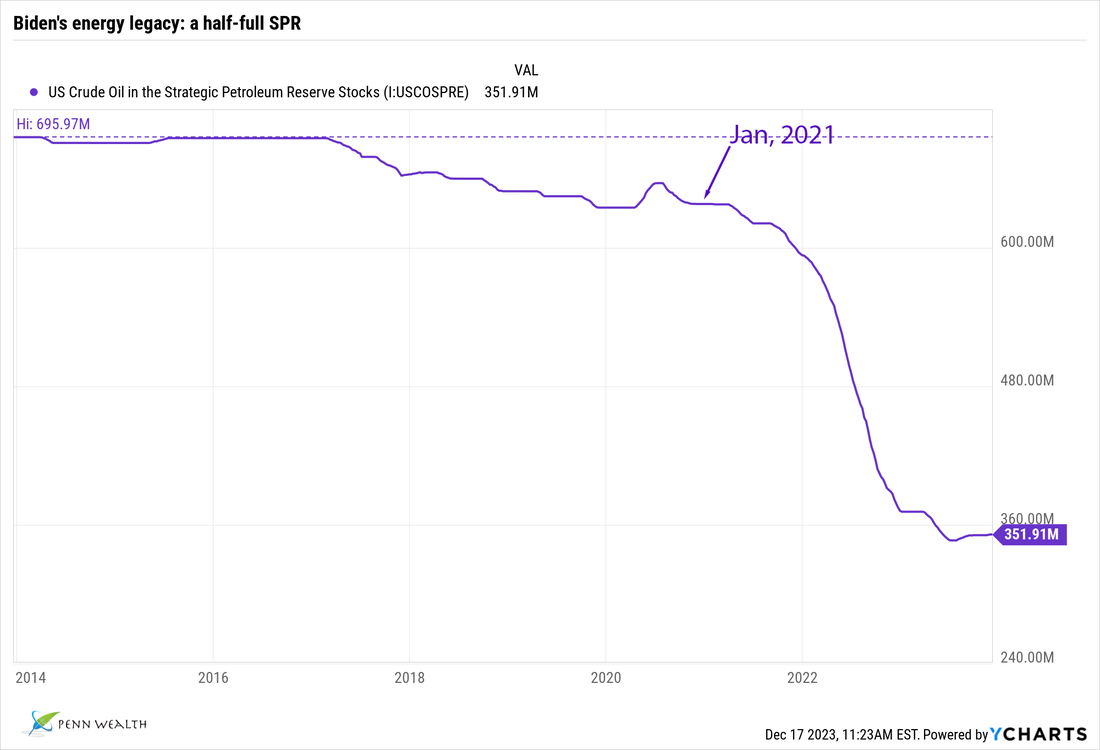

Disgraceful: The US Strategic Petroleum Reserve sits half full for political reasons

OPEC cut production by 1M bpd in 2023; The Unites States made up for that, foiling the cartel's plans

