Renewables

The following headlines have been reprinted from The Penn Wealth Report and are protected under copyright. Members can access the full stories by selecting the respective issue link. Once logged in, you will have access to all subsequent articles.

|

PLUG $3

HYDR $6 13 Nov 2023 |

America's hydrogen darling, Plug Power, is in freefall

Remember when that cleanest of clean energies, hydrogen, was going to be the panacea for America's future energy needs? Investors poured billions of dollars into hydrogen power plays, with Plug Power (PLUG $3) leading the charge. Sure bet, right? On Thursday the 9th of November, Plug issued its latest earnings report. It did not go well. The two words which typically spell doom for a company were uttered: "going concern." Management is pursuing a possible loan from the Department of Energy for as much as $1.5 billion, and it also needs the billions of dollars in subsidies from the government to continue. Neither of these mentioned bullet points gave warm and fuzzy feelings to investors: shares of PLUG plunged 43% the following day and are now down 95% since January 2021. Once a $36 billion firm, Plug's market cap is now $2 billion. As could be expected, downgrades came flooding in after the earnings release. The average price target by analysts who follow the company fell from $12 to $5 per share, and even the biggest of hydrogen power bulls admitted that help may not come soon enough to save this industry leader. For the quarter, Plug reported $200 million in sales and a net loss of $283.5 million. To meet its full-year sales forecast, it will need to record $500 million in sales in the fourth quarter. We don't see that happening. Plug's stated objective is to build an end-to-end green hydrogen ecosystem, from production to storage and delivery to energy generation. It envisions green hydrogen highways crisscrossing North America and Europe. This may still happen, but it is looking less likely that Plug will be the company delivering the results. Another great example of investors rushing into a promising field during its nascent stages, urged on by glowing news articles. Our recommendation: don't try to catch a falling knife. That goes not only for shares of PLUG, but also for shares of the Global X Hydrogen ETF (HYDR $6). |

|

SEDG $78

ENPH $83 TAN $41 27 Oct 2023 |

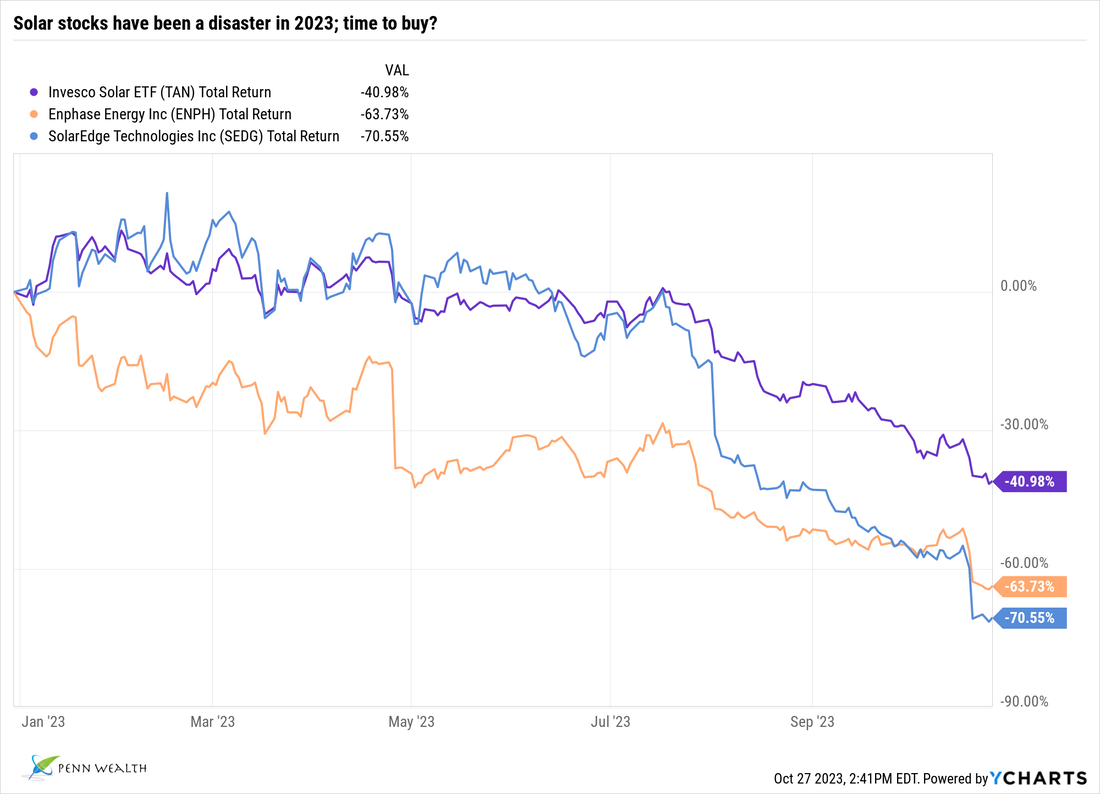

Solar stocks have been in freefall this year; what gives?

