Penn After Hours

This report has been compiled and produced by Penn Wealth Publishing, LLC, a legally separate entity from Penn Wealth Management, our registered investment advisory service. It is intended for informational purposes only and should not be construed as investment advice. Always consult with your professional financial advisor before making any investment decision. Looking for an advisor? Visit Penn Wealth Management...

Create wealth by reading beyond the headlines...

Sign up to get the top business & investment headlines of the week delivered right to your inbox!...

Sign Up Now

For Email Marketing you can trust.

Headlines for the Month of July 2024

Mo, 22 Jul 2024

Multiline Retail

Macy's will go it alone, ends talk of sale to go private

Last December we wrote of Macy's (M $16) planned deal to sell itself to Arkhouse Management and Brigade Capital Management for approximately $6 billion, thus becoming a privately held retailer. Shares surged 20% higher on the news. Last week, the opposite took place. Shares of M plunged after the company's board unanimously agreed to walk away from what they perceived as an underwhelming proposal that came with a lack of certainty over financing. They punted despite the raised offer price of $7 billion from the would-be buyers.

Macy's has faced severe competition in recent years from not only traditional peers such as Nordstrom and Kohl's, but also from retail giants like Amazon, Walmart, and Target who have been encroaching on their turf with higher-quality clothing. As if the environment weren't challenging enough, Chinese online retailers like SHEIN are now eating into market share. JC Penney lost its battle to stay public after being forced into bankruptcy by a massive debt load, only to be purchased for the paltry amount of $800 million ($300 million in cash and the assumption of $500 million of debt) by two retail REITs. The same two REITs, Brookfield Asset Management and Simon Property Group, were on the verge of buying struggling retailer Kohl's for $8.6 billion back in 2022 until management downgraded its full-year outlook. Kohl's now has a market cap of $2.5 billion.

Macy's may not end up like its unfortunate peers, however. Not only does the company own massive real estate holdings (which Arkhouse and Brigade almost certainly would have sold off to gain capital), it also has a promising strategic initiative to be spearheaded by new CEO Tony Spring. Actions will include closing unprofitable locations, increasing the upscale Bloomingdale's brand, enhancing the customer shopping experience, and improving an already robust online presence. Had the firm gone private, the focus would have been squarely on cannibalizing the company's assets rather than maximizing potential.

We last owned Macy's in the Intrepid Trading Platform back in 2020. In November of that year, we closed the position for an 82% gain. While we don't currently plan on adding the company back into a strategy, we do believe the shares are worth north of $20.

Th, 11 May 2024

Technology Hardware & Equipment

The strange case of Microsoft ordering workers to carry iPhones

To be clear, this order only involves Microsoft's (MSFT $466) Chinese workforce, but on its face it does seem odd. After all, the iOS used in Apple's (AAPL $225) iPhones is a competitor to Microsoft's Windows operating system. So why the sudden mandate?

Android is an operating system created by Google (GOOGL $189) to power mobile devices such as smartphones. Currently, around 70% of the world's phones use this technology, despite the iPhone's dominance in the US market. Following a series of Russian-linked cyberattacks, Microsoft launched a cybersecurity program called Secure Future Initiative (SFI). Under this program, employees will soon be required to verify their identities upon logging into their devices, which necessitates the downloading of Microsoft's Authenticator password manager and Identity Pass app. While these apps are available on Google Play, that service isn't available in China thanks to the communist nation's Internet censorship system, known as the Great Firewall. This leaves Apple's App Store as the only viable download source in the country.

Obviously, authorities would like every citizen to use smartphones made by China's Huawei or Xiaomi, which have developed their own unique software platforms—migrating away from Android. Any Microsoft employee in China using Android phones, to include devices made by the two domestic firms, will be provided an iPhone 15 by the company. More and more Chinese firms and government agencies are banning foreign phones from the workplace, citing security concerns. Coming from the world's leading intellectual property (IP) thief, that is rich.

This case further spotlights the fine line American firms operating in China must walk. It also provides more evidence for the need to diversify away from the increasingly troublesome country. The guise of free and fair trade has been revealed for what it has always been: a sham.

Tu, 21 May 2024

Semiconductors & Equipment

Nvidia just had an incredible quarter; a stock split is on the way

Precisely three months ago to the day, we reported on AI chip designer Nvidia's (NVDA $1,035) "crazy-good quarter." We are running out of adjectives to use for this firm's performance on the heels of a quarter that just eclipsed the previous one. Sales jumped 262% (not a typo) in the fiscal first quarter from the previous year, to $26 billion, and earnings came in at $6.12 per share; both numbers handily beat Wall Street estimates. Guidance for the second fiscal quarter of the year calls for $28 billion in revenue, and we have little doubt that the number will be reached. Shares were trading up double digits at the open following the release.

Just a reminder of what Nvidia does. In macro terms, think of it as the engine of AI. It provides a complete hardware and software package for companies operating within this new realm. It is the world's leading designer of graphics processing units (GPUs) which were traditionally used in gaming platforms, but are now an integral part of artificial intelligence. No one single company benefits more from the adoption of AI than Nvidia.

Going into Thursday morning, Nvidia was a $2.3 trillion company sitting in size only behind Microsoft and Apple. By the day's close, it carried a market cap in excess of $2.6 trillion, just 10% below Apple's market cap. Putting its growth in perspective, the company's shares were selling for around $100 apiece back in October of 2022. Along with the blowout quarterly results and the $1,000+ share price came news that the company would execute a ten-for-one stock split as of market open on June 10th. This would put them back around the $100 range, making the company more attractive to many retail buyers (though the valuation doesn't change due to a split, of course). In other words, we don't see their share price or the company's 39 forward multiple dissuading new buyers from jumping in.

In addition to the obvious customers such as Amazon, Meta, Microsoft, and Google, Nvidia is also working with over 300 companies in the autonomous driving space. Cash rich, growing free cash flow, and accelerating revenue growth; it is difficult not to love this firm. Not only is Nvidia a member of the Penn New Frontier Fund, it is also a top holding in several ETFs within the Penn Dynamic Growth Strategy.

Tu, 21 May 2024

Latin America

Even with leftists, China is wearing out its welcome in Latin America

No matter the year, there are always a handful of leftist leaders sprinkled throughout Latin America who would gladly work hand-in-hand with China if for no other reason than their disdain for the United States. The current lineup includes AMLO of Mexico, Lula of Brazil, Boric of Chile, and Petro of Colombia. Lula regularly welcomes Chinese warships to dock at ports in Rio, not to mention "warships" of the Iranian navy. But the communist nation seems to be doing everything it can to spoil its simpatico relationship with our neighbors to the south by using the old and stale playbook of dumping—flooding a foreign market with goods at a price below which domestic producers can compete.

Two dozen years ago, China exported under 100,000 tons of steel to Latin America each year. Now, it is flooding the region with almost ten million tons of the metal alloy—worth around $8.5 billion—annually. The US and EU have already slapped massive penalties on steel emanating from China, and suddenly three of the four countries mentioned above are following suit with similar—though not near as stiff—tariffs. They must walk a fine line, however, as China is both the biggest buyer of raw materials from and a major investor in the region. There are many retribution levers in which to pull, and China has shown a willingness to wantonly use these tools in the past.

Argentina is a great example of how quickly the landscape can change. Just two short years ago, under the leadership of Peronist President Alberto Fernandez, the country became part of China's grand Belt and Road Initiative—otherwise known as the New Silk Road. With the election of outspoken capitalist Javier Milei came the worst possible outcome for China: a pro-American president who talks of the evils of communism. While China has done an excellent job of placing government officials in the smallest of South American provinces, it won't take much for the working class masses to see what is going on. As is always the case, socialist leaders will try to pin economic troubles on the US; but that argument is getting more and more tenuous. As a miner in Argentina's northwestern province of Jujuy ("who who EEH") put it, "The Chinese seem to be taking over everything." The best thing the United States can do in response is work diligently to strengthen ties throughout every corner of the region.

The United States has a comically bad strategy with respect to maintaining relations in Latin America. In fact, it really isn't a strategy at all. It is more to the discredit of America's hodge-podge approach to the region that it is to the credit of China's efforts. With each new US administration comes a new policy, much to the consternation of our true friends throughout Latin America. We are not going to win over the likes of a Lula in Brazil, but why alienate those who share our beliefs? It is time for a Monroe Doctrine 2.0; a warning shot fired over the head of communist China. But who is around to craft such a document?

