Maritime—Shipping & Ports

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

AMKBY $7

03 Nov 2023 |

Container shipping giant Maersk gives bleak outlook on trade

To get a good read on the state of global trade, we often look to the bellwether container shipping firms for clues. Four in particular we look at are Diana Shipping (Greece), Costamare (Greece), Nordic American Tankers (Bermuda), and A.P. Moller Maersk (Denmark; AMKBY $7). Shares of the latter plunged on rather dire comments—and actions—by the CEO. Chief Executive Officer Vincent Clerc announced in an interview with Bloomberg that at least 10,000 workers (out of 88,000) would lose their jobs. In a rather poor choice of words, he said that "6,000 of those have already been executed." Shares fell 16% on the news, finding themselves 35% below where they started the year. Clerc said he sees the global shipping business remaining "subdued and pressured" until about 2026. Container lines had been riding high with increased demand for consumer goods both during and in the immediate aftermath of the pandemic, leading to higher freight prices and record profits. In 2022, for example, Maersk netted $32 billion off of $82 billion in revenue. Third quarter revenue plunged to $12 billion, or about half that of the same quarter last year. Earnings fell to $1.88 billion. Of course, this is good news for customers who saw their rates spike from about $2,000 per 40-foot container unit to over $10,000 between 2019 and 2022. Those rates have now plunged back down to their pre-pandemic levels (more good news on the inflation front, as those prices were passed along to consumers). Maersk, which hopes to save $600 million on the cost-saving measures, transports about one-sixth of the world's containers. With the shippers tanking (no pun intended), is it time to buy before a rebound? Not quite. With the Chinese economy foundering, much of Europe in a technical recession, and the US possibly heading for recession in the first half of 2024, these stocks are too risky right now. Put them on your radar and revisit around the middle of next year |

|

NAT

|

Our maritime shipper spikes on the growing concern over container shortage

(12 Feb 2021) For anyone who believes that America, or the world in general, is ready to stand up to China's trade practices, try this one on for size: the communist nation ended 2020 with a record trade surplus. The demand for Chinese goods is now so great that the world is facing a shipping container crisis. Just how bad is it? Because the shippers can make so much more money on the goods leaving China as opposed to the goods entering the country—like grain from the United States—they are literally rushing back empty containers to China to alleviate the backlog of goods waiting at Chinese ports. Spot freight rates are up nearly 300% from a year ago. While that is a sick testament to the state of global trade, one industry is certainly reaping the rewards: the maritime shippers which had been crushed during the trade war and subsequent pandemic. We have been fascinated by this highly-cyclical industry for decades, and when one of our favorites, Nordic American Tankers (NAT $4), saw its share price drop to $2.80 this past October, we jumped in, adding the Bermuda-based shipper to the Penn Intrepid Trading Platform. NAT jumped 14% in one day on news of the container shortage. Think the run will be short-lived or that the shippers are now overvalued? Take a look at the accompanying chart on NAT. Despite the fact that there are nearly 200 million intermodal freight containers around the world, the rapid increase in demand caught nearly everyone off guard. Ready for the icing on the cake? 97% of these containers are now made in, you guessed it, China. For a brief refresher on the shipping industry, visit our 2018 Penn Wealth Report story on The State of Global Shipping. We see the upswing continuing to gain momentum as global economies revive. |