SolarEdge (SEDG $78) is a major supplier to the solar power industry, offering power optimizers, inverters, and a cloud-based monitoring platform for residential, commercial, and small-scale utility installations. Shares of SEDG are down 72% year-to-date (YTD). Enphase Energy (ENPH $83) delivers solutions which manage solar generation, storage, and communication on one efficient platform. Shares of ENPH are down 69% YTD. Both of these hardware manufacturers are top holdings within TAN ($41), the Invesco Solar ETF which finds itself down 41% YTD. After so much hype in this arena, what gives? For the most part, blame that holy grail of renewable resources, Europe. Americans may feel uneasy about their own economy, but Europe has been an actual economic disaster recently; especially the continent’s largest player—Germany. This has led the haughty governments of the region to do some soul searching about their energy needs, and this has culminated in mass cancellations and pushouts of solar projects. Crippled by huge inventories and slowing installations, solar companies are reeling. Higher interest rates are another reason for the precipitous drop in the share price of solar companies. Clean energy tech firms require massive amounts of capital for their projects, and attracting ESG-friendly investors was relatively simple when rates were sitting near zero (an analogy would be the tech lending going on at now-defunct Silicon Valley Bank). But now these firms face the double whammy of higher rates and stricter lending standards. Combine these factors with the steep drop-off in demand, and the plunge makes more sense. So, should investors begin nibbling at the higher-quality stocks in this industry? Enphase has an average price target of $171 right now, which would represent a 106% upside potential; SolarEdge’s average price target is $174, representing similar valuations. Both look interesting at these levels for investors sanguine on the American and European economies for the year ahead. However, SolarEdge has its own unique challenges (supply chain issues, higher raw material prices, and currency exchange risks) which would make us steer clear. The company is also based out of Israel, meaning serious geopolitical concerns may affect operations for some time. For the riskier portion of an investor’s portfolio, Enphase might be worth a look right now—just be sure and review the company’s debt load first. We do not currently own any of the stocks or ETFs in this industry within our Penn portfolios. If we did, however, it would probably TAN (to somewhat mitigate our risk) in the Dynamic Growth Strategy. |

|

TAN $78

08 Jun 2022 |

Solar stocks surge on Biden’s decision to hold off on new solar tariffs for two years

(08 Jun 2022) Investing in the solar energy movement has always been fraught with danger, with the slightest shift in sentiment or any new legislative (or executive) actions generally causing an oversized reaction by investors in the industry. The latest news on the latter front, however, had solar enthusiasts cheering. The Biden administration announced there would be no new tariffs placed on solar panel imports for the next two years. There had been a major push underway by the US Department of Commerce to investigate whether global solar panel suppliers were using deceptive tactics to avoid getting hit with tariffs on goods emanating from China. That push, along with supply chain constraints, led to a major slowdown in solar panel installation in the US. In a decision we find more impactful on the US economy, the president also signed three executive orders designed to increase domestic production of solar panels. Tesla, which had been in partnership with Panasonic to produce such panels at a Buffalo, New York facility, has since exited the production side of the business and now focuses solely on installation of the systems. The Invesco Solar ETF (TAN $78) has been on a roller coaster ride this year, dropping 25% before rebounding to flat YTD. The new legislation, along with soaring energy prices, could provide a catalyst for the companies within this fund in the second half of the year. Enphase Energy (ENPH $214) is the largest of the fund’s 42 holdings, with a 12% weighting. While we do not currently own any direct solar plays in the Penn strategies, we do own Tesla (TSLA $737), a major renewables player and lithium-ion battery manufacturer, in the New Frontier Fund. |

|

TAN $74

|

Solar stocks are getting crushed on the back of new California proposals

(20 Dec 2021) Interesting, coming from the state which claims to be on the vanguard of societal evolution (smirk). The once-darling solar stocks, names like Sunrun (RUN $32), First Solar (FSLR $86), EnPhase Energy (ENPH $180), and SolarEdge Technologies (SEDG $263), have been plummeting since California proposed new rules which would make it more costly for families to put solar panels on their roofs. At the heart of the issue are the California utilities, which don't like the competition from the bourgeois middle class of the state who dare to generate their own household power. These utility concerns, working through the California Public Utilities Commission, wish to extort a monthly "grid fee" from anyone with the panels on their roofs, and they want to reduce the amount of payout for the power coming back to the grid from solar sources. While these recommendations must still be codified by state legislators, the threat was enough to sink the shares of major players. California-based Sunrun, for example, has seen its share price drop by two-thirds since January. One hopeful sign: the commissioner who penned the proposal will be leaving his post soon and won't be around to help bring it to fruition. Here is the solution for homeowners: get off the grid by storing the solar power your panels collect in your own storage system. True, the needed efficiencies are not quite there yet, but we believe power storage will be the golden ticket for investors in this industry, and the nightmare for utility companies. In the energy storage space, Tesla's (TSLA $900) systems are hard to beat. We also like Johnson Controls (JCI $76), Enphase Energy, and Generac (GNRC $346). To take advantage of the industry without placing a big bet on any one player, the Invesco Solar ETF (TAN $74) may be the way to go. The ETF holds an eclectic group of 49 companies engaged in solar power production, storage, and infrastructure. |