Mo, 22 Jul 2024

Multiline Retail

Macy's will go it alone, ends talk of sale to go private

Last December we wrote of Macy's (M $16) planned deal to sell itself to Arkhouse Management and Brigade Capital Management for approximately $6 billion, thus becoming a privately held retailer. Shares surged 20% higher on the news. Last week, the opposite took place. Shares of M plunged after the company's board unanimously agreed to walk away from what they perceived as an underwhelming proposal that came with a lack of certainty over financing. They punted despite the raised offer price of $7 billion from the would-be buyers.

Macy's has faced severe competition in recent years from not only traditional peers such as Nordstrom and Kohl's, but also from retail giants like Amazon, Walmart, and Target who have been encroaching on their turf with higher-quality clothing. As if the environment weren't challenging enough, Chinese online retailers like SHEIN are now eating into market share. JC Penney lost its battle to stay public after being forced into bankruptcy by a massive debt load, only to be purchased for the paltry amount of $800 million ($300 million in cash and the assumption of $500 million of debt) by two retail REITs. The same two REITs, Brookfield Asset Management and Simon Property Group, were on the verge of buying struggling retailer Kohl's for $8.6 billion back in 2022 until management downgraded its full-year outlook. Kohl's now has a market cap of $2.5 billion.

Macy's may not end up like its unfortunate peers, however. Not only does the company own massive real estate holdings (which Arkhouse and Brigade almost certainly would have sold off to gain capital), it also has a promising strategic initiative to be spearheaded by new CEO Tony Spring. Actions will include closing unprofitable locations, increasing the upscale Bloomingdale's brand, enhancing the customer shopping experience, and improving an already robust online presence. Had the firm gone private, the focus would have been squarely on cannibalizing the company's assets rather than maximizing potential.

We last owned Macy's in the Intrepid Trading Platform back in 2020. In November of that year, we closed the position for an 82% gain. While we don't currently plan on adding the company back into a strategy, we do believe the shares are worth north of $20.

Th, 11 May 2024

Technology Hardware & Equipment

The strange case of Microsoft ordering workers to carry iPhones

To be clear, this order only involves Microsoft's (MSFT $466) Chinese workforce, but on its face it does seem odd. After all, the iOS used in Apple's (AAPL $225) iPhones is a competitor to Microsoft's Windows operating system. So why the sudden mandate?

Android is an operating system created by Google (GOOGL $189) to power mobile devices such as smartphones. Currently, around 70% of the world's phones use this technology, despite the iPhone's dominance in the US market. Following a series of Russian-linked cyberattacks, Microsoft launched a cybersecurity program called Secure Future Initiative (SFI). Under this program, employees will soon be required to verify their identities upon logging into their devices, which necessitates the downloading of Microsoft's Authenticator password manager and Identity Pass app. While these apps are available on Google Play, that service isn't available in China thanks to the communist nation's Internet censorship system, known as the Great Firewall. This leaves Apple's App Store as the only viable download source in the country.

Obviously, authorities would like every citizen to use smartphones made by China's Huawei or Xiaomi, which have developed their own unique software platforms—migrating away from Android. Any Microsoft employee in China using Android phones, to include devices made by the two domestic firms, will be provided an iPhone 15 by the company. More and more Chinese firms and government agencies are banning foreign phones from the workplace, citing security concerns. Coming from the world's leading intellectual property (IP) thief, that is rich.

This case further spotlights the fine line American firms operating in China must walk. It also provides more evidence for the need to diversify away from the increasingly troublesome country. The guise of free and fair trade has been revealed for what it has always been: a sham.

Tu, 21 May 2024

Semiconductors & Equipment

Nvidia just had an incredible quarter; a stock split is on the way

Precisely three months ago to the day, we reported on AI chip designer Nvidia's (NVDA $1,035) "crazy-good quarter." We are running out of adjectives to use for this firm's performance on the heels of a quarter that just eclipsed the previous one. Sales jumped 262% (not a typo) in the fiscal first quarter from the previous year, to $26 billion, and earnings came in at $6.12 per share; both numbers handily beat Wall Street estimates. Guidance for the second fiscal quarter of the year calls for $28 billion in revenue, and we have little doubt that the number will be reached. Shares were trading up double digits at the open following the release.

Just a reminder of what Nvidia does. In macro terms, think of it as the engine of AI. It provides a complete hardware and software package for companies operating within this new realm. It is the world's leading designer of graphics processing units (GPUs) which were traditionally used in gaming platforms, but are now an integral part of artificial intelligence. No one single company benefits more from the adoption of AI than Nvidia.

Going into Thursday morning, Nvidia was a $2.3 trillion company sitting in size only behind Microsoft and Apple. By the day's close, it carried a market cap in excess of $2.6 trillion, just 10% below Apple's market cap. Putting its growth in perspective, the company's shares were selling for around $100 apiece back in October of 2022. Along with the blowout quarterly results and the $1,000+ share price came news that the company would execute a ten-for-one stock split as of market open on June 10th. This would put them back around the $100 range, making the company more attractive to many retail buyers (though the valuation doesn't change due to a split, of course). In other words, we don't see their share price or the company's 39 forward multiple dissuading new buyers from jumping in.

In addition to the obvious customers such as Amazon, Meta, Microsoft, and Google, Nvidia is also working with over 300 companies in the autonomous driving space. Cash rich, growing free cash flow, and accelerating revenue growth; it is difficult not to love this firm. Not only is Nvidia a member of the Penn New Frontier Fund, it is also a top holding in several ETFs within the Penn Dynamic Growth Strategy.

Tu, 21 May 2024

Latin America

Even with leftists, China is wearing out its welcome in Latin America

No matter the year, there are always a handful of leftist leaders sprinkled throughout Latin America who would gladly work hand-in-hand with China if for no other reason than their disdain for the United States. The current lineup includes AMLO of Mexico, Lula of Brazil, Boric of Chile, and Petro of Colombia. Lula regularly welcomes Chinese warships to dock at ports in Rio, not to mention "warships" of the Iranian navy. But the communist nation seems to be doing everything it can to spoil its simpatico relationship with our neighbors to the south by using the old and stale playbook of dumping—flooding a foreign market with goods at a price below which domestic producers can compete.

Two dozen years ago, China exported under 100,000 tons of steel to Latin America each year. Now, it is flooding the region with almost ten million tons of the metal alloy—worth around $8.5 billion—annually. The US and EU have already slapped massive penalties on steel emanating from China, and suddenly three of the four countries mentioned above are following suit with similar—though not near as stiff—tariffs. They must walk a fine line, however, as China is both the biggest buyer of raw materials from and a major investor in the region. There are many retribution levers in which to pull, and China has shown a willingness to wantonly use these tools in the past.

Argentina is a great example of how quickly the landscape can change. Just two short years ago, under the leadership of Peronist President Alberto Fernandez, the country became part of China's grand Belt and Road Initiative—otherwise known as the New Silk Road. With the election of outspoken capitalist Javier Milei came the worst possible outcome for China: a pro-American president who talks of the evils of communism. While China has done an excellent job of placing government officials in the smallest of South American provinces, it won't take much for the working class masses to see what is going on. As is always the case, socialist leaders will try to pin economic troubles on the US; but that argument is getting more and more tenuous. As a miner in Argentina's northwestern province of Jujuy ("who who EEH") put it, "The Chinese seem to be taking over everything." The best thing the United States can do in response is work diligently to strengthen ties throughout every corner of the region.

The United States has a comically bad strategy with respect to maintaining relations in Latin America. In fact, it really isn't a strategy at all. It is more to the discredit of America's hodge-podge approach to the region that it is to the credit of China's efforts. With each new US administration comes a new policy, much to the consternation of our true friends throughout Latin America. We are not going to win over the likes of a Lula in Brazil, but why alienate those who share our beliefs? It is time for a Monroe Doctrine 2.0; a warning shot fired over the head of communist China. But who is around to craft such a document?

Headlines for the Month of April 2024

Th, 25 Apr 2024

Airlines & Air Freight

No more fighting for those refunds on canceled flights

It would be difficult for anyone to say, with a straight face, that the state of air travel in the US has improved over the past generation; in fact, one could easily argue that since 9/11 and the pandemic, it has gotten decidedly worse. Try to question that delayed or canceled flight and face the wrath of a ticket agent ready to call for airport security. You may be the paying customer, but they are the airline apparatchik.