|

WTI $70/bbl

18 Dec 2023 |

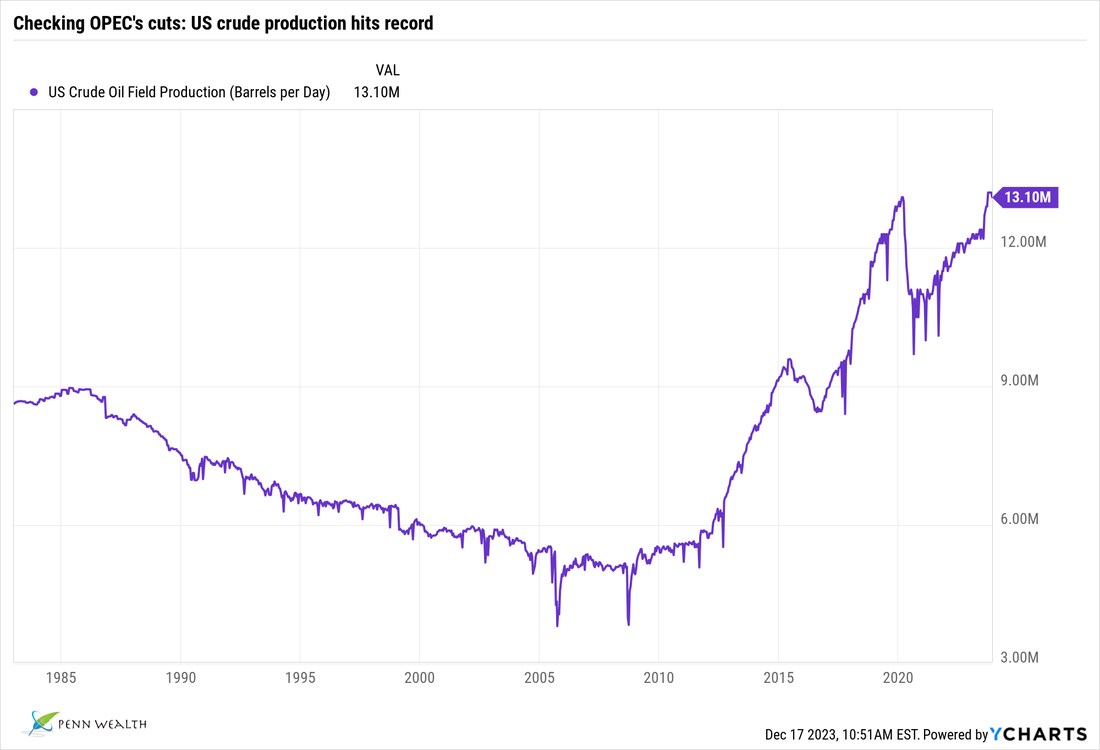

Foiling OPEC: The United States hits new record production levels

At the start of 2023, the OPEC nations were pumping some 31 million barrels per day (bpd) of crude onto the market; oil was sitting at $80.51 per barrel. The cartel found that price too low, and announced a cut of one million bpd to pump up prices. The move appeared to have maximum impact by September, when crude hit $91.20 per barrel. But two factors would soon combine to foil our dear friends' effort: both of them positive for the US. The first factor was a serious drop-off in China's rate of economic growth. Considering the percentage of oil used by the communist nation, it makes sense that a good level of demand destruction in Asia would force prices down. The second factor was the unexpected spike in US crude production, especially shale. At the start of the year, the US was pumping 12.1 million bpd of oil; by mid-December, that amount had risen by the precise amount of OPEC's cuts—one million bpd. Between the end of November and the second week of December, crude prices dropped from $80 per barrel to $70 per barrel. The US had retained its moniker as the world's number one energy producer. Gasoline prices in the US, in turn, returned to what we would consider a normal level: around $2.50 per gallon. America's shale renaissance has been a nightmare for OPEC over the past decade. In 2014, the cartel tried to crush the movement by flooding the world with additional crude to undercut the US effort. At first, the plan seemed to be working, with WTI crude falling to $44 per barrel by March 2015 and all the way down to $28 per barrel a year later. In April 2020, as pandemic fear was at its height, crude infamously began trading in negative figures. Below $50 per barrel, it is extremely difficult for shale producers to stay afloat, let alone remain profitable; and it really takes oil trading above $60 per barrel for these companies to thrive. We are certainly above that price now, and we don't see the Saudis pushing for OPEC to try its 2014 stunt again. In fact, the group's action forced these explorers to become more efficient, increasing production while reducing costs (drilling rig count is down 20% ytd despite the 1M bpd increase). Perhaps American shale producers should send a thank you card to the cartel. Our challenge with investing in this industry is that most of the companies tend to be laden with debt. If we had to pick one player to invest in, it would be APA Corp (APA $35; formerly Apache). This $11 billion mid-cap driller boasts an enormous and geographically diverse reserve base, and it has nice free cash flow. Shares are probably worth around $50. To mitigate risk a bit, investors could buy the Invesco Energy Exploration & Production EFT (PXE $30), which owns 30 industry leaders (Phillips 66 is the largest holding). |

|

WTI $90/bbl

30 Sep 2023 |

Yes, you are paying too much at the pump; just be glad you don’t live in Cali

The most recent price of gas in our neck of the woods is $3.59 at the local Casey’s (CASY $271). Since they are always about a dime per gallon more expensive than the local Murphy USA—attached to about 1,000 Walmart (WMT $160) stores around the country, let’s call it $3.50 per gallon. That’s with oil sitting at $90 per barrel. In our estimation, with Europe in the doldrums and Xi Jinping’s grand plans in the dumpster (at least for this year), oil should be in the $70 to $80 range, and we should be able to fill up our tanks for around $40. Oh well, at least we don’t live in California. Unleaded gas, not that fancy premium stuff, now costs Californians an average of $6.05 per gallon—about $2 above the national average. In a feeble effort to give citizens of the Golden State “relief” at the pump, Governor Gavin Newsom ordered the state’s Air Resources Board (CARB) to allow winter-grade gas to be released a bit early this year. What a magnanimous ruler. The argument is that the winter-grade variety evaporates more rapidly in the sweltering summer heat, causing increased smog in the valleys; hence the typical November release. With any luck, gas will drop—perhaps—a buck per gallon thanks to this move. If drivers can just hold on until 2035 when Newsom’s ban on combustion engines takes effect and all of the state's energy problems disappear. The truth is, if market forces were simply allowed to operate naturally in the state, Californians would be a lot better off in virtually every economic sense. Consider this: The cabal that is supposedly leading the national charge for clean air drove away the world’s greatest electric car company—at least to a large degree—due to onerous regulations and constant political and judicial attacks. It’s not about clean air, it is about winning on the political stage. And the poor citizens of California are the pawns on the board. It is almost unfathomable to think that Ronald Reagan was once governor of California. How far that beautiful state has descended in two generations. If the citizens keep getting pushed around by Sacramento, however, the unthinkable might just happen once again. |

|

WTI $70/bbl

27 Mar 2023 |

No more excuses: begin refilling the Strategic Petroleum Reserve

With a capacity of 714 million barrels, the Strategic Petroleum Reserve, or SPR, is the world’s largest stockpile of oil. Held in underground tanks in Louisiana and Texas, this Department of Energy-maintained stash was a direct result of the 1973 energy crisis when OPEC labeled the United States a “hostile entity” and embargoed all oil exports to the country. To any American who vividly remembers that time, the current state of the SPR is appalling. Now sitting at its lowest level since 1983—a time at which our energy needs were much lower—the SPR is just over half full (372 million barrels). Over the course of the past two years, the Biden administration has authorized the release of a staggering 266 million barrels of crude for no strategic reason, simply the tactical reason of lowering the price at the pump. That was never what the program was intended for. As for refilling the SPR, last October the administration cited high prices and further stated that a program would be put in place to begin refilling the reserve when oil fell into the $67 to $72 per barrel range. It dropped down to that range in the middle of March, leading to the latest round of excuses. When questioned about the lack of action, Energy Secretary Jennifer Granholm said it would take years to replenish the tanks. All we could think of was Ronald Reagan’s classic response to the argument that his Star Wars program would take decades to implement: “Well, then let’s get started.” Granholm’s response was not exactly Reaganesque: “This year it will be difficult for us to take advantage of this low price.” She laid the blame on Congress and maintenance work being done at two of the four SPR sites. No more excuses; it is time to refill this critical component of America’s energy security. The Saudis were reportedly irked by Granholm's comments that the administration would not begin refilling the SPR this year, directly leading to the OPEC+ announcement that it would cut 1.1 million barrels per day of production between May and the end of the year. That led to a sudden spike in the price of crude, which now sits at $80.54 per barrel. Complete and utter ineptness directly led to American consumers paying more at the pump. What's next, another massive release from the SPR? |

|

UNG $8.50

Henry Hub spot $2.65 02 Feb 2023 |

Remember when natural gas was going to be the investment of the decade?

Think back for a minute to last summer. There were a lot of nightmare scenarios dancing around the economic horizon, but few more haunting than Vlad Putin’s desire to make Europeans pay for their support of Ukraine in the war. His number one weapon was energy, and endless stories painted a dire picture of gas bills quadrupling on the continent and many being left without natural gas to heat their homes. For investors, this pointed to an incredible opportunity to invest in the energy commodity using instruments such as UNG ($8.50), the United States Natural Gas ETF. Indeed, shares of UNG had risen from around $12 going into 2022 to $34.50 by August, a gain of some 187%. And that was during the warm days of summer; imagine (argued investors) how high they might go during the frigid European winter! Fast forward six months. UNG is sitting at $8.50, or 75% lower than it was in August. What happened? A prolonged spell of mild weather on the continent and stronger-than-expected supply inventories have combined to knock natural gas prices back down to pre-war levels. US natural gas production is hitting record highs (we are the world’s largest producer), and US LNG exporters increased shipments to Europe by nearly 150% year-over-year. Europe’s dependence on Russian gas has dropped from over 40% to near zero, yet Putin’s dream of exacting pain has failed to manifest. The pain to be felt in Russia by lost revenue due to his actions, however, is just beginning. We distinctly remember the copious stories in the financial press about natural gas facilities being knocked offline by storms and an explosion at a plant in the US, the hardship Europeans would face over the winter months, and the critical shortage of LNG. What seemed like a no-brainer of an investment turned into a nightmare for anyone buying into the hype. Yet another great lesson on behavioral finance and the false narratives so prevalent within the media. Always do your homework before investing, and have a specific exit strategy if events don’t play out as expected. |

|

Venezuela

01 Dec 2022 |

License to pump oil in Venezuela is as farcical as tapping the Strategic Petroleum Reserve