|

CSIQ

|

Under the Radar: Canadian Solar Inc

(30 Jun 2020) Canadian Solar (CSIQ $19) is a $1.1 billion integrated provider of solar power products, services, and system solutions. The firm designs, develops, and manufactures solar wafers, cells, modules, and other products integral to the industry. With an ultra-low P/E ratio of 3.8, short- and long-term assets which easily cover debt loads, and a positive annual cash flow (the firm made $172 million on $3.2 billion in sales last year), Canadian Solar is one of the better-run companies in a challenging—but highly promising—industry. Founded in 2001, the Ontario-based small-cap derives most of its revenue from Asia, but is active in over 160 countries around the world. We believe shares of CSIQ are trading at a 32% discount to their fair value of $25. |

|

GE

|

Better late than never: GE decides to get into the energy storage business

(07 Mar 2018) There are so many reasons why General Electric (GE $14-$15-$31) went from king of the hill to nearly irrelevant, and they all swirl around a leadership vacuum. The former "biggest company in the world" has now decided that its next big thing is energy storage. To be sure, this burgeoning business will be enormous. The overarching problem with alternative energy has been storage of the energy produced, for later use. Tesla (TSLA) understood that years ago, and built the famed Gigafactory near Sparks, Nevada. They also deployed a giant battery system in Australia last year. Germany's Siemens AG (SMAWF) joined forces with US utility company AES (AES) to create what will be the world's largest battery storage unit, to be located in Long Beach, California. Now, finally, General Electric is launching GE Reservoir, a giant platform that will store massive amounts of energy generated from wind turbines and solar panels for use on-demand. Will the company become a leader in the battery storage game? Based on two previous flops—one to sell battery systems and one to create its own battery cells—we don't like their odds. |

|

GLBL

|

Under the Radar: TeraForm Global, Inc.

UPDATE: (28 Dec 2017) Tera Form Global goes private. Brookfield Asset Management took TeraForm Global private, paying shareholders $5.10 per share. (20 Sep 2017) TeraForm Global (GLBL $3-$5-$5) is a diversified, renewable energy company. Headquartered in Bethesda, Maryland, the company owns and operates solar, wind, and hydro-electric power generation assets around the world. The company has steadily grown its revenues over the past five years, doubling its operating revenue last year (to $214 million). The company is in the small-cap growth style box, with an $840 million market cap. TeraForm’s systems have a portfolio capacity of 919 megawatts (MW), with the vast majority being produced in Brazil, India, and China. |

Penn New Frontier Fund member First Solar Pops on Earnings Beat

(25 Feb 16) Penn New Frontier Fund member First SolarFSLR popped 12.4% on Wednesday after beating street estimates for the fourth quarter. It is an impressive feat for an alternative energy company to even turn a profit, but the Arizona-based firm reported a bottom-line gain of $1.60 per share on the back of fourth-quarter earnings of $164.1 million. The average analyst estimate for earnings was 80 cents per share.

For the year, First Solar, the largest solar energy company in the US, brought in $3.6 billion in revenue. Nearly $550 million of that amount trickled down to a bottom-line profit for the year, equaling an impressive operating margin of 15%. For comparison, consider SolarCity’sSCTY 2015 operating margin of -162%.

Despite lower energy prices, which typically hurt alternative energy companies, we added First Solar to the New Frontier Fund last fall because of its industry-leading project management and installation process. In the last issue of the Journal, we discussed India’s $100 billion alternative energy push, and how a company like FSLR can reap massive gains from its business in that country.

Despite the current fossil fuel glut, alternatives will continue to gain steam going forward, both in the US and around the globe. That being said, selection is critical to avoid buying into a company based on the outlook of its industry rather than the fundamentals of its business.

Subsidies have kept the solar industry afloat over the past decade. It is not unreasonable to think that these subsidies may suddenly evaporate, considering the country’s $19 trillion debt crisis. If that happens, only the strongest will survive. Economies of scale will shutter the doors of many smaller alternative energy startups, leaving only the biggest and strongest. We believe FSLR stands head and shoulders above its peer group.

The Chinese government has provided artificial life support to its own energy companies like Trina Solar, but we see American ingenuity ultimately winning this race.

(Reprinted from the Journal of Wealth & Success, Vol. 4, Issue 3.)

(OK, got it. Take me back to the Penn Wealth Hub!)