Complaints surrounding air travel in general and difficulties in dealing with ticket agents specifically have reached an all-time high. Consider this disturbing statistic: one-third of all Spirit Airlines (SAVE $4), JetBlue Airways (JBLU $6), and Frontier Airlines (ULCC $6) flights end up being either delayed or canceled. Delta (DAL $48) has the best on-time record, but flyers still face a one-in-five chance of a delayed or canceled flight with that airline. And arguing for a refund has become a running joke. At least until now.

Under new Department of Transportation rules, airlines will now be required to give automatic refunds for canceled or significantly delayed flights, providing much needed consistency throughout the industry. Here's what the DOT considers a "significant change": delays of more than three hours for domestic flights and six hours for international travel; being downgraded to a lower class; a change of departure or arrival airport; and an increase in the number of connections. Any of these circumstances would trigger the auto-refund policy. Missing luggage not delivered back to passengers within a reasonable amount of time (12 hours max for domestic flights) would also trigger the new rule, which is set to be fully in place within the next six months. It is unfortunate that the government had to get involved with this situation, but in this specific case the airlines have no one to blame but themselves.

We own United Airlines (UAL $53) in the Penn Global Leaders Club and consider it best-in-class. We believe investors should completely steer clear of the low-cost carriers mentioned above, as their margins will continue to shrink based on this much-needed ruling. Recall that the FTC recently shot down the merger between Spirit and JetBlue, leaving these carriers inordinately vulnerable to the new policy.

Fr, 05 Apr 2024

Market Pulse

Not a pretty week, except for oil and gold bulls

Despite a Friday rally on a blowout jobs report, it was a down week in the market, with the small caps performing the worst—off 2.84%. Sadly, oil moved in the opposite direction with crude closing Friday at $86.73 per barrel. One other positive mover: gold. We made a big bet on the precious metal last year based on expected (eventual) rate cuts and the fiscally irresponsible politicians in D.C. That has paid off in spades: gold is now the largest position in our client portfolios, surpassing Microsoft (MSFT $426) last week. Both the S&P and the NASDAQ dropped close to 1% over the five sessions.

As mentioned, we did have a nice rally on Friday after the March jobs report showed payrolls rising by 303,000 for the month (214k was the estimate). The unemployment rate dropped from 3.9% to 3.8%. While this indicates a strong labor market, it certainly didn't add any bullet points to the rate cut argument. In fact, Powell reiterated that the Fed is in no hurry to move—which is a major reason why the week finished in the red. Expectations are now for two cuts by the end of the year, which would bring the federal funds rate down to a range of 4.75% to 5%. The long-term average rate is 4.6%.

Is the stock market overvalued? It depends on which corner you are looking at. The big tech names have driven the recent rally, leaving many reasonably priced gems sitting at reasonable valuations. The S&P 500 is a cap-weighted index, meaning the behemoths skew the results. There is an equal-weighted S&P 500 ETF (RSP $166) which looks a lot more attractive. Also, despite sticky rates, we are overweighting small-cap equities, which are just up 1.88% year to date. Back to the Fed: The Bureau of Labor Statistics releases its consumer price index next Wednesday, which will give us a good indication of which FOMC meeting will offer the first cut. Analysts are expecting a headline number around 3.5%, which is still well above the Fed's 2% inflation target. Time a little extra time this week to enjoy the beautiful (but probably windy) spring weather!

Mo, 01 Apr 2024

Restaurants

Add a Krispy Kreme doughnut to that Egg McMuffin order

In a rather brilliant move for both companies, Krispy Kreme (DNUT $15) will begin selling its doughnuts at McDonald's (MCD $280) locations across the country with a phased rollout beginning in the second half of this year. This follows a highly successful test of the program at 160 McDonald's restaurants in Lexington and Louisville, Kentucky—a dry run which exceeded expectations by both firms. Krispy Kreme already sells its doughnuts at thousands of grocery stores around the country using its hub-and-spoke model, delivering fresh-baked treats to stores within a certain mile radius of each bricks-and-mortar location.

There are just over 350 Krispy Kreme locations in the US, but there are around 14,000 McDonald's restaurants in the US, meaning the opportunity for the North Carolina-based firm is huge. The bakery also operates the Insomnia Cookies brand, which not only has 240 locations but also delivers "warm, delicious cookies right to your door daily until 3 AM." The ramp-up to handle daily McDonald's deliveries will be considerable, but the efficient assembly line system already in place should be up for the task. As for McDonald's, the "sweet" portion of their breakfast lineup has been sorely lacking, and this deal will mark a major improvement. The original glazed, chocolate iced with sprinkles, and chocolate iced cream-filled varieties will be offered throughout the day.

While both restaurants' stocks popped on the news, Krispy Kreme was the clear winner—jumping 40% in one day. The sugar high wore off quickly, however, with the shares giving back half of that gain over the ensuing days. McDonald's accounts for around one-third of all breakfast visits to fast-food restaurants, coffee shops, and bakeries, including the likes of Dunkin' and Starbucks.

Investors might be tempted to jump into Krispy Kreme shares on this news, but there are other factors which should be weighed—no pun intended. We have written about the farcical share structure of the company under which JAB Holding Company (think Caribou Coffee, Panera Bread, Keurig, and Peet's Coffee) retains 78% control. Furthermore, the company brought DNUT (former symbol KKD) public once again at $21 per share three years ago, and they have yet to regain that price. As for McDonald's, we have a $320 target share price, which would represent just a 14% jump from current levels.

Th, 25 Apr 2024

Airlines & Air Freight

No more fighting for those refunds on canceled flights

It would be difficult for anyone to say, with a straight face, that the state of air travel in the US has improved over the past generation; in fact, one could easily argue that since 9/11 and the pandemic, it has gotten decidedly worse. Try to question that delayed or canceled flight and face the wrath of a ticket agent ready to call for airport security. You may be the paying customer, but they are the airline apparatchik.

Complaints surrounding air travel in general and difficulties in dealing with ticket agents specifically have reached an all-time high. Consider this disturbing statistic: one-third of all Spirit Airlines (SAVE $4), JetBlue Airways (JBLU $6), and Frontier Airlines (ULCC $6) flights end up being either delayed or canceled. Delta (DAL $48) has the best on-time record, but flyers still face a one-in-five chance of a delayed or canceled flight with that airline. And arguing for a refund has become a running joke. At least until now.

Under new Department of Transportation rules, airlines will now be required to give automatic refunds for canceled or significantly delayed flights, providing much needed consistency throughout the industry. Here's what the DOT considers a "significant change": delays of more than three hours for domestic flights and six hours for international travel; being downgraded to a lower class; a change of departure or arrival airport; and an increase in the number of connections. Any of these circumstances would trigger the auto-refund policy. Missing luggage not delivered back to passengers within a reasonable amount of time (12 hours max for domestic flights) would also trigger the new rule, which is set to be fully in place within the next six months. It is unfortunate that the government had to get involved with this situation, but in this specific case the airlines have no one to blame but themselves.

We own United Airlines (UAL $53) in the Penn Global Leaders Club and consider it best-in-class. We believe investors should completely steer clear of the low-cost carriers mentioned above, as their margins will continue to shrink based on this much-needed ruling. Recall that the FTC recently shot down the merger between Spirit and JetBlue, leaving these carriers inordinately vulnerable to the new policy.

Fr, 05 Apr 2024

Market Pulse

Not a pretty week, except for oil and gold bulls

Despite a Friday rally on a blowout jobs report, it was a down week in the market, with the small caps performing the worst—off 2.84%. Sadly, oil moved in the opposite direction with crude closing Friday at $86.73 per barrel. One other positive mover: gold. We made a big bet on the precious metal last year based on expected (eventual) rate cuts and the fiscally irresponsible politicians in D.C. That has paid off in spades: gold is now the largest position in our client portfolios, surpassing Microsoft (MSFT $426) last week. Both the S&P and the NASDAQ dropped close to 1% over the five sessions.

As mentioned, we did have a nice rally on Friday after the March jobs report showed payrolls rising by 303,000 for the month (214k was the estimate). The unemployment rate dropped from 3.9% to 3.8%. While this indicates a strong labor market, it certainly didn't add any bullet points to the rate cut argument. In fact, Powell reiterated that the Fed is in no hurry to move—which is a major reason why the week finished in the red. Expectations are now for two cuts by the end of the year, which would bring the federal funds rate down to a range of 4.75% to 5%. The long-term average rate is 4.6%.