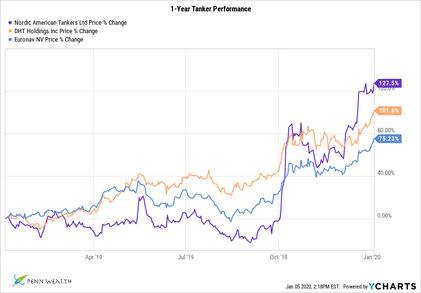

Global shipping industry is getting its groove back, spurred by economics, trade, and geopolitics. (05 Jan 2020) Not long ago, we discussed "The State of Global Shipping" in an issue of The Penn Wealth Report (see story link below). We compared the industry, which had been decimated by the trade war and global economic slowdown, to Bank of America (BAC), which was selling for $2.53 during the height of the financial crisis. In other words, look for this industry to come roaring back. Specifically, we mentioned picking up Nordic American Tankers (NAT) at $2.10 per share. On Friday, NAT hit $5.05 per share, and tanker stocks are soaring as trade tensions ease and geopolitical tensions in the Middle East heat up. Management at NAT just issued a press release outlining how much revenue is now being generated from their vessels' spot voyages. In short, it is a lot higher than it was a year ago. And we see this comeback story continuing in 2020. We believe global growth has troughed and should pick back up over the coming quarters. This should certainly help the bottom line of quality shipping companies. The industry can be challenging to navigate, however; we recommend members re-visit the Penn Wealth Report story, which briefly discusses fundamentals, chief players, and industry trends.

|

NAT

|

Shares of Penn Intrepid member Nordic American Tankers pops 21.3% in one day. Nordic American Tankers has been one of our favorite maritime trading stocks. Extremely volatile, but nonetheless a strong company in the industry, we believed shares were undervalued at $2.10 this past February, so we added the position to the Penn Intrepid Trading Platform. On Monday, shares of NAT spiked 21.3% on news that the company was scrapping its bond offering due to its strengthening financial position. On Tuesday morning, as the Dow was falling over 300 points in early trading, NAT held its own. Due to the volatile nature of the shares, we sold our position at $2.63 for a short-term, 25% gain. For members, the sell was annotated within The Trading Desk.

|

|

The State of Global Shipping

After investors got burned during the global downturn, this industry is now rife with opportunity—but be careful! (See article in The Penn Wealth Report by clicking button to right) |

|

NAT

|

Nordic American Tankers gives rosy outlook for maritime industry in 2018

(12 Feb 2018) According to the commentary section of its fourth-quarter earnings report, shipping firm Nordic American Tankers (NAT $2-$2-$9) sees a sunny horizon for the industry throughout 2018. The company, which operates a fleet of 33 Suezmax oil tankers, notes that—from their perspective—the world economy is "enjoying its strongest upswing since 2010." From a revenue standpoint, the report shows that the time charter equivalent (TCE) for 4Q2017 was $13,800 per day per ship, up from $10,600 in 3Q2017. This metric would signify a significant increase in demand, buttressing the company's outlook for the year ahead. As for NAT as an investment, it takes nerves of steel to pull the trigger—the company's $1.97 share price represents a 77% haircut from its 52-week high of $8.68. |

|

DRYS

|

DryShips pops 24% on share buyback announcement

(07 Feb 2018) The headline may be a bit misleading, as maritime shipper DryShips (DRYS) has traded between $0.96 and $5,685.39 per share (yes, you read that right) over the past 52 weeks. The 24% pop, bringing the share price up to $3.54, highlights just how volatile this industry can be (DRYS is a typical-sized shipper in the industry), and also gives us a nice segue-way into our upcoming report on the industry in the next issue of The Penn Wealth Report. Consider for a moment the nearly-unfathomable amount of consumer goods and commodities (including natural gas and oil) which must be transported, in any given year, from producer to consumer at various points around the world. Investors can make some nice coin on trading these shippers, but one really has to understand the nuances of the industry—probably more than any other corner of the market. In the article, we will look at some of the major players, the challenging environment ahead, and some industry trends for 2018. |

|

LNG

|

US delivers first shipment of gas to former Soviet satellite Lithuania

(21 Aug 2017) America has this wonderfully-valuable commodity in abundance, yet (for some strange reason) we wouldn’t share it with our friends around the world. All that has changed. Lithuania, a former soviet satellite-state, just received its first cargo shipment of American produced liquefied natural gas (LNG) from the Independence, a US-based tanker. For ease of transport, natural gas is chemically converted into a liquid state, taking up 1/600th the amount of space that natural gas would use, all without the need for pressurization. Former President Obama said he was for the export of this commodity, yet did not allow one transaction to take place. Lithuania has, for all intents and purposes, been held hostage by Moscow due to its need for Russian LNG. Upon receipt of the asset, Lithuania’s energy minister said that “the US is already the country’s most important strategic partner, and now becomes a reliable LNG supplier for the whole region.” |