The headline intrigued us: “Chevron Gets US License to Pump Oil in Venezuela.” Despite the despot Maduro running the country, we could certainly use more oil to counteract OPEC’s promise to reduce supply and the sanctions on Russian crude. It didn’t take very long, however, before we figured out that this was just another gimmick which would barely move the needle. The United States produces some 11.7 million barrels per day (BPD) of crude—more than any other country on the planet. Granted, that is down 10% from what we were generating in 2019, but still mighty impressive. While Venezuela does have an enormous store of oil reserves beneath its surface (around 300 billion barrels, or 18% of the world’s known supply), it is only able to pump less than 700,000 BPD—down from 2.3 million BPD in 2016—due to its crumbling energy infrastructure. The deal to resume production, brokered by Norway and signed in Mexico City, is contingent upon the Maduro government implementing a $3 billion humanitarian relief program and holding talks on free elections in the country. Anyone holding their breath on either of those two requirements actually getting accomplished? But here is where the deal gets really humorous. The Biden administration prohibits pdVSA, the Venezuelan state-owned oil and natural gas entity, from receiving any profits from the oil Chevron sells from the deal; instead, under the new license, all profits will be used to pay off the hundreds of millions of debt owed to Chevron by pdVSA. What, then, is the incentive for Maduro to abide by the agreement and allow Chevron to ramp production back up in the country? That is a good question. Watch for the old bait and switch routine to be pulled. Chevron provides infrastructure, and Venezuela delivers more to China. Since we are talking oil supplies, let’s revisit the Strategic Petroleum Reserve, the emergency stockpile of oil maintained by the US Department of Energy. It is now down to a disgraceful 400 million barrels from its authorized 727 million barrels. The SPR is sitting there in case of a national emergency, not to reduce the price of oil. So far this year, the administration has released 165 million barrels from the reserve and has announced plans to allow another 15 million barrels to flow. A figurative drop in the bucket with respect to affecting oil prices, but a decision which will impact US readiness. Stop the release and rebuild the supply to authorized levels. The aim of Venezuela in the Mexico City talks was to get American energy companies back to Venezuela; more specifically, their money, know-how, and equipment. Keep your eyes on this deal, as it will not turn out as expected by those who cobbled it together. Not that we are against more oil production in the Americas; there is nothing more we would like to see than an energy-independent Western hemisphere. |

|

Crude/bbl $88

06 Oct 2022 |

OPEC’s win-win solution: take a jab at Biden and get a spike in oil prices

To say there is no love lost between the Biden administration and the Kingdom of Saudi Arabia is quite an understatement. When Biden flew to Saudi Arabia this past summer in an effort to get the titular head of OPEC to raise production, the country responded with a slap-in-the-face promise to boost output by a paltry 100,000 barrels per day. Now that the administration is getting what it wants before the upcoming mid-term elections—lower prices at the pump—OPEC+ holds a meeting in which it announces a two million BPD production cut. Oil futures, which had dropped to the upper-$70s/bbl range recently, surged back into the upper-$80s. This was a win for not only Russia, which has navigated the oil ban by selling crude to its nation-state buddies China and India, but also for Saudi Arabia, which got another chance to poke Biden in the eye and get the price of oil closer to its target $100/bbl range. The administration, clearly miffed, is responding in the feeblest of ways: promising to tap the US Strategic Petroleum Reserve yet again and discussing the possibility of easing sanctions on Maduro’s Venezuela. That is akin to a sweater-clad Jimmy Carter holding a fireside chat and encouraging Americans to turn down their thermostats in winter. The administration seems unwilling to take the correct course of action, which is to encourage—in deeds not words—increased production at home. The two million BPD cut by OPEC will probably only amount to an increase of one million barrels, as many members of the oil cartel are not currently meeting their quota; that amount could be countered were the US to begin pumping the same amount it did back in early 2020. But the love affair between the US energy complex and the Biden administration is on par with the Kingdom’s affection for the president. Additionally, with the litany of recent regulations thrown against “big oil” and the cancellation of the Keystone pipeline, getting back to 13 million BPD would be extremely challenging in the short run. That leaves the greatest “hope” for reduced prices at the pump being a global economic slowdown—something nobody wants. With respect to energy prices, the US finds itself between a rock and a hard place, and American consumers will be the ones getting crushed. The path of least resistance with respect to reining in oil prices seems to be a global economic slowdown. The regulations which have hampered oil production in this country will remain largely intact, and getting Venezuela back up to speed would take years. Also, consider the fact that there have been no new refineries built within the US for three decades, and the ongoing ESG battle against companies in the fossil fuels industry. That being said, if there is a marked slowdown in global growth we could see oil dropping back into the mid-$70s range this winter. |

|

LNG

|

As we head into sweater weather and beyond, beware the trajectory of natural gas prices

(07 Sep 2021) For anyone paying the family bills and living in a home which utilizes both gas and electric utilities, the cooler months generally meant a nice cost savings as the AC was turned off and the gas-powered heat came on. It always boggled our minds that homeowners would willingly go to an all-electric house, considering the spread between the price of the two commodities. That spread hasn't completely vanished, but the natural gas advantage is being rapidly diminished. In fact, the Henry Hub Natural Gas Spot Price has risen a remarkable 78%, from $2.43 to $4.33 per million British thermal units (MMBtu), just since this past April. A confluence of events have led to the dramatic price increase, from Europe's war on fossil fuels to an especially cold winter last year to a mysterious supply shortage in Russia. Whatever the mix of reasons, over which we have little to no control, expect higher gas bills this winter. Ironically, the spike in LNG prices has led to a semi-resurgence in the "dirtiest" of all fossil fuels, coal, as the price of the latter is substantially less than the former. Adding insult to injury is the fact that the hybrid work-from-home model means that families, not the companies they work for, will shoulder a higher percentage of the burden as they tap into more energy for their domestic work requirements. Our pocketbooks may be hurting this winter, but the vilified fossil fuel producers have provided a nice opportunity for high-risk-tolerance investors. Cheniere Energy (LNG $89), a major exporter of liquified natural gas (no easy task, by the way), is up 50% ytd; while the hated coal company, Peabody Energy Corp (BTU $19), is up a whopping 670%. For a basket of LNG holdings, investors can consider the United States 12 Month Natural Gas ETF (UNL $12), the United States Natural Gas ETF (UNG $16), and the iPath Bloomberg Natural Gas ETN (GAZ $25). |