Is the stock market overvalued? It depends on which corner you are looking at. The big tech names have driven the recent rally, leaving many reasonably priced gems sitting at reasonable valuations. The S&P 500 is a cap-weighted index, meaning the behemoths skew the results. There is an equal-weighted S&P 500 ETF (RSP $166) which looks a lot more attractive. Also, despite sticky rates, we are overweighting small-cap equities, which are just up 1.88% year to date. Back to the Fed: The Bureau of Labor Statistics releases its consumer price index next Wednesday, which will give us a good indication of which FOMC meeting will offer the first cut. Analysts are expecting a headline number around 3.5%, which is still well above the Fed's 2% inflation target. Time a little extra time this week to enjoy the beautiful (but probably windy) spring weather!

Mo, 01 Apr 2024

Restaurants

Add a Krispy Kreme doughnut to that Egg McMuffin order

In a rather brilliant move for both companies, Krispy Kreme (DNUT $15) will begin selling its doughnuts at McDonald's (MCD $280) locations across the country with a phased rollout beginning in the second half of this year. This follows a highly successful test of the program at 160 McDonald's restaurants in Lexington and Louisville, Kentucky—a dry run which exceeded expectations by both firms. Krispy Kreme already sells its doughnuts at thousands of grocery stores around the country using its hub-and-spoke model, delivering fresh-baked treats to stores within a certain mile radius of each bricks-and-mortar location.

There are just over 350 Krispy Kreme locations in the US, but there are around 14,000 McDonald's restaurants in the US, meaning the opportunity for the North Carolina-based firm is huge. The bakery also operates the Insomnia Cookies brand, which not only has 240 locations but also delivers "warm, delicious cookies right to your door daily until 3 AM." The ramp-up to handle daily McDonald's deliveries will be considerable, but the efficient assembly line system already in place should be up for the task. As for McDonald's, the "sweet" portion of their breakfast lineup has been sorely lacking, and this deal will mark a major improvement. The original glazed, chocolate iced with sprinkles, and chocolate iced cream-filled varieties will be offered throughout the day.

While both restaurants' stocks popped on the news, Krispy Kreme was the clear winner—jumping 40% in one day. The sugar high wore off quickly, however, with the shares giving back half of that gain over the ensuing days. McDonald's accounts for around one-third of all breakfast visits to fast-food restaurants, coffee shops, and bakeries, including the likes of Dunkin' and Starbucks.

Investors might be tempted to jump into Krispy Kreme shares on this news, but there are other factors which should be weighed—no pun intended. We have written about the farcical share structure of the company under which JAB Holding Company (think Caribou Coffee, Panera Bread, Keurig, and Peet's Coffee) retains 78% control. Furthermore, the company brought DNUT (former symbol KKD) public once again at $21 per share three years ago, and they have yet to regain that price. As for McDonald's, we have a $320 target share price, which would represent just a 14% jump from current levels.

Headlines for the Month of March 2024

Th, 28 Mar 2024

Specialty Retail

Already a contractor favorite, Home Depot doubling down on bet

Our Home Depot (HD $383) position within the Penn Global Leaders Club is up roughly 250% since purchase, and we have no intention of taking our profits anytime soon. For several years we have favored this home improvement retailer over you-know-who, and its latest acquisition is a great example as to why. The $400 billion Atlanta-based firm, which Ken Langone forged from a sleepy hardware store into an industry leader, has agreed to purchase specialty trade distributor SRS Distribution Inc for $18.25 billion, including debt.

Home Depot is already the hands-down favorite retailer of construction professionals, with the pro business accounting for half of its revenue. That is double the percentage of competitor Lowe's. SRS, which has a fleet of 4,000 delivery vehicles and a 750-branch network spread across the United States, should bump that needle even higher. The company serves roofers, landscapers, pool contractors, and other professionals.

Home Depot will use a combination of cash on hand and new financing to fund the deal, which is expected to close later this year. The anti-business FTC always poses a legal threat, but this would be a hard acquisition to shoot down over monopoly concerns—nonetheless, we wouldn't be surprised to see them try. The specialty retailer earned $15 billion on $152 billion in sales last year and has turned an annual profit as far back as the eye can see.

We absolutely love this deal. Not only will it give Home Depot the ability to better serve their pros by making on-site delivery with a fleet of 4k vehicles, the company is also gaining the vast knowledge base of what its community of craftsmen and installers want from their supplier.

We, 27 Mar 2024

Global Strategy: East & Southeast Asia

A few years ago Xi was saber rattling; now he sips tea with US CEOs

It's amazing what dollar signs in one's eyes will do to cloud vision. After countless cases of IP theft, a chronically uneven playing field, the self-proclaimed narrative about taking over as the world's leading economy (how's that going, by the way?), we have Chief Antagonist Xi Jinping dining with American business executives, flashing his best Winnie the Pooh grin, begging them to bolster investments within his country. The meeting spoke volumes. Sadly, we suspect many of these "wise and seasoned" execs were totally taken in.

China's vice president told the group that "investing in China is to invest in the future," but foreign companies have been moving in the opposite direction for the past four years. Foreign direct investment began falling during the pandemic, and there is no sign that the exodus will end anytime soon. That drawdown has filtered through the economy, causing Chinese citizens to guard their pocketbook. A vicious cycle of reduced consumer spending at home and the dumping of excess goods abroad is underway, and Beijing looks flatfooted in its response. Two real-world examples: iPhone sales in China fell 24% y/y through the first six weeks of 2024; meanwhile, Brazil, India, and South Africa—three fellow BRICS members—have all lodged formal antidumping investigations on specific goods coming from China.

The Western world faced similar challenges with respect to Japan some forty years ago, but that democratic, pro-free-trade nation made changes to assuage concerns. China seems to be going in the opposite direction of increasing state control when things aren't going their way. It is the very definition of a command economy—one in which a centralized government tries to control all aspects of supply and demand. That is a fanciful concept which has never worked. As for the CEOs, many would no-doubt like to see the US ease restrictions placed on trade with China over the course of the past two administrations. But considering we have the same two players in the race this election cycle, odds of that happening are near zero. Expect China's economic woes to continue. Sadly, the Chinese people will bear the brunt while the communist government will simply double down.

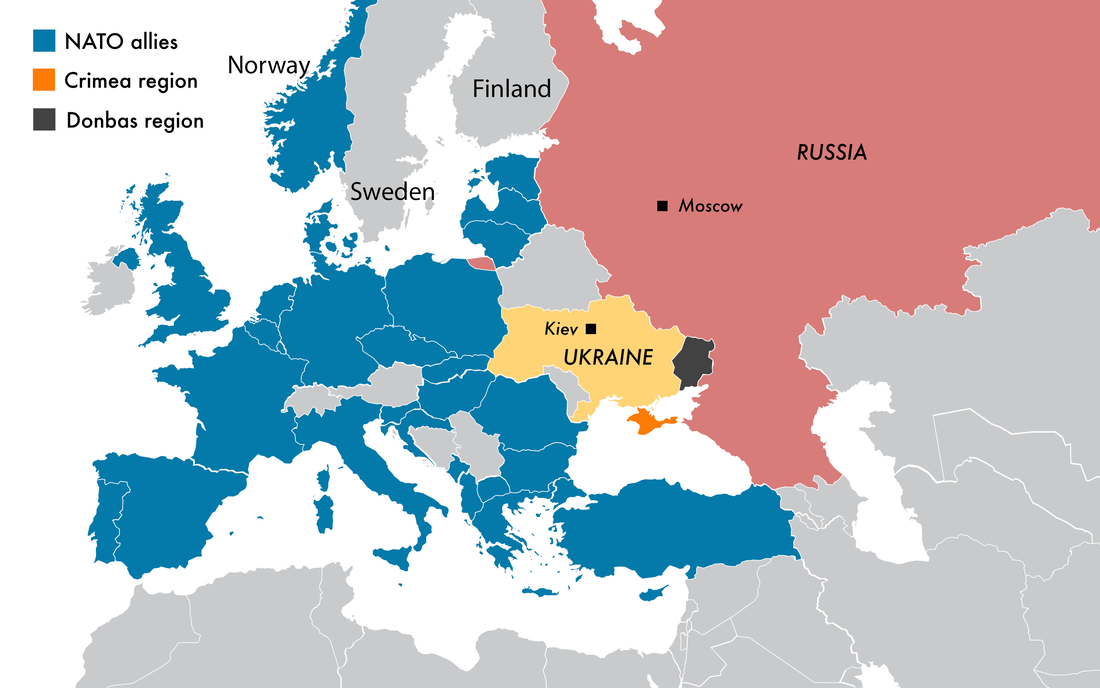

With respect to China, an economic story always has a geopolitical component to it. Just as they stripped the golden goose that was Hong Kong, they are now looking at the incredible wealth and power of the Taiwanese economy with envy. If they see a United States tiring of its defense of Ukraine against a Russian aggressor, they will eventually calculate that an invasion of land they already claim as theirs is worth the risk. We can't believe there are Americans who would say this is not our business; then again, there were plenty of Americans before December 7th, 1941 who said we had no business getting into a war on the other side of the world.