Saudi Arabia and Russia agree to cut oil production, but we believe this is predicated on the US joining in. (07 Apr 2020) The world produces roughly 100 million barrels per day of oil. Of that amount, America is now the leading producer, at 13M bpd. Saudi Arabia comes in second, at 12M bpd, and Russia is third, at 11M bpd. After President Trump spoke directly with Crown Prince MBS of Saudi and President Putin of Russia, he announced that the two energy-reliant nations had agreed to a much-needed 10M bpd cut, or roughly 10% of current production. While the two have implicitly backed what the president is saying, we believe there is a little more to the story. As the leading producer in the world, it seems as though MBS and Putin expect the US to play a major role in those cuts. While we don't know exactly how Trump's meeting with oil executives in the White House (the day after his OPEC+ calls) went, we are seeing some signs of movement among the big US producers. Exxon Mobil (XOM $30-$42-$83) announced a 30% reduction in capital expenditures, which would almost certainly mean cuts in production—the largest CapEx cuts will be in the Permian Basin. US shale producer Continental Resources (CLR $7-$11-$52), another White House meeting participant, just announced that it would slash April and May production by 30%, suspending its dividend along the way. In fact, Continental CEO and famed energy maven Harold Hamm went as far as telling an industry publication that US producers had all but promised a 30% production cut. He said President Trump went out of his way to tell executives that no coordination would be needed (no doubt to tamp down the appearance of collusion), but that he expected they would do the right thing for their companies, and the industry as a whole. Will that be enough to assuage the Saudis and the Russians? Actually, it probably will be. No country is exactly in the catbird seat with respect to this issue, and none of the major producing nations want oil to remain in the $20s—or lower. That should be enough for the 10M bpd cut to actually happen. Update: OPEC+ did agree to a plan that would reduce production by 10M bpd—for up to two months. After that, we can expect smaller cuts. A Russian spokesman for Putin also threw cold water on our expectation that American energy producers' CapEx reductions would be enough. Dmitry Peskov told the Financial Times that, "You compare the general reduction in demand (of US firms) with reductions for stabilizing world markets. It's like comparing length and breadth."

|

Saudi

Aramco |

Saudi Aramco just made history as the world's largest-ever IPO. (11 Dec 2019) Five years ago, Alibaba became the largest company to ever go public—raising around $25 billion. Saudi Aramco, which just made its debut on the Saudi stock exchange, surpassed that level with just 1.5% of the company's shares being listed. Based on the price of those shares, which spiked up to the daily allowable limit of 10% on the Saudi exchange, the entire company has a market cap of $1.88 trillion. By comparison, Apple—the largest publicly-traded company in the world until Aramco—has a market cap of $1.2 trillion. Saudi Arabia's Gulf allies certainly helped the cause, with Kuwait and the United Arab Emirates investing $1 billion and $1.5 billion, respectively, in the shares. That being said, just about 10% of the IPO offers came from outside of the Kingdom, with the remaining 90% of funds generated from Saudi investment houses, companies, and wealthy local families. As we have previously outlined, a vast majority of the amount raised in the successful IPO will be used to help fund Saudi Vision 2030, Crown Prince Salman's massive effort to diversify the Kingdom's economy away from—somewhat ironically—oil. In the last issue of The Penn Wealth Report we made the case for investing in Saudi Arabia as we enter the new year. Despite the geopolitical risks and the muted price of oil, we see abundant investment opportunities in the region—at least among the nations embracing capitalism.

|

Oil-based ETF in Dynamic Growth Strategy spikes double digits following attack on Saudi oilfields. (16 Sep 2019) First, let's get the obvious out of the way: Iran is responsible for the weekend missile and drone attacks on Saudi Arabian oil installations. Less obvious but equally certain: Saudi Arabia will not let these attacks go unpunished, and odds are the retaliatory measures will take place before the press gets wind of the plans. Crown Prince Mohammad bin Salman is, for all intents and purposes, in charge of that country, and he is a hawk, especially with respect to Iran (another reason our relationship with the prince is so important from a strategic standpoint). As for fallout from the attacks, which took about 5.7 million barrels per day (out of 7M bpd total) out of production, oil immediately jumped around 14%. On 18 Dec 2018, we purchased OIL—the iPath S&P GSCI Crude Oil ETN—within the Penn Dynamic Growth Strategy when crude was sitting at $47 per barrel. That investment spiked around 14% as soon as the trading session opened following the attacks. The tensions in the Middle East, from attacks on oil assets to the pirating of tankers in the Gulf, will ratchet up before they subside, and that means we are in no hurry to take our profits on OIL. Iran is feeling cocky, and it badly miscalculated with this latest attack. While members of the Trump administration are directly pointing fingers at the country, the president is slightly more reticent on the issue, which means other factors may be in play. If Iran reads this as hesitation, the mullahs are likely to dig the hole they are in a little bit deeper. In other words, count on them to do the wrong thing. Another note of interest: While America has become essentially oil-independent as the new world leader in production, China still relies heavily on Saudi Oil. This will be yet another reason for that country to iron out a trade deal with the US.

Thanks to troubles in two Gulfs on opposite sides of the globe, oil is suddenly above $60 again. (12 Jul 2019) Earlier this week, three Iranian vessels tried to carry out what the mullahs had promised: stop the flow of oil through the Strait of Hormuz. Thanks to the Royal Navy's frigate HMS Montrose, however, the three ships stood down as the BP oil tanker pushed through. The Royal Navy was assisted with intelligence data collected from a US Navy P-3 Orion in the skies above the Strait. That incident, coupled with the specter of Tropical Storm Barry rolling through the Gulf of Mexico, heading for Louisiana's refineries, led to WTI crude spiking back above the $60 mark for the first time in six weeks. Roughly 50% of drilling activities in the Gulf of Mexico have ceased, and refineries are being temporarily shut down in preparation of Barry hitting landfall. While the storm in the Gulf of Mexico will come and go, there is no end in sight for the geopolitical storm in the other Gulf. So, despite talk of a global slowdown, we see oil prices on some pretty solid footing. We bought the ETF OIL when WTI crude was at $45. We do not see any reason to take our double-digit, short-term gains on the investment.

OPEC+ agrees to extend supply cuts in bid to keep oil prices high, but America is the spoiler. (02 Jul 2019) OPEC, or OPEC+ as it is sometimes now referred to as Russia builds stronger ties to the group, has agreed to keep its 1.2 million barrel-per-day supply cut in place for at least the next nine months—until March of 2020—as it grapples with attempts to keep the price elevated. Here's the problem with their plan: neither Saudi Arabia nor Russia are the leading producer of crude in the world any longer; that prize now goes to the United States. Thanks to the shale renaissance and a loosening of the restrictive standards put in place under the previous administration, the US is now on pace to produce between 12 and 13 million barrels per day in 2019. That is a nightmare scenario for OPEC, but even more so for their quasi-member Russia, which relies on income generated from the sale of oil to build their military and support their flailing economy. A full 70% of Russia's exports are oil- and gas-based, and over 50% of the country's federal budget revenues come from the energy sector. We continue to believe the sweet spot for crude, which is now at $56.22, is between $45 and $60 per barrel. This is high enough for US producers to turn a profit, but low enough to hurt Russia's economy and keep a clamp on Putin's military aspirations. We added the ETF OIL to the Dynamic Growth Strategy when crude dropped to around $45/barrel.

Oil jumps after latest attack on tankers in the Middle East. (13 Jun 2019) In December of last year, when crude was sitting close to $45 per share, we added the iPath S&P GSCI Crude Oil ETN (OIL $45-$54-$79), an oil tracking note, as a satellite position within the Dynamic Growth Strategy. With a nearly straight trajectory up, the note (and oil) quickly hit $65. We chose to keep that position open, as we see crude in a clear channel, and we are in no hurry to take profits. Case in point: just as oil had dropped near a multi-month low and the lemmings were predicting further drops due to demand destruction, another series of tanker attacks took place in the Strait of Hormuz. One of the two ships hit was carrying methanol from Saudi Arabia to Singapore, while the other was bound for Japan with its cargo of naptha—a petrochemical feedstock. As for the culprit, there is no doubt. While we like Becky Quick of CNBC, she is the quintessential journalist—she inferred that Iran couldn't be responsible, as they helped rescue the survivors. Wow. Back to oil prices: they are in a channel, and we see a number of possible events driving prices higher. We purchased OIL in December, and plan on holding the ETN for at least one year. We have used this tool, and its bearish cousin DUG, for over a decade to trade the usually-predictable swing in crude prices.

Oil breaks into the $40s, hitting new 2018 low. (17 Dec 2018) Oversupply and concerns about a global economic slowdown helped drive down crude oil futures down to their lowest level since August of 2017, falling 25% in the last three months alone. That's great news for drivers, not so much for US drillers. However, oil would have to drop to the mid-$40s range for most drillers in this country to see their profits evaporate. It was just a few weeks ago that the OPEC/Russian alliance agreed to cut production by 1.2 million barrels per day (BPD), but considering the fact that the US is now producing a record 12 million BPD, and that Russia will probably cheat (low oil is killing their economy), downward pressure remains intact. Additionally, Mexico's President "Amlo," who took office on 01 Dec, announced plans to raise that country's oil and gas output by 50% within the next six years. US light crude closed Tuesday's session at $45.91 per barrel. Despite the oversupply and global growth concerns, the mid-$40s is, we believe, the bottom channel for US light crude. For action we took in this area, members can visit the Trading Desk.

Another crack in the bloc: Qatar to leave OPEC. (06 Dec 2018) In the big scheme of things, Qatar is somewhat of a blip on the radar screen within OPEC. In fact, you have to go through ten countries—from a production standpoint—until you get to the peninsular Arab nation. That being said, the country's decision to leave OPEC after 57 years (it joined the year after the organization was founded) is another sign of trouble for the once-dominant oil producing cabal. Why is Qatar leaving? In the first place, it has had a long-running spat with Saudi Arabia, OPEC's titular head, with the Saudis accusing Qatar of being a state sponsor of terrorism. Secondly, the country wants to curry favor with the US, and sees this as a way to stick it to Saudi Arabia and cozy up to the US at the same time. Qatar has some leverage: the country's breakeven point on oil—the point in the fulcrum at which it can still maintain a balanced budget—is $47 per barrel versus $88 for Saudi Arabia. Additionally, the tiny country is the world's largest exporter of liquefied natural gas (LNG), so its reliance on oil is not as high. The move by Qatar, from the US standpoint, is a good one. Not only does it hurt OPEC, it keeps the US/Qatar alliance strong, and weakens the ties between Iran and Qatar. This move should help to keep oil prices near the lower band of their recent channel.

Oil futures just broke into the $50s in longest daily losing streak since 1984. (09 Nov 2018) Approximately one month ago, on the 3rd of October, crude was going for $76.24 per barrel, and consumers were paying out the nose at the pumps. Now, just four days after the much-hyped new Iranian sanctions went into full effect, oil broke into the $50s, closing Friday at $59.87 per barrel. Once again, the oil experts were wrong. And oil in the $50s is great: it provides some relief at the pump but still offers some nice profits to US drillers. Speaking of which, the US just hit another historic level of production: 11.6 million barrels per day. OPEC and their quasi-partner Russia are now threatening more cuts to increase the price of crude; let them, the American energy renaissance is alive and well (despite the Obama-appointed federal judge in Montana who just placed the Keystone Pipeline on hold once again).

|

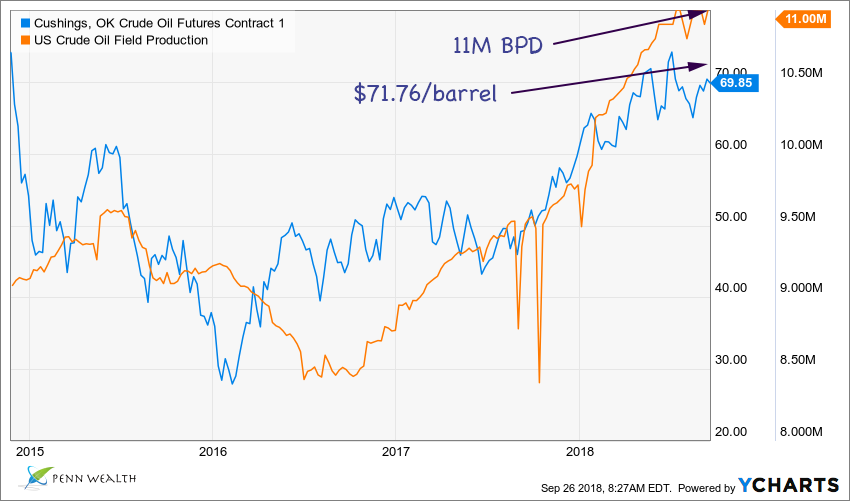

Crude hits four-year high, but not everyone is hurting. (26 Sep 2018) Most people cringe when they see the price of oil go up. Not only does that equate to spending more money at the pump, it also helps many of our enemies, or at least "questionable friends" around the world, such as Russia and OPEC member-states. Since America's energy renaissance, however, at least we can take a little comfort in the fact that the American energy sector, and its mostly blue collar workforce, also reap the benefits of higher oil prices. Take a look at the chart: crude just hit $71.76 per barrel, a four-year high; but US oil production followed suit, hitting a remarkable 11 million bpd. With new Iranian sanctions taking effect soon, industry experts are predicting further gains, but we appear to be at the high point of a channel. The one bright spot, we believe, is the fact that China's rate of economic growth continues to slow.