Tu, 26 Mar 2024

Aerospace & Defense

Better late than never: Boeing brooms CEO and two other senior execs

So overdue. In the four years since Boeing's (BA $188) chairman of the board at the time, Dave Calhoun (who has a degree in finance, not engineering), anointed himself as the only guy who could fix the ailing aerospace giant, he has—or will have by the time he is gone—made around $80 million in total compensation. Since he took the helm, the company has lost $71 billion in market cap—or about 40% of its value. Over the same time period the company's only major airframe competitor, Airbus (EADSY $46), has grown by $27 billion—or 23%. Over Calhoun's tenure, multiple safety incidents involving Boeing aircraft have occurred, major aircraft orders have been cancelled out of frustration, and the FAA began an unprecedented oversight program. Now, after backroom pleas to the board by airline CEOs, Calhoun is gone, along with Chairman Larry Kellner and commercial airplanes head Stan Deal. Sadly, Calhoun will remain in his position through the end of the year.

Besides brooming these three, there was another move at the company we love: former Qualcomm CEO and all-around brilliant business mind Steve Mollenkopf was appointed as the new chairman of the board. Not only did he masterfully run the semiconductor firm, he holds a bachelor's degree in electrical engineering from Virginia Tech and a master's in electrical engineering from the University of Michigan. Someone with engineering credentials as chairman of a massive industrial firm—what a concept. While Mollenkopf essentially ruled himself out as the next CEO (too bad the former chairman didn't have such humility), he will lead the search committee for Calhoun's replacement.

One name at the top of that list is Patrick Shanahan, the current CEO of Spirit AeroSystems (SPR $35) and a former US Secretary of Defense. Boeing recently announced its intent to purchase Spirit—a company it spun off back in 2005. Shanahan has a Bachelor of Science degree in mechanical engineering from the University of Washington, a Master of Science degree in mechanical engineering from MIT, and an MBA from the MIT Sloan School of Management. While he may technically be considered an insider, we believe Shanahan would be an excellent choice to lead the company back to its former benchmark position in the industry. Larry Culp, who took over a similar situation at General Electric (GE $174) after the Calhoun-like Jeffrey Immelt was "retired," has also been named as a potential replacement, but he is slated to lead GE Aerospace when it becomes a standalone company next month. No matter who takes the helm, at least three problematic senior execs are gone.

With shares sitting just $12 above their 52-week low, is it too early to buy back into the company? We actually don't think so. Yes, we don't know the replacement yet; and yes, the debt load carried by the firm is now massive, but we believe it will stage a massive comeback over the next five years. It may be difficult to get in near this price once the pieces begin falling into place. (No, we are not ready to add Boeing back into the Global Leaders Club just yet.)

Fr, 22 Mar 2024

Interactive Media & Services

It's only fitting that Reddit should soar like a meme stock at open

After all, it was the subreddit r/wallstreetbets that helped push AMC Entertainment (AMC $4) up to $640 per share in the summer of '21, and Radio Shack-like GameStop (GME $13) up to $120 four months prior. Shares of social media platform Reddit (RDDT $49) were priced at $34 in the IPO market, but only the anointed few could have purchased them at that price: they began trading around $48 and the fan base was buying shares at $57.80 exactly six minutes later. When IPO day was complete, shares were sitting just shy of $50—a 48% premium to the IPO price.

It's not clear how soon Reddit can turn a profit (it lost $91 million on $800 million of revenue last year), but one financial tidbit which is known is the CEO's salary leading up to the launch. Steve Huffman, who founded the company with Alexis Ohanian while the two were roommates at the University of Virginia, had a salary of $193 million in 2023. Granted, the majority of that largesse was awarded through a complicated scheme that Rube Goldberg would be challenged to draw on paper. Another "known" is the share class structure. We loathe multiple share classes designed to favor the few—why not just stay private if you want to retain that level of control? (We all know the answer to that, of course.) Average, ordinary investors will only be allowed to buy Class A shares, which provide for one vote per share. In addition to owning some 400,000 of those himself, Huffman will also own over 4 million shares of Class B stock—which offer ten votes per share. Class B owners will control some 97% of the total voting power.

All of this isn't to say that Reddit won't turn a profit one of these days. Revenue is generated through advertising and ad-free premium memberships, and the company plans to use its IPO windfall to massively increase its advertising effort. But it enters a crowded market of social media giants, and it faced a mini revolt on its last money-making scheme: charging third-party apps fees to retain access. As of yet, we don't see an animal that will become Reddit's cash cow; only an appeal to the content provider's 72 million daily active users to keep buying stock.

We are so reminded of our Penn Wealth Report issue entitled "The Show Must Go On." It highlighted schemes like NFTs, SPACs, and meme stocks during their heyday. On that cover was the following warning: "This Will Not End Well."

Th, 21 Mar 2024

Beverages, Tobacco, & Cannabis

Is Boston Beer now so cheap that it is worthy of a look?

We had been raving fans of The Boston Beer Company (SAM $295), and not just because founder Jim Koch always showed up to CNBC interviews with a Sam Adams in hand. Not only had the brewer remained fiercely independent, unlike Anheuser-Busch, Coors, and Miller—all now foreign-owned entities, it simply brewed great beer. Then it went down the hard seltzer rabbit hole at the expense of its beer lineup, and the shares began to crater.

SAM shares have plunged 78% since April 2021, and Koch is brooming the firm's CEO, Dave Burwick, after six years at the helm. But was Burwick really the problem? His résumé, after all, was impressive: he spent time at Peet's Coffee, Deckers Outdoor, Weight Watchers International, and PepsiCo. And it was Koch himself who declared the company's commitment to its ill-fated hard seltzer push. Shipments declined from the previous year in every quarter of 2023, and Q4's results were disastrous. The company lost $18 million (-$1.46/share) on $417 million in revenue over the course of the fourth quarter.

Current board member Michael Spillane, a seventeen-year Nike vet, will take over the CEO role as of next month, but we don't see any strategic initiatives which would get us excited about owning the brand once again. Competition is fierce in both the seltzer and craft beer segments, and consumers of the latter generally gravitate toward local brewers rather than large, national brands. One bright spot: the company holds no debt on its books. With interest rates sitting close to two-decade highs, this is one small-cap that doesn't need to worry about refinancing.

We wouldn't touch SAM shares until there is some indication that the leadership change will make a positive impact on the company's future. Right now, we would value the shares around $350—hardly an undervalued gem.

Mo, 18 Mar 2024

Semiconductors & Equipment

"Friendshoring": India wants to become a global foundry leader

American companies may be at the forefront of semiconductor design, but the actual production of those designs takes place overwhelmingly outside of the United States at factories known as foundries. Nearly 50% of all chip production takes place in Taiwan—which China continues to claim as its own, 25% in mainland China, 15% in South Korea, 6% in the US, and 2% in Japan. India says it wants to shake up that mix within the next five years.

Why aren't there more foundries in the United States? Time, money, and cost effectiveness are three reasons. It takes somewhere between $10 billion and $15 billion to get a new plant up and running, and the process takes between three and five years. This is why companies from Intel to AMD to Apple design their chips in house but outsource production to companies such as Taiwan Semiconductor (TSM $141). India's minister of electronics and IT, meanwhile, believes his country can become one of the top global foundry destinations within the next five years. Citing tension between China and the West, he has been courting tech companies from around the world with a simple message: "India is a "trusted value chain partner" open for business and ready for investment. US chip designer Qualcomm (QCOM $169), which just opened a new factory in Chennai that will employ some 1,600 workers, is buying into that narrative. CEO Cristiano Amon said his company plans to double its investment in the country.

Even Asian fab giants are getting in on the act. Hon Hai Precision Industry, otherwise known as Apple chip supplier Foxconn, said it will invest over $1 billion in new operational facilities in India. The country certainly has a lot of catching up to do in the tech arena, but a dedicated effort over the next five years could certainly vault it into a top-tier producer—a push which the United States and other Western countries should fully support. Especially considering the fact that China will never give up its claim over Taiwan, and it is simply a matter of time before the communist country makes it move.

Through its aggressive actions and incendiary rhetoric over the past five years China has proven it cannot be relied upon as a trustworthy partner going forward. The genie is out of the bottle: countries will continue to diversify away from the Chinese mainland, and India, which just became the world's most populous country, will be one of the major beneficiaries of this seismic shift.

Tu, 05 Mar 2024

Cryptocurrencies

On the back of new bitcoin ETFs, cryptos are soaring once again

On 08 November 2021, bitcoin hit an all-time high price of $67,566. One year later, in November 2022, it was sitting at $15,814—a 77% drop. Much like meme stocks and NFTs, reality hit this "new asset class," and investors fled like rats from a sinking ship. All of the talk about cryptocurrencies serving as a hedge against a downturn in stocks suddenly looked silly, as bitcoin easily outpaced the horrendous losses equities were piling up for the year. Then, in the early days of 2024, came the SEC's begrudging move to approve spot bitcoin ETFs.

Ironically, based on SEC Chair Gary Gensler's total disdain for cryptos, his department's approval of eleven spot bitcoin ETFs in January led to a massive new rally in the digital currency. This past Tuesday, bitcoin hit a new all-time high, trading above $69,000 for the first time in its history. Nearly $20 billion has flowed into these new vehicles since the SEC ruling, with the iShares Bitcoin Trust (IBIT $38) growing from zero to $10 billion in under eight weeks, and there are more catalysts on the horizon.

Sticking with the ETFs, it should be noted that when the first gold exchange-traded funds were introduced a few decades ago, it led to a boon for the precious metal. Everyday investors flooded into the commodity, causing prices to soar. It is easy to make the case for bitcoin doing the same, as many institutional investors who were limited by charter—or by comfort level—from investing in crypto will now be able to buy into the likes of the iShares or Fidelity bitcoin products.

Yet another catalyst comes next month, when the next bitcoin halving will take place. Bitcoin has a cap of 21 million; at each halving, the reward for bitcoin miners is cut in half. This event happens after each 210,000 blocks are mined, up until the maximum supply is released. The last halving occurred in May 2020, after which bitcoin prices rose from around $9,000 per coin to over $60,000 in the subsequent twelve months. While few are calling for a repeat of that insane spike, many crypto experts believe the coin will hit $100,000 before the end of the year. Thanks, SEC.

Yes, we do believe crypto is here to stay; and yes, we even would go as far as calling it a new asset class. That said, we wouldn't recommend allocating more than 5% of a portfolio to the digital currency, or about half the amount we would feel comfortable placing in a gold ETF.

Th, 28 Mar 2024

Specialty Retail

Already a contractor favorite, Home Depot doubling down on bet

Our Home Depot (HD $383) position within the Penn Global Leaders Club is up roughly 250% since purchase, and we have no intention of taking our profits anytime soon. For several years we have favored this home improvement retailer over you-know-who, and its latest acquisition is a great example as to why. The $400 billion Atlanta-based firm, which Ken Langone forged from a sleepy hardware store into an industry leader, has agreed to purchase specialty trade distributor SRS Distribution Inc for $18.25 billion, including debt.

Home Depot is already the hands-down favorite retailer of construction professionals, with the pro business accounting for half of its revenue. That is double the percentage of competitor Lowe's. SRS, which has a fleet of 4,000 delivery vehicles and a 750-branch network spread across the United States, should bump that needle even higher. The company serves roofers, landscapers, pool contractors, and other professionals.

Home Depot will use a combination of cash on hand and new financing to fund the deal, which is expected to close later this year. The anti-business FTC always poses a legal threat, but this would be a hard acquisition to shoot down over monopoly concerns—nonetheless, we wouldn't be surprised to see them try. The specialty retailer earned $15 billion on $152 billion in sales last year and has turned an annual profit as far back as the eye can see.

We absolutely love this deal. Not only will it give Home Depot the ability to better serve their pros by making on-site delivery with a fleet of 4k vehicles, the company is also gaining the vast knowledge base of what its community of craftsmen and installers want from their supplier.

We, 27 Mar 2024

Global Strategy: East & Southeast Asia

A few years ago Xi was saber rattling; now he sips tea with US CEOs

It's amazing what dollar signs in one's eyes will do to cloud vision. After countless cases of IP theft, a chronically uneven playing field, the self-proclaimed narrative about taking over as the world's leading economy (how's that going, by the way?), we have Chief Antagonist Xi Jinping dining with American business executives, flashing his best Winnie the Pooh grin, begging them to bolster investments within his country. The meeting spoke volumes. Sadly, we suspect many of these "wise and seasoned" execs were totally taken in.

China's vice president told the group that "investing in China is to invest in the future," but foreign companies have been moving in the opposite direction for the past four years. Foreign direct investment began falling during the pandemic, and there is no sign that the exodus will end anytime soon. That drawdown has filtered through the economy, causing Chinese citizens to guard their pocketbook. A vicious cycle of reduced consumer spending at home and the dumping of excess goods abroad is underway, and Beijing looks flatfooted in its response. Two real-world examples: iPhone sales in China fell 24% y/y through the first six weeks of 2024; meanwhile, Brazil, India, and South Africa—three fellow BRICS members—have all lodged formal antidumping investigations on specific goods coming from China.

The Western world faced similar challenges with respect to Japan some forty years ago, but that democratic, pro-free-trade nation made changes to assuage concerns. China seems to be going in the opposite direction of increasing state control when things aren't going their way. It is the very definition of a command economy—one in which a centralized government tries to control all aspects of supply and demand. That is a fanciful concept which has never worked. As for the CEOs, many would no-doubt like to see the US ease restrictions placed on trade with China over the course of the past two administrations. But considering we have the same two players in the race this election cycle, odds of that happening are near zero. Expect China's economic woes to continue. Sadly, the Chinese people will bear the brunt while the communist government will simply double down.

With respect to China, an economic story always has a geopolitical component to it. Just as they stripped the golden goose that was Hong Kong, they are now looking at the incredible wealth and power of the Taiwanese economy with envy. If they see a United States tiring of its defense of Ukraine against a Russian aggressor, they will eventually calculate that an invasion of land they already claim as theirs is worth the risk. We can't believe there are Americans who would say this is not our business; then again, there were plenty of Americans before December 7th, 1941 who said we had no business getting into a war on the other side of the world.

Tu, 26 Mar 2024

Aerospace & Defense

Better late than never: Boeing brooms CEO and two other senior execs

So overdue. In the four years since Boeing's (BA $188) chairman of the board at the time, Dave Calhoun (who has a degree in finance, not engineering), anointed himself as the only guy who could fix the ailing aerospace giant, he has—or will have by the time he is gone—made around $80 million in total compensation. Since he took the helm, the company has lost $71 billion in market cap—or about 40% of its value. Over the same time period the company's only major airframe competitor, Airbus (EADSY $46), has grown by $27 billion—or 23%. Over Calhoun's tenure, multiple safety incidents involving Boeing aircraft have occurred, major aircraft orders have been cancelled out of frustration, and the FAA began an unprecedented oversight program. Now, after backroom pleas to the board by airline CEOs, Calhoun is gone, along with Chairman Larry Kellner and commercial airplanes head Stan Deal. Sadly, Calhoun will remain in his position through the end of the year.

Besides brooming these three, there was another move at the company we love: former Qualcomm CEO and all-around brilliant business mind Steve Mollenkopf was appointed as the new chairman of the board. Not only did he masterfully run the semiconductor firm, he holds a bachelor's degree in electrical engineering from Virginia Tech and a master's in electrical engineering from the University of Michigan. Someone with engineering credentials as chairman of a massive industrial firm—what a concept. While Mollenkopf essentially ruled himself out as the next CEO (too bad the former chairman didn't have such humility), he will lead the search committee for Calhoun's replacement.