|

Has the Saudi Aramco IPO really been cancelled? (23 Aug 2018) Although the press is making it sound like a new story, we reported on a probable delay in the massive Saudi Aramco IPO this past March. The real issue is the price tag: Saudi Arabia wants to raise $100 million in the IPO of its national oil company, but is only willing to sell 5% of the company to the public. That would value the oil giant at a ridiculous $2 trillion. Keep in mind that Apple just became the first trillion dollar company in the world. While Reuters has been reporting that the Saudis called the IPO off due to challenges raising the capital, energy minister Khalid-al-Falih said the public offering was still a go—just at a time when market conditions are more favorable. That probably means no earlier than late 2019. Keep in mind, however, that the Saudis need the price of oil to remain high to make this work; preferably higher than the current $71 per barrel for Brent Crude. With technology increasing America's ability to pull oil from the ground, a reduced regulatory stance in the US, and the rise of alternative energy, we believe $70 per barrel should be the high of the range. Anything above that probably has more to do with market manipulation than the forces of supply and demand.

Oil prices spike as US urges allies to boycott Iranian oil. (26 Jun 2018) Let's face it, oil and gas prices don't need much of an excuse to spike, taking more money out of our wallets. Crude got just such an excuse today, as the US Department of State said it expects allies to reduce Iranian oil imports to zero by this November or face sanctions. West Texas Intermediate immediately spiked 3% on the announcement, jumping to over $70 per barrel for the first time in the month of June. WTI topped out at $72.02 on May 22nd, and bottomed out about a month later at $64.90 per barrel. We are sure it won't take long for the fresh increase to hit the pumps.

OPEC agrees to raise output by one million barrels per day. (22 Jun 2018) President Trump reportedly asked OPEC member Saudi Arabia to raise oil output to help alleviate high prices at the pump. The Saudis want to keep America happy. The Russians want to raise output to increase revenues. Iran wants to keep the OPEC cap in place to keep oil prices high and stick it to their sworn enemy—America. In the end, OPEC did agree to "reduce the reduction" put in place via the group's 2016 deal, compromising just enough to eliminate an Iranian veto (the Iranian oil minister had stormed out of the meeting in a huff Thursday night). On paper, this means an increase of one million barrels per day (BPD) by the group's members and "friends," such as Russia. However, with turmoil and disruption in spots like Venezuela and Libya, the actual effect will probably be more like 600,000 BPD on the market, or 1/2 of 1% of global supply. Markets were underwhelmed by the decision, and Brent crude futures actually rose about 2% on the news. Who has been hurt the most by the higher oil prices? Probably India, which imports over 85% of the oil needed for its rapidly-growing economy. India's pro-business leader, Prime Minister Narendra Modi, removed caps on the price of gas back in 2014, and higher prices at the pump have been causing a consumer backlash against his government.

|

Legendary Oilman T. Boon Pickens Inspires a New Fund

The NYSE Pickens Oil Response ETF is one of the most fascinating new funds we have seen in some time. (See article in The Penn Wealth Report by clicking button to right) |

Despite record US output, oil prices continue their climb on geopolitical risks

(07 May 2018) US crude oil broke through $70 per barrel on Monday, marking its highest price since 2014 and representing a 45% spike from one year ago. This occurred despite the fact that US energy production is at its highest level in history—over 10 million barrels per day are now being produced, versus around half that amount just ten years ago. With all of this added US supply, why does the price of crude continue to rise? Geopolitical forces around the globe are conspiring to foment fear and uncertainty in the energy commodities space. In Venezuela, a virtual breakdown of the government has frozen that country's oil infrastructure. With respect to Iran, fear that the president will pull out of the 2015 nuclear deal (which was horrible, even if Iran were abiding by the terms—which they are not) is putting upward pressure on prices. Meanwhile, the Saudis continue to push for $80/barrel oil as that country struggles to fund their massive economic transformation. In the past, we might have been tempted to purchase a short oil fund with prices this elevated; right now, however, there is simply too much uncertainty.

(07 May 2018) US crude oil broke through $70 per barrel on Monday, marking its highest price since 2014 and representing a 45% spike from one year ago. This occurred despite the fact that US energy production is at its highest level in history—over 10 million barrels per day are now being produced, versus around half that amount just ten years ago. With all of this added US supply, why does the price of crude continue to rise? Geopolitical forces around the globe are conspiring to foment fear and uncertainty in the energy commodities space. In Venezuela, a virtual breakdown of the government has frozen that country's oil infrastructure. With respect to Iran, fear that the president will pull out of the 2015 nuclear deal (which was horrible, even if Iran were abiding by the terms—which they are not) is putting upward pressure on prices. Meanwhile, the Saudis continue to push for $80/barrel oil as that country struggles to fund their massive economic transformation. In the past, we might have been tempted to purchase a short oil fund with prices this elevated; right now, however, there is simply too much uncertainty.

What does a delay in the massive Saudi Aramco IPO mean?

(13 Mar 2018) According to the Financial Times of London, the massive, $2 trillion Saudi Aramco IPO has been put on hold until 2019. The reason? The $2 trillion price tag. The numbers are simply staggering. The Saudi Arabian-controlled company wants to sell just 5% of itself on, more than likely, two exchanges—the domestic Tadawul exchange and a foreign exchange. New York, London, and Hong Kong appear to be the three foreign cities in the running for the ticker. Five percent of $2 trillion is $100 billion, which is what the Kingdom hopes to raise on the deal. Financial analysts are having a really tough time justifying that valuation; hence the delay. Crown Prince Mohammed bin Salman, who is in line to be the next king, needs the funds to further his massive economic reform program underway in Saudi Arabia.

(13 Mar 2018) According to the Financial Times of London, the massive, $2 trillion Saudi Aramco IPO has been put on hold until 2019. The reason? The $2 trillion price tag. The numbers are simply staggering. The Saudi Arabian-controlled company wants to sell just 5% of itself on, more than likely, two exchanges—the domestic Tadawul exchange and a foreign exchange. New York, London, and Hong Kong appear to be the three foreign cities in the running for the ticker. Five percent of $2 trillion is $100 billion, which is what the Kingdom hopes to raise on the deal. Financial analysts are having a really tough time justifying that valuation; hence the delay. Crown Prince Mohammed bin Salman, who is in line to be the next king, needs the funds to further his massive economic reform program underway in Saudi Arabia.

Crude hovers just above the $60 per barrel mark, trigger finger getting itchy

(02 Jan 2018) It's the highest oil prices have been in over two years, and it has us itching to pull the trigger on our favorite short oil investment, the ProShares UltraShort Oil and Gas ETF (DUG $36-$36-$53). With tensions high in Iran, West Texas Intermediate futures closed above $60 last Friday—the first time that has happened since the summer of 2015. Brent, the global benchmark was sitting at $66.57 per barrel by the close of trading on Monday. With US producers taking their equipment out of mothballs, expect oil to trade in a range, despite the saber-rattling at OPEC headquarters. If we are not at the peak of that range, we are mighty close. Consider the fund we have used literally since it came into existence in 2007: DUG is sitting at its one year low, down 32% since August. At $35.78, we may put this back to work soon in the Intrepid Trading Platform. If and when we do, it will be announced in the Trading Desk.

(02 Jan 2018) It's the highest oil prices have been in over two years, and it has us itching to pull the trigger on our favorite short oil investment, the ProShares UltraShort Oil and Gas ETF (DUG $36-$36-$53). With tensions high in Iran, West Texas Intermediate futures closed above $60 last Friday—the first time that has happened since the summer of 2015. Brent, the global benchmark was sitting at $66.57 per barrel by the close of trading on Monday. With US producers taking their equipment out of mothballs, expect oil to trade in a range, despite the saber-rattling at OPEC headquarters. If we are not at the peak of that range, we are mighty close. Consider the fund we have used literally since it came into existence in 2007: DUG is sitting at its one year low, down 32% since August. At $35.78, we may put this back to work soon in the Intrepid Trading Platform. If and when we do, it will be announced in the Trading Desk.

The IEA confirms it: US shale producers are OPEC's biggest enemy

(14 Dec 2017) The Paris-based (i.e. not a US shill) International Energy Agency has confirmed what we, as Americans, had hoped was true: the US energy renaissance, specifically shale production, will continue to be a nightmare for OPEC. Ever since the Yom Kippur War in 1973, it has been the goal of (nearly) every US administration to make America an energy-independent nation. Today, we can truly say that goal has been achieved. In its latest monthly report, the IEA stated that the re-ramping up of US shale production will make OPEC "not quite so happy" in 2018. The agency sees an increase of 1.6 million barrels per day in 2018 by non-OPEC nations, completely undermining the organization's plan to raise oil prices by cutting their members' production levels. This follows their failed attempt to push US shale producers to the brink of extinction by increasing production in 2016. Sweet revenge. For a taste of what hell OPEC put the US consumer through in the early 1970s, members can click the link to read the story of The First Great American Oil Crisis.

(14 Dec 2017) The Paris-based (i.e. not a US shill) International Energy Agency has confirmed what we, as Americans, had hoped was true: the US energy renaissance, specifically shale production, will continue to be a nightmare for OPEC. Ever since the Yom Kippur War in 1973, it has been the goal of (nearly) every US administration to make America an energy-independent nation. Today, we can truly say that goal has been achieved. In its latest monthly report, the IEA stated that the re-ramping up of US shale production will make OPEC "not quite so happy" in 2018. The agency sees an increase of 1.6 million barrels per day in 2018 by non-OPEC nations, completely undermining the organization's plan to raise oil prices by cutting their members' production levels. This follows their failed attempt to push US shale producers to the brink of extinction by increasing production in 2016. Sweet revenge. For a taste of what hell OPEC put the US consumer through in the early 1970s, members can click the link to read the story of The First Great American Oil Crisis.

Growing US rig count is undermining OPEC's production cuts

(11 Dec 2017) The US oil rig count has more than doubled since the middle of last year, and that is putting a clamp on OPEC's efforts to keep the price of crude artificially high. In the summer of 2016, the US rig count fell to just over 300; as of the end of last week, that number rose to 751 and will continue to grow. With the rig count, US oil production continues to hit new all-time highs—the current rate of US production is 9.72 million barrels per day. West Texas Intermediate (WTI) crude futures fell to 57.10 on the rig count update.

(11 Dec 2017) The US oil rig count has more than doubled since the middle of last year, and that is putting a clamp on OPEC's efforts to keep the price of crude artificially high. In the summer of 2016, the US rig count fell to just over 300; as of the end of last week, that number rose to 751 and will continue to grow. With the rig count, US oil production continues to hit new all-time highs—the current rate of US production is 9.72 million barrels per day. West Texas Intermediate (WTI) crude futures fell to 57.10 on the rig count update.

We are getting close to dusting off our short oil ETFs

(22 Nov 2017) By all rights, oil should be hovering around $45-$50 per barrel right now. Instead, thanks in part to the recent Keystone Pipeline disruption, crude settled out the day at a two-year high of $58 per barrel. That belies logic. The US is producing a record $9.62 million barrels per day, and world demand is nowhere near a peak. Despite the upcoming OPEC meeting on 30 Nov, at which time the cartel is expected to extend its production restrictions, look for oil to peak around $60 before heading back down. We use the United States Short Oil Fund, symbol DNO, or the ProShares UltraShort, symbol DUG, to play an expected drop in prices, and we are close to adding one of them back into the Penn Intrepid Trading Platform.

(22 Nov 2017) By all rights, oil should be hovering around $45-$50 per barrel right now. Instead, thanks in part to the recent Keystone Pipeline disruption, crude settled out the day at a two-year high of $58 per barrel. That belies logic. The US is producing a record $9.62 million barrels per day, and world demand is nowhere near a peak. Despite the upcoming OPEC meeting on 30 Nov, at which time the cartel is expected to extend its production restrictions, look for oil to peak around $60 before heading back down. We use the United States Short Oil Fund, symbol DNO, or the ProShares UltraShort, symbol DUG, to play an expected drop in prices, and we are close to adding one of them back into the Penn Intrepid Trading Platform.

US crude production, oil exports, hit record highs as oil nears $60 per barrel

(09 Nov 2017) Did OPEC really think they could crush US shale producers with their production cut? As oil nears $60 per barrel, US shale producers kicked back into gear, helping the country produce a record high 9.62 million barrels per day for the week ended 03 November. Furthermore, the government's decision to actually allow oil exports to take place is having a positive impact on the American economy—US exports of crude also hit a new high of 2 million barrels per day. (See chart in The Penn Wealth Report.)

(09 Nov 2017) Did OPEC really think they could crush US shale producers with their production cut? As oil nears $60 per barrel, US shale producers kicked back into gear, helping the country produce a record high 9.62 million barrels per day for the week ended 03 November. Furthermore, the government's decision to actually allow oil exports to take place is having a positive impact on the American economy—US exports of crude also hit a new high of 2 million barrels per day. (See chart in The Penn Wealth Report.)