One name at the top of that list is Patrick Shanahan, the current CEO of Spirit AeroSystems (SPR $35) and a former US Secretary of Defense. Boeing recently announced its intent to purchase Spirit—a company it spun off back in 2005. Shanahan has a Bachelor of Science degree in mechanical engineering from the University of Washington, a Master of Science degree in mechanical engineering from MIT, and an MBA from the MIT Sloan School of Management. While he may technically be considered an insider, we believe Shanahan would be an excellent choice to lead the company back to its former benchmark position in the industry. Larry Culp, who took over a similar situation at General Electric (GE $174) after the Calhoun-like Jeffrey Immelt was "retired," has also been named as a potential replacement, but he is slated to lead GE Aerospace when it becomes a standalone company next month. No matter who takes the helm, at least three problematic senior execs are gone.

With shares sitting just $12 above their 52-week low, is it too early to buy back into the company? We actually don't think so. Yes, we don't know the replacement yet; and yes, the debt load carried by the firm is now massive, but we believe it will stage a massive comeback over the next five years. It may be difficult to get in near this price once the pieces begin falling into place. (No, we are not ready to add Boeing back into the Global Leaders Club just yet.)

Fr, 22 Mar 2024

Interactive Media & Services

It's only fitting that Reddit should soar like a meme stock at open

After all, it was the subreddit r/wallstreetbets that helped push AMC Entertainment (AMC $4) up to $640 per share in the summer of '21, and Radio Shack-like GameStop (GME $13) up to $120 four months prior. Shares of social media platform Reddit (RDDT $49) were priced at $34 in the IPO market, but only the anointed few could have purchased them at that price: they began trading around $48 and the fan base was buying shares at $57.80 exactly six minutes later. When IPO day was complete, shares were sitting just shy of $50—a 48% premium to the IPO price.

It's not clear how soon Reddit can turn a profit (it lost $91 million on $800 million of revenue last year), but one financial tidbit which is known is the CEO's salary leading up to the launch. Steve Huffman, who founded the company with Alexis Ohanian while the two were roommates at the University of Virginia, had a salary of $193 million in 2023. Granted, the majority of that largesse was awarded through a complicated scheme that Rube Goldberg would be challenged to draw on paper. Another "known" is the share class structure. We loathe multiple share classes designed to favor the few—why not just stay private if you want to retain that level of control? (We all know the answer to that, of course.) Average, ordinary investors will only be allowed to buy Class A shares, which provide for one vote per share. In addition to owning some 400,000 of those himself, Huffman will also own over 4 million shares of Class B stock—which offer ten votes per share. Class B owners will control some 97% of the total voting power.

All of this isn't to say that Reddit won't turn a profit one of these days. Revenue is generated through advertising and ad-free premium memberships, and the company plans to use its IPO windfall to massively increase its advertising effort. But it enters a crowded market of social media giants, and it faced a mini revolt on its last money-making scheme: charging third-party apps fees to retain access. As of yet, we don't see an animal that will become Reddit's cash cow; only an appeal to the content provider's 72 million daily active users to keep buying stock.

We are so reminded of our Penn Wealth Report issue entitled "The Show Must Go On." It highlighted schemes like NFTs, SPACs, and meme stocks during their heyday. On that cover was the following warning: "This Will Not End Well."

Th, 21 Mar 2024

Beverages, Tobacco, & Cannabis

Is Boston Beer now so cheap that it is worthy of a look?

We had been raving fans of The Boston Beer Company (SAM $295), and not just because founder Jim Koch always showed up to CNBC interviews with a Sam Adams in hand. Not only had the brewer remained fiercely independent, unlike Anheuser-Busch, Coors, and Miller—all now foreign-owned entities, it simply brewed great beer. Then it went down the hard seltzer rabbit hole at the expense of its beer lineup, and the shares began to crater.

SAM shares have plunged 78% since April 2021, and Koch is brooming the firm's CEO, Dave Burwick, after six years at the helm. But was Burwick really the problem? His résumé, after all, was impressive: he spent time at Peet's Coffee, Deckers Outdoor, Weight Watchers International, and PepsiCo. And it was Koch himself who declared the company's commitment to its ill-fated hard seltzer push. Shipments declined from the previous year in every quarter of 2023, and Q4's results were disastrous. The company lost $18 million (-$1.46/share) on $417 million in revenue over the course of the fourth quarter.

Current board member Michael Spillane, a seventeen-year Nike vet, will take over the CEO role as of next month, but we don't see any strategic initiatives which would get us excited about owning the brand once again. Competition is fierce in both the seltzer and craft beer segments, and consumers of the latter generally gravitate toward local brewers rather than large, national brands. One bright spot: the company holds no debt on its books. With interest rates sitting close to two-decade highs, this is one small-cap that doesn't need to worry about refinancing.

We wouldn't touch SAM shares until there is some indication that the leadership change will make a positive impact on the company's future. Right now, we would value the shares around $350—hardly an undervalued gem.

Mo, 18 Mar 2024

Semiconductors & Equipment

"Friendshoring": India wants to become a global foundry leader

American companies may be at the forefront of semiconductor design, but the actual production of those designs takes place overwhelmingly outside of the United States at factories known as foundries. Nearly 50% of all chip production takes place in Taiwan—which China continues to claim as its own, 25% in mainland China, 15% in South Korea, 6% in the US, and 2% in Japan. India says it wants to shake up that mix within the next five years.

Why aren't there more foundries in the United States? Time, money, and cost effectiveness are three reasons. It takes somewhere between $10 billion and $15 billion to get a new plant up and running, and the process takes between three and five years. This is why companies from Intel to AMD to Apple design their chips in house but outsource production to companies such as Taiwan Semiconductor (TSM $141). India's minister of electronics and IT, meanwhile, believes his country can become one of the top global foundry destinations within the next five years. Citing tension between China and the West, he has been courting tech companies from around the world with a simple message: "India is a "trusted value chain partner" open for business and ready for investment. US chip designer Qualcomm (QCOM $169), which just opened a new factory in Chennai that will employ some 1,600 workers, is buying into that narrative. CEO Cristiano Amon said his company plans to double its investment in the country.

Even Asian fab giants are getting in on the act. Hon Hai Precision Industry, otherwise known as Apple chip supplier Foxconn, said it will invest over $1 billion in new operational facilities in India. The country certainly has a lot of catching up to do in the tech arena, but a dedicated effort over the next five years could certainly vault it into a top-tier producer—a push which the United States and other Western countries should fully support. Especially considering the fact that China will never give up its claim over Taiwan, and it is simply a matter of time before the communist country makes it move.

Through its aggressive actions and incendiary rhetoric over the past five years China has proven it cannot be relied upon as a trustworthy partner going forward. The genie is out of the bottle: countries will continue to diversify away from the Chinese mainland, and India, which just became the world's most populous country, will be one of the major beneficiaries of this seismic shift.

Tu, 05 Mar 2024

Cryptocurrencies

On the back of new bitcoin ETFs, cryptos are soaring once again

On 08 November 2021, bitcoin hit an all-time high price of $67,566. One year later, in November 2022, it was sitting at $15,814—a 77% drop. Much like meme stocks and NFTs, reality hit this "new asset class," and investors fled like rats from a sinking ship. All of the talk about cryptocurrencies serving as a hedge against a downturn in stocks suddenly looked silly, as bitcoin easily outpaced the horrendous losses equities were piling up for the year. Then, in the early days of 2024, came the SEC's begrudging move to approve spot bitcoin ETFs.

Ironically, based on SEC Chair Gary Gensler's total disdain for cryptos, his department's approval of eleven spot bitcoin ETFs in January led to a massive new rally in the digital currency. This past Tuesday, bitcoin hit a new all-time high, trading above $69,000 for the first time in its history. Nearly $20 billion has flowed into these new vehicles since the SEC ruling, with the iShares Bitcoin Trust (IBIT $38) growing from zero to $10 billion in under eight weeks, and there are more catalysts on the horizon.

Sticking with the ETFs, it should be noted that when the first gold exchange-traded funds were introduced a few decades ago, it led to a boon for the precious metal. Everyday investors flooded into the commodity, causing prices to soar. It is easy to make the case for bitcoin doing the same, as many institutional investors who were limited by charter—or by comfort level—from investing in crypto will now be able to buy into the likes of the iShares or Fidelity bitcoin products.