Global growth, OPEC cuts push oil prices to their highest level since summer of '15

(03 Nov 2017) It seems like just yesterday we were filling our tanks up with $2 per gallon gas, with promises of prices at the pump going even lower. Now, with global growth ramping up quicker than anyone expected, and OPEC's production cuts actually holding, US crude futures are suddenly at a two-year high of more than $54 per gallon. The national average for a gallon of gasoline has spiked from $1.83 in February of 2016 to $2.60 today. OPEC members are rubbing their greedy little hands together, believing they are once again in the driver's seat, but their hopes will be dashed by something they refuse to recognize. American shale drillers are not dead, they are simply waiting for prices to go a bit higher before tapping the enormous number of wells they have sitting idle. If oil gets closer to $60 per barrel, those wells come online and OPEC gets a nasty surprise.

(03 Nov 2017) It seems like just yesterday we were filling our tanks up with $2 per gallon gas, with promises of prices at the pump going even lower. Now, with global growth ramping up quicker than anyone expected, and OPEC's production cuts actually holding, US crude futures are suddenly at a two-year high of more than $54 per gallon. The national average for a gallon of gasoline has spiked from $1.83 in February of 2016 to $2.60 today. OPEC members are rubbing their greedy little hands together, believing they are once again in the driver's seat, but their hopes will be dashed by something they refuse to recognize. American shale drillers are not dead, they are simply waiting for prices to go a bit higher before tapping the enormous number of wells they have sitting idle. If oil gets closer to $60 per barrel, those wells come online and OPEC gets a nasty surprise.

UPDATE: Boy, was Kilduff ever wrong. Oil went in precisely the opposite direction since this was written. (20 Jun 2017) Will oil drop below $40 per barrel? The financial press is lazily reactive on most topics. Take oil prices. When crude was in the low-$50s and climbing just a few short months ago, all the talk was of $60 per barrel oil. Now that prices have plummeted down to the $43 range, the "experts" are looking for oil in the $30s. An expert we do listen to with respect to the commodity is John Kilduff. That's why we took notice today when he made a confident prediction that crude will soon break below $40 per barrel. If that happens, we will probably add our old friend OIL ($5-$5-$7) back into the Intrepid Trading Platform and wait for the near-certain profit.

(29 Mar 2017) Don't look now, but the US is suddenly exporting oil. Last week, the United States did something which would have seemed unfathomable just a generation ago: we exported over 1 million barrels per day of crude oil. As the US energy renaissance continues, despite OPEC's effort to destroy the movement by driving down prices, we continue to erode that organization's power in the world. US refineries are also ramping up production, supplying 9.5 million barrels of gasoline per day last week, up from 9.2 million in the previous week. Not bad, considering we haven't built a new refinery in this country in thirty years.

(2016.12.27) China another reason oil won't go much higher in near term. With crude oil futures sitting around $55 per share, we believe it is a sucker's bet to get bullish on the commodity right now. While the US economy continues to improve and OPEC just capped production, the instinct is to expect higher prices. China, however, has been taking advantage of low prices by stockpiling crude in newly-built storage facilities for its "teapot refineries"—small, privately-owned companies now sanctioned by the communist state. As oil prices rise, the strategic buying will abate, thus reducing demand (and prices).

Who will Blink First and Cut Oil Production to Force Prices Back Up?

(01 Sep 15) The US energy renaissance was something few people saw coming. In the Middle East it was discounted, belittled, and impugned. But the US got the last laugh, as American ingenuity brought forth a literal flood of new oil and gas onto the world scene. Last November, the wizards of oil at OPEC tried to strangle American producers by refusing to cut production. That backfired like a cheap Russian missile, and oil plummeted 50% as US companies simply improved their efficiency.

Now that our enemies around the world are feeling real pain, they have decided to “negotiate” the lowering of production levels. OPEC has signaled they are ready to stand by their friends (read: fellow thugs and terrorist states) and begin real talks on cutting production. There is just one problem: every member-state is expecting the cutbacks to start elsewhere.

Think about it. Russia is in dire straits, considering its export base is overwhelmingly fuel-centric. If Putin orders less crude be taken out of the ground and the ocean floor, he has even fewer sickly rubles to re-build his Russian empire. Then there is fellow emerging market (that term has become a joke) Venezuela. A buffoonish Nicolas Maduro is driving the economy into the ground, irrespective of the price of oil. His ruthless regime, like Putin’s, cannot afford to bear the brunt. They point the finger back at the “wealthy” Saudis.

Then there is Iran. The rotten nuclear deal the US agreed to with the mullahs means that they can start selling oil on the open market. (Ironically, they cannot use much of their own oil, as they have little refining capability.) It’s hard to convince someone frothing at the mouth to sell their oil to also be the ones to fall on their sword.

One common thread for the OPEC cabal is their general dislike for America and their hatred for our current drilling capabilities. But will that be enough for them to put aside their own differences and foist higher crude prices on the world? Perhaps. The day the news was leaked, oil futures shot up 9%.

(Reprinted from the Journal of Wealth & Success, Vol. 3, Issue 35. Not a member? Click Here.)

(OK, got it. Take me back to the Penn Wealth Hub!)

Crude’s Rebound was Short-Lived, Finishes at $45 per Barrel.

(Sa, 14 Mar 15) With a rally lasting just long enough to fool the capricious press and Goldman Sachs analysts, oil reversed back down this week and hit a new recent low of $45 per barrel. OPEC issued a report essentially blaming US frackers, which is great—it gives them a taste of the medicine they have been force-feeding the rest of the world for nearly two generations.

Interestingly, the rapid drop in oil prices and the rapid rise in the strength of the dollar have been made the scapegoat for recent market weakness. When the Fed finally takes responsible action and raises interest rates, you can bet that the market will throw another tantrum. That is looking less and less likely this summer, and we stand by our December prediction.

Should you begin buying energy names with crude at $45? Well, the geniuses at Goldman Sachs (who told us last year that oil was going to $200 per barrel soon) are now telling us that $20 per barrel is possible. No, it really isn’t. Once again, they have joined the herd mentality. That being said, a number of energy companies are now being forced to layoff workers and liquidate assets. Some will not live to see $80 per barrel again, let alone Goldman’s $200. But if you stick to efficiently run integrated oil companies, and the strongest drillers, now should be a great time to take a position.

We just picked up a major integrated oil company in the Penn Global Leader’s Club, and imagine that we will look back in a few years and be very pleased with that decision. When the Goldman lemmings are going in one direction, it often pays to make a 180° turn. Analysts wish to keep their jobs and their guest spots on CNBC—take advantage of their arrogance.