Yet another catalyst comes next month, when the next bitcoin halving will take place. Bitcoin has a cap of 21 million; at each halving, the reward for bitcoin miners is cut in half. This event happens after each 210,000 blocks are mined, up until the maximum supply is released. The last halving occurred in May 2020, after which bitcoin prices rose from around $9,000 per coin to over $60,000 in the subsequent twelve months. While few are calling for a repeat of that insane spike, many crypto experts believe the coin will hit $100,000 before the end of the year. Thanks, SEC.

Yes, we do believe crypto is here to stay; and yes, we even would go as far as calling it a new asset class. That said, we wouldn't recommend allocating more than 5% of a portfolio to the digital currency, or about half the amount we would feel comfortable placing in a gold ETF.

Headlines for the Month of Feb 2024

We, 28 Feb 2024

Technology Hardware & Equipment

Tim Cook is no Steve Jobs, but something needs to happen soon

Not that long ago, we were self-proclaimed "Apple cores"—we built our technology infrastructure around the company's (AAPL $183) products, from iPhones to MacBook Pros, iPads to wearables. That is still mostly the case, but our commitment just isn't the same.

We once again include PCs in the mix, because there are some things you simply cannot do as efficiently on a Mac (Excel, for example). Before he died in 2011, Apple's brilliant founder, Steve Jobs, proclaimed to have "cracked the code" with respect to the TV. Had he lived, we have no doubt that the company would have created something amazing in this arena. We recently threw one of our Apple remotes and its accompanying device in the trash out of frustration, purchasing a new Roku device in its place.

Mainly to assist with sleep, we recently purchased an Oura ring. A few days later we read that Apple was thinking about developing a ring tied to Apple Health, but it was still on the drawing board. The company recently lost a court battle to Massimo, forcing it to shut down the blood oxygen feature on its Apple Watch. We also purchased advanced Google Nest smoke and CO2 detectors and love them. Apple HomeKit, which is apparently now part of Apple Home, feels like an afterthought. Now comes the news that, after a decade of secretive research, the Apple car is dead. Steve Jobs would clean house.

Apple's car project was a moonshot expected to generate billions of dollars for the firm in the not-too-distant future. Now, the "ultimate mobile device" sits in a scrap heap, with the firm telling some 2,000 project workers that their mission is over. Instead, the next massive project will be built around the future of AI. There's only one problem: the company has to play a serious game of catch up against rivals like Microsoft and Google.

But how will that manifest? We don't see new AI products generating long lines in front of Apple stores like we saw for the first iPhones back in 2007. Will the focus be on putting the technology to work in the $3,500 Vision Pro? Whatever the answer, it won't manifest soon. Furthermore, we are not convinced Tim Cook really has an answer which he is committed to. We miss Steve Jobs' passion.

Apple is still the second-largest company in the world—behind Microsoft, but it needs to crystallize its vision. After watching a once-great American company like Boeing flounder under weak leadership, we don't want to see this happen at Apple. The company has been in the Penn Global Leaders Club for a long time, and we sit on massive long-term unrealized gains, but the same could have been said for Boeing right before we broomed the company—after two consecutive 737 crashes and a completely inept response.

Sa, 24 Feb 2024

Market Pulse

The market week could be summed up with one company name

This past week's market success could be boiled down to one word: NVIDIA (NVDA $788). The tech company's simply remarkable quarter fueled the chip industry, the NASDAQ, and the markets overall. With all the angst over the elections, a "higher for longer" Fed, and Russia launching a nuke into space, it was precisely the good news investors needed.

We don't talk about the Dow Jones Industrial Average much, as we believe it to be an antiquated index representing only 30 companies in a price-weighted manner. The press likes large numbers in their headlines, so they continue to report on the Dow, but the S&P 500 is the real gauge for the markets. Nonetheless, we feel duty-bound to report that top Penn holding Amazon (AMZN $175) has replaced faltering Walgreens Boots Alliance (WBA $22) in the Dow. Ironically, Walgreens was only added to the Dow six years ago, in 2018. See why this is ironic in our Q&A.

We had some exciting space news this week when the privately built and launched Odysseus lunar lander set down on the surface of the moon. Unfortunately, it ended up on its side, but the feat is still impressive. We applaud NASA's brilliant NextSTEP program, which seeks out American companies to work with for the advancement of the country's efforts in space. A publicly traded company, Intuitive Machines (LUNR $7), built the Odysseus and launched it aboard a SpaceX Falcon 9 rocket. Expect many more lunar landings by the US over the coming years.

For the holiday-shortened trading week, the S&P 500, the NASDAQ, and the All Cap World Index ex-US were all up about 1.5%. Small caps continue to struggle, with the Russell 2000 off 88 bps for the week and 41 bps for the year. We should get a little relief at the pumps soon, as oil dropped 3.35%—to $76.57 per barrel of WTI crude. This coming week will see Salesforce, TJX, Paramount, and Hewlett Packard all report earnings, and home price figures for December will drop on Tuesday the 27th.

Fr, 23 Feb 2024

Semiconductors & Equipment

NVIDIA's crazy-good quarter makes it third-largest company in the world

Just how good was NVIDIA's (NVDA $800) quarter? Consider this: The company added over $200 billion to its size after reporting its Q4 results—the largest one-day market cap spike in history; and it leapfrogged over Amazon and Alphabet to become the third-largest publicly traded company in the world—behind only Microsoft ($3T) and Apple ($2.9T). (Granted, an argument could be made that Saudi Aramco has the same $2T market cap.)

Consider NVIDIA the picks-and-shovels company for the AI revolution, providing both hardware and software solutions to virtually every company which boasts an AI presence. Business is so good at Jensen Huang's firm that it is scrambling to try and keep pace with demand. The seasoned CEO used terms like "tipping point" and "astronomical" to describe sales, and that was not hyperbole.

Sales more than tripled in the fourth quarter from a year earlier, and earnings surged over eightfold. That almost seems impossible. All results easily exceeded analysts' expectations, leading NVDA shares to surge 15% out of the gate on Thursday and fomenting a massive rally across the industry. The tech companies surrounding NVIDIA in size all require its hardware, leading to a virtuous cycle we don't see ending anytime soon.

What does NVIDIA's rocking quarter mean to the NASDAQ specifically and the markets overall? At the very least it was a shot in the arm, but Huang sees something much bigger. He believes that "a whole new industry is being formed" around AI. If that turns out to be the case, it is seismic. We remember getting prematurely excited about concepts from the metaverse to 5G to supercomputing, but this does feel different. The CEO sees a new wave of investments worth trillions of dollars kicking into gear, and a doubling in the number of data centers around the world over the next five years.

Then again, we remember firsthand this same kind of talk about the "new economy" we were entering into some twenty-five years ago. That period ended with 78% of the NASDAQ's market cap erased. However, right now NVIDIA has a quite respectable forward P/E of 33; back in 1999, Yahoo! (for example) had a P/E of 1,100, and Cisco (one of the largest companies in the world at the time) had a multiple of 230. So it is safe to say we are not quite at tech bubble levels. In other words, let's celebrate the quarter and enjoy the ride.

Speaking of data centers, if Huang's predictions are right it would behoove investors to look at three major data center REITs: Prologis (PLD $134), Digital Realty Trust (DLR $138), and Equinix (EQIX $882). We have owned all three in various Penn strategies.

Th, 22 Feb 2024

Consumer Electronics

Walmart to buy Vizio for $2.3 billion

To be honest, not only didn't we realize Vizio (VZIO $11) was a publicly traded company, we never would have guessed the firm is based in America (Irvine, CA). We discovered these facts after learning that Walmart (WMT $176) plans to buy the smart TV maker for $2.3 billion in cash.

Anyone who has been a regular customer of Walmart recognizes the name, having to walk by the giant Vizio boxes as they pass the electronics section which divides the grocery and consumer products sections of most supercenters. But why would the retailer buy this particular name?

First off, it should be noted that Vizio's books look great. The company holds zero debt on its balance sheet and sits on $335 million of cash and equivalents. But the real catalyst for the deal seems to revolve around advertising. You see, making and selling devices is only one side of the company's business. The other side is known as Platform+, which includes SmartCast, the TV operating system that enables owners to instantly access built-in apps and hundreds of free channels from their device. Consider it an integrated Roku, of sorts.

The reason SmartCast is important to Walmart has everything to do with controlled advertising. Three years ago, Walmart rebranded its media group as Walmart Connect, the conduit for advertisers to reach the company's customer base. SmartCast will greatly enhance this reach, allowing the firm to rake in advertising dollars while also gleaning incredible amounts of consumer data in the process—as they own